Planting the Flag: Why Institutional Void Entrepreneurship Can Foster Foreign Direct Investments Inflows ()

1. Introduction

The main assumption of the New Institutional Economics (NIE) is that the better a country establishes its insti- tutional environment, guaranteeing safeguards for investments, the more investment will take place in this coun- try [1] -[5] . The Foreign Direct Investment (FDI) literature follows the same line [5] -[10] . Pierpont [5] , for in- stance, presents strong arguments that the more democratic a country is, the more FDI inflow it will receive. Moreover, Caetano and Caleiro [11] expose the impact of investment freedom on FDI attraction.

FDI inflow, however, depends not only on the institutional level of the host country, but also on the entrepre- neurial choices of investors. In other words, FDI trends are not only influenced by institutions and macroeco- nomic aspects, but also derived from an entrepreneurial evaluation of institutional conditions, and the possible gains and risks of executing the investment. As we know, investing decisions are backed by differences in entre- preneur perception, depending on his or her ability to see profit possibilities [12] [13] . Secure institutional envi- ronments can provide safeguards for the investment: however, greater risk is often accompanied by greater ex- pectation of profit. We can see examples throughout history, for instance during the age of exploration or in a gold rush, when many entrepreneurs hurried to areas lacking institutions aiming to be the first to “plant their flags,” guaranteeing access to possible valuable areas. Some succeeded and gained immense fortunes, while others failed, even facing death in some cases [14] .

A lack of institutional safeguards, despite heightening the risk of an investment, may also generate the possi- bility of increased returns. We can thus argue that regions with “weaker” institutional environments may attract what we are naming “institutional void entrepreneurship,” entrepreneurs who take advantage of institutional gaps in order to obtain extra gains. In this sense, we propose that there are different patterns of FDI depending on the level of institutional development of the regions. On one hand, in regions where there is a history of FDI inflow, like Latin America, the investor demands a stable institutional environmental which guarantees the con- tinuity of returns on their investments. On the other hand, in regions without this historical inflow of FDI, like Sub-Saharan Africa, institutional void entrepreneurship can flourish, leading to an increase in FDI. However, to understand our proposition it is important to consider the institutional environment not as a single bloc, but in its different domains—legal, economic, social, and political—as they affect FDI, after Aoki (2007).

Given this theoretical perspective, the present study aims to empirically compare two institutional environ- ments in order to verify the patterns, if any, among investments and institutions in these locations. The analysis between Latin America and Sub-Saharan Africa allows us to compare distinct institutional environments to un- derstand whether even a region with weak institutions can attract FDI. It is important to note that we are consi- dering Latin America to be a stronger institutional environment than Sub-Saharan Africa, in order to verify if there are differences in FDI inflow pattern. This segmentation is justified as a methodological strategy for evaluating dissimilarities among regions.

For this purpose we have collected data from international organizations such as UNCTAD, World Bank, and the Heritage Foundation, and executed ten econometric models, based both on ordinary last squares regressions (OLS) and fixed- and random-effect panel data. Following this introduction, Section 2 of this paper presents a literature review; Section 3 describes the methodology used; Section 4 in turn presents the results and their interpretation; and Section 5 offers some concluding remarks.

2. Institutional Void Entrepreneurship and Foreign Direct Investment Decisions

As North [1] states, the institutional environment is determinant for economic development; however, this insti- tutional environment is not a unified bloc of characteristics, but rather a conjunct of distinct domains of influence. According to Aoki [15] , one of the most influent authors of NIE, institutional environments can be segmented into four distinct domains: political, legal, economic, and social. Each one of these domains offers evidence for a secure institutional environment: clear and enforced property rights (legal domain); economic freedom to carry out productive activities and commerce (economic domain); absence of corruption among authorities (political domain); and social cohesion among society actors and individuals (social domain). Some of these domains are more related to ownership (such as legal and political) than others (such as economic and social). Backed by these assumptions we can infer that FDI inflow depends on the institutional development level of host countries, but that this institutional level can be differently evaluated by investors taking into account the distinct domains.

