Is the Federal Reserve Learning? A New Simple Correlation of Inflation and Economic Stability Trends ()

1. The Federal Reserve Inflation Formula

The Federal Reserve effectively manages interest rates and monetary policy to ensure stable economic growth. In the recent paper by Yellen [1] relationships were shown between inflation, unemployment and wages in elaborating the considerations related to historical trends and future economic performance for the USA. The focus was on the ability to predict both expectations and trends. All the plots and data were given in terms of calendar year (or quarters), which is the conventional and easily understood reporting and human timescale used by economists.

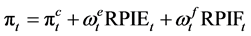

Yellen [1] examined the change in the price index for personal consumption expenditures (PCE). The empirical relation for inflation forecasting was given as a running corrected yearly time series, subscript t, in annualized growth rates of total and core prices,  and

and  respectively, for 1990 to 2014 (all the terms are as defined in [1] ):

respectively, for 1990 to 2014 (all the terms are as defined in [1] ):

(1)

(1)

where

(2)

(2)

From inspection of Equation (1) and Equation (2), we can observe there are seven (7) adjustable constants all less than unity (shown in bold type) plus an eighth factor on the end of Equation (2). Derived from differential data fitting [1] , these constants directly affect the relative contributions of the influence of the economic factors:

weighted annual growth rate of energy goods prices.

weighted annual growth rate of energy goods prices.

weighted annual growth rate of food and beverage prices.

weighted annual growth rate of food and beverage prices.

expected long run inflation.

expected long run inflation.

level of resource utilization.

level of resource utilization.

effect of relative import prices.

effect of relative import prices.

white noise term which corrects for “tracking” errors.

white noise term which corrects for “tracking” errors.

Importantly, the successful record of the Federal Reserve in combating inflation and unemployment using policy adjustments has resulted in recent historically low interest rate values. Assuming that the Federal Reserve and its advisors and staff act like any other body or people, we wondered if there was:

1) Any (perhaps hidden) evidence of learning in these trends;

2) A simpler forecasting or fitting equation.

2. Application of Learning Theory

Learning theory requires a measure of experience and risk exposure, as going forward individual and system rules and knowledge are corrected for past mistakes and errors. The trial measure we adopted before was the accumulated GDP [2] , as being both available and one that is of considerable importance to economic growth and risk exposure. So we thought we would try that again as a starting point, and the GDP is available on-line in trillions of 1991$. This risk exposure/learning measure also has the considerable advantage that it is possible to correlate and make predictions using simple exponential equations rather than time-series that contain non-linear terms like the numerical calendar year raised to some power, e.g. (2014)power.

We therefore translated all the calendar years into summations of previous successive year GDPs. to give the accumulated GDP for any year, . Using the starting year, t = 1 as 1981, as the range adopted in the Yellen [1] paper, the result is shown in Figure 1. The original data are taken from the paper [1] , and the solid line is the Federal Reserve trend from the above Equation (1) and Equation (2), and all the

. Using the starting year, t = 1 as 1981, as the range adopted in the Yellen [1] paper, the result is shown in Figure 1. The original data are taken from the paper [1] , and the solid line is the Federal Reserve trend from the above Equation (1) and Equation (2), and all the

tabulated values are given in Appendix A.

Also shown in Figure 1 is the learning trend line for the inflation rate, πt, as expected from learning theory [3] , which fits a myriad of modern system data that exhibit learning from other complex technologies and also covering multiple disciplines (transport, surgical procedures, industrial accidents, near misses, etc.). This exponential form has only three variable parameters, and was fitted to the PCE index data using the commercial software pro Fit version 7, and is given by:

(3)

(3)

We may observe that the e-folding learning scale is about $70 T, and the underlying expected and actual predicted inflation rate is near 2%, which is the current Federal Reserve target and the future expert expectation ( [1] , p. 30).

Note the deviation between the Federal Reserve trend line from (1) and (2) is only slightly different from the learning Equation (3). Therefore, there is clear evidence of lear- ning.

3. Stability and Unemployment

We can also examine economic stability, particularly in relation to unemployment. For this analysis the data from 1981 onwards were downloaded from the Bureau of Labor Statistics (BLS) website (http://data.bls.gov/generated_files/graphics/latest_numbers_LNS14000000_1981_2015_all_period_M08_data.gif), and converted to quarterly averages to be consistent (see full data Table in Appendix A).

![]()

Figure 2. Unemployment and inflation trends.

The result shown in Figure 2 does not show any learning, so clearly is decoupled. The data indicate an underlying quasi-periodic fluctuation with a period, f, of about $180 T, and there is also a trend visible of growth in fluctuation amplitude over ten times greater risk/experience exposure. There is an underlying unemployment rate over the interval 1981-2015 of about 6.5% behind these fluctuations.

The totally empirical equation that was trial fitted to these data is a simple combination of a pure sin wave with an exponential growth amplitude modification. This choice simply reflects the linking of periodic forces and potential instability, as is common in for example in wave dynamics, and is given numerically by:

(4)

(4)

4. Conclusions and Future Work

We may conclude that the Federal Reserve has learnt to control inflation rate via an implicit learning process, and has also tempered the fluctuations in unemployment rate, which previously showed evidence of instability.

Yellen [1] also discusses the role of “expectation” in forecasting and economic changes in policies and directions. This behavioral response to rule changes is clearly linked to the learning processes in society and by people, let alone by regulators and financial markets, and is just one aspect of cognitive psychology. The use of learning approaches examined here is a fruitful topic for future research on economic predictions and for interpretive purposes.

Appendix A: Data Tables