A Linear Regression Approach for Determining Option Pricing for Currency-Rate Diffusion Model with Dependent Stochastic Volatility, Stochastic Interest Rate, and Return Processes ()

1. Introduction

A foreign exchange rate depends on the supply and demand dynamics of a currency. The exchange rate is a function of trade balance, the interest rate differential and differential inflation expectations between the two countries [1] [2] .

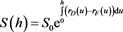

Let S(u),  = exchange rate process over the time interval:

= exchange rate process over the time interval: , where u = number of domestic currency units, e.g., $, per unit of foreign currency = $-price of foreign currency.

, where u = number of domestic currency units, e.g., $, per unit of foreign currency = $-price of foreign currency.

As interest rate  increases, $ appreciates because investors prefer $-denominated bonds. Assuming a frictionless, arbitrage-free continuous-time economy in [1] , we define a diffusion process model for S(u). In addition, using interest-rate parity condition we have

increases, $ appreciates because investors prefer $-denominated bonds. Assuming a frictionless, arbitrage-free continuous-time economy in [1] , we define a diffusion process model for S(u). In addition, using interest-rate parity condition we have

, see [1] .

, see [1] .

In the following section, the formula for valuations of currency spot options is considered, where we obtain a closed form formula for the call option price that has a simple algebraic expression, which is similar to the call option price expression of a Black-Scholes model, making it much easier to compute its value and study. As in [2] , we can define an implied volatility function and derive its skewness property.

Subsequently, the proposed three-factor exchange-rate diffusion model is discussed, such that the stochastic volatility process and the stochastic domestic interest rate process each have a stochastically dependent Brownian motion return process.

In the next section, a linear regression approach that derives explicit expressions for the distribution function of  is treated.

is treated.

Foreign exchange rate option modeling is the subject of several well-known papers and in chapters within [3] [4] [5] [6] . Leveraging Heston’s model [4] for this application would introduce complexity due to the need to numerically integrate conditional characteristic functions obtained as solutions of nonlinear pdf to derive the call option prices. An equivalent two-factor Black-Derman-Toy model [2] can be formulated with introduction of H(u).

The method suggested in this paper results in Black-Scholes type formula for call option pricing, which is easily computable.

Finally, we provide concluding remarks and suggestions for future direction.

2. Currency Spot Option

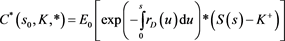

Given the spot rate , consider the present value of option

, consider the present value of option

(1)

(1)

where K is the known strike price and  is a mean-reverting stochastic process given in (2) below.

is a mean-reverting stochastic process given in (2) below.  is the value of the exchange rate at the option’s maturity price. The option to purchase foreign currency over the counter can be exercised when S(s) > the strike price exchange rate K.

is the value of the exchange rate at the option’s maturity price. The option to purchase foreign currency over the counter can be exercised when S(s) > the strike price exchange rate K.

3. A Diffusion Process Model

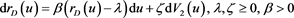

A continuous-time risk-adjusted and risk-neutral exchange rate model, under a Martingale Measure Q, is defined below as a diffusion process (2), mean-reverting stochastic processes: Volatility  (3) and domestic interest rate

(3) and domestic interest rate  process (4), and foreign interest rate

process (4), and foreign interest rate  is a known constant.

is a known constant.

(2)

(2)

(3)

(3)

(4)

(4)

(5)

(5)

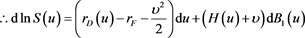

Equation (5) is obtained from Equation (2) by the application of Ito calculus [7] .

Assumption:

, where

, where  and

and ![]() and

and ![]() are independent Brownian processes.

are independent Brownian processes.

![]() , where

, where ![]()

and ![]() and

and ![]() are independent Brownian processes. (6)

are independent Brownian processes. (6)

From the assumption above, the return processes ![]() are correlated with

are correlated with ![]() and that

and that ![]() are standard Brownian motion processes.

are standard Brownian motion processes.

Then it follows, see [2] [3] , that the distributions of ![]() and

and ![]() are Gaussian processes.

are Gaussian processes.

Alternatively, ![]() and

and ![]() may be expressed as:

may be expressed as:

![]() (7)

(7)

![]()

where ![]() is the long-term mean and where

is the long-term mean and where![]() .

.

![]() (8)

(8)

Remark 1:

From (8), choosing ![]() and that is small in value, we can make

and that is small in value, we can make ![]() negligible.

negligible.

If, alternatively, we assume that ![]() has a square root process [8] , then the random variable H(u) distribution is non-central

has a square root process [8] , then the random variable H(u) distribution is non-central![]() . For simplicity we chose the mean-reverting process model (3).