Knowing that institutions affect the attractiveness of FDI [5] -[10] , a possible means of advancing the theory is to evaluate which domains better determine FDI inflows, and moreover if this pattern is similar when two dis- tinct regions are compared. The main thrust of this paper is to analyze whether investment decisions change in response to distinct institutional environments.

In this sense, Aoki’s taxonomy [15] can shed light on the NIE’s puzzle when we see the increase of FDI in some countries that have a weak institutional environment. As we see in Figure 1, the evolution of FDI inflow in Latin America is considerably greater than that in Sub-Saharan Africa. Despite this fact, since the beginning of the 1990s, Sub-Saharan Africa has also presented linear growth in FDI. What we learn from this evolution is that both regions have been considered for FDI inflow, although Latin America is preferred by investors. Furthermore, based on Sub-Saharan Africa’s scores on institutional domains, we may infer that investors in Sub- Saharan Africa are mainly institutional void entrepreneurs, since there is a high institutional risk in investing in these countries compared to Latin American countries. We can see some illustration of this by comparing the mean scores on institutional variables of the two institutional environments (Table 1).

Keeping this in mind, we split our sample in two in order to see if investors evaluate similarly both distinct institutional environments, one “stronger”, Latin America, and the other “weaker”, Sub-Saharan Africa. The se- lection of these two regions results from their similarities as developing regions, but considering their differences in historical inflows of FDI (Figure 1).

Although institutions matter, they matter in distinct ways depending on which domain is considered, and the eclectic paradigm could drive us towards another aspect not previously considered. In this sense, we are testing three hypotheses according to the NIE literature, in order to verify if the absence of a particular domain provides greater incentive to institutional void entrepreneurship. Note that the location advantage [6] can also act as a de- terminant of FDI execution: a given institutional domain may hold greater importance for investors depending on the region where they intend to apply their resources. Although democracy is an important factor in FDI deci- sions [5] , an investor could be comfortable with some corruption (political domain) depending on the country which the investment is being executed. This position is present in the work of Alston et al. [2] ; Khanna, Palepu and Sinha [16] ; Lippman and Rumelt [17] ; and Weeb et al. [18] . These authors, in different ways, argue that en- trepreneurs can in some sense find better positions in informal economies where there are more margins to bar-

![]()

Figure 1. Evolution of FDI inflow (USD per capita). Source: UNCTAD stat.

![]()

Table 1. Comparision of Latin America and Sub-Saharan Africa.

Source: UNCTAD; heritage foundation. *Heritage foundation provides a value for each varia- ble in a range from 0 to 100.

gain, influence government by lobbying, or through small- or even large-scale corruption. In order to verify the importance of freedom from corruption for FDI inflow we state hypothesis 1,

H1: The more freedom from corruption (political domain), the greater the FDI applications, if the institutional environment is strong.

Further to this perspective, Kim and Mahoney [19] state the importance of property rights (legal domain) for strategic decisions. Backing by well-defined property rights is the only way to guarantee that value generated will be realized by the “asset owner” (residual claimant). In this sense, foreign direct investors would carefully choose target countries by analyzing which State has superior property rights safeguards, in order to guarantee their economic rents [5] . Conversely, from an entrepreneur’s point of view, the greater the potential gains, the greater the risk linked to the activity; therefore, exploring institutional voids where property rights are not yet well defined can be a possible source of competitive advantage, because this lack of institutions can generate a barrier against competitors who are less confident in applying resources to those areas [12] , [13] . Based on these two arguments we state hypothesis 2.

H2: The greater the property rights (legal domain), the greater the FDI applications, if the institutional envi- ronment is strong.

Regarding economic freedom (economic domain), scholars have pointed out that freedom to move resources internally or externally is important for investment decisions [6] -[8] , [10] . According to Singh and Jun [7] : “(…) it is generally believed that removing restrictions and providing good business operating conditions will posi- tively affect FDI flows.” ([7] , p. 6). More specifically, Akinlo and Apanisile [20] , for instance, conclude that Sub-Saharan African countries should open their economies to a greater extent in order to drive FDI inflows. This relation between economic freedom and FDI is almost a consensus among scholars as a determinant for the occurrence of FDI. However, we may also infer that institutional void entrepreneurs can take advantage of these barriers facing competitors. For instance, the entrepreneur could “capture the State” [16] [17] [21] , or even forge ties with governments in order to use investment barriers as a protection against competitors’ attacks or actions on its market. In order to test this assumption we state hypothesis 3.

