The Influence of New Enterprise Tax Reform on Foreign Invested Enterprises in China—Based on Computable General Equilibrium (CGE) Analysis ()

1. Introduction

Since January 1, 2008, the “Enterprise Income Tax Law of People’s Republic of China (draft)” has been implemented in China. As a result, the income tax rates for domestic and foreign invested enterprises were unified at the rate of 25%. Before that, in order to attract more FDI, China had adopted tax law on foreign invested enterprises. Foreign Investment Enterprises enjoyed a relatively low tax rate. According to the data, the actual tax burden for the domestic funded enterprises is two times of that for foreign invested enterprises. In particular, domestic enterprises income tax rate is about 22% - 30%, while foreign enterprise income tax rate is about 11% - 15%. It caused the domestic enterprises to be in a disadvantaged competitive position. As China is in the post- industrial era, the focus of the future economic development in our country becomes the industrial structure adjustment. We need to transfer from extensive development to intensive development and reduce foreign capital enterprises which are high polluting low energy efficient and low value added. After the new corporate income tax policy was implemented, foreign corporate tax rate has increased significantly, and has greatest impact, so this paper is meaningful in exploring the impact of the new corporate income tax to Foreign Investment Enterprises on FDI, output, employment, etc.

Wang [1] analyzed the dual tax regime for corporate income tax by examining the differences between two corporate income tax rates, and confirmed that tax burden of domestic funded companies is higher than that of the foreign invested enterprises. Chen [2] - [5] found that the difference between tax burdens of foreign and domestic funded companies was due to both the different requirements for tax deductibles and the different tax rates. His empirical results also show that the tax burden of domestic funded businesses is double heavier than that of foreign invested enterprises. Whalley and Wang [6] identified the effect of behaviors of the state-owned enterprises under a unified enterprise tax structure on the social welfare. In a worker control model, they argued that a higher tax rate on state-owned enterprises was called for on efficiency grounds as taxes on state-owned enterprises reduced shirking by the workers (resulting in lower productivity) and a reduced state-owned enterprise tax rate under a unified tax would relax the discipline on state-owned enterprises resulting in losses. Their results indicate a 0.26% loss in GDP welfare and a larger loss relative to an optimal tax scheme. Alternatively, in a managerial control model, they found a 0.19% welfare loss from a unified tax, and larger losses relative to initial higher state-owned enterprise tax rates. Der Hoek, Peter, Kong and Li [7] firstly discussed the dual company tax system and emphasized its influence on the foreign capital enterprise, and then also discussed the effect of a unified income tax. In that context, the unification of the income tax rate is an essential reform. The new corporate income tax policy will not adversely affect the robust trend of growing foreign investment in China. Furthermore, the new corporate income tax may positively affect the growth rate of the Chinese economy, because the future inflows of foreign capital may be redirected to the most innovative sectors which will allow foreign companies to become the most innovative sectors. Finally, the phenomenon of the “fake foreign capital” could gradually diminish, thus improving the efficiency of China’s economy. Ji, Ye and Zhang [8] also built a CGE model to analyze the local and global optimal enterprise tax rate. The results showed that the optimal unified enterprise tax rate for manufacturing industries is 21.82% if tax revenue was given and the globally optimal enterprise tax rates were 33.11%, 18.17%, and 18.06% for state- owned enterprises (SOEs), foreign invested enterprises (FIEs) and other private enterprises (OPEs).

In summary, previous studies of the new enterprise income tax reform focused on China’s overall economy, especially the state-owned enterprises among the domestic funded companies. They explored the impact of the new CIT on the social welfare, employment and taxation. They also discuss the local optimum and global optimum income tax. While the new enterprise income tax reform affected the foreign sector mostly, which previous studies have no in-depth discussion. Therefore, this article analyzes that under the new corporate income tax reform, comparing with the benchmark equilibrium and the 25% unified income tax equilibrium in output, capital investment, wage levels and return on capital foreign sector. In particular, we discussed the impact of new CIT on the FDI.

