1. Introduction

On September 13, 2004 the Chicago Board Options Exchange’s Market Volatility Index, which measures investor’s market expectations of near-term volatility conveyed by Standard & Poor index option prices, fell to a new eight-year low of 13.16% annualized, down roughly 14% since August 2004 (Figure 1).

Similarly in Asia, the annualized market volatility as represented by the regional index, MSCI AC Asia ex Japan Index, fell from 20% to 18%, while implied volatility dropped from 23.9% to 20.8% (Figure 2).

In addition, the cross-sectional volatility, a measure of stock market return dispersion fell to a low level last seen 1997. The 90-day rolling volatility also showed the decline in absolute market volatility with MSCI US Index falling from a high of 16% in March 2001 to 6.7% as of August 2004 (Figure 3), while MSCI AC Asia ex Japan Index fell modestly from 13.9% to 8.5% during the same period (Figure 4).

2. Observation

2.1. Tracking Error and Market Volatility

In discussing fund performance, the term tracking error [1] [2] is commonly used. This is a measure of the deviation of fund performance from benchmark performance [3]. As market volatility fell, active risk or the tracking error [4] for typical portfolios trended down accordingly. This relationship can be explained mathematically via the following formula:

![]()

Figure 2. MSCI AC Asia ex Japan versus volatility.

![]()

Figure 3. MSCI USA cross-sectional volatility.

![]()

Figure 4. MSCI AC Asia ex Japan cross-sectional volatility.

(1)

(1)

where TE denotes the portfolio’s tracking error measured in % per annum.  denotes the portfolio’s beta [5] which is its sensitivity to the market or benchmark in the Capital Asset Pricing Model.

denotes the portfolio’s beta [5] which is its sensitivity to the market or benchmark in the Capital Asset Pricing Model.  is the market or benchmark’s total volatility and

is the market or benchmark’s total volatility and  is the portfolio’s residual volatility. Volatilities are measured in % p.a.

is the portfolio’s residual volatility. Volatilities are measured in % p.a.

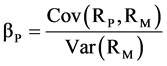

can be expressed statistically as

can be expressed statistically as

[6] [7] (2)

[6] [7] (2)

(2) is further simplified as  [8]-[10]

[8]-[10]

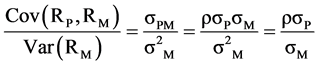

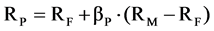

The expected return of risky portfolio P is

(3)

(3)

which can be rewritten as

[8] [9] (4)

[8] [9] (4)

and after rearrangement,

[8] [9] (5)

[8] [9] (5)

where  is the Market Price of Risk [8] [9] and

is the Market Price of Risk [8] [9] and  is the risk-free rate in % per annum.

is the risk-free rate in % per annum.

For performance measurement, the managed portfolio P is compared with the benchmark M [11]. Relative risk is important. If a portfolio manager is being compared to a performance benchmark, then the difference in return between his portfolio’s return,  , and the benchmark’s return,

, and the benchmark’s return, ![]() , is of pivotal importance. This difference is called the active return or tracking error of the portfolio since it describes how well the portfolio can track the benchmark [4] [9].

, is of pivotal importance. This difference is called the active return or tracking error of the portfolio since it describes how well the portfolio can track the benchmark [4] [9].

As observed, total portfolio volatility decreased as market volatility fell. In general, it is reasonable to assume portfolio residual volatility does not increase, i.e. unsystematic portfolio volatility stays relatively constant. Under this circumstance, portfolio’s tracking error should decreaseas market volatility drops, provided that portfolio beta stays close to one. From a risk modelling perspective, declining total portfolio volatility is usually accompanied by declining factor risk and increasing (absolute) factor correlations, which in turn would result in a lower tracking error, given the same active portfolio exposure relative to a benchmark [12].

2.2. Market Volatility Analysis

The sharp decline of the VIX index in 2004 was due to a combination of factors, largely relating to investor expectations. The VIX is considered a contrarian indicator and typically moves counter to the stock market level. It rises when most investors are pessimistic and feel that risk levels are increasing. The opposite is true when most investors are bullish and more confident about the market outlook when the VIX index declines.

In August 2004, the Asian stock market volatility was also trending down albeit less drastically as its US counterpart. In general, a falling volatility in Asia, both trailing and implied, partly reflected investor’s lack of direction, partly indicated the excess supply of options in the market. Implied volatility in Korea fell the most in August as a result of a market rally. Implied volatility in Hong Kong actually increased in August, partly as a result of investors buying more put options in an attempt to mitigate downside risk.

