Disequilibrium Systems Representation of Growth Models—Harrod-Domar, Solow, Le-ontief, Minsky, and Why the U.S. Fed Opened the Discount Window to Money-Market Funds ()

Received 2 November 2015; accepted 5 December 2015; published 8 December 2015

1. Introduction

The form of a model (representation of an economic event) can assist or impede empirical validation of the model. In science, models can be directly validated or invalidated empirically, while theory cannot be so directly verified. Instead, a theory is indirectly verified by means of the direct verification of the models constructible within the theory.

A classic example in physics was Bohr’s quantified model of an atom which directly derived the empirical Rydberg formula and verified the model. Later Heisenberg’s quantum matrix theory and Schrodinger’s atomic wave theory provided the semantic theory in which to embed the Bohr model. Empirical evidence was the Rydberg formula, which summarized the patterns of spectral emission of hydrogen atoms. Bohr’s model quantized the orbits of electrons in hydrogen atoms, from which Bohr then derived Rydberg’s formula. Heisenberg and Schrodinger formulated quantum theories in which the Bohr model could be derived from fundamental assumptions (such as the Heisenberg uncertainty principle and Schrodinger’s Hamiltonian wave equation). The quantum model of the atom was directly verified by experimental data, while the quantum theory was indirectly verified by the quantized atomic model.

So too in the social sciences, models can be directly verified, while theory is only indirectly verified. This challenge of verification of theory was particularly appreciated by Robert M. Solow when he published his famous paper on modeling economic growth. Solow wrote: “All theory depends on assumptions which are not quite true. That is what makes it theory. The art of successful theorizing is to make the inevitable simplifying assumptions in such a way that the final results are not very sensitive. A ‘crucial’ assumption is one on which the conclusions do depend sensitively, and it is important that crucial assumptions be reasonably realistic. When the results of a theory seem to flow specifically from a special crucial assumption, then if the assumption is dubious, the results are suspect.” [1] The importance of models to theory is that a model can verify the empirically applicability of theoretical assumptions.

We will apply the Harrod-Domar and Solow theoretical assumptions to the empirical case of the Global Financial Crisis by representing the models in a disequilibrium system representation in order to directly explain historical evidence.

2. Methodology

Modeling economic growth or stability has long been a tradition in the discipline of economics, with different approaches. For example, Hendrik Van den Berg summarized: “Over the past several hundred years, economic thinkers have examined the economy from a variety of perspectives. Some have sought to describe the economy as a dynamic system that continually changes its shape and composition, while others analyzed the economy as a static system consisting of a constant and stable set of interconnected parts. The latter approach is technically easier to design and manipulate, and it has conveniently enabled economists to use partial equilibrium models that focus on one segment of economic activity under the ‘all other things equal’ (ceteris paribus) assumption. We can also distinguish between those economic thinkers who chose to construct models that aggregated the whole economy into a few curves in a diagram or a small set of mathematical equations, while others used less precise techniques to describe the economy as a complex system consisting of many parts interconnected in complex ways. Finally, economic thinkers have alternatively viewed the economy as a system with a stable equilibrium and one that is continuously changing and potentially unstable.” [2]

Methodologically, we follow the “complex system approach” and modify the traditional economic-growth models to include dynamics of structural features in financial systems, such as “shadow banking”. We translate into graphic representation the traditional algebraic-differential equation formulations of economic growth models. As are algebra and calculus topics in mathematics, so too are topology and graph theory; and we begin modeling in graph theory notation. The methodological advantage of translating economic models from algebraic format into graphic-system format is to provide the capability of representing complex economic concepts with greater clarity and accuracy. Algebraic or differential equations in a model can be re-expressed in a graphic systems dynamics representation; and since Jay Forrester’s introduction of ‘systems dynamics’, modelers have been making such translations [3] .

To test the validity of the system representation of the Harrod-Domar-Solow growth model, we will use a historical case study of an event in the 2007-09 Global financial crises. In the style of historical case studies, we will use direct quotes from contemporary observers to point to sources of historical evidence. Contemporary cases are a blend of the case approach and historical methodology. In historical methodology, sources and direct quotes provide evidence of historical information and interpretation. Contemporary case studies derive historical information from investigative reporters on economic and financial events and on interpretation of these events by contemporary economists and economic commentators. The direct quotes in this article point to sources of historical evidence on the unfolding of the events in the crisis summer of 2008. There are many descriptions of the crisis; and we will not attempt a summary of the events but only focus upon the emergence of jeopardy in the money-market funds, as a key event in the financial crisis. Case studies in economics can be used to provide a basic empirical technique in institutional and micro-economic analyses of the validity of theory and models.

3. Keynes-Harrod-Domar Economic Modeling

Historically, the formulation of economic growth models took a major change when John Maynard Keynes reformulated traditional economic models. Hendrik Van den Berg wrote: “When Keynes published his General Theory in 1936, the neoclassical paradigm was well-established in the economics profession. Even though the Great Depression weighed heavily on economists’ minds, economists were somewhat hesitant to jump to a new paradigm that seemed to contradict conventional mainstream economic thought. Most mainstream economists were more accepting of Hicks’ interpretation of Keynes’ General Theory, which omitted Keynes’ more complex and radical ideas... (and afterwards) the growth models were derived from Keynesian macroeconomic foundations by Roy Harrod (1939) and EvseyDomar (1946).” [2]

It is useful to treat the Harrod and Domar models as basically similar. Hendrik Van den Berg wrote: “Harrod and Domar independently developed what turned out to be identical growth models, which we now refer to as the Harrod-Domar model. That two economists would independently produce the identical model was not surprising; their models were logical extensions of the same Keynesian macroeconomic model. In analyzing how macroeconomic policy could restore full employment, Keynes had focused on aggregate demand, especially the potentially volatile component called investment. Harrod and Domar pointed out that investment changed the economy’s supply side as well as the demand side, and full employment could be maintained only if investment and the other sources of aggregate demand grew just fast enough to exactly absorb the increased output that the new investment made possible.” [2] As described by Hendrik Van den Berg, the Harrod-Domar model consisted of two parts, a supply-side model of production and a demand-side model of demand.

4. Harrod-Domar Supply-Side Model

For the supply-side, the Harrod-Domar model posited two equations:

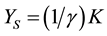

1. A constant marginal product of capital means the economy exhibits a constant capital-output ratio K/YS = γ, so that the supply of output YS is proportional to the stock of capital K:

“In a steady state of production, the quantity of production YS is proportional to the capital K invested in production capacity by the factor of (1/γ).” [2]

2. An increase in capital ∆K creates a proportional (Σ) increase in production ∆YS.

Harrod-Domar also assumed that all savings S goes into productive investment IS and all productive investment goes into capital K: S = IS = K

In Figure 1, we translate these equations into systems dynamics notation. In systems notation, one can improve upon the algebraic form by introducing controls in the flows from savings S to investment I to capital K. Savings and investment and capital may not all be in equal ratio, and one can add more proportional factors to relate variable levels of transformation of savings to investment to productive capital:

τ is the ratio of savings S to investment IS, τ = IS/S.

Θ is the ratio of productive capital ∆K to investment IS, Θ = ∆K/IS.

In systems dynamics notation, flows are depicted by “arrows” in the direction of the flow; sources of a flow are depicted by a “cloud” symbol; stocks by a “rectangle” symbol; and control of a flow by the “triangle-over- an-oval” symbol. In graph theory, components of a graph are nodes connected by lines; and in systems graphs, the lines denote flows of things, controlled by valves. Thus in Figure 1, the Harrod-Domar algebraic model is

![]()

![]()

Figure 1. Graphic systems dynamics representation of the supply-side of the Harrod-Domar model.

represented by flow from savings S to investment IS to capital K into production YS, with flows controlled by the proportionate factors of τ, Θ, γ, and Σ.