Based on computable general equilibrium model (CGE) model, this paper establishes a general equilibrium model containing production and consumption. According to the actual data of economic operation in 2007, we conduct parameter calibration on the model production function (scale parameters  and share parameters

and share parameters ) and the utility function (share parameters

) and the utility function (share parameters ). Then we get two equilibriums: benchmark equilibrium and 25% unified tax rate equilibrium. By comparing the two equilibriums, we examine the influence of implementation of new corporation income tax rate on the foreign-funded enterprises sector’s output, capital investment, rate of return on capital, employment, labor wages, etc. Then we examine the relationship between the unified tax rate and the foreign direct investment. We conclude that if we set the unified tax rate at 25%, there is little impact on foreign direct investment (FDI), prevent the economy from suffering serious impact. Finally, we conduct sensitivity analysis of the actual income tax rate of foreign companies and the government departments’ conversion coefficient of return on the capital of state-owned enterprises. We find that when the actual income tax rate of the foreign capital enterprise department is higher than 8% and when the government departments’ conversion coefficient of state-owned enterprises is greater than 0.2, unified tax rate 25% will reduce the foreign direct investment. Both of these approaches can achieve the goal of eliminating inefficient foreign- invested enterprises.

). Then we get two equilibriums: benchmark equilibrium and 25% unified tax rate equilibrium. By comparing the two equilibriums, we examine the influence of implementation of new corporation income tax rate on the foreign-funded enterprises sector’s output, capital investment, rate of return on capital, employment, labor wages, etc. Then we examine the relationship between the unified tax rate and the foreign direct investment. We conclude that if we set the unified tax rate at 25%, there is little impact on foreign direct investment (FDI), prevent the economy from suffering serious impact. Finally, we conduct sensitivity analysis of the actual income tax rate of foreign companies and the government departments’ conversion coefficient of return on the capital of state-owned enterprises. We find that when the actual income tax rate of the foreign capital enterprise department is higher than 8% and when the government departments’ conversion coefficient of state-owned enterprises is greater than 0.2, unified tax rate 25% will reduce the foreign direct investment. Both of these approaches can achieve the goal of eliminating inefficient foreign- invested enterprises.

2. Model Specification

In this paper, we build economic model that contains two parts: production and consumption. According to the ownership, we divide the production section into 4 departments: Agricultural (Referred to as “Agriculture”), state-owned Enterprises, (Referred to as “SOEs”), Foreign Investment Enterprises (Referred to as “FIEs”) and Other Private Enterprises (Referred to as “OPEs”). By the corresponding they refer to . Assuming that the four kinds of merchandises in the production departments are different from each other, the economy there are four kinds of alternative goods. The model built in this paper considers not only the country’s economy, but also the foreign trade situation of open economy, so we introduce the price distortion factors like import tariffs and export subsidies, and therefore making the prices have two kinds of goods: one is the world prices without tariffs or subsidies, which is represented as

. Assuming that the four kinds of merchandises in the production departments are different from each other, the economy there are four kinds of alternative goods. The model built in this paper considers not only the country’s economy, but also the foreign trade situation of open economy, so we introduce the price distortion factors like import tariffs and export subsidies, and therefore making the prices have two kinds of goods: one is the world prices without tariffs or subsidies, which is represented as ; the other is the domestic consumer prices, which is represented as

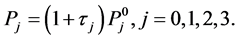

; the other is the domestic consumer prices, which is represented as . The relationship between domestic prices and world prices can be expressed as:

. The relationship between domestic prices and world prices can be expressed as:

(1)

(1)

In the Formula (1),  is the jth commodity’s import tariffs or export subsidies tax rates. We assume that a country only imposes import duties, but no export tariffs, but implements export tax refund for exports or subsidies. In terms of the real trade situation, our country is a net importer of agricultural products and a net exporter in manufactured goods (products). So for agricultural department,

is the jth commodity’s import tariffs or export subsidies tax rates. We assume that a country only imposes import duties, but no export tariffs, but implements export tax refund for exports or subsidies. In terms of the real trade situation, our country is a net importer of agricultural products and a net exporter in manufactured goods (products). So for agricultural department,  is agricultural products’ rate of import tariff. For the other three manufacturing sectors,

is agricultural products’ rate of import tariff. For the other three manufacturing sectors,  is the export tax rebates or tax subsidies of manufacturing products.

is the export tax rebates or tax subsidies of manufacturing products.

