Optimal Investment under Dual Risk Model and Markov Modulated Financial Market ()

1. Introduction

The classical surplus process of an insurer is given by

(1)

(1)

where x > 0 is the initial surplus, c is the positive constant premium income rate, Nt is Poisson process with parameter , which denotes the total number of claims up to time t. Denote the time of arrival of the ith claim by Ti and the size of the ith claim by Yi. More details about the surplus process can be found in Asmussen and Albrecher [1] , Rolski et al. [2] . As pointed out by Albrecher et al. [3] , its dual process may also be relevant for companies whose inherent business involves a constant flow of expenses while revenues arrive occasionally due to some contingent events (e.g. discoveries, sales). For instance, pharmaceutical or petroleum companies are prime examples of companies for which it is reasonable to model their surplus process as

, which denotes the total number of claims up to time t. Denote the time of arrival of the ith claim by Ti and the size of the ith claim by Yi. More details about the surplus process can be found in Asmussen and Albrecher [1] , Rolski et al. [2] . As pointed out by Albrecher et al. [3] , its dual process may also be relevant for companies whose inherent business involves a constant flow of expenses while revenues arrive occasionally due to some contingent events (e.g. discoveries, sales). For instance, pharmaceutical or petroleum companies are prime examples of companies for which it is reasonable to model their surplus process as

(2)

(2)

The past decade has witnessed an increasing attention on the research of dual risk model. For example, see Albrecher et al. [3] for optimal dividend problem, see Cheung and Drekic [4] for dividend approximation and dual risk model with perturbation, see Yao et al. [5] for optimal dividend and equity issuance, see Zhu and Yang [6] for ruin probability under a Markov modulated dual risk model.

As we all know, investment is an important element in the financial agent for which can bring them potential profit. Thus, optimal investment for insurers has drawn great attentions in recent years, for example, see the works of Bai and Guo [7] , Browne [8] , Fleming and Hernández [9] , Hipp and Plum [10] , Li et al. [11] , Zhang and Siu et al. [12] . However, to our best knowledge, there are few papers concentrate on the optimal investment of agent with dual risk process. This is the main contributions of this paper.

Usually, the coefficients of the dynamics of the financial market are assumed to be constant. However, in reality, the returns from the risky assets might not be constants. So, it would be of practical relevance and importance to consider asset pricing models with non-constant coefficients, which can incorporate the feature of non- stationary returns. Among all kinds of stochastic coefficients models, Markov-modulated risky model has been recognized recently as an important feature to asset price models. There is much literature documenting such models in assets returns, such as French et al. [13] . Meanwhile, since Markov-modulated risky model contains several very important stochastic volatility models, thus can be seen as an explanation of many well-known empirical findings, such as the volatility smile, the volatility clustering, and the heavy-tailed nature of return distributions (c.f. Fleming and Hernández [9] , Pham [14] , Zariphopoulou [15] [16] , and references therein). In this paper, the optimal investment problem of an agent with dual risk process under the Markov modulated financial market is studied. By dynamic programming principle, we obtained the HJB equations satisfied by the value function and finished the corresponding verification theorem. A solid example is presented to illustrate how to solve the HJB equation when the claims are exponential distribution. This rest of this paper is organized as follows. In Section 2, the model and problem are introduced. The HJB equation associated with our control problem and the verification theorem for optimal control are investigated in Section 3. In Section 4, we focus on the exponential utility function and closed form expression for optimal investment is obtained. In Section 5, we listed the highlights of this paper and conclusions from the results.

2. Formulation of the Problem

Let  be a complete probability space which carries all random variables to appear in this paper. To proceed our discussion, we introduce the following variables and notations. Let

be a complete probability space which carries all random variables to appear in this paper. To proceed our discussion, we introduce the following variables and notations. Let  and

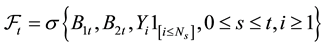

and  are two standard Brownian motions, which describe the perturbations of the insurer and the financial market and

are two standard Brownian motions, which describe the perturbations of the insurer and the financial market and  is the augmented filtration generated by aforementioned stochastic process, i.e.

is the augmented filtration generated by aforementioned stochastic process, i.e.

and satisfying the usual conditions. For simplicity,  ,

,  ,

,  and

and  are assumed to be mutually independent.

are assumed to be mutually independent.

Assume that there are two kinds of asset available for investors, one risky asset and one risk free asset. The risky asset is assumed to be

(2.1)

(2.1)

where ,

,  are the stochastic investment return rate and volatility of the risky market respectively. The dynamic of the external factor is specified by the solution to the following stochastic differential equation (SDE for short)

are the stochastic investment return rate and volatility of the risky market respectively. The dynamic of the external factor is specified by the solution to the following stochastic differential equation (SDE for short)

(2.2)

(2.2)

where![]() , and

, and![]() .