In the steady-state of production YS: some proportion τ of savings S flows into investment IS, from which some proportion Θ flows into capital K, from which some proportion (1 − γ) finances the production level YS. Also an increase of capital ∆K from savings S creates a proportionate Σ increase in production ∆YS.

The cloud sources in the production supply system are represented by the variables:

S, IS, K, YS and ∆K

The stock of production supplies are represented by the variables:

YS and ∆YS

The flow valve controls are represented by the variables:

τ, Θ, γ, and Σ.

5. Expanded Systems Representation of the Harrod-Domar Model

In terms of system feed-backs, what is left out of the Harrod-Domar model is the return-of-profits (revenue feedback) to savings from profits of the sales. The methodological advantage of expressing the algebraic equations of the Harrod-Domar model in the graphic representation of systems dynamics is that one can depict feed- back loops in the system. We next expand the Harrod-Domar model into a feed-back system of how revenue RS is created from production YS and contributes to future investment, as shown in Figure 2. The principle feed- back loops in the expanded H-D supply model are:

- revenue RS created by production YS;

- additions to savings S from the revenue RS;

- unemployment LS which can result from cost-cutting ε1 to Labor L.

This addition to the H-D model shows that production creates revenue RS, part of which can become future savings S and can contribute to future investment IS. Revenue RS from sales of produced commodities contributes back to savings S:

1) Principal savings from production revenue arise from distribution of revenue to shareholders, managers, and labor pension funds,

2) Reduction of revenue distributions to labor can occur from lay-offs which increase unemployment.

The feedback-loops bring the theoretical economic assumptions in the Harrod-Domar model closer to empirical reality of economic systems.

![]()

Figure 2. Graphic systems dynamics representation of the modified supply-side of the Harrod- Domar model, adding: revenue, savings-feedback, and unemployment.

6. Demand-Side of Harrod-Domar Model

In the Harrod and Domar approach, both a supply-side and demand-side were modeled, where YS expressed the quantity of the supply side of production and YD expressed the quantity of the demand side of the production. Hendrik Van den Berg wrote: “To capture the potential inconsistencies between investment’s dual effects on aggregate demand and the economy’s productive capacity, Harrod and Domar specified separate demand and supply sides in their model (YD and YS)―because they wanted to make a fundamental point about the potential dynamic inconsistency between aggregate demand and aggregate supply. They hypothesized a very simple supply side model in which investment was the only contributor to economic growth... Harrod and Domar intended the simple supply-side equation to be used in combination with a demand side model in order to provide a valuable insight into the dynamic behavior of an economy.” [2]

Harrod and Domar assumed the demand for investment ID could differ from the supply of investment IS because of the behavior of investors could differ from the needs of an economic system. Hendrik Van den Berg wrote: “Like Keynes, Harrod and Domar focused on investment as a source of instability in the circular flow of aggregate output and income. In his General Theory, Keynes argued that investment was always a potential source of instability because the decision to invest could not be based on a precise comparison of estimated future returns and current opportunity costs of investment. In reality, no one has enough information about the future to perform such a deterministic exercise. ‘Only a little more than an expedition to the South Pole, is it [investment] based on exact calculation of benefits to come,’ Keynes (1936: p. 162) wrote in Chapter 12 of the General Theory.’” [2]

The reason for the difference between actual supply of investment IS and demand for investment ID was how an investment decision, based upon past experience, might not be accurate for the future. Van den Berg wrote: “Fundamentally, future events cannot be accurately estimated from past events because the economy is not ergodic, that is, the world is not a stable, unchanging system in which variables in time-series and cross-section data have the identical statistical characteristics. Because investment is based on so little solid information, Keynes argued that investment was driven by ‘animal spirits’, by which he meant the complex combination of confidence, optimism, and unsubstantiated faith in the future of the economy.” [2]

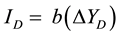

Investment behavior depends upon investor confidence (based upon recent events). But optimism can decline, when forecasts prove inaccurate. Harrod and Domar assumed that investment demand ID would be based upon an extrapolation from recent economic performance. And investment demand ID would be proportional b to pro- duction demand YD: . Van den Berg wrote: “The parameter b relates new investment to the change of aggregate demand, which Harrod and Domar assumed aggregate demand consisted just of consumption and investment.” [2]

. Van den Berg wrote: “The parameter b relates new investment to the change of aggregate demand, which Harrod and Domar assumed aggregate demand consisted just of consumption and investment.” [2]

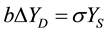

The economy is in equilibrium when desired investment equals actual savings:

or

or .

.

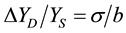

Thus  defines the balance in the dynamics of an H-D model of an economic system:

defines the balance in the dynamics of an H-D model of an economic system:

and

and

The economy continues on a given growth path only as long as b = γ. And this was the part of the H-D model which Robert M. Solow disliked. Solow wrote: “The characteristic and powerful conclusion of the Harrod-Do- mar line of thought is that, even for the long run, the economic system is at best balanced on a knife-edge of equilibrium growth. Were the magnitudes of the key parameters―the savings ratio, the capital-output ratio, the rate of increase of the labor force―to slip ever so slightly from dead center, the consequence would be either growing unemployment or prolonged inflation. In Harrod’s terms the critical question of balance boils down to a comparison between the natural rate of growth which depends, in the absence of technological change, on the increase of the labor force, and the warranted rate of growth which depends on the saving and investing habits of households and firms.” [1]

Solow wrote: “But this fundamental opposition of warranted and natural rates turns out in the end to flow from the crucial assumption that production takes place under conditions of fixed proportions. There is no possibility of substituting labor for capital in production. If this assumption is abandoned, the knife-edge notion of unstable balance seems to go with it. Indeed it is hardly surprising that such a gross rigidity in one part of the system should entail lack of flexibility in another.” [1] Solow was objecting to in the demand side of the H-D model because of its delicate balance based upon the ratio of the demand and supply of production: . In any economy, supply (demand) may not always be in proper proportion to what is produced (supply). Such a balance is indeed delicate; and the “warranted rates-of-return” on investment may not match “actual rates”. Investment needed and actual may not always match.

. In any economy, supply (demand) may not always be in proper proportion to what is produced (supply). Such a balance is indeed delicate; and the “warranted rates-of-return” on investment may not match “actual rates”. Investment needed and actual may not always match.

However, Solow did not provide a demand-side model to replace the H-D demand side model. Hendrik Van den Berg wrote: “Robert Solow’s neoclassical growth model consisted of an aggregate production function in which investment was subject to diminishing returns and the entire capital stock was subject to depreciation. Solow thus presented a slightly more complex supply side-only model, not a complete general equilibrium growth model. In contrast to Harrod and Domar’s constant-returns production function, Solow’s model permitted the capital-output ratio to adjust, thus giving the model a stable equilibrium. Solow thus eliminated the knife’s edge, one of the alleged justifications for macroeconomic policy activism and a source of discomfort among orthodox economists taught to believe in the invisible hand. However, Solow also showed that in the long run, investment alone cannot sustain economic growth, no matter how high the economy’s rate of saving. According to the Solow model, the economy will gradually settle in a steady state of zero growth unless innovation and technological change continually raise the economy’s aggregate production function. But, technology entered the model as an exogenous variable, determined elsewhere.” [2]

Solow constructed his model: “There is only one commodity, output as a whole, whose rate of production is designated Y(t). Thus we can speak unambiguously of the community’s real income. Part of each instant’s output is consumed and the rest is saved and invested. The fraction of output saved is a constant s, so that the rate of saving is sY(t). The community’s stock of capital K(t) takes the form of an accumulation of the composite commodity. Net investment is then just the rate of increase of this capital stock dK/dt or K, so we have the basic identity at every instant of time: dK/dt = sY. Output is produced with the help of two factors of production, capital and labor, whose rate of input is L(t). Technological possibilities are represented by a production function .