Hypothesis: the 4 production departments only consume two inputs, which are labor (L) and capital (K). Their output can be made by Cobb-Douglas Production function:

(2)

(2)

In the Formula (2),  and

and  are the jth department’s production function’s compensation factor and factors inputs’ weight factor. In the Formula (2), judging each element of the input weights, we know that the four the production departments have a constant size of return in output. In view of the four production departments’ actual situation in the our country, we assume that in the production departments for non-state enterprises ,which are

are the jth department’s production function’s compensation factor and factors inputs’ weight factor. In the Formula (2), judging each element of the input weights, we know that the four the production departments have a constant size of return in output. In view of the four production departments’ actual situation in the our country, we assume that in the production departments for non-state enterprises ,which are , the products are in a completely competitive market; while in the production departments for state-owned enterprises, which is

, the products are in a completely competitive market; while in the production departments for state-owned enterprises, which is , the products are in an uncompetitive market.

, the products are in an uncompetitive market.

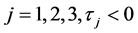

First of all, we analyze the manufacturers output decision. Among the three non- state enterprises’ production department, . Manufacturers determine the returns of inputs according by the marginal value of products

. Manufacturers determine the returns of inputs according by the marginal value of products , which is:

, which is:

(3)

(3)

![]() (4)

(4)

In the Formula (3), the ![]() is the jth department’s unit labor returns or wage rates; in the Formula (4), the

is the jth department’s unit labor returns or wage rates; in the Formula (4), the ![]() is the jth department’s unit capital returns. When considering the country’s economic model, all the manufacturers in the production departments will be satisfied with the zero profit condition. That means each department’s allocation of factors in the added value of the manufacturer’s production should be equal to the income, which is

is the jth department’s unit capital returns. When considering the country’s economic model, all the manufacturers in the production departments will be satisfied with the zero profit condition. That means each department’s allocation of factors in the added value of the manufacturer’s production should be equal to the income, which is![]() .

.

If the government imposes taxation on capital income rather than labor income, the unit of capital remuneration or the price needs to be adjusted. When there is corporate income tax, the (3) and (4) which decide the factors’ return can still hold. However, in this now situation, the ![]() in (4) is not the net rate return of capital, but the gross-of- tax which contains the corporate income tax

in (4) is not the net rate return of capital, but the gross-of- tax which contains the corporate income tax![]() . If we set the production department j’s net rate return of capital as

. If we set the production department j’s net rate return of capital as![]() , then the relationship between the gross-of-tax and net rate return of capital is

, then the relationship between the gross-of-tax and net rate return of capital is![]() .

.

The production’s zero profit conditions of each department is:

![]() (5)

(5)

In the above context, we inspect the non state-owned sector production’s decision problem. For the state-owned enterprise’s production department, we assume that its market is not a completely competitive market1. The paying prices of labor and capital elements and the quantities of demanded in state-owned enterprises are more complex. The labor price paid is not determined by the marginal product value of the elements. In the state-owned enterprises which is controlled by workers, any policy change and the reform of bottom line should not reduce the existing wages to the workers. Hereby, we make the department of the workers’ wages in the state-owned enterprise fixed as![]() . Because labor can flow freely among the non-state sectors, state-owned enterprises can determine the quantities of labor employed

. Because labor can flow freely among the non-state sectors, state-owned enterprises can determine the quantities of labor employed ![]() according to the fixed labor remuneration and the necessary return on capital. We set the capital can free flow in the state-owned enterprises, so the demand for capital can be determined by the principle of seller’s monopoly on the use of factors in production. Thus, the production’s zero profit conditions of state-owned enterprise is:

according to the fixed labor remuneration and the necessary return on capital. We set the capital can free flow in the state-owned enterprises, so the demand for capital can be determined by the principle of seller’s monopoly on the use of factors in production. Thus, the production’s zero profit conditions of state-owned enterprise is:

![]() (6)

(6)

In the Formula (6), the ![]() is the net rate return of capital in that production department.

is the net rate return of capital in that production department.

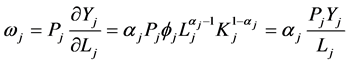

Harberger [9] [10] , in his Corporate income tax model, only considers two production departments: one is a company which is required to pay corporate income tax, the other is a non company production department that don’t have to pay corporate income tax . Corresponding to the four divisions in this paper’s economic model, we treat agricultural production department as the non company type, and set state-owned enterprises, foreign capital enterprise departments and other private enterprise departments as a company type. As to agricultural production department such as non company type, we set its corporate income tax ![]() as 0, and set the rest three departments’ corporate income taxes to be positive, which means

as 0, and set the rest three departments’ corporate income taxes to be positive, which means![]() .

