A Multi-Attribute Decision Making for Investment Decision Based on D Numbers Methods ()

1. Introduction

The aim of investment decision is to make maximize gains and minimize risk under uncertain environment. Variance portfolio model was a powerful tool to handle investment decision and established by Markowitzin in 1952 [1] [2] , which marked the beginning of the model securities portfolio investment theory. This model, Markowitz’s Portfolio theory [3] [4] [5] [6] , was modified by Sharpes Capital Asset Pricing model [7] [8] and Rosss Arbitrage Pricing theory [9] [10] [11] , then it was used to solve the investment decision making problem. In these methods, the factor of investment decision is usually represented by real numbers. However, indeed, the investment decision making is relative to many criteria, which are uncertainty. Investment decision making can be seen as a MADM problem. MADM has been studied by many researchers [12] [13] [14] [15] [16] . For MADM, two problems are key issues. One is that how to represent uncertain factors and another is how to fuse these uncertain factors. Many methods are applied to reveal uncertainty factors such as fuzzy set method [17] , rough set method [18] , probability method [19] [20] and interval numbers [21] [22] . The interval number is an effective way to solve the problem of uncertainty since its value range is bigger than real number, and that has simple forms. Thus, the interval numbers represented kinds of uncertain factors for investment decision making [23] [24] . For the second problem, Dempster-Shafer (D-S) theory was a useful tool to handle it. D-S theory was first proposed by Dempster in 1967, which was further developed by Shafer in 1976. The basic probability assignment (BPA) in Dempster-Shafer (D-S) theory represents the information of both certain or uncertain. Furthermore, the Depmster’s combination rule can combine multiple BPAs. Thus, Dempster-Shafer theory of evidence has been widely used in multiple criteria decision making [25] - [30] . However, D-S theory has some drawback, such as the completeness constraint and exclusiveness hypothesis [31] . As improved D-S theory, D numbers theory is proposed in references [31] [32] . D numbers theory removes some strong hypotheses from Dempster-Shafer theory of evidence. It enables the D numbers theory more powerful in dealing with uncertainty as well as incompleteness. In D numbers theory, the elements may be compatible. Meanwhile, framework may be incomplete. D numbers theory is a powerful tool to handle incomplete and uncertainty information. Thus, D numbers theory is applied into many fields, such as environmental impact assessment [33] [34] , bridge condition assessment [35] and curtain grouting efficiency assessment [36] . Our goal is to handle investment decision problem using D numbers method. In this paper, the uncertain information of investment decision is revealed using interval number and D numbers theory. Meanwhile, the weights of uncertain factors are calculated using entropy weight method. Thus, a new MADM model for investment decision is proposed. The paper is organized as follows. The preliminaries of interval number, D numbers theory and entropy weight method are introduced in Section 2. The proposed method and an illustrative example are given in Section 3. Some conclusions are drawn in Section 4.

2. Preliminaries

2.1. Interval Number Method

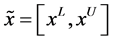

Interval number is actual a collection of all real numbers on a closed interval. Interval number represents a kind of uncertainty, and it has a great potential for application in different fields, such as establish fuzzy portfolio model and multi-objective portfolio model [37] [38] . An interval number is denoted as , which is defined as follows [37] .

, which is defined as follows [37] .

Definition 2.1. If  is the upper bound of the range,

is the upper bound of the range,  is the lower range, we have:

is the lower range, we have:

(1)

(1)

Especially, the interval number  is a real number when

is a real number when .

.

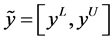

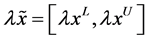

For two interval numbers,  and

and , they are some properties as follows,

, they are some properties as follows,

1)  if

if  and

and .

.

2) .

.

3) , and when

, and when ,

, .

.

The interval decision matrix is key factors for investment decision. The interval decision is defined as below.

Definition 2.2. A decision matrix  is composed of interval number

is composed of interval number , where

, where

(2)

(2)

In investment decision, the attributes can be divided into two types: benefit type and cost type. For example, profit is benefit type, while risk is cost type. To eliminate the influence of different physical dimension for the decision result, the standardized original decision matrix is denoted as![]() , where

, where ![]() is defined as below,

is defined as below,

![]() (3)

(3)

or

![]() (4)

(4)

where ![]() belongs benefit type, while

belongs benefit type, while ![]() belongs cost type.

belongs cost type.

