Executives’ Overconfidence, Political Connection and Acquisition Premium of Enterprises ()

1. Introduction

With the continuous improvement of the degree of opening up, Chinese enterprises are facing more and more turbulent market competition environment. To enhance their competitiveness, acquisitions have become the most preferred strategic choice for Chinese enterprises. However, the frequent acquisitions are accompanied by serious premium phenomenon. Throughout the domestic and international acquisition premium behavior of enterprises, we find the majority of enterprises fell into a financial crisis, and gradually went to a loss or even bankruptcy due to paying too high premium. Nevertheless, enterprises are still on the way. This phenomenon has aroused wide concern among the scholars and gradually become an important research topic.

Foreign scholar Roll (1986) proposes “overconfidence hypothesis” to give a scientific explanation. He believes that even in the case that acquisitions are paid significantly higher than the market price or seriously damaged the value of the enterprises, overconfident executives still often initiate acquisition activities [1] , Which spreads the research on the relationship between executives’ overconfidence and acquisition decision-making based on behavioral finance at home and abroad [2] . Malmendier & Tate (2003) find that overconfident executives are more likely to conduct “low-quality” acquisitions of value destruction [3] . Song and Dai (2015) empirically test overconfident managers can significantly reduce the company’s financial performance and market performance after acquisitions [4] . Therefore, the study of factors strengthening or weakening the adverse impacts of executives’ overconfidence on the enterprise decisions of acquisition has substantial practical and theoretical significance.

Existing research on the factors strengthening or weakening the adverse impacts of executives’ overconfidence on the enterprise decisions of acquisition suggest they are mainly conducted from the perspective of the governance structure of the board and the capital structure. For example, Hayward & Hambrick (1997) find the separation between CEO and chairman of the board or higher proportion of independent directors, will weaken the impact of CEO hubris on the premiums [5] . Zhu and Yu (2015) also find that the separation between the chairman and the CEO, the increase in the number of board meetings may undermine the positive correlation between executives’ overconfidence and acquisition activities [6] . Malmendier & Tate (2006), Zhai and Zhang(2012) have found that overconfident executives have high cash flow sensitivity and are prone to over-investments when companies have sufficient cash flow [7] [8] .

It is showed that enterprises can obtain massive resource benefits by establishing political connection in the specific institutional context of China’s transitional economy [9] , such as preferential financing and investment treatment [10] ; more government subsidies and more favorable tax rates [11] ; regulatory easing, easier to break industry barriers; as an alternative mechanism for property rights protection, offset some of the negative effects of the institutional environment [11] ; make full use of government monopoly resources [9] , etc. However there are obvious inconsistencies in the conclusions about effects of political connection on enterprises’ strategic decisions and performance. We hold that these studies are mainly “capital” perspective in the backgroud that executives are completely rational, while ignoring the factor of executives’ irrationality and the influences of other mechanisms of political connection, such as weakening illusion control and providing information. Therefore, combining executives’ irrationality with political connection and considering these two mechanisms, we study the role of political connection in strengthening or weakening the adverse impacts of executives’ overconfidence on the enterprise decisions of acquisition.

This paper breaks through the existing research based on the perspective of capital and board of directors, and studies the mechanisms of weakening or strengthening the influence of overconfidence on the acquisition premium from the perspective of political connection, which is conductive to reveal a deep-level mechanisms about how the political connection affect the enterprise strategic decision-making and selection, also help enterprises to further consider how to improve their governance mechanism to help managers make scientific and rational investment decisions, and finally help enterprises to realize healthy development.