. ![]() are correlated Brownian motions with the correlation coefficient

are correlated Brownian motions with the correlation coefficient![]() . Model (2.2) covers many Markov modulated risk models, such as the Heston model and a special CIR model. Our model also includes a risk-free asset governed by

. Model (2.2) covers many Markov modulated risk models, such as the Heston model and a special CIR model. Our model also includes a risk-free asset governed by

![]() (2.3)

(2.3)

where ![]() is the interest rate function. We interpret the process Zt as the behavior of some economic factor that has an impact on the dynamics of the risky asset and the risk-free asset price. In this paper, we allow the company takes an investment strategy into account when making decisions. Then if Xt is the company’s wealth, and let Kt denote the amount invested into the risky asset at time t. The remained reserve

is the interest rate function. We interpret the process Zt as the behavior of some economic factor that has an impact on the dynamics of the risky asset and the risk-free asset price. In this paper, we allow the company takes an investment strategy into account when making decisions. Then if Xt is the company’s wealth, and let Kt denote the amount invested into the risky asset at time t. The remained reserve ![]() is invested into the risk-free asset, then the wealth process of the insurer can be written as following equation. To clarify the impact of investment policy, we adopt

is invested into the risk-free asset, then the wealth process of the insurer can be written as following equation. To clarify the impact of investment policy, we adopt ![]() as the wealth process of the insurer, then

as the wealth process of the insurer, then

![]() (2.4)

(2.4)

where ![]() is the initial surplus of the insurer and c the positive real constant premium rate. Moreover, if at time

is the initial surplus of the insurer and c the positive real constant premium rate. Moreover, if at time ![]() the wealth of the insurer is x and the external factor is z. Then the wealth process satisfies

the wealth of the insurer is x and the external factor is z. Then the wealth process satisfies

![]()

with the convention that![]() .

.

Definition 1 We say that the strategy ![]() is admissible if it satisfies the following conditions

is admissible if it satisfies the following conditions

1) The strategies Kt has to be measurable and predictable with respect to the filtration![]() ;

;

2) There is a constant CK which may depend on the strategies K such that

![]()

We denote the set of admissible strategies as![]() .

.

Suppose that the company is interested in maximizing the expected utility of wealth at time T. Without loss of generality, we can define the utility function ![]() to be a twice continuously differentiable function, with

to be a twice continuously differentiable function, with ![]() and

and![]() , then our goal is the following value function:

, then our goal is the following value function:

![]() (2.5)

(2.5)

We say that an admissible combined strategies ![]() is optimal if

is optimal if

![]()

Hypothesis 1 1) The functions![]() ,

, ![]() and

and ![]() are such that there is a strong solution for SDE (2.1), (2.2) for example the functions fulfil Lipschitz and linear growth conditions.

are such that there is a strong solution for SDE (2.1), (2.2) for example the functions fulfil Lipschitz and linear growth conditions.

2) The function ![]() is continuous, positive and

is continuous, positive and ![]() for all

for all![]() .

.

3. Properties of Value Function and the Verification Theorem

In this section we embed the problem of maximizing the expected utility from terminal wealth on a finite horizon ![]() in the framework of stochastic control theory by dynamic programming method. Then the HJB equation associated with the control problem (2.5) is given by

in the framework of stochastic control theory by dynamic programming method. Then the HJB equation associated with the control problem (2.5) is given by

![]() (3.1)

(3.1)

with terminal condition![]() , where

, where

![]()

The following verification theorem shows that under some proper conditions, a solution to previous HJB equation provides us the optimal investment policy.

Theorem 2 (The Verification Theorem) Suppose that there is a smooth solution ![]() to the HJB Equation (3.1) with terminal condition

to the HJB Equation (3.1) with terminal condition![]() . Assume also that for each

. Assume also that for each ![]()

![]() (3.2)

(3.2)

![]() (3.3)

(3.3)

![]() (3.4)

(3.4)

Then for each ![]()

![]()

Suppose further that there exist two bounded measurable functions![]() ,

, ![]() such that

such that

![]()

then ![]() defines a pair of optimal strategy and

defines a pair of optimal strategy and

![]()

Proof. Let![]() , by Itô’s Lemma, it follows that for

, by Itô’s Lemma, it follows that for ![]()

![]() (3.5)

(3.5)

where ![]() is the Poisson random measure on

is the Poisson random measure on ![]() defined by

defined by

![]()

Compensate (3.5) by

![]()

we have

![]() (3.6)

(3.6)

Assumptions (3.3) and (3.4) mean that

![]()

are martingales. Assumption (2.8) implies that

![]()

is