. For simplicity we chose the mean-reverting process model (3).

![]()

![]()

where ![]() and

and ![]()

![]() (9)

(9)

Assuming![]() , and

, and

![]() (10)

(10)

The Brownian motion processes ![]() and

and ![]() are as follows:

are as follows:

![]() , where

, where ![]() (11)

(11)

In addition, the Brownian motion processes ![]() and

and ![]() under Q are independent.

under Q are independent.

Remark 2:

![]() : the volatility process.

: the volatility process.

It follows from [2] that the distribution of ![]() is:

is:

![]() (12)

(12)

Alternatively, ![]() may be expressed as

may be expressed as

![]() (13)

(13)

where ![]() and

and![]() .

.

See [9] for a similar assumption. See also [2] and [3] .

Note that ![]() has a normal distribution with mean 0 and variance s, so

has a normal distribution with mean 0 and variance s, so ![]() can be written as

can be written as![]() , where

, where ![]() is a standard normal variable. Then

is a standard normal variable. Then ![]() can be written as a quadratic function of

can be written as a quadratic function of

![]() plus a residual term

plus a residual term![]() . {See Proposition 1 below}.

. {See Proposition 1 below}.

For![]() , we define a volatility process

, we define a volatility process

![]() .

.

Define![]() , as the average standard

, as the average standard

deviation in the case of uncorrelated Brownian motion process

![]() [See [10] , p. 182].

[See [10] , p. 182].

Proposition 1:

![]()

![]() (14)

(14)

where

![]() (15)

(15)

Proof: See Appendix B.

We consider a mean-reverting Gaussian process model (2), the volatility stochastic processes ![]() and the processes,

and the processes, ![]() and

and ![]() in (3) to be correlated; where

in (3) to be correlated; where ![]() is a standard Brownian motion return process. In addition, in (3), we define the volatility

is a standard Brownian motion return process. In addition, in (3), we define the volatility ![]() as a mean reverting Gaussian process with

as a mean reverting Gaussian process with ![]() as its long-term mean.

as its long-term mean.

Assumption 1:

![]() (16)

(16)

In (4), we define the domestic interest rate process ![]() as a mean reverting Gaussian process with

as a mean reverting Gaussian process with ![]() as its long-term mean. The process

as its long-term mean. The process ![]() is such that the return process

is such that the return process ![]() is a correlated standard Brownian motion process to

is a correlated standard Brownian motion process to![]() . The foreign interest rate

. The foreign interest rate ![]() is a constant

is a constant ![]()

Assumption 2:

It follows from [2] that the distribution of![]() :

:

![]() (17)

(17)

Now we use the results obtained in Proposition 1 to derive an explicit expression for

![]()

Proposition 2:

![]() (18)

(18)

Remark 3:

From the expression for

![]() . the stochastic terms

. the stochastic terms

![]() modifies

modifies ![]() and the constant term

and the constant term ![]() modifies

modifies ![]() with the addition of

with the addition of ![]() and the constant terms

and the constant terms ![]() modifies

modifies ![]() with the addition of

with the addition of![]() .

.

Then, using the results in [2] , Proposition 1 and those in Appendix A and Appendix B we have:

![]() (19)

(19)

Therefore,

![]()

![]()

![]()

Remark 4:

Note that ![]() in this paper is an updated version from the

in this paper is an updated version from the ![]() in [2] ,

in [2] ,

due to our treatment of a stochastic interest rate: ![]()

![]()

![]()

In the case of![]() .

.

![]() , where

, where ![]() (20)

(20)

![]() (21)

(21)

![]() where

where

![]() (22)

(22)

![]()

![]()

![]() is provided in (B1)

is provided in (B1)

![]()

Case 1:![]() ;

;

![]()

Let ![]()

![]()

Let![]() .

.

Assumption 3: ![]() and

and ![]() are independent random variables.

are independent random variables.

Assumption 4:![]() .

.

Assumption 5: ![]() and

and![]() .

.

If Assumptions (4) and (5) hold, then the conditional risk-neutral distribution of ![]() is:

is:

Proposition 3:

![]()

![]() (23)

(23)

where

![]() (24)

(24)

If![]() , then the roots of the equation defined in (24) are equal so that

, then the roots of the equation defined in (24) are equal so that![]() , then there exists a value

, then there exists a value ![]() such that

such that

![]() .

.

In other words, ![]() is the lowest value for the conditional random variable

is the lowest value for the conditional random variable![]() .

.