.

![]()

1At present, China’s state-owned enterprises in economy are mainly exist in the telecommunications, banking, petrochemical, infrastructure, etc. And most of the state-owned enterprises still rely on national preferential policies and enjoy monopoly profits. Therefore, we can reasonably assume that state-owned enterprises belong to a non perfect competitive market.

In this paper, our constructed model of economic equilibrium also consider the situation of open economy. If we set ![]() as the commodity sector of j’s net imports (

as the commodity sector of j’s net imports (![]() ) or net exports (

) or net exports (![]() ), then a country is like a typical consumer, its consumer demand of commodity j can be expressed as

), then a country is like a typical consumer, its consumer demand of commodity j can be expressed as![]() . That means the consumer demand equals the sum of the output and net imports.

. That means the consumer demand equals the sum of the output and net imports.

Based on the above assumptions, a country only imposes tariffs on its net imports, and to our country’s analysis in foreign trade situation, only agricultural department exists net import (![]() ) among the four of the production departments, so the government’s tariff revenue comes from the imports of agricultural products, which is:

) among the four of the production departments, so the government’s tariff revenue comes from the imports of agricultural products, which is:

![]() (7)

(7)

Because the three industrial sectors are all net exports and government need to deal with exports’ tax refund for export goods, a country must pay the export tax rebate as:

![]() (8)

(8)

In addition to import tariffs and export tax rebates, a country also imposes the enterprise income tax within its territory. Because Agricultural production department is the non company department, its corporate income tax is zero, so the country’s income tax revenues comes from the type of company’s production department. The quantitative relation is expressed as:

![]() (9)

(9)

In the Formula (9), ![]() is the income tax rate of j department,

is the income tax rate of j department, ![]() is the net return on capital of j department. China is a country with a strong government, so the Chinese government plays an important role in the society in various fields. It needs strong financial supports, so when a new Enterprise Income Tax is carried out, the new enterprise income tax will never lower than the original enterprise income tax. Hereby, we can reasonably assume that the enterprise income tax is fixed at

is the net return on capital of j department. China is a country with a strong government, so the Chinese government plays an important role in the society in various fields. It needs strong financial supports, so when a new Enterprise Income Tax is carried out, the new enterprise income tax will never lower than the original enterprise income tax. Hereby, we can reasonably assume that the enterprise income tax is fixed at![]() .

.

In the open economy, a country’s trade balance often appears unbalanced situation. We set B as the trade balance, then these 4 commodity departments’ economic net trade balance can be expressed as:

![]() (10)

(10)

In the Formula (10), ![]() is the net imports (

is the net imports (![]() ) of j department or the value of net exports (

) of j department or the value of net exports (![]() ) of j department. When

) of j department. When![]() , the country’s trade balance of payments appears deficit; when

, the country’s trade balance of payments appears deficit; when![]() , the country’s trade balance of payments appears surplus. To the essence, the trade surplus means that a country is providing consumer loans to the other countries, and trade deficit is a country enjoying a consumer credit from other countries.

, the country’s trade balance of payments appears surplus. To the essence, the trade surplus means that a country is providing consumer loans to the other countries, and trade deficit is a country enjoying a consumer credit from other countries.

If we regard a country as a typical consumer, and because the enterprise income tax revenue is just the income redistribution, which means it can offset within country, a country’s total income is only constructed by domestic output, import tariffs and export subsidies and net trade, namely:

![]() (11)

(11)

As a typical consumer, its utility can be represented by linear homogeneous CD function:

![]() (12)

(12)

As a result, that typical consumer’s utility maximization problem under a budget constraint ![]() can expressed as follows:

can expressed as follows:

![]() (13)

(13)

By computing the solutions of utility maximization, we can obtain the typical consumer’s consumption demand for the goods:

![]() (14)

(14)

Finally, we give the general economic equilibrium conditions of the economic system. We assume that each factor stock is fully utilized, and there are no redundant elements. As a result, each factor market completely satisfies market clearing conditions. At this time, the economic equilibrium conditions are:

![]()