2.2. D Numbers Theory

D numbers theory is proposed by Deng [31] , which is the development of Dempster- Shafer theory of evidence. It is brief introduced as follows,

Definition 2.3. Let ![]() be a finite nonempty set, D number is a mapping D:

be a finite nonempty set, D number is a mapping D:![]() , it satisfied with

, it satisfied with

![]() (5)

(5)

where ![]() is an empty set and B is a subset of

is an empty set and B is a subset of![]() . From the definition, the elements of D numbers do not mutually exclusive and the sum of assessment can be less than one.

. From the definition, the elements of D numbers do not mutually exclusive and the sum of assessment can be less than one.

Definition 2.4. For a discrete set![]() , where

, where ![]() belongs to

belongs to ![]() and

and ![]() if

if![]() , for any

, for any ![]() and

and![]() , a special form of D numbers can be expressed by:

, a special form of D numbers can be expressed by:

![]()

or be represented simply as:

![]()

An example is given to describe the D numbers. For MADM, the set of ![]() is a frame of discernment. The assessment score belong the interval

is a frame of discernment. The assessment score belong the interval![]() , an expert gives his evaluation in the frame of Dempster-Shafer theory, it is shown as below:

, an expert gives his evaluation in the frame of Dempster-Shafer theory, it is shown as below:

![]()

![]()

![]()

where![]() ,

, ![]() ,

,![]() . The sum of

. The sum of ![]() equals to one, i.e., it means that information is complete. However, for another assessment, which is denoted as

equals to one, i.e., it means that information is complete. However, for another assessment, which is denoted as![]() . Some information is incomplete since an expert has not full realization for this assessment [31] . Thus, the assessment is given as follows by D numbers method:

. Some information is incomplete since an expert has not full realization for this assessment [31] . Thus, the assessment is given as follows by D numbers method:

![]()

![]()

![]()

where![]() ,

, ![]() ,

, ![]() , The set of

, The set of ![]() are not a frame of discernment actually because the intersection between these elements is not empty. The sum value of

are not a frame of discernment actually because the intersection between these elements is not empty. The sum value of ![]() equals to 0.9, i.e. the information is incomplete. Some rules of D numbers theory are given as follows [31] .

equals to 0.9, i.e. the information is incomplete. Some rules of D numbers theory are given as follows [31] .

Definition 2.5. For a given D numbers, the overall assessment is defined as:

![]() (6)

(6)

In Dempster-Shafer theory of evidence, two BPAs can be fused into a BPA. Similarity, in D numbers method, the fusing rules of two D numbers have been proposed [31] . It is defined as below,

Definition 2.6. Let ![]() and

and ![]() be two D numbers,

be two D numbers,

![]()

![]()

The combination of ![]() and

and ![]() denoted by

denoted by![]() , we have:

, we have:

![]() (7)

(7)

with

![]() (8)

(8)

![]() (9)

(9)

where:

![]()

where ![]() and

and![]() .

.

2.3. Interval Numbers Decision Based on Entropy Weight

According to the basic principle of information theory, information is the orderly degree of a measurement system. The entropy is a measurement of disorder degree in a system. The absolute value of them is equal, while their symbol is inverse. Therefore, many scholars use Entropy weight method to measure the weight. The smaller information entropy is, the higher weight is [8] [9] . Entropy weight method is introduced as below.

Definition 2.7. For MADM, any solution set![]() ,

, ![]() is a property set. Information entropy is defined as:

is a property set. Information entropy is defined as:

![]() (10)

(10)

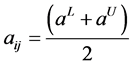

Using the formula (2) (3) (4), we have the standardized matrix![]() . The matrix

. The matrix ![]() is normalized as

is normalized as![]() , where

, where

![]() (11)

(11)

Then, attribute ![]() has information entropy

has information entropy

![]() (12)

(12)

Specially, we have: ![]() when

when ![]()

According to information entropy, the attribute’s weight vector can be calculated as follows,

![]()

with

![]() (13)

(13)

The comprehensive attribute values can be obtained as below,

![]() (14)

(14)

According to the value of![]() , the rank of investment decision is given. Finally, the MADM problem is solved according to the ranking.

, the rank of investment decision is given. Finally, the MADM problem is solved according to the ranking.

3. Proposed Method

3.1. A New MADA Based on D Numbers Methods

In this section, a new MADA model for investment project is proposed. In this model, firstly, the uncertain information of investment decision is represented by using interval number and D numbers theory. The uncertain information is given as follows,

![]()

where

![]() (15)

(15)

where ![]() is an interval number,

is an interval number, ![]() is real number for the interval number of

is real number for the interval number of

the uncertainty information. We have: ![]() and

and![]() . According to Equa-

. According to Equa-

tion (2), the decision matrix of uncertainty factors A is obtained. Secondly, using Equation (6), the corresponding matrix is obtained. Considering type of factors, the corresponding matrix must change into the standard matrix R. Thus, the standard matrix R is obtained according to Equations (3), (4) and (11) at third step. Lastly, the weights of uncertainty factors are calculated by using entropy weight method. According to Equation (14), the value of each decision is calculated. So, we make decision according to the value of each decision.