2.2.1. Lower Volatility and Higher Implied Volatility Correlation

・ The reflation push by global central banks in 2003-04 through massive monetary and fiscal injection caused all asset classes to rise simultaneously. The intra asset class correlation had yet to differentiate itself.

・ Globalization in terms of more efficient markets, computerized marketplaces, free trade agreements, and diversification resulted in a lower risk level. As such, CPI spikes became less likely, due to proactive central banks and wage pressures partially offset through skilled labor outsourcing.

・ With recent lessons fresh in their mind, corporate managers did not make mistakes in terms of increasing capex and inventory at the top of the market with their excess free cash flow. Instead higher payout ratios and buy-backs emerged rather than M & A frenzy.

・ Many hedge funds chasing the same returns caused alpha crowding. As a result, demand for alpha creation or yield-pick up (even associated with mispriced risk) under the low volatility and low return environment was on the rise.

・ Structural change on the demand side for offsetting risk increased, which led to new structured products development through greater and more sophisticated use of derivative products.

2.2.2. Where Can Volatility Go from Here?

Given the historical low volatility environment and the explosion in hedge-fund-managed-assets over the decade from 1994 to 2004, one can argue that the leverage in the system, the short term profits horizons of hedge funds, and an inundation of proprietary traders, all ensure that volatility would not remain at low levels for an extended period. An external shock due to political events, the realization of unexpected systemic risk (e.g. LTCM), or the realization that volatility was too cheap would cause volatility to spike upwards.

One can also argue that the actual and implied levels of volatility are determined by underlying supply and demand rather than “fear factor” or event risk. Implied volatilities did not react to events such as the Madrid bombings for longer than a week or the Jakarta bombings for more than a day; while crude oil market went through a roller-coaster ride since March, 2004, due to a mismatch of supply and demand. Investors were chasing short-term returns and there was “alpha-crowding” in hedge funds, prompting many investors to focus on convertible bonds and other long-volatility structured products issued or backed by solid global companies. When every investor is bullish and takes long positions, market volatility gets cheaper and would remain low until something happens.

2.3. Tracking Error & Portfolio Size

Against the backdrop of declining market volatility, the forecasted total volatility, the forecasted total volatility of benchmark MSCI All Country Asia Pacific ex Japan (MSCI AC AP ex Japan Index) decreased from a high of 21.3% p.a. in January to 18.7% p.a. in August, 2014. Total portfolio risk fell accordingly from a high of 23.5% p.a. to 19.6% p.a. while tracking error decreased from a 3.98% high to 3.08% annualized during the same period (Figure 5).

As shown in the risk decomposition chart (Figure 6), the portfolio’s risk characteristics did not change much as its risk breakdown had been rather steady over time. The predicated beta of the portfolio was close to 1.0, indicating no market-timing bet. In the meantime, the proportion of tracking error from equity risk had been dominant with an average close to 50%, which clearly showed that the portfolio had been driven by bottom-up stock picking.

Given that portfolio’s tracking error is trending down, we have examined the potential impact on portfolio tracking error and risk characteristics by reducing number of stocks held in the portfolio. There were 69 stocks in the portfolio as of August 2004. As expected and is illustrated in Figure 7, the portfolio tracking error increased as the number of stocks decreased. In addition to a tracking error increase, the portfolio’s risk characteristics started to deviate from their current positions as the number of the stocks dropped below 60.

3. Conclusion

If low market volatility continued to persist, a portfolio manager would consider using less number of stocks to achieve the targeted active risk level in terms of risk characteristics (Figure 8). However, there existed a potential downside risk if volatility suddenly spiked up, relative returns would become more volatile. In light of a low volatility environment and the relationship between portfolio size and tracking error, a prudent manager would reduce the portfolio size to 60 stocks, as this would increase the tracking error to 3.25% (est.), while preserving the current portfolio risk characteristics.

![]()

Figure 7. Tracking error: Dragon vs MSCI AC AP ex Jpn as of August-31-2004.

![]()

Figure 8. Dragon portfolio risk characteristics versus No. of Stocks as of Aug-31-04. Decomposition of active risk %.

Acknowledgements

The authors would like to thank XianJiaotong-Liverpool University for supporting and sponsoring the publication of this paper.