We assume that the capital can flow freely among the non-state sectors, so when the economy reaches equilibrium, the other three non-state sectors’ capital return should be equal, which means![]() . And we also assume that the capital can’t flow freely in the state sectors, its return on capital cannot be decided by the market, but by the investor-the government. It is the government that makes some compulsory rules on capital return, such as value maintaining and adding requirements, in order to prevent the excessive expansion of state-owned enterprises. Because the state-owned enterprises take other social responsibilities in the national economy, the government’s return on capital of state-owned enterprise is lower than that of non-state enterprise sectors. Therefore, when the economy reaches equilibrium, the return on capital of state-owned sector is

. And we also assume that the capital can’t flow freely in the state sectors, its return on capital cannot be decided by the market, but by the investor-the government. It is the government that makes some compulsory rules on capital return, such as value maintaining and adding requirements, in order to prevent the excessive expansion of state-owned enterprises. Because the state-owned enterprises take other social responsibilities in the national economy, the government’s return on capital of state-owned enterprise is lower than that of non-state enterprise sectors. Therefore, when the economy reaches equilibrium, the return on capital of state-owned sector is![]() , in which the

, in which the![]() .

.

In order to compare of tax policy change on welfare easier, this paper gives some indicators commonly used in measuring the increase and decrease of welfare, namely Hicks Equivalent income changes (Hicksian Equivalent Variations of Welfare Change). This index uses currency to measure the change of welfare, and provides a unified scale for measuring welfare effects of different policy situations. Equivalent concretely can be defined as the changes in income:![]() . Among them, E is the payoff function, expressed as the minimum cost to obtain U utility level under the price level of P. Variables’ superscript “0” expresses the equilibrium before the policy change, while the “1” expresses the equilibrium after the policy change. Equivalent income measures such changes: calculating based on the price before the policy change, the amount of money that consumers need to increase to obtain the level of utility after the policy change. Shoven and Whalley [11] show that, when the utility function is a linear homogeneous function, the changes in Hicks’ equivalent income can be simplified as:

. Among them, E is the payoff function, expressed as the minimum cost to obtain U utility level under the price level of P. Variables’ superscript “0” expresses the equilibrium before the policy change, while the “1” expresses the equilibrium after the policy change. Equivalent income measures such changes: calculating based on the price before the policy change, the amount of money that consumers need to increase to obtain the level of utility after the policy change. Shoven and Whalley [11] show that, when the utility function is a linear homogeneous function, the changes in Hicks’ equivalent income can be simplified as:

![]() , among them the

, among them the ![]() is the income level of consumers before the

is the income level of consumers before the

policy change. So, the percentage changes of Hicks equivalent income relative to datum income is:

![]() (15)

(15)

3. Data and Parameter Calibration

3.1. Data

In this paper, we obtain the data from “China statistical yearbook 2008” and “China labor yearbook, 2008”, and divide our country into four departments according to the economy type: the department of Agriculture (Agriculture), the department of state- owned enterprises (SOEs), foreign investment enterprises (FIEs) and other private enterprise departments (OPEs). The data used in agricultural sector is from the first industry; the state-owned enterprise sector’s data consist of four parts: state-owned units, urban collective units, joint-stock cooperative units, associated units and so on; the foreign investment enterprise department’s data made up of two parts: Hong Kong (China), Macao (China) and Taiwan (China) enterprises and foreign investment units; other private enterprise departments’ data consist of three parts: the limited liability company (LLC), Stock corporation (Inc.), and other domestic enterprises. In this paper, our research objects are agricultural and manufacturing, so according to the proportion of the industrial added value, we assign the output value of the third industry (non- manufacturing) to the three departments: the state-owned enterprises, the foreign investment enterprises and other private companies. And then we get four departments’ economic operation data: the agricultural sector, state-owned enterprises, foreign investment enterprise departments, and other private enterprises. The results are shown in Table 1. Then we set the minimum wage department-wage rate in the department of agriculture, ![]() , the other three departments’ wage rates are equal to the ratio of the weighted average labor remuneration in three departments and the labor remuneration of agriculture department.

, the other three departments’ wage rates are equal to the ratio of the weighted average labor remuneration in three departments and the labor remuneration of agriculture department.

![]()

Table 1. The economic operation data (units of value: 1 billion yuan).

Data from “China statistical yearbook 2008” and “China labor yearbook, 2008”.

3.2. Parameter Calibration2

This paper needs some calibration parameters, which are the parameters of the production function![]() ; the number of parameters and the utility function

; the number of parameters and the utility function![]() . The results are showed in Table 2.

. The results are showed in Table 2.

