Integro-Differential Equations for a Jump-Diffusion Risk Process with Dependence between Claim Sizes and Claim Intervals ()

1. Introduction

In the risk process that is perturbed by diffusion, the surplus process  of an insurance portfolio is given by

of an insurance portfolio is given by

(1)

(1)

where  is the initial surplus,

is the initial surplus,  is the positive constant premium income

is the positive constant premium income

rate,  is the aggregate claims process, in which

is the aggregate claims process, in which

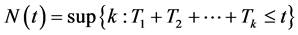

is the claim number process (denoting the number of claims up to time t), and the interarrival times  is a sequence of positive random variables.

is a sequence of positive random variables.  is a sequence of nonnegative independent identically distributed (i.i.d.) random variables with distribution function

is a sequence of nonnegative independent identically distributed (i.i.d.) random variables with distribution function  and density function

and density function ,

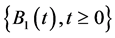

,  is a standard Brownian motion that is independent of the aggregate claims process

is a standard Brownian motion that is independent of the aggregate claims process ,

,  is a positive constant.

is a positive constant.

2. Improved Risk Model

In this paper, it is assumed that the claim occurrence process to be of the following type: If a claim  is larger than a random variable

is larger than a random variable , then the time until the next claim

, then the time until the next claim  is exponentially distributed with rate

is exponentially distributed with rate![]() , otherwise it is exponentially distributed with rate

, otherwise it is exponentially distributed with rate![]() . The quantities

. The quantities ![]() are assumed to be i.i.d. random variables with distribution function

are assumed to be i.i.d. random variables with distribution function![]() . Assuming that

. Assuming that

![]() ,

,

which is the net profit condition.

In the daily operation of insurance company, in addition to the premium income and claim to the operation of spending has a great influence on the outside, and there is also a factor that interest rates should not be neglected. As in [15] , this paper assume that the risk model Equation (1) is invested in a stochastic interest process which is assumed to be a geometric Brownian motion![]() , where r and σ2 are positive constants, and

, where r and σ2 are positive constants, and ![]() is a standard Brownian motion independent of

is a standard Brownian motion independent of![]() . Let

. Let ![]() denote the surplus of the insurer at time t under this investment assumption. Thus,

denote the surplus of the insurer at time t under this investment assumption. Thus,

![]() (2)

(2)

Denote T to be the ruin time (the first time that the surplus becomes negative), i.e.,

![]()

and ![]() if

if![]() .

.

This article is interested in the expected discounted penalty (Gerber-Shiu) function:

![]() , (3)

, (3)

where ![]() is the indicator function,

is the indicator function, ![]() is the force of interest and

is the force of interest and ![]() is a nonnegative function of

is a nonnegative function of ![]() and satisfies

and satisfies![]() .

.

Furthermore, let ![]() be the time when the first claim occurs, and random variable

be the time when the first claim occurs, and random variable ![]() being exponentially distributed with rate

being exponentially distributed with rate![]() . Assuming that

. Assuming that

![]() ,

,![]() .

.

For![]() , define

, define

![]() , (4)

, (4)

such that

![]() , (5)

, (5)

then,![]() .

.

3. Integro-Differential Equations for ![]()

In this section, a system of integro-differential equations with initial value conditions satisfied by the Gerber-Shiu function ![]() is derived.

is derived.

Define![]() , and

, and

![]() (6)

(6)

Lemma 3.1 Let ![]() for

for![]() . For

. For ![]() define the hitting time

define the hitting time![]() . Then, for

. Then, for![]() , it can be concluded that

, it can be concluded that

![]() (7)

(7)

Proof ![]() is a reflecting diffusion with generator

is a reflecting diffusion with generator

![]() ,

,

acting on functions satisfying the reflecting boundary condition![]() .

.

If

![]()

and ![]() for t > 0, then, according to Itô’s formula

for t > 0, then, according to Itô’s formula ![]() is a local mar-

is a local mar-

tingale. Using the separation variable technique, we find that

![]()

is a solution, where

![]() ,

,

![]() is a solution of

is a solution of

![]() .

.

Here

![]() .

.

Using the initial condition ![]() for

for![]() , we get

, we get![]() , consequently

, consequently

![]() .

.

Applying the Optional Stopping Theorem, it follows that

![]() ,

,

and thus

![]() .

.

This ends the proof of Lemma 3.1.

Similarly, the following lemma can also be obtained.