. .” [1]

.” [1]

In the graphic systems representation, one needs to add Solow’s supply-production YS as a function of both capital K and labor L. Also since labor L is a system input to production YS one needs to add a source of labor L into the systems representation. This is shown in Figure 3.

Thus what Solow’s model does is to introduce the productive factor of labor into the production function. . We have thus integrated the two models of H-D supply economic growth model with Solow’s model, while adding the feedback loops into the models of how revenue RS (creating profits) results from sales of production and then can flow back into future savings S. Profits from revenue can be distributed to share

. We have thus integrated the two models of H-D supply economic growth model with Solow’s model, while adding the feedback loops into the models of how revenue RS (creating profits) results from sales of production and then can flow back into future savings S. Profits from revenue can be distributed to share

![]()

Figure 3. Graphic systems dynamics representation of the modified supply-side of the harrod- domar model, adding: revenue, savings-feedback, and unemployment.

holders SH or to managers M or tolabor pension funds LF or to labor L. We see in the feed-back that future savings can be increased by return-of-profits. Also the systems model can extend the Solow’s introduction of the contribution of labor into the production system, along with production’s contribution to employment/unem- ployment, into economic growth models.

In the proportion of revenue RS going to labor, it is common business practice to increase or decrease employment. Not only can profits flow to labor but also reductions in labor costs can result in changes in employment. Sometimes, reduction of labor costs may occur to increase profits to managers/shareholders; and also sometimes the increase of labor costs may increase production (or even inflation).

Thus the H-D-S feed-back systems model can also depict a reduction/increase in labor costs which create labor unemployment/employment ∆LS in proportion ε1 to the reduction/increases in labor expenses: L = ε1∆LS. If ε1 is positive, there will be an increase in employment. But if ε1 is negative, there will be a decrease in employment.

7. Integrated Harrod-Domar-Solow-Leontief Model with Supply and Demand Sides

Since the difference between IS and ID is difficult to measure (e.g. Keynes’ “animal spirits”), we turn instead to a different model of production demand YD, that of the Leontief model. The Leontief model of production-con- sumption had not been used in previous Harrod-Domar-Solow kinds of models because of it methodological position, lying between macro and micro models. Mauro Boianovsky and Kevin D. Hoover wrote: “Domar reacted positively to Solow’s aggregative neoclassical growth model. Domar later noted that before the Solow 1956 paper, he had treated capital as the only explicit production factor because he thought including labor as well would require a complex, highly disaggregated production function along the lines of Leontief’s dynamic input-output system.” [4]

We can now use the Leontief model, because one of the advantages of a systems graphic representation of the H-D model is that one can include an aggregate version of Leontief input-output system as the demand side. Wassily Leontief had formulated an economic model of national economy as an input-output balance of products produced and consumed [5] . He described the production (P) from an economic sector (such as manufacturing or agriculture) as consisting of the sum of the I-th products PI produced in the region. Then the Harrod- Domar demand output can be set as:

Leontief traced the distribution of the quantity of production PI into the quantity consumed by consumers CI or by the other J-th industrial sectors ![]() or exported to other Kth countries

or exported to other Kth countries![]() . Leontief wrote this input-output economic model for commodity production as the vector equation:

. Leontief wrote this input-output economic model for commodity production as the vector equation:

![]()

This is read as the quantity of production PI of the I-th product in an economic region is distributed to the regional consumers CI of the I-th products and to the sum of the regional industrial purchasers ![]() of the I-th product and to exports

of the I-th product and to exports ![]() to all the K-th counties. Now we set the production demand YD in the economy as equal to the sum of all the products PI produced for distribution in the economy:

to all the K-th counties. Now we set the production demand YD in the economy as equal to the sum of all the products PI produced for distribution in the economy:![]() .

.

The sum ΣPI is equal to the production demand YD, since this is the production actually sold to the consumer, industrial and export markets:![]() .

.

As shown in Figure 4, we will use this Leontief production equation to construct a demand side for a Harrod- Domar-Leontief model. When in savings equilibrium:

![]()

![]()

![]()

![]()

In the systems representation, the Production Demand ![]() grows as the flow of the demand of con- sumer consumption

grows as the flow of the demand of con- sumer consumption ![]() plus the flow of industrial demand

plus the flow of industrial demand ![]() plus the export demand

plus the export demand ![]() . One can add control valves

. One can add control valves ![]() to each flow to indicate how production demand YD could vary as demand from each sector varied.

to each flow to indicate how production demand YD could vary as demand from each sector varied.

Now we can integrate the two systems models of production supply YS and demand YD as shown in Figure 5. The systems feed-back connection occurs when in the production supply, a reduction (ε1) in employment costs creates labor lay-offs, which feeds back to reduced consumer consumption ![]() which in turn reduces demand in the commodity market of the economy.

which in turn reduces demand in the commodity market of the economy.

When the supply-side and demand-side of the Harrod-Domar model are presented together in systems-dy- namics representations, one sees that the H-D equilibrium condition is for balance between the supply and demand of production:![]() . Then the price-equilibrium of the commodity market occurs in this balance. The feed-back ε1 between two production values is the employment level, which then impacts the H-D equilibrium condition of

. Then the price-equilibrium of the commodity market occurs in this balance. The feed-back ε1 between two production values is the employment level, which then impacts the H-D equilibrium condition of![]() .

.

When![]() , then supply exceeds demand; and production will be cut, leading into a recession. Labor will be reduced, increasing unemployment ∆LS. This increase in the unemployment factor ∆LS (from revenue

, then supply exceeds demand; and production will be cut, leading into a recession. Labor will be reduced, increasing unemployment ∆LS. This increase in the unemployment factor ∆LS (from revenue

![]()

![]()

Figure 4. Systems dynamics representation of Harrod-Domar- Leontief demand-side model.

![]()

Figure 5. Systems dynamic model of Harrod-Domar-Leontief supply-demand model.

distribution RS of the supply production YS) provides a proportionate decrease ε1 of consumer consumption. This pattern is the traditional business cycle, when excess production leads to a decrease in employment which, in turn, further reduces demand.

The systems representation of the Harrod-Domar-Solow model indicates that in an economy (wherein consumer consumption is a significant proportion of production demand), a proportionate decrease in employment (ε1) will result in a decrease in consumer consumption ΣICI. This is the condition for a recession in an economy, when YS > YD. The systems dynamics graphic representation of the H-D-S model enables one to explicitly include in the macro-economic equation not only “production” but also “employment”.

Earlier Keynes, Harrod, and Domar had assumed ‘business cycles’ were due to differences in investment between the supply and demand of investment. But next we will see, in the Global Financial Crisis of 2007-08, that it was not a “business cycle” (between supply-demand of production) which created the crisis. Instead it was a “failure of a financial market” which triggered the crisis. In a systems model of Keynes-Harrod-Domar- Solow-Leontief model, one must add the feature of financial market failures into economic growth model. And we will test the validity of this integrated model in that historical case when the U.S. money-market failed in 2008.