4. Equilibrium Comparison

On the basis of the preamble, this paper calculates the two equilibriums: benchmark equilibrium and 25% unified tax rate equilibrium. Benchmark equilibrium is calculated based on 2007 data for agriculture department, state-owned enterprises department, foreign investment enterprises and other private enterprises’ enterprise income tax rate. They are respectively 0%, 30%, 15% and 22%. The results are shown in Table 3. We can easily get the following conclusions through Table 3.

First of all, we focus on the new enterprise income tax’s influence on social welfare. The social welfare can be represented by the value of the utility function. We can see from Table 3 that the benchmark equilibrium’s utility function value is 6084.816514, and the 25% unified tax rate equilibrium’s utility function value is 6099.868765, which is higher than the benchmark equilibrium’s utility function value by 0.247%. So we conclude that the new 25% unified tax rate can improve the whole social welfare. This is because all sectors of the economy improve their output and all sectors’ consumption also increases with the new company income tax.

![]()

2This paper conducts optimization calculation through the GAMS 23.5 software. And the optimization calculation was done by three procedures: Calibration parameter Calibration, data Counterfactual and Equilibrium.

We now take a look at the impact on foreign investment enterprises after the new enterprise income tax was adopted. Foreign direct investment in benchmark equilibrium is to 9636.70400 and the 25% unified tax rate equilibrium is to 9459.329878, declining by 1.841%. The foreign investment enterprises’ return on capital is increasing, but net return on capital is falling, indicating that after the unified tax rate was adopted, the foreign investment enterprises’ department improves their efficiency of capital, but the price of capital becomes more expensive. The labor wages in foreign investment

![]()

Table 3. The comparison between benchmark equilibrium, 25% unified tax rate equilibrium and optimal unified tax rate.

enterprises’ department appears falls to 2.45106, decline by 1.439%.That means the labor wages’ price is lower. The foreign investment enterprises’ employment level increases to the 25% unified tax rate employment 1566.498240 from benchmark employment 1540.71672 by 1.673%. After the implementation the new enterprise income tax, the foreign investment enterprises was adjusted their inputs of capital and labor, which are reducing the capital input whose price becomes more expensive, and increasing the labor input whose price becomes lower. Therefore, after the implementation of the 25% united tax rate, some low value-added foreign investment enterprises were eliminated, and foreign direct investment is not obviously influenced by this new policy, only declining slightly. But it has also reduced the foreign investment enterprises’ labor wages.

5. The Relationship between FDI and the Unified Tax Rate

When the unified tax rate is 25.493%, the foreign direct investments remain unchanged. When the unified tax rate is lower than 25.493%, the foreign direct investment fall compared with the situation when unified tax rate were not adopted. When the unified tax rate is higher than 25.493%, the foreign direct investments begin to increase compared with the situation when unified tax rate were not adopted. And we can see from Figure 1, as the unified tax rate increases to a greater degree , the amplitude of the foreign direct investments increase is decreasing.

The 25.493% united tax rate is slightly greater than the current implemented 25% unified tax rate, indicating that the current 25% unified tax rate has no obvious impact on foreign direct investment (FDI) (The foreign direct investment falls 1.84% = (9636.70400 − 9459.329878)/9636.70400). And the 25% unified tax rate is at the position of the graphic tangent slope which is relatively steep which means as long as the unified tax rate increase or decrease slowly, the foreign direct investment can also present great changes. Therefore, the current 25% unified tax rate can make the foreign enterprise investment remain stable, and avoid the national economy from being seriously impacted.

6. Sensitivity Analysis of FDI

6.1. The Sensitivity Analysis about the Income Tax in Foreign Capital Enterprise

![]()

3See der Hoek, Peter, Kong and Li [7] .

Because the preferential rates for foreign companies are different all over the country, it is difficult to accurately measure the foreign investment enterprise’s actual income tax rate. Therefore, in accordance with the relevant academic research results3, we take the scope of the foreign enterprises’ actual income tax rate as (5%, 5%). Like the analysis of the above steps (parameter Calibration → Counterfactual → Equilibrium), we analyze the sensitivity of foreign investment enterprise income tax rate to the foreign direct investment (FDI). And the results are shown in Table 4.

We can see from Table 4, first of all, when the foreign investment enterprises’ actual income tax rate increases from 5% to 20%, in both benchmark equilibrium and 25% unified income tax rate equilibrium, the foreign direct investments are increasing.