2. Theory and Hypothesis

2.1. Executives’ Overconfidence and Acquisition Premium

Behavioral finance is a cognitive psychology research on People’s behavior and decisions under the uncertain conditions. Based on the upper echelon theory and behavioral decision theory, it further studies the influence of all kinds of psychological characteristics of managers on enterprise’s investment decision (such as overconfidence) under the conditions of environmental uncertainty, incomplete information and limited individual ability. Behavioral finance combines irrational factors with business activities, providing a new perspective to explain frequently occurred acquisition anomalies in the market. In this study, on the basis of behavioral finance executives’ overconfidence shows five psychological activities:

First, overestimating their ability. Overconfident executives think they have a wealth of knowledge and experience to overestimate their ability to predict and judge, the ability to discover new information, the ability to manage and the ability to complete the task, that they can do more difficult projects [12] . Second, overestimating the possibility of project success. Overconfident executives tend to overestimate investment returns and underestimate investment risk, underestimate the benchmark rate of failure to enter emerging markets [13] , underestimate the cultural conflicts that arise from acquisitions, and so on, and thus they have a blind optimism about the success of the project. Third, underestimating the uncertainty of the environment. Overconfident executives believe that behavior and outcome are determined by the factors in control rather than the factors out of control. The greater their awareness of control, the greater the likelihood of underestimating uncertainty and risk, the greater tendency to make risky decisions [12] . They desire to demonstrate their ability through the successful implementation of acquisition decisions. Fourth, overestimating arising synergies from acquisitions. Weston’s synergistic theory includes operational, managerial, and financial synergies. Operational synergies can bring economies of scale and economies of scope; management synergies can make the acquirers and the targets to learn from each other; financial synergies can enable enterprises to obtain internal and external financing with a smaller cost. Overestimation of synergies can also lead to overconfident executives with higher acquisition tendencies. Last, overestimating the ability of the target business to create profits [3] . Overconfident executives tend to overestimate the resource capabilities and prospects of the target firm, believing that they can create greater wealth for the firm after acquisitions.

In general, these five psychological activities have significantly influenced overconfident executives’ perception of acquisition activities, believing that they have the ability to take on more challenging acquisitions, can deal well with the difficulties and obstacles during the process of acquisitions, comfirming acquisitions can bring the benefits of synergy effect, to create greater wealth for themselves, which makes them willing to pay higher premiums for successful acquisitions. Therefore, we hypothesize:

Hypothesis 1: Executives’ overconfidence is positively related to the premium paid for the acquisitions.

2.2. Moderating Role of the Political Connection

Under the background of deepening reform and accelerating economic transformation and upgrading, and that the system vacancy and institutional conflict has existed for a long time, the Chinese government still has strong intervention in the operation of enterprises. At the same time, burdened with the social pension, employment promotion, social security maintenance and stability and other multiple policy burden, for their own interests the government often use their own power to intervene in the enterprises’ management activities, requiring enterprises to share the government’s commitment and responsibilities to these policy [11] [14] , which leads the government to produce a strong tendency to control the enterprises.

Studies shows that when people are able to decide on an investment project and have an absolute influence on the outcome of the projects, they will have a control illusion [15] . The illusion control will make overconfident managers choose more challenging projects, make more bold decisions. When enterprises establish political connection, especially in the way to establish that the executives currently or have served in the government, or as a member of the National People’s Congress or CPPCC members, the government is strengthening intervention and control on the enterprise management decision. The existence of government intervention and control will not only reduces the control of decision-making of executives, but also make the business performance be more dependent on political connection, rather than the manager’s own ability, resulting in the weakening of executive’s control illusion, and thus make the overconfident executives appear cautious in making investment decisions to inhibit the corporate acquisition premium. The higher the level of political association, the higher the degree of government intervention and control, the stronger the dependence of the enterprise on the political connection, the stronger the control illusion is impaired, the easier the influence of the executives confidence on the acquisition premium is weakened.

In addition, corporate executives just interpret the limited state’s macroeconomic policies, market information, and other corporate information. But by building political connection, they can gain a more comprehensive understanding and master more reliable information to help make rational investment decisions, avoiding irrational investment behavior. And in the current political and economic environment, the higher levels of government has a much more comprehensive understanding of macroeconomic policies, the market information on other companies than the lower government. Therefore, when enterprises’ political connection are in higher level, there are more channels to obtain valued information and the information is more complete, more reliable, so that overconfident executives can be more cautious, objective and rational to make the appropriate acquisition decision-making, inhibit the level of corporate acquisition premium.