8. Case Study: Rescuing the U.S. Money Market Funds in 2008

In fact, the critical event in the 2007-08 Global Financial Crisis (upon which the whole of the U.S. economy hinged) was not the collapse of the housing market, nor the collapse of the mortgage derivatives market, nor the bankruptcies of Bear Sterns, Merrill Lynch, Lehman brothers. Instead it was the collapse of the Primary Reserve Fund (and other money-market funds). Neil Irwin wrote: “As the New York Fed’s market monitoring staffers made their daily calls (on September 16, 2008) to sources on the trading desks of Wall Street and beyond, and more senior Fed officials sounded out old contacts of their own, they were told of a situation that seemed on the verge of spinning out of control. More (money market) funds would break the buck, putting $ 3.8 trillion of Americans’ savings at risk. And all that money being pulled out of mutual funds meant less cash available for banks, as well as companies that fund their operations with commercial paper. If the money market funds went, so would the solvency of banks (that had weathered the collapse of Lehman and the near collapse of AIG) along with the ability of much of corporate America to make its payroll. Bernanke told Time magazine in 2009: ‘We came very, very close to a depression. The markets were in anaphylactic shock.’” [6]

The “shock” occurred in a series of failures:

2005. Collapse of the U.S. housing bubble;

2006. Collapse of the Mortgage-Based Derivatives Market;

June 2007. Collapse of Derivative Hedge Funds in Bear Stearns;

March 2008. Collapse of Bear Sterns Investment Bank (and sale to Morgan Chase Bank);

7 September 2008. Collapse of Fannie Mae and Freddy Mac (and into government conservatorship);

15 September 2008. Bankruptcy of Lehman Brothers Investment Bank;

15 September 2008. Collapse of AIG insurance firm (and rescue by U.S. Government);

15 September 2008. Reserved Primary Fund breaks the “buck”;

18 September 2008. U.S. Government Guarantee of Money-Market Funds;

19 September 2008. U.S. Treasury Department announces TARP program (and conversion of Goldman Sachs and Morgan Stanley into holding banks).

Joe Nocera written: “On Monday, Sept. 15, 2008, when the news broke that... there would be no last-minute reprieve for Lehman, à la Bear Stearns, all hell broke loose. The stock market tanked, dropping more than 500 points that day. The Reserve Primary Fund, a money market fund that held Lehman bonds, ‘broke the buck’. Shortly afterward, the American International Group nearly collapsed, and had to be bailed out with an extraordinary $85 billion loan from the government. Morgan Stanley was rumored to be next. Banks all over Europe were teetering. There were even fears about the stability of mighty Goldman Sachs. On Wall Street―indeed, in financial capitals all over the Western world―the panic was palpable.” [7]

Historically, it was the ‘breaking of the buck’ by the money market fund, Reserve Primary Fund, which poised the whole U.S. economy upon the brink of depression. The “contagion” from the financial system into the production system occurred on September 15, with a bank run on the Reserve Primary Fund (and not the runs on Bear Sterns nor Merrill Lynch nor Lehman Brothers). Thus in 2007-08, it was not an economic crisis of the U.S. production system (i.e., manufacturing) but one of the U.S. financial system (i.e. banking). What is particularly interesting was the direct “economic connection” of the “money-market funds” to financing the “daily demand of production capital” by U.S. companies.

Money-market funds had not been included in the traditional macro-economic growth models; and yet in 2007-08 such funds (and investment banks) were playing major roles in collapsing the U.S. economy. The lack of anticipation of the global financial crisis of 2007-08 had also happened because “shadow banking” was not in economic models. The issue of stability/instability of modern economies cannot be empirically explained without understanding the structured-feature of the modern banking system. And this had earlier been emphasized by Hyman Minsky [8] . How can such kinds of institutions (the shadow banking institutions) be included in economic growth models?

We examine the details of how the contagion of the derivatives financial market passed on to the money- market funds. Neil Irwin wrote: “On September 16, as Bernanke and Geithner focused on what to do about AIG, another kernel looked ready to explode. Reserve Management was one of the earliest innovators of a product that had transformed the way many people around the world save, as well as how many companies fund themselves. Introduced in 1971, the Reserve Primary Fund, like all money market mutual funds, performed many of the functions of a bank, both for savers and for borrowers, but without all the costly regulation and overhead of a bank. What does a bank do? It takes money from people who wish to save and lends it out to others who wish to invest. A money market mutual fund does the same thing. Savers deposit money, and the managers of the fund invest that money in safe, short-term investments: commercial paper issued by General Electric to manage its cash flow, for example, or Treasury bills issued by the U.S. government, or the repurchase agreements that investment banks use to fund themselves.” [6]

Money market funds had been allowed to proliferate in the U.S. financial system, providing banking functions, but without being regulated by banks. In the late 1990s, the economic theory of “perfect markets” had been used by Summers, Rubin, and Greenspan to justify deregulation over all financial markets―so that even quasi-banks did not require regulation. The policy of deregulation had allowed quasi-banks to grow and grow to $3.8 trillion dollars. Neil Irwin wrote: “Unlike a bank, though, a money market fund doesn’t have to maintain a large cushion of capital―it invests nearly all of its investors’ money in securities. It doesn’t have the costly overhead of bank branches and tellers, so it can generally pay a higher rate of interest to savers and demand lower interest rates from borrowers. But it also lacks the range of government guarantees that the banking system has―federal deposit insurance, as well as access to emergency Fed lending. Indeed, the funds exploded in popularity in the 1970s and 80s in no small part to get around regulations, specifically caps on bank interest rates. Nonetheless, the investments seemed so safe that Americans parked their cash in them in remarkable quantities: $ 3.8 trillion by August 2008, or $ 12,000 for each American man, woman, and child, more than half the total amount of money on deposit at U.S. banks.” [6]

The Reserve Primary Fund was the first of the money market funds to begin suffering a classic “run” on its bank. Neil Irwin wrote: “The Reserve Primary Fund accounted for only $ 62 billion of that total of $3.8 trillion). And of its $ 62 billion in assets, only a bit more than 1 percent―$ 785 million―was invested in securities from Lehman Brothers. Yet when Lehman went under, the entire fund came close to collapse. From its public disclosures, investors were well aware that the Reserve Primary Fund had significant investments in Lehman. The evening of Sunday, September 14, as the investment bank appeared headed for bankruptcy, Reserve Fund managers fretted that they could see people withdrawing money from the fund as a result―up to $ 1.5 billion... At 8: 37 a.m. on Monday, they had already received $ 5 billion in redemption requests.” [6]

After the announcement of Lehman Brothers bankruptcy, it was on that same crisis Monday (September 15, 2008) when the U.S. Treasury and Federal Reserve became aware of the financial perils to the Reserve Primary Fund. James Stewart wrote: “Bruce R. Bent, Sr., the chairman of the Reserve Management Company, which ran the country’s oldest money-market fund, had just arrived in Rome, where he was planning to celebrate his fiftieth wedding anniversary, when his son, Bruce Bent II, the firm’s vice-chairman, called him from New York... The subject they discussed was the Lehman bankruptcy. The Bents’ money-market fund owned hundreds of millions of dollars of Lehman debt securities.... It was now publicly known that the Primary Fund was exposed to Lehman’s failure. Time Warner, which had $820 million in the fund, requested redemptions that morning. The Bents contacted the New York Fed at 7:50 A.M., according to S.E.C. documents, to express concern about Lehman’s effect on the money-market industry and on the Primary Fund.” [9]

The board of the Reserve Management met that morning an 8 A.M. and again in the afternoon at 1 pm. James Stewart wrote: “Bent II reported that redemption requests had reached $16.5 billion. According to the minutes, he described ‘what appeared to be a run on the Primary Fund.’... by the end of the day redemption requests totaled more than $20 billion.” [9]

As the crisis continued on Wednesday (September 17, 2008), it increased. James Stewart wrote: “Asian and European stock markets had dropped sharply, and trading was halted in Russia. News that the Primary Fund had broken the buck had called into question the safety and viability of the global money-market industry... Already, money-market redemption requests were surging; on Tuesday alone, they had been $33.8 billion, compared with a total of $4.9 billion for the entire previous week. Large money-market funds, including Fidelity, Vanguard, and Dreyfus, rushed to issue statements reassuring investors that their holdings were safe and would retain their one- dollar-per-share value, but that didn’t seem to stem the tide. Even more worrisome, funds that had no exposure to troubled securities were confronting huge redemptions. Putnam announced that it would close and liquidate the $12.3-billion Institutional Prime Money Market Fund, even though the fund owned no Lehman or AIG securities and maintained its one-dollar share value.” [9]