H3: The greater the economic freedom (economic domain), the greater the FDI applications, if the institution- al environment is strong.

Finally, one of the objectives of this research is to verify the similarities and divergence patterns of FDI ap- plications in developing countries, to ascertain if there are differences among the distinct institutional environ- ments of Latin America and Sub-Saharan Africa. Entrepreneurial theory [12] tells us that entrepreneurs make distinct evaluations of risk, which drives distinct expectations of future gains on carrying out certain projects [13] . This expectation can generate an institutional void entrepreneurship which drives entrepreneurs to invest in countries with fewer institutional guarantees [18] . Backed by these three hypotheses, we proceed to our metho- dology, where we present the variables used as well as the econometric model applied.

3. Methodology

The statistical analysis is based on cross-sectional quantitative methods, making use of secondary data from in- ternational organizations and foundations. To this end, fixed- and random-effects panel data analyses were em- ployed. These techniques allow tracking of the changes in the dependent variable from the changes in the ex- planatory variables, which occur over time and between the different cases studied [22] . Thus, it was possible to analyze which variables are significant in the change of FDI over the period considered (2000-2010).

The dependent variable of the present model is Foreign Direct Investment inflow (USD per capita): this vari- able was collected on UNCTAD databases for a period of eleven years. Our independent variables, related to in- stitutional aspects, are respectively: Freedom from Corruption (H1); Property Rights (H2); and Investment Free- dom (H3). All these three variables are scored between zero and 100, and were collected by the Heritage Foundation and non-profit organizations that grade the institutional aspects of various countries. We also included some control variables supported by the FDI literature [5] -[10] . All the variables are related to macroeconomic aspects. In the following models we inserted: GDP total (USD per capita); inflation rate (%); interest rate (%) and exchange rate (%), as long as year dummies. Table 2 presents some descriptive statistics and the correlation matrix of the model variables for Latin America and Sub-Saharan Africa respectively.

The fixed- and random-effect panel technique is indicated for this study because it corrects possible endogeneity problems without requiring instrumental variables [23] . Another relevant aspect for the use of models in

(a) ![]() (b)

(b) ![]()

Table 2. Descriptive statistics of variables of the quantitative study. (a) Latin America mean standard deviation and correla- tions, (b) Sub-Saahrian África mean standard deviation and correlations.

Source: authors.

the fixed-effect panel format lies in the possibility of interaction between variables, especially the interaction with annual variables, aiming to assess possible impacts occurring in a given period. On the other hand, the random-effect panel is advantageous because it “considers explanatory variables that are constant over time” ([22] , p. 442). This fact is relevant to the study, especially because this model includes institutional variables which tend to vary on time horizons from ten to one hundred years [24] .

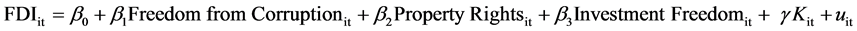

Based on the assumptions described above, we sought to structure the data model on fixed- and random-effect panel, Equation (1), to confirm the three hypotheses of the study.

(1)

(1)

where K = vector of control variables.

4. Results and Analysis

Below we present the results of the fixed- and random-effect panel models (see Table 3 and Table 4). In total, ten different models were performed; one ordinary last squares (OLS), two random-effect (RE) models and two fixed-effect (FE) models for Latin America, and the same sequence for Sub-Saharan Africa. The control variables were gradually included in the models. Finally, it is worth noting that we performed heteroscedasticity tests for the OLS, and the panels were performed with cluster robustness.

Initially we are able to see that for both models (Latin America and Sub-Saharan Africa) only property rights seem to be a significant variable. These results corroborate H2, and consequently Aoki’s assumptions [15] . However, the results reject H1 and H3, showing that both “freedom from corruption” and “investment freedom” are not relevant variables for FDI decisions.