Both two mechanisms of political connection―weakening illusion control and providing information make overconfident executives become more cautious to making acquisition decisions, which to some extent inhibits the corporate acquisition premium. Therefore, we hypothesize:

Hypothesis 2a: The relationship between executives’ overconfidence and acquisition premium will be negatively moderated by the political connection.

Hypothesis 2b: The higher the level of corporate political connection, the more likely to weaken the impact of executives’ overconfidence on acquisitions premium.

3. Methods

3.1. Data and Sample

We utilize the acquisition events implemented by all A-share listed companies from 2007 to 2014 as the initial sample. All acquisition events are based on the sample company as the acquirers, not the targets. After excluding the samples of the financial companies, ST, *ST companies, the samples of listed companies in the same year, the samples that CEOs are changed, the samples that do not disclose earnings forecasts and disclose the forecast information after the end of the disclosure period, and the samples of companies that implemented debt restructuring and tender offer, as well as the samples of missing values and outliers, our final sample consists of 419 observed values (see Appendix 1). The data came from th China Listed Firm’s Merger & Acquisition, Asset Restructuring Research Database in the CSMAR.

3.2. Measures

・ Acquisition premiums. According to the unique China’s capital market, this paper takes the measurement methods commonly used by domestic scholars [16] [17] . Acquisition premiums are commonly defined as the acquirer’ bid minus the targets’ preannouncement market value divided by the targets’ preannouncement market value. The higher the ratio, the Larger the size of acquisition premium.

・ Executives overconfident (OC). At present, there are a variety of ways to measure executives’ overconfidence, such as: 1) executives stock options or stock holdings [3] [7] ; 2) business climate index [18] ; 3) executives relative compensation [12] ; 4) earnings forecast bias. Lin, Hu, Chen (2005) first identified if the company’s annual profit is more than the actual, the executives will be overconfident; Yu (2008) and Jiang (2009) etc. also consider the inconsistency between the performance forecasts and actual performance as a judge whether the executives are overconfident; 5) mainstream media evaluation [5] ; 6) the frequency of acquisitions [19] ; 7) executives personal characteristics [18] . The advantages and disadvantages of these seven kinds of measurement methods have been widely discussed. Considering the needs of empirical research, data availability and special circumstances of China’s securities market, we mainly use two methods to measure and test the robustness by the second method.

・ The first method is to learn from Yu, Jiang and others’ approach, according to the listed company’s annual performance notice to determine whether the executives are overconfident (OC1). The type of performance forecasts includes four optimistic expectations (slightly increased, deficit loss, continued surplus, pre-increase) and four pessimistic expectations (slightly reduced, the first loss, continued losses, reduction). We choose four optimistic expectations as a sample of the study, if the optimistic expectations don’t come true (that is, the performance forecasts and the actual performance is inconsistent), the executives will be defined as overconfidence, the value is 1, otherwise 0.

・ Learning from Yu, Li, Pan and others’ approach, the second is to use composite index composed of individual indicators of executives personal characteristics as a measure of overconfidence. The personal characteristics of the executives include: 1) gender. Women are more conservative and cautious than men; 2) age. Younger executives are more likely to make risk decisions, and if the age of executive is less than the sample mean, the value is 1, otherwise 0; 3) education. People who receive high level of education firmly believe that their own ability and the accuracy of judgment, and behave more confident. If the degree is above the undergraduate, the value is 1, otherwise 0; 4) educational background. Executives with administrative backgrounds have a deeper understanding of risk and are less likely to be overconfident. If the executive does not have an administrative background, the value is 1, otherwise 0; 5) the separation of positions. If CEO is the chairman of the board at the same time, it will become more confident, the value is 1, otherwise 0. Based on the total value of the above five features, a comprehensive index is constructed. If the composite index is 4 or 5, it is defined as overconfidence (OC2), the value is 1, otherwise 0.