The financial contagion from the money-market funds went next to manufacturing firms, such as General Electric (GE). James Stewart wrote: “In the face of mounting redemptions, money-market funds raced to sell whatever they could find buyers for, but there were no buyers for all but the safest, shortest-term securities. Early that morning, Paulson had a disturbing phone conversation with Jeffrey Immelt, the chief executive of General Electric. Immelt reported that the capital markets were ‘very bad’, and Paulson said he understood that the commercial-paper markets were under stress. ‘That’s bad for GE’, Immelt replied. Like most large corporations, GE uses the commercial-paper market to fund its day-to-day operations, including those of GE Capital, its huge finance arm. GE was worried about its ability to roll over its short-term debt, and the previous day had paid 3.5 per cent, much higher than normal, for an overnight loan. (The lower-rated Ford Motor Credit reportedly had to pay 7.5 per cent.) For companies like GE, the uncertainty was as debilitating as the high rates.” [9]

This is how, on Wednesday September 17, financial contagion had run from the financial sector into the production sector. James Stewart quoted an government official: “A Treasury official described the situation: ‘Lehman Brothers begat the Reserve collapse, which begat the money-market run, so the money-market funds wouldn’t buy commercial paper. The commercial-paper market was on the brink of destruction. At this point, the banking system stops functioning. You’re pulling four trillion out of the private sector’―money-market funds―‘and giving it to the government in the form of T-bills. That was commercial paper funding GE, Citigroup, FedEx, all the commercial-paper issuers. This was systemic risk. Suddenly, you have a global bank holiday.’” [9]

Financial contagion from banks to commodity producers spreads both as a kind of “leverage burning” and as kind of “credit freezing”. Bankruptcy contagion from banks had “burned” from one financial institution (Lehman Brothers) to another (Reserve Primary Fund). Then this “burning” actually “froze” commercial credit for the production sector. Neil Irwin wrote: “When people demanded their money back, it meant that the Reserve fund’s managers needed to sell other assets to get the necessary cash. And the week of September 14, 2008, was one of the worst weeks in the history of finance to try to sell commercial paper and other short-term investments. The Reserve Primary Fund may not have been a bank, but it was experiencing a run on the bank nonetheless. It announced Tuesday evening that it would have to ‘break the buck’, meaning that shares in the fund normally worth $ 1 would in fact be worth only 97 cents.” [6]

“Breaking the buck” was the quaint term the mutual funds used to indicate how nominal shares purchased in their fund by savings depositors were always priced a “one buck per share”. Neil Irwin wrote: “In response, investors started pulling their money out of other money market funds, making $169 billion in withdrawals the very next day. A vicious cycle was setting in. As investors yanked their money from the funds, the funds were forced to dump commercial paper into the market to free up cash, causing their value to fall further, creating more losses. At the same time, the withdrawals threw into doubt the funding that many U.S. corporations use to pay for everyday operations.” [6]

In traditional economic theory, only commercial banks were central to the financial system, and the Federal Reserve banking staff had not paid much attention to the mutual funds. But in that week of September 14, Federal Reserve staff started to pay attention. This was the crisis point at which the then Federal Reserve Chairman Ben Bernanke became frightened of the U.S. economy tipping into a depression. Neil Irwin commented about that moment of fear: “The idea that money itself may be unsafe triggers an almost primal fear in even the most levelheaded of investors. The problem in the Panic of 2008 wasn’t that some investments lost value. It’s that many of the investments that lost value―money market mutual funds being a prime example―had been viewed as absolutely safe. The basic reality of modern monetary systems had been laid bare. Money is simply an idea, a concept―a giant confidence game, even. People wanted out. That was the feeling in the air that week in September 2008.” [6] The U.S. financial system was entering into the panic of bank runs; and Bernanke knew that the three years of bank runs (1930, 1931, and 1932) had plunged the U.S. economy into the Great Depression.

Ben Bernanke resolved to not allow a second Great Depression; he would extend the “Bagehot principle” of the U.S. Federal Reserve to act as a lender-of-last-resort not only to commercial banks―but to all financial institutions. Neil Irwin wrote: “Could Walter Bagehot’s time-honored approach to stopping a panic―lending freely to illiquid, not insolvent, firms at a penalty interest rate―be made to work when the panic was happening almost everywhere on earth at the same time, and in markets where traditional rules didn’t apply? The Fed’s strategy for dealing with the panic was emblematic of its overall approach to the crisis. Bernanke, the Great Depression scholar, had particular admiration for Franklin Delano Roosevelt’s strategy during the 1930s. Not every program his administration undertook did much good, but there was a spirit of experimentation, of throwing everything the government had against the wall to see what would stick. As the money market funds trembled, Bernanke directed his troops to adopt the same approach: ‘Try everything.’” [6]

The U.S. Federal Reserve instituted a facility to bail out the mutual funds. Neil Irwin wrote: “First, just three days after the Reserve Fund broke the buck, came the Asset Backed Commercial Paper Money Market Mutual Fund Liquidity Facility, or AMLF. With Fed staffers in New York and Washington already stretched thin with crisis fighting, the program was administered by the Federal Reserve Bank of Boston, which had particular expertise in money market funds.... The Fed would lend money to banks, which could then buy the securities the money market funds were selling off and pledge them to the Fed, with the banks themselves taking no financial risk for their role as intermediary. The program lent out $ 24 billion on its first day of operation, September 22, 2008, and $ 217 billion before the panic wound down, routing money through banks like State Street and J.P. Morgan Chase to mutual funds run by household-name companies such as Janus and Oppenheimer.” [6]

The run on money market funds stopped. Commercial short-term loans from the financial sector continued to fund the daily operations of U.S. production sector. A depression was avoided, although a recession occurred. But there are big differences between a depression and a recession, in depth and in length.

9. Modeling the Financial System of the 2007-08 Financial Crisis

About the 2007-08 fiscal crisis, the empirical evidence for theory is that it was a crisis not in the failure of “production”; it was a failure of “finance”. The contagion ran from derivatives to investment banks to “money markets”―then finally to ‘production’ in the form of short-term “commercial paper”. This evidence says that in the Harrod-Domar and Solow models, concern about the stability of national production, the “knife-edge” of the supply-demand investment ratio (![]() ), was not empirically relevant to the 2007-08 crisis.

), was not empirically relevant to the 2007-08 crisis.

Empirically one needs to add to the systems-graphic model of the H-D-S-L growth models, a “crisis” model of financial market disequilibrium (and not a commodity business cycle instability). This distinction between sources of economic instability (financial crises or commodity business cycles) is important. Previously in the economic literature, Irving Minsky had emphasized that a financial market differed from a commodity market in that the financial system required three components for trading capital assets: 1) credit-debt transactions as a fundamental financial process; and 2) a capital-asset market for liquidity of the asset; and 3) money as a medium of value-exchange. As shown in Figure 6, Minsky’s emphasis on a time dimension can be included in a supply- demand graph by adding a third time dimension to the graph. [10]

A financial capital-asset transaction occurs over time, beginning with a loan for an asset purchase, followed by rents (income stream) from the productivity of the capital asset, which are used for payments of the loan until the sale of the asset. Financial agents provide a purchase loan to the purchaser of the asset, receiving in turn, from the purchaser, loan payments on the debt over time from T1 through T2. Financial markets price the capital asset for purchase at time T1 and later for sale at time T2. Debt makes a financial process operate. Yet one aspect of debt can destabilize the process; and this is “leverage”. To increase profit, a financial system uses debt to finance the purchase of capital assets. Profits can be increased through financial leverage; and this is the financial rational of “leverage” (more “present-debt” toward greater “future-wealth”). However, when present-debt is too large (too highly leveraged), it might not create future- wealth but, instead, bankruptcy. Excessive “leverage” increases the likelihood of bankruptcy and not future- wealth.