Remark 5:

Since we know the CDF of lnS(s) we can estimate the parameters of the underlying model (2)-(5).

Case 2: Conditional Risk-neutral Distribution function of![]() ,

,![]() . Suppose

. Suppose![]() , Conditional risk-neutral distribution of

, Conditional risk-neutral distribution of ![]() is as follows:

is as follows:

![]()

![]()

where

![]()

Example 1

![]()

![]() :

:

![]() :

:

Then

![]()

Remark 6:

From the expression for

![]()

the stochastic terms ![]() modify the term

modify the term ![]() and the constant terms

and the constant terms ![]() modifies

modifies ![]() with the addition of

with the addition of ![]() .

.

Proof:

Apply a proof similar to the one in Appendix A of [2] using the result for ![]() in Appendix B of the current paper. See also Proposition 4.

in Appendix B of the current paper. See also Proposition 4.

Remark 7:

Assume![]() , which implies that

, which implies that![]() .

.

If Assumption (3) holds then the conditional risk-neutral distribution of ![]() is:

is:

![]() (25)

(25)

where

![]() (26)

(26)

If![]() , then the roots of the equation defined in (26) are equal so that

, then the roots of the equation defined in (26) are equal so that![]() , then there exists a value

, then there exists a value ![]() such that

such that![]() .

.

In other words, ![]() is the lowest value of the conditional random variable

is the lowest value of the conditional random variable![]() .

.

Call option price:

![]()

Proposition 4:

![]()

where from Proposition 1

![]()

See Appendix B.

![]()

Remark 8:

Given the formula for

![]() , the stochastic expression

, the stochastic expression ![]() modifies the function

modifies the function ![]() and the constant terms

and the constant terms![]() , modifies

, modifies ![]() with the addition of

with the addition of![]() .

.

![]() (27)

(27)

Let

![]()

![]() (28)

(28)

Then

![]()

Hedge Ratio:

![]()

D-Neutral Portfolio

Delta-Neutral Portfolio

Consider the following portfolio that includes a short position of one European call and a long position of delta units of the domestic currency.

The portfolio of delta-neutral positions is defined as:

![]()

We obtain below Conditional Risk-neutral Distribution function of

![]() (29)

(29)

by considering the cases of: h = 1, 0 and −1

We use a discrete approximation (see [2] , (28)).

Suppose![]() , which implies

, which implies![]() .

.

Again, we consider the Equations (1)-(4) to define Example 1 below.

![]() (30)

(30)

![]() (31))

(31))

![]() (32)

(32)

![]() (33)

(33)

Let

![]()

Then,![]() :

:

And![]() :

:

If Assumption (2) holds then the unconditional risk-neutral distribution of![]() and

and ![]() are independent random variables.

are independent random variables.

Then Figure 1 depicts the unconditional risk-neutral distribution of

![]() .

.

Remark 9:

Future movement of values of risk-free interest rate and volatility are uncertain and as they increase, they affect call option values as depicted in the above Figure 2, Figure 3 ( [5] , p. 204). Sudden changes in their values may occur because of economic shock. See the models suggested in [11] [12] .

![]()

Figure 1. Unconditional risk-neutral CDF of lnS(s), strike price (cents) k from 1.1 to 16.2.

![]()

Figure 2. Unconditional call option price with strike price k (cents) from 1.1 to 26.

![]()

Figure 3. Unconditional hedge ratio with strike price k (cents) from 1.1 to 26.

4. Conclusion

We define a three-factor exchange-rate diffusion model with 1) stochastic volatility process, 2) stochastic domestic interest rate process, and 3) return process which are Brownian motion return processes that are stochastically dependent. Further generalization is possible with the assumption of domestic and foreign stochastic interest rate processes which are subject to economic shocks [11] [12] . The results are applicable to bond option models ( [5] , p. 783).

Appendix A

![]()

![]()

is the regression coefficient.

![]()

![]() (2A1)

(2A1)

![]()

Then the regression equation is

![]() (2A2)

(2A2)

Assumption 6:

![]() (Approximately) (2A3)

(Approximately) (2A3)

Note that ![]() and

and

![]() .

.

![]()

Assumption 7:

![]() (Approximately)

(Approximately)

(2A4)

Proof of Proposition 1:

![]()

![]()

Appendix A from [2]

![]()

where

![]()

![]()

where

![]()

Appendix B

![]()

See [13] .

![]()

because

![]()

Let ![]()

where ![]()

Let

![]()

Let

![]()

where applying Wilk’s linear regression [14] , we get

![]() (B1)

(B1)