Secondly, when the foreign investment enterprises’ actual income tax rate is lower than or equal to 8%, the 25% unified tax rate equilibrium’s foreign direct investment is more than the benchmark equilibrium’s foreign direct investment, and when the

![]()

Figure 1. The relationship between foreign direct investment and the unified tax rate.

![]()

Table 4. The sensitivity analysis of the foreign enterprise income tax rate.

foreign investment enterprises’ actual income tax rate is higher than 8%, 25% unified tax rate equilibrium’s foreign direct investment is less than the benchmark’s. This means that when the foreign investment enterprises’ actual income tax rate is higher than 8%, the foreign direct investment will be reduced under 25% unified tax rate, or the foreign direct investment will increase. According to all kinds of news reports and academic researches, our country’s actual income tax rate of foreign investment enterprises is higher than 8%, so the new enterprise income tax can reduce the foreign capital investment.

6.2. The Sensitivity Analysis of the Capital Return Convert Coefficient C in State-Owned Enterprises

Because the government’s convert coefficient “c” for the state-owned enterprises’ capital return is hard to measure, this paper does some sensitivity analysis and the results are shown in Table 5. Along with the increase of the convert coefficient, the benchmark equilibrium’s foreign direct investment have no obvious change, while the 25% unified

![]()

Table 5. The sensitivity analysis of state-owned enterprises.

income tax rate’s foreign direct investment begin to fall. When the conversion coefficient is less than or equal to 0.2, the amount of foreign direct investment increases under the unified tax rate 25%; When the conversion coefficient is greater than 0.2, the amount of foreign direct investment falls under the 25% unified tax rate.

7. Conclusions

This paper comprehensively analyzes the influence of unified tax rate on the foreign direct investment (FDI), and thus sets up a general equilibrium model which contains production and consumption. After studying the data from our country’s actual economic operation in 2007 and conducting the model parameter calibration, we solve and get benchmark equilibrium and 25% unified tax rate equilibrium.

And then we find that after the implementation of the new enterprise income tax, the foreign investment enterprises’ output is increasing and the input of the capital is decreasing; the return on the capital is increasing; the employment is increasing and the labor wages is decreasing; on the whole, the whole social welfare is increasing. After analyzing the relationship between the unified tax rate and foreign direct investment, we get the following conclusions: when the unified tax rate is lower than 25.493%, the foreign direct investment will decline. When the unified tax rate is more than 25.493%, the foreign direct investment will increase; and when the unified tax rate is at the position of 25% where the tangent slope between foreign direct investment and the unified tax rate is relatively steeper, the 25% unified tax rate can effectively avoid foreign enterprises from serious impact.

In the last part of this paper, we do sensitivity analysis on the conversion coefficient c of both actual income tax rate for foreign enterprises and the return on capital of state-owned enterprise. We make the following conclusions: when the foreign capital enterprise actual income tax rate increases, the foreign direct investment under the benchmark equilibrium and 25% unified income tax equilibrium is both increasing; When the foreign capital enterprises’ actual income tax rate is higher than 8%, the foreign direct investment falls under 25% unified tax rate. And conversely, the foreign direct investment increases. When the conversion coefficient increases, the foreign direct investment increases under the 25% unified tax rate. On the contrary, the foreign direct investment falls under 25% unified tax rate.

The conclusions of this paper provide a theoretical explanation about the current withdrawal of FDI. In addition to the rising labor wages and land costs, which most people have already argued, this paper points out that losing the preferential enterprise income tax may be another important reason. Moreover, considering that foreign enterprises compromise a large share in the economy, the study will serve as a theoretical guidance for Chinese government in making related policies. In developing a new economic policy, we can use the CGE method to estimate the economic consequences of this policy. In particular, the impacts on the foreign sector should be taken into full consideration.

This paper has the following deficiencies: 1) The research methods need to be improved. In future study, we will try to use DSGE approach to measure the foreign department performance under the new corporate tax rate reform more accurately, such as the labor input, capital input and the return on capital investment as well as the wage levels, etc. 2) In order to fulfill the purpose of the new corporate tax rate reform, the further investigation on the optimal level of corporate income tax rates under any given the production efficiency is needed.

Sponsored

This research is sponsored by the National Natural Science Foundation of China (No. 71303078).