This was earlier pointed out by Irving Fisher, who called a financial state of excessive-leverage as “debt deflation” [11] . Later Hyman Minsky called the state of excessive financial leverage: “Ponzi finance” [8] . Even later, Paul McCulley continued to emphasize the importance of the economic role of “leverage”: “At its core, ca-

![]()

Figure 6. Financial market: three-dimensional (price, quantity, time) supply-demand-price-disequili- brium chart―over time.

pitalism is all about risk taking. One form of risk taking is leverage. Indeed, without leverage, capitalism could not prosper. And it is grand, while the ever-larger application of leverage puts upward pressure on asset prices. There is nothing like a bull market to make geniuses out of levered dunces. (Speculation) begets ever riskier debt arrangements, until they have produced a bubble in asset prices. Then the bubble bursts.” [12] The housing market in 2005 was a financial bubble. The mortgage-derivative market in 2006 was a financial bubble.

Other economists now emphasize this point, about economic instability: that it is the financial system which is prone to cyclic failure, not the production system. For example, Claudio Borio wrote: “...I consider the major source of systemic risk is the ‘financial cycle’ and its link with systemic financial (banking) crises than the far better known ‘business cycle’... By ‘financial cycle’ I mean, somewhat loosely, the self-reinforcing interaction between risk perceptions and risk tolerance, on the one hand, and financing constraints on the other that, as experience indicates, can lead to serious episodes of financial distress and macroeconomic dislocations. This is what has also come to be known as the pro-cyclicality of the financial system.” [13] Borio views the Global Financial Crisis of 2007-08 as part of a “financial cycle”.

Next, as shown in Figure 7, one should insert into the systems graphic form of a Harrod-Domar-Solow model, the graphic dynamics of a financial market. In this case it was the financial bubble of mortgage derivatives which triggered the 2007-08 financial crisis.

Also in applying the systems Harrod-Domar-Solow-Leontief-Minsky growth model to this fiscal crisis, one must distinguish two sources of savings S, the normal one for commercial banks savings and another for money- market savings. Thus into the H-D-S-L-M growth model, one needs to introduce some institutional distinctions between the forms of banking, which operate savings deposits and formulate business loans. Figure 7 shows the connections between (1) the disequilibrium collapse of the financial mortgage-derivative market) and (2) a bank run on money-market funds and (3) jeopardy of money-market funds and (4) freezing of credit for short-term commercial loans for commodity production firms.

This graphic-systems form of the H-D-S-L-M growth model methodologically provides a direct empirical comparison of the theoretical model to empirical reality in theevents in 2007-08 of the economic crisis: (1) → (2) → (3) → (4).

10. Reprise

We view the economy as consisting of two systems: commodity-production systems and financial systems; and

![]()

Figure 7. Disequilibrium system of derivative market.

represent their interactions in system-dynamics models. We have embedded a financial model into the economic production models in order to trace how financial bubbles can create economic instability in production systems.

Two years before the crisis in 2005, the U.S. Federal Reserve apparently had not understood the nature of financial bubbles nor included them in their conceptual models of economic stability. Ben Bernanke was then a member of the Board of Governors of the U.S. Federal Reserve System; and the Board discussed the U.S. housing bubble in 2005. Ben Bernanke wrote: “As house prices continued to increase, the Federal Open Market Committee (a committee of the Federal Reserve) paid more attention. The FOMC heard a special staff presentation on the topic at it June 2005 meeting... Today the transcript makes for painful reading... The staff presentation was set up as a debate... Most policymakers at the meeting, like most staff economists, downplayed the risks... Clearly many of us at the Fed, including me (Bernanke) underestimated the extent of the housing bubble and the risks it poised.” [14]

In retrospect, mainstream economic thinking then was not focused upon financial crises. Ben Bernanke wrote: “The remarkable economic stability of the latter part of the 1980s and the 1990s―a period that economists have dubbed ‘the Great Moderation’―likely bred complacency.” [14] Earlier in a speech (which Ben Bernanke gave after becoming a member (governor) of the Federal Reserve System), he said: “So, is deflation a threat to the economic health of the United States? Not to leave you in suspense, I believe that the chance of significant deflation in the United States in the foreseeable future is extremely small, for two principal reasons. The first is the resilience and structural stability of the U.S. economy itself. Over the years, the U.S. economy has shown a remarkable ability to absorb shocks of all kinds, to recover, and to continue to grow. Flexible and efficient markets for labor and capital, an entrepreneurial tradition, and a general willingness to tolerate and even embrace technological and economic change all contribute to this resiliency. A particularly important protective factor in the current environment is the strength of our financial system.” [15] Until 2007, Bernanke had believed in the “strength of our financial system”.

Also most of the other governors and staff of the Federal Reserve System had not taken the economic risks of financial bubbles seriously. The “great moderation” of mainstream economics in the 1980s and 1990s was experienced by economists. Then only the Solow economic growth model had been required reading by mainstream economics. But the disequilibrium theory of financial markets of Irvin Minsky had not been required reading. Yet (as Minsky had described) the connection of a disequilibrium financial crisis to economic instability again occurred. Ben Bernanke wrote: “We now know that the U.S. economy shrank at 2% annual rate in the 3rd quarter of 2008, an astonishing 8.2% in the fourth quarter (the worst performance in fifty years), and a 5.4% rate in the first quarter of 2009. It was easily the deepest recession since the Depression.” [14]

It was on that Monday September 15, when the U.S. Secretary of the Treasury, Henry Paulson, had to deal both with the potential bankruptcy of AIG and the run on the money market fund of the Reserve Management Company. Paulson realized that government intervention to save AIG was going to cost at least $85 billion or more. He went to inform the President George Bush about the massive investment the Federal Government was going to have to make, after the bankruptcy of Lehman Brothers―to prevent AIG and more financial institutions going bankrupt. James Stewart wrote: “That afternoon (September 15), President Bush, accompanied by Josh Bolten and Joel Kaplan, his chief of staff and deputy chief of staff... sat down with Paulson and Bernanke in the Roosevelt Room of the White House. Bush asked: ‘So what is going on in our financial system, and what are we going to do?” [9]

The Treasury Secretary Paulson and Chair of the Federal Reserve Bernanke had been trying to keep the President Bush informed about the unfolding crisis and its economic consequences. James Stewart wrote: “Paulson told Bush: ‘AIG is about to fail.’... Bush wondered aloud: ‘How have we come to the point where we can’t let an institution fail without affecting the whole economy? Bernanke reiterated that what had begun as a subprime-mortgage problem in the U.S. was emerging as a global crisis, which made it even harder for the Fed to combat the problems on its own.’” [9]

The President supported the decisions of Paulson and Bernanke about the crisis. James Stewart wrote: “When Bernanke and Paulson finished, Bush said, ‘Sometimes you have to make the tough decisions. If you think this has to be done, you have my blessing’. But, as he (Bush) rose to leave, he said, ‘Someday you guys are going to need to tell me how we ended up with a system like this.’” [9]

To understand “how we ended up” requires both an explanation and an anticipation of financial instabilities to be included within improved models of economic growth. The models need to show (1) “how-financial-bubbles- occur” and (2) “how-financial-crises-collapse-production-economies”. As has been sketched in the previous Figure 7, we now see the importance of modeling theoretical interaction between financial bubbles and production instability.