3.2. A Numerical Example

In this section, a numerical example is introduced for describing the proposed method. Supposing for promoting a new product, a company plans to choose a project from the four investment projects. These investment projects are denoted as![]() ,

, ![]() ,

, ![]() and

and![]() , respectively. Four attributes are considered in evaluating the four choices, they are amount investment (million dollar) denoted as

, respectively. Four attributes are considered in evaluating the four choices, they are amount investment (million dollar) denoted as![]() , the expected net present value (million dollar) denoted as

, the expected net present value (million dollar) denoted as![]() , the risk profit value (million dollar) denoted as

, the risk profit value (million dollar) denoted as ![]() and the risk loss value (million dollar) denoted as

and the risk loss value (million dollar) denoted as![]() . In uncertainty theory, uncertain factors in many fields is determined by expert assessment measures. Then the company invites ten experts to give the assessments. In many previous studies,

. In uncertainty theory, uncertain factors in many fields is determined by expert assessment measures. Then the company invites ten experts to give the assessments. In many previous studies, ![]() is a definite value, but in the study of uncertain information, mostly is blurred, so using interval number to re- present by

is a definite value, but in the study of uncertain information, mostly is blurred, so using interval number to re- present by![]() . In D numbers, the value of

. In D numbers, the value of ![]() is depended on the percent of experts who agree with

is depended on the percent of experts who agree with![]() . For example, for the attribute

. For example, for the attribute ![]() in investment project

in investment project![]() , seven experts think that the value of it is

, seven experts think that the value of it is ![]() and two experts think that is

and two experts think that is![]() . Another one don’t give any value. So we have

. Another one don’t give any value. So we have![]() . Similarly, all assessment are given by the combination of interval number and D numbers, which are shown as below,

. Similarly, all assessment are given by the combination of interval number and D numbers, which are shown as below,

![]()

where

![]()

![]()

![]()

![]()

For calculating the weight of each attribute, the process can be divided into four steps.

Step 1. Using the formula:![]() , all the assessment are given by D numbers and shown as follows,

, all the assessment are given by D numbers and shown as follows,

![]()

![]()

![]()

![]()

Step 2. We replace the D numbers in the matrix by ![]() the corresponding matrix is obtain as follows,

the corresponding matrix is obtain as follows,

![]() (16)

(16)

Step 3. The expected net present value and risk profit value are the benefit type. Amount of investment and risk loss value are the cost benefit attributes. Using the

formula (3) (4) (11), we can get the normalized matrix ![]()

![]() (17)

(17)

Step 4. Using the formula (12) obtains the output information entropy of attribute![]() .

.

![]()

According to Equation (13), the attribute’s weight vector can be calculated as follows,

![]()

Using Equation (14), each value of scheme ![]() can be obtained as follows,

can be obtained as follows,

![]()

So, we have![]() . The rank of investment projects is

. The rank of investment projects is![]() . Thus, the second investment project is the best choice in four plans for company. In our methods, every uncertainty factor is represented by interval number. Furthermore, incomplete information is revealed D numbers method. For compare with previous methods, our proposed method is more flexible. It is accord with the actual circumstance in investment decision.

. Thus, the second investment project is the best choice in four plans for company. In our methods, every uncertainty factor is represented by interval number. Furthermore, incomplete information is revealed D numbers method. For compare with previous methods, our proposed method is more flexible. It is accord with the actual circumstance in investment decision.

4. Conclusion

Although there are many methods to deal with investment decision problems, no method represents the uncertainty and incomplete information in investment project. In this paper, the combination of interval number and D numbers method is used to deal with investment decision problems. All the assessments are represented by the combination of interval number and D numbers. Meanwhile, the weights of uncertainty factors are calculated using entropy weight method. Thus, a new MADM model for investment decision is proposed. A numerical example is used to illustrate the efficiency of the proposed method.

Acknowledgements

The work is partially supported by Found of Educational Commission of Hubei Province of China (Grant No. D20151902), the Doctoral Scientific Research Foundation of Hubei University for Nationalities (Grant No. my2014b003), the Training Programs of Innovation and Entrepreneurship for Undergraduates of Hubei University for Nationalities (Grant No. 2014Z046).