・ Political connection (PC). Based on the particular domestic institutional environment and the actual situation of Chinese enterprises, we examine the political connection from two dimensions: First, political connection. If the chairman, general manager or CFO of the company currently or have served in the government, or as a member of the National People’s Congress or CPPCC members, that means the company has a political connection [20] [21] , the value is 1,otherwise 0. Second, political connection level (PCL). The corresponding assignment is 5, 4, 3, 2, 1, according to the executive in the administrative level of the division of the work unit for the national, provincial, municipal, county level and below. The higher the score, the higher the level.

・ Control variables. Following existing research, we control the 13 variables that may have an impact on the acquisition premium, which is divided into four categories. First, firm characteristics, acquirer firm size, age, cash flow and ROA. Second, Governance structure: the proportion of independent directors; ownership concentration. Third, acquisition characteristics: history, payment methods, financial advisor. Forth, other conventional influences: executives age, financial crisis, industry and year.

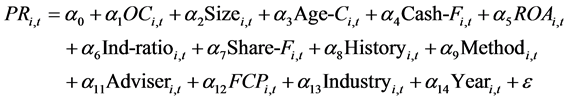

3.3. Regression Model

In order to test the relationship between executives’ overconfidence and acquisition premium, we establish mode 1.

In order to further test the relationship between the political connection, the overconfidence of executives, and acquisition premium, we establish the following model 2 and model 3.

4. Results

4.1. Regression Analysis

We use the STATA/MP 13.1 for data analysis. Table 1 presents the means, standard deviations and correlations of the variables that we measure in the model. The average value of the acquisition premium is 0.064 and the standard deviation is 0.159, which indicates that there is a significant difference in the size of acquisition premium of different enterprises. The mean value of the political connection is 0.456, the standard deviation is 0.499, the mean level of political

![]()

Table 1. Descriptive statistics and correlation analysis.

Note: * **, ***respectively indicate significant correlation at 10%, 5%, 1% level. T values in brackets.

connection is 1.513, the standard deviation is 1.854, indicating that many enterprises are actively establishing the political connection, and there are great differences in the level of political connection of different enterprises. The correlation coefficient of political connection and political connection level is 0.893. It is so high mainly because the political connection level is evaluated with political connections in the sample. In order to avoid serious mutual linear problem, the study will be on the two variable regression analysis respectively. In addition, the correlation degree of other variables is low. The correlation coefficient between overconfidence and premium is 0.038, which is positive correlation but not significant. So we need to further test in regression analysis.

Acquisition premium is a continuous variable that can be analyzed by using a general linear model. Table 2 shows the results of using OC1 to measure executives’ overconfidence. The models (1), (2), (3) show the regression results of the relationship between executives’ overconfidence, political connection and acqui-

![]()

Table 2. Relationship between overconfidence and acquisition premium test (OC1).

Note: *, **, ***respectively indicate significant correlation at 10%, 5%, 1% level. T values in brackets.

sition premium. Model (1) first adds control variables as the benchmark model, regression results in model (2) with executives’ overconfidence as explanatory variables show that executives’ overconfidence coefficient is 0.017, significant at the 5% level, by controlling the variables that may affect the acquisition premium, which suggests executives’ overconfidence significantly enhance the size of acquisition premium. The hypothesis 1 is supported. In model (1) and (2), the coefficient of political connection is negative, but not significant, indicating that political connection do not directly have a significant negative impact on the premium. The model (3) reports the regression results after adding the variables of political connection. The results show that the coefficient of overconfidence and political correlation is −0.034, which is also significant at 5% level, indicating that the political connection will weaken the influence of executives’ overconfidence on the acquisition premium. The hypothesis 2a is supported. The models (4), (5), (6) show the regression results of the relationship between executives’ overconfidence, political connection level and acquisition premium. The model (6) shows that the coefficient of overconfidence and political connection level is 0.02, and not significant, indicating that the higher the level of political connection is, the less likely it is to weaken the impact of executives overconfidence on the acquisition premium. So the hypothesis 2b is not supported. This may be because the higher the level of political connection, the higher the reputation of the firm, will help to enhance investor confidence in the decision-making of the company, which will bring more financing to the company. Instead, overconfident executives may pay higher premium for the acquisitions.