11. Structured Finance Models in Economic Growth Production Models

In addition to not understanding the dynamics of financial bubbles in 2005, the U.S. government apparently did not fully understand the financial system, especially the role of “shadow banking” in the system. Ben Bernanke wrote: “...in 2005 at the Council of Economic Advisers, (Steve Braun and I)... estimated the effects of a housing price bust in our presentation to President Bush. Steve’s and my presentation proved wrong because we did not take into account the possibility that losses on subprime mortgages could ultimately destabilize both the U.S. and global financial systems.” [14]

The US Federal Reserve apparently had not appreciated the structured features of modern banking. Ben Bernanke wrote: “Today, depositors (in banks) almost never line up at tellers’ windows to take out their cash. Since1934, the federal government has protected bank depositors against losses, up to a limit, even if their bank fails. But that didn’t mean that runs were history. As we (the Federal Reserve) were learning in August 2007, they (bank runs) now occurred in different forms.” [14]

Banks were not only “commercial banks” taking deposits and lending out money. Banks had different forms: commercial banks, investment banks, money-market funds, hedge funds. The latter banking institutions are now called “shadow banking”. Earlier, Hyman Minsky had described how financial firms which borrow money from commercial banks create a “layering” of institutional finance (Minsky, 1975). The bottom institutional layer of any financial system consists of commercial banks which derive their capital from depositors and make loans to borrowers. Borrowers can be consumers, productive businesses, or financial businesses. Above this bank layer is a higher layering of financial institutions, all of which depend upon the banks for financing. The principal financial process of this middle layer is “leveraging”. Minsky wrote: “In a layered financial structure, the (financial) unit acquiring a liability (making an investment) may have liabilities of its own (borrowing money for the investment), and its ability to fulfill its obligations depends upon the cash flow it receives from its assets (investment)... (But) a financial unit may have the principle amount of some debt outstanding falling due and not have the cash or liquid assets on hand to meet the payment (‘leverage’). In these circumstances, the firm may pay its amount due by issuing new debt, rolling over, or refunding, its debt.” [8] Speculative leverage is when the investment income from a debt cannot fully service the loan; and the loan must be refinanced.

This speculative leveraged layer (shadow banking) came to the attention of the Federal Reserve in 2007, as Ben Bernanke wrote: “Over the past few decades, a network of diverse nonbank financial firms and markets, dubbed the shadow banking system by economist, Paul McCulley, had developed alongside the formal banking system. The shadow banking system included nonbank lenders like mortgage companies and consumer finance companies, as well as companies operating in securities markets, such as investment banks. These firms relied on short-term funding other than government-insured deposits.” [14]

Thus into conceptual models of mainstream economics, one needs to indicate the institutional forms of savings and investments. It is not sufficient to neither indicate all savings in one variable S nor indicate all investment in one variable IS. In Figure 7, we had to distinguish sources of savings between savings S (commercial banks) and savings S (money-market funds). This is why the Harrod-Domar and Solow models needed to be re-expressed from algebraic equations into graphic systems dynamics forms―in order to improve empirical discrimination between the banking and shadow-banking institutions in the flow of savings S.

The forms of loans (investments IS) between commercial and shadow banking can differ in term and in leverage. Ben Bernanke wrote: “These (shadow banking) firms relied on short-term funding other than government- insured deposits... This short-term, uninsured financing―typically provided by institutional investors, like money market funds or pension funds―is called wholesale funding, to distinguish it from the bank deposits of individuals, known as retail-funding. But, like retail funding in the days before (Federal) deposit insurance, wholesale funding is potentially subject to runs.” [14] It appears that in the crisis, government financial officials finally began to pay attention to shadow banking and its risks in destabilizing an economy.

Yet earlier, the economist Hyman Minsky had described the operations of the structured finance (shadow banking. Hyman Minsky wrote: “... our complex financial structure consists of a variety of institutions that lever on owners’ equity and normally make on the ‘carry’, which is borrowing at a lower rate than their assets can earn.” (Minsky, 1975) The financial term “carry” means the “difference” in interest rate (that a financial firm can make from an investment) above the interest rate (the financial firm must pay to a bank to finance its investment). It is this “carry” which enables higher-level financial institutions to make money from leverage, during the time of a financing loan.

Ben Bernanke provided an illustration of how the “carry” form of profitability (leverage) created instability in the shadow banking. Ben Bernanke wrote: “On March 6, 2008, an investment fund sponsored by the Carlyle Group, a private equity firm whose partners moved in Washington’s inner cycles, also failed to meet margin calls. The fund’s $22 billion portfolio consisted almost entirely of mortgage-backed securities issued and guaranteed by Fannie and Freddie.” [14]

That year in March 2008, the Federal National Mortgage Association (Fannie Mae) was already seen to be in financial trouble. Fannie Mae had been founded as a government-backed mortgage company to purchase long-term residential mortgages. After a change to wholly private management, greedy executives had the firm purchase sub-prime mortgages to rapidly build sales and increase executive bonuses. Fannie Mae was going bankrupt when the mortgage market failed due to the sub-prime mortgages. On September 7, 2008, the U.S. Federal Housing Finance Agency placed Fannie Mae (Federal National Mortgage Association) and Freddie Mac (Federal Home Loan Mortgage Corporation) into government conservatorship.

Earlier in March 2008, when the Carlyle fund had been holding newly risky Fannie and Freddie mortgage-back bonds, the Carlyle fund would fail―due to its excess leverage (carry) in buying the Fannie and Freddie securities. Ben Bernanke wrote: “The Carlyle fund had paid for its securities (bonds) by borrowing $30 dollars for every $1 in capital invested in the fund... By Monday March 10, it had unloaded nearly $6 billion in assets ? yet another fire sale.” [14]

The “shadow banking” Carlyle investment fund had been making a profit on the difference between the interest earned on the Fannie and Freddie securities and the interest cost of borrowing money to purchase the securities―“carry”. Highly leveraged, it was vulnerable to the state of the financial system.

12. Summary

Because the commercial banking and shadow banking institutions operate differently in terms of investment, it is important to add feed-back loops to the traditional models of economic growth―in order to connect instabilities in financial systems with business cycles in which financial bubbles can plunge production systems into a recession or a depression.

We have shown the feed-back connections from financial market busts to production employment. This kind of connection from financial conditions to production conditions to employment did show up in the financial crisis early in 2008. Ben Bernanke wrote: “At 8:30 a.m. Friday morning, March 7 (2008), the financial markets, already fragile, would learn what we (the Federal Reserve) had learned confidentially the evening before―that the nation’s payrolls had fallen by 63,000 jobs in February, the second consecutive decline... The job news was a tangible indication that financial instability, contracting credit, and falling confidence were seriously damaging the economy.” [14]

It had been on the crisis weekend of September 13-14, 2008 when the Federal Reserve System was thinking about a Lehman Brothers bankruptcy and unable to find a buyer at that weekend, Lehman declared bankruptcy on Monday September 15, 2008. At that same day, the Federal Reserve System turned to rescuing the insurance company AIG and next to the peril of the money-market funds. Ben Bernanke wrote: “We discussed the money market funds at length. Even some of the largest, best-known money funds were reporting significant outflows. The runs had the potential to inflict serious economic damage, not only by adding to the financial market panic, but also because many large corporations depend on money funds to buy their commercial paper. A pullback by the money funds would hurt the ability of companies like General Electric or Ford to finance their daily operations.” [14]

It was at this point that the Federal Reserve realized it needed to go all out to prevent a depression in the U.S. economy, triggered by the collapse of the derivatives market. Ben Bernanke wrote: “We needed to stop the bleeding… But it was technically and legally complicated. Rather than lending directly to the money funds, we (Federal Reserve) would lend to banks... on the condition that they purchase the liquid asset-backed commercial paper from money funds.” [14]

Connections between financial markets and daily production occur through short-term commercial paper, funded in part by shadow banking firms (such as the money-market funds). This illustrates a direct connection between the flow of credit in the financial market and daily operations in the production sector. And this is why in Figure 7, we have indicated a financial connection between the money-market funds and rate of capital dK/dt flow into the production YS.