Along the same lines, as we have stated before property rights are the only variables which are significant for attracting FDI. However, the signal of the variable changes from one model to the other. As shown in the results for Latin America in Table 2, the higher the level of property rights, the greater the inflows of FDI, which cor- roborates (H2). Conversely, the results presented on Table 3 for Sub-Saharan Africa show that the lower the property rights score, the higher the FDI inflows, rejecting (H2).

This result conflicts with the assumptions of the NIE as evidenced by the economic literature on organizations [19] , instead demonstrating that institutional void entrepreneurship occurs where there is a weak institutional environment. Taking a closer look at the results, it is important to consider some aspects not previously eva- luated. FDI is an investment decision made by foreigners considering the eclectic paradigm [6] . In some sense, any decision to apply resources externally relies on entrepreneurship. According to entrepreneurial theory [25] - [28] , entrepreneurs have advantages in investing in environments with limited property rights because they can provide extra rents (or a premium). For instance, some Sub-Saharan Africa countries, such as Mozambique, offer an example of this. The absence of a regular property rights market (derived from Mozambican communist law) enables investments inland based on the investor’s relations with authorities. These relations permit foreign investors who assume the risk of investing in a country with low institutional security to extend their influence and act over areas not considered in initial contracts. In other words, investors stake their flags on Mozambican land, and take advantage of that by expanding the original limits of their property, gaining even more rents than the initial contract allows for. These investments may jeopardize community rights to access land and water, which is often neglected by government regulators [29] -[31] .

As shown by the example above, the absence of property rights could foster future gains, mainly because the risk involved increases, or because investor gains greater bargaining power [17] for setting the property rights on subsequent occasions. In other words, the entrepreneur who invests in a low-property-rights environment runs a greater risk of losing the investment, but if that does not occur, the entrepreneur gains a premium for accepting the risk and being the first mover towards an investment whose value was in the public domain [32] . Thus, the negative signal present on Table 3 for Sub-Saharan Africa can indicate that those entrepreneurs are planting their flag on public domain areas in order to guarantee extra rents in the future, when the value of that area emerges. One perspective is to compare the evolution of FDI inflows in Latin America and Sub-Saharan Africa (see Figure 1). From the graph we can infer that because of the exponential evolution of Latin American FDI inflows, foreign investors are more likely to gradually desire better secured property rights in order to guarantee the amount of investment already committed. On the contrary, in Sub-Saharan Africa, the low level of foreign investment over history encourages investors, who see in the absence of property rights an opportunity for gaining extra rents.

5. Conclusions

FDI trends respond significantly to the institutional environment. However, some domains are more important

![]()

Table 3. Regression analysis for Latin America.

Robust standard errors in parentheses. ***p < 0.01, **p < 0.05, *p < 0.1. Source: authors.

![]()

Table 4. Regression analysis for Sub-Saharan Africa.

Robust standard errors in parentheses. ***p < 0.01, **p < 0.05, *p < 0.1. Source: authors.

than others. The results of the present study show that property rights (legal domains) are more important for FDI application decisions than the political or economic domains. This represents an advance in the literature on FDI, especially because it shows a crucial factor for attracting foreign investment.

Although the results show the importance of property rights, we can infer that property rights have two dis- tinct effects on investors. If countries have a historically low level of FDI together with a low score for property rights, institutional void entrepreneurs may see this lack of safeguards as an opportunity to invest in resources that are in the public domain [32] by planting their flag, aiming to gain extra rents in the future. This is the case in many Sub-Saharan African countries. Conversely, if countries have higher scores for property rights, with better guaranteed rights over assets, more risk averse entrepreneurs will apply resources because they are confi- dent that the value generated will be realized for the owner of the economic and legal rights.

This study’s contribution is rooted in the analysis of so-called institutional void entrepreneurship, as a distinct category of entrepreneurship that deserves attention, mainly it is directed at countries that lack institutions, tak- ing advantage of institutional weakness in order to secure extra rents. Future studies can be developed in order to better evaluate the impact of these entrepreneurs on the institutional evolution of countries.

Acknowledgements

We thank Coordenação de Aperfeiçoamento de Pessoal de Nível Superior (CAPES), Centre for Organization Studies (CORS) for helping on the funding of this research.