4.2. Robustness Test

To test the reliability of the above results, we use a composite index of executives’ personal characteristics as a measure of executives’ overconfidence to carry out the robustness test. In the same way, all the acquisitions events of A-share listed companies in 2007 and 2014 were selected as the initial sample. After eliminating the sample that did not meet the relevant requirements, the final sample value was 1100. Table 3 shows the regression results of OC2 as a measure of executives’ overconfidence. The Model (2) shows that the executives’ overconfidence coefficient is 0.013 and is significant at the 5% level. The hypothesis 1 is supported. The Model (3) shows that the coefficient of overconfidence and political connection is −0.065 and is significant at the 5% level. The hypothesis 2a is supported. The Model (6) suggests that the regression coefficient for executives’ overconfidence and political connection level is negative but not significant, indicating that hypothesis 2b is not supported. The results of robustness test are similar to those in Table 2, which shows that the conclusion of this study has good stability.

5. Conclusions

Acquisition events of all A-share listed companies in 2007-2014 taken as the sample, we empirically test the relationship between executives’ overconfidence

![]()

Table 3. Relationship between overconfidence and acquisition premium test (OC2).

Note: *, **, ***respectively indicate significant correlation at 10%, 5%, 1% level. T values in brackets.

and acquisition premium. The study finds that Chinese enterprises in the context of the transition economy, as the main body of the new round of acquisitions, initiate acquisition premium behavior that are highly associated with executives’ overconfidence, which is consistent with the foreign research conclusions. Further, breaking through the existing research based on the perspective of capital and board of directors, we combine executive’s irrationality with political connection to study the mechanisms of weakening or strengthening the influence of overconfidence on the acquisition premium from the perspective of political connection. Different from the previous studies, this paper combines the two mechanisms of political connection-weakening the control of illusion and information provision, and draws a conclusion different from the existing research. It shows the political connection will weaken the influence of executives’ overconfidence on the acquisitions premium; however, political connection level is not necessarily an important safeguard against weakening the executives’ overconfidence.

The political connection does not have a direct and significant impact on the corporate buy-out premium, but rather by weakening the manager’s illusion, reducing the manager’s opportunistic behavior, providing more comprehensive and reliable information, so that making the overconfident manager finally make more rational and reasonable acquisition decision. This reveals a deep- level mechanism about how the political connection affect the enterprise Strategic decision-making and selection, also suggests political connection can serve as an effective governance mechanism to help the enterprises with overconfident executives to make scientific and reasonable investment decisions,. As a result, the enterprises with overconfident executives can make full of the political connection to reduce the non-rational investment activities, and finally help enterprises to realize healthy development.

But at the same time, it is necessary to examine the role of political connection. The higher level of political connection does not necessarily mean more easily weaken negative influences of executives’ overconfidence. It shows that the political connection level is not the higher the better. Excessive attention to the construction of the political connection level will lead to excessive government intervention and control in the corporate decision-making to restrict managerial discretion to a greater extent and will lead to excessive dependence on political connection while ignoring the construction of enterprises’ internal capacity (e.g. innovation. internal governance). Therefore, in the current background of China’s transition economy, the establishment of a benign political connection is extremely necessary. Chinese entrepreneurs should pay more attention to innovation, focus on improving their “hard power”, rather than engage in “relations”. At the same time, the government should pay more attention to serving and building a platform to help enterprises to grow faster and stronger.

Appendix 1

A-share listed companies (249 companies, 419 observed values).

![]()

Submit or recommend next manuscript to SCIRP and we will provide best service for you:

Accepting pre-submission inquiries through Email, Facebook, LinkedIn, Twitter, etc.

A wide selection of journals (inclusive of 9 subjects, more than 200 journals)

Providing 24-hour high-quality service

User-friendly online submission system

Fair and swift peer-review system

Efficient typesetting and proofreading procedure

Display of the result of downloads and visits, as well as the number of cited articles

Maximum dissemination of your research work

Submit your manuscript at: http://papersubmission.scirp.org/

Or contact jssm@scirp.org