In 2009 the crisis was over and the recession had begun. James Stewart concluded: “Meanwhile, the economy is still in a deep recession, with unemployment at nearly ten per cent. But the simple fact is this: America did not plunge into the economic abyss it faced that Thursday night. The bold stroke of guaranteeing the money-market funds stopped the panic and halted withdrawals from the funds. The commercial-paper market slowly came back to life and, with it, the credit markets. Turning Morgan Stanley and Goldman Sachs into bank holding companies with Fed supervision and support stopped the run on investment banks. The details and mechanics of the TARP legislation proved less important than the sense that a comprehensive plan to address the crisis was under way. The reprieve bought enough time for the re-emergence of reason over unbridled fear.” [9]

13. Results and Future Research

There are three advantages to expressing economic growth models from algebraic form to systems graph theory form.

Firstly, the systems form enables one to add to an economic model more components to sufficiently enable a direct comparison of theoretical model to a historical case study of an economic event―such as the feed-back connections from production to savings.

Secondly, the graphic topological form enables the economic model to connect two different forms of market dynamics, price-equilibrium for commodity markets and price-disequilibrium for financial markets. It can depict the contagion from the money-market funds for financing production (in commodity markets), which arose from the failure of the financial derivative markets.

Thirdly, the issue of balance in the economic system can be distinguished into two issues of stability/instabi- lity: balance in the production business cycle and balance in the financial markets.

Theoretical models of economic growth have provided the intellectual framework for monetary policy; but such models have not anticipated financial booms and busts. For example, Claudio Borio wrote: “If the criteria for an institution’s success are diffusion and longevity, then central banking has been hugely successful. But if the criterion is the degree to which it has achieved its goals, then the evaluation has to be more nuanced. Historically, those goals have included a changing mix of financial and monetary stability. Attaining monetary and financial stability simultaneously has proved elusive across regimes. Edging closer towards that goal calls for incorporating systematically long-duration and disruptive financial booms and busts―financial cycles―in policy frameworks. For monetary policy, this means leaning more deliberately against booms and easing less aggressively and persistently during busts. What is ultimately at stake is the credibility of central banking―its ability to retain trust and legitimacy.” [16]

In the global banking panic of 2007-08, the central bank policies, in the United States and in Great Britain, had not anticipated the failure of financial markets. Then central bank regulators had been using the exogenous economic theory that all markets are perfect to avoid regulation. But empirically, financial markets had been far from perfect, and bank panics have been recurrent.

There were arguments about whether or not the Federal Reserve should have saved Lehman Brothers and then the collapse of the financial system might not have occurred. In 2009, a New York Times reporter, Joe Nocera, thought about this: “What if they’d saved Lehman Brothers? What if, a year ago this weekend, the government and the banking industry had somehow found a way to keep Lehman from filing for bankruptcy? How might that have changed the course of the financial crisis? ...Christine Lagarde, France’s finance minister, for instance, called the decision ‘horrendous’ and a ‘genuine mistake.’... The head of the European Central Bank, Jean- Claude Trichet, has said the same thing in private. He quotes one of Mr. Trichet’s aides as saying, ‘It never occurred to us that the Americans would let Lehman fail.’” [7]

But Joe Nocera concluded that the panic would have occurred anyway, but only on a larger scale: “If Lehman had been sold to Bank of America, as originally planned, some other firm―no doubt bigger, and posing more danger to the global financial system―would have failed instead. By then, there was simply too much panic in the air. A crisis of some sort was inevitable.” [7]

Financial contagion is a system failure, a failure of the system of banking. This occurs when many banks in a system participate in the same financial error―which in 2008 had been the widespread banking participation in the mortgage derivatives market. It was a flawed market, a market doomed to failure―when mortgage bonds interest payments were stripped (securitized) from the mortgage bonds―leaving bonds useless, having no future value―“toxic assets”. By then the U.S. government officials had finally realized that “securitization” was economically harmful. It had created a derivatives market which was inherently to be systematic financial failure― securitized mortgage bonds were basically “toxic assets” but widely held by many financial institutions.

Not just Lehman Brothers needed to be rescued from its holding “toxic” bonds, but all the big U.S and European banks had to be rescued, “bailed out”. Joe Nocera wrote: “In truth, a Merrill or AIG default would have created something akin to a financial nuclear bomb―much worse than Lehman’s filing for bankruptcy. Merrill was a much bigger firm, with deep roots on Main Street thanks to its ‘thundering herd’. AIG was the world’s largest insurance company, whose credit-default swaps were propping up half of Europe’s banks (By buying AIG’s swaps, European banks evaded their capital requirements). Lehman, by contrast, was a smaller firm, with practically no ties to Main Street. The risks it posed to the system were real―but smaller. Almost everyone I’ve ever spoken to in Hank Paulson’s old Treasury Department agrees that without the immediate panic caused by the Lehman default, the government would never have agreed to make the loans needed to save AIG, a company it knew very little about. In effect, the Lehman bankruptcy caused the government to panic, which in turn and subsequently caused the government to save the firms it really had to save―to prevent catastrophe. In retrospect, if you had to choose one firm to throw under the bus to save everyone else, you would choose Lehman.”[7]

Had the government officials anticipated or understood the dimensions of the crisis? Joe Nocera thought not: “It would be nice to be able to say that officials at Treasury and the Federal Reserve understood this at the time. But of course they didn’t. Throughout history, people have stumbled their way through crises, not fully understanding the potential consequences of their actions, hoping the choices they make turn out to be the right ones. Mr. Bernanke is a well-known student of the Great Depression, which guided many of his actions during the crisis. Mr. Paulson showed immense tenacity once the crisis struck. History, I now believe, will praise their efforts in subduing the collapse. But the Lehman default? You know the old saying: Sometimes, it’s better to be lucky than good. A year ago this weekend, it turns out, was one of those times.” [7] It would be useful to government officials to have valid economic models of financial and production economic systems, so that policy can be based upon intelligent analysis, rather than lucky guesses.

Experimentation is difficult in the social sciences, because manipulating and controlling people for scientific study is unethical. However, history provides “natural experiments”, describing what people actually did to each other―histories of societies and histories of economic systems. Economic theory should be based upon economic history, as history is the scientific ground for all societal theory. Although economic historians have produced splendid and detailed histories, these have not always grounded the construction of economic theory (particularly the doctrine that “markets are perfect”). Economic historians have taken broad views about the history of banks and economies; but a broad historical insight has not always crept into economic theory construction. For example, Ben Bernanke wrote: “Economists have not always fully appreciated the importance of a healthy financial system for economic growth nor the role of financial conditions in short-term economic dynamics. As a matter of intellectual history, the reason is not difficult to understand. During the first few decades after World War II, economic theorists emphasized the development of general equilibrium models of the economy with complete markets; that is, in their analyses, economists generally abstracted from market, “frictions” (such as imperfect information or transaction costs). But without such frictions, financial markets have little reason to exist.” [15] Bernanke was commenting that, due to the then recent prosperity, this had encouraged many economists to believe that markets were actually perfect―and to down play any ‘problem’ about any market as merely a small “friction” on the powerful drive of economic “perfection”. Perfect markets don’t need regulation; real markets do. Properly regulated real markets can become nearly perfect.

Future research can further elaborate on modeling the connections of market crashes in the financial system to credit freezes in the production system―in order to improve the validity of economic theoretical models that are useful to guide proper regulation.