Lemma 3.2 Let ![]() for

for![]() . For

. For ![]() define the hitting time

define the hitting time![]() . Then, for

. Then, for![]() , it can be concluded that

, it can be concluded that

![]() (8)

(8)

Theorem 3.1 Assuming that ![]() is second order continuously differentiable functions in u, then

is second order continuously differentiable functions in u, then ![]() satisfies the following integro-differential equation

satisfies the following integro-differential equation

![]() , (9)

, (9)

![]() , (10)

, (10)

with the initial value conditions

![]() ,

,![]() .

.

Proof Let ![]() be the time when the first claim occurs which exponentially distributed with rate

be the time when the first claim occurs which exponentially distributed with rate![]() . Consider the risk process

. Consider the risk process ![]() defined by Equation (2) in an infinitesimal time interval

defined by Equation (2) in an infinitesimal time interval![]() . There are three possible cases in

. There are three possible cases in ![]() as follows.

as follows.

1) There are no claims in ![]() with probability

with probability![]() , thus

, thus![]() ;

;

2) There is exactly one claim in ![]() with probability

with probability![]() . According to different of the claim amount, there are three possible cases in this case as follows.

. According to different of the claim amount, there are three possible cases in this case as follows.

a) The amount of the claim![]() , i.e., ruin does not occur, and thus

, i.e., ruin does not occur, and thus![]() ;

;

b) The amount of the claim![]() , i.e., ruin occurs due to the claim;

, i.e., ruin occurs due to the claim;

c) The amount of the claim![]() , i.e., ruin occurs due to oscillation (observe that the probability that this case occurs is zero).

, i.e., ruin occurs due to oscillation (observe that the probability that this case occurs is zero).

3) There is more than one claim in ![]() with probability

with probability![]() .

.

Thus, considering the three cases above and noting that ![]() is a strong Markov process, we have

is a strong Markov process, we have

![]() (11)

(11)

By Taylor expansion, we have![]() , thus Equation (11) becomes

, thus Equation (11) becomes

![]() (12)

(12)

Then, by Itô’s formula we have

![]() . (13)

. (13)

Therefore, by dividing t on both sides of Equation (12), letting![]() , using Equation (13), we obtain Equation (9), and similarly we can obtain Equation (10).

, using Equation (13), we obtain Equation (9), and similarly we can obtain Equation (10).

The condition ![]() follows from the oscillating nature of the sample paths of

follows from the oscillating nature of the sample paths of![]() . Now, we prove

. Now, we prove![]() .

.

For all![]() , let

, let![]() ,

,![]() . Then, by the strong property of

. Then, by the strong property of![]() , it can be concluded that

, it can be concluded that

![]()

According to Lemma 3.1, it can be concluded that

![]() ,

,

![]()

Thus, ![]() , and correspondingly

, and correspondingly![]() . Similar results can be derived for

. Similar results can be derived for![]() .

.

And for all![]() , let

, let![]() ,

, ![]() , according to Lemma 3.2 we obtain

, according to Lemma 3.2 we obtain![]() , thus

, thus![]() .

.

This ends the proof of Theorem 3.1.

4. Differential Equations for ![]()

Let ![]() and

and ![]() in Equation (3), correspondingly the expected discounted penalty function

in Equation (3), correspondingly the expected discounted penalty function ![]() turns into the ultimate ruin probability

turns into the ultimate ruin probability![]() .

.

Obviously,

![]() ,

,

and

![]() .

.

Suppose that

![]() ,

, ![]() ,

,

and ![]() is exponentially distributed with rate

is exponentially distributed with rate![]() . Then, we get the following theorem.

. Then, we get the following theorem.

Theorem 4.1 Assuming that ![]() is second order continuously differentiable functions in u, then

is second order continuously differentiable functions in u, then ![]() satisfies the following integro-differential equation

satisfies the following integro-differential equation

![]() (14)

(14)

![]() (15)

(15)

with the initial value conditions

![]()

Proof According to Equation (9), it can be concluded that

![]()

By taking the derivative with respect to u on both sides of the above formula, and after some careful calculations, we obtain Equation (14). And similarly we can prove that Equation (15) holds. This ends the proof of Theorem 4.1.

5. Conclusion

In this paper, we consider a jump-diffusion risk process compounded by a geometric Brownian motion with dependence between claim sizes and claim intervals. We derive the integro-differential equations for the Gerber-Shiu functions and the ultimate ruin probability by using the martingale measure. Further studies are needed for the numerical solution of Equations (9), (10), (14) and (15). The results derived in this paper can be generalized to similar dependence ruin models.

Acknowledgements

This research was supported by the National Natural Science Foundation of China (No. 11601036), the Natural Science Foundation of Shandong (No. ZR2014GQ005) and the Natural Science Foundation of Binzhou University (No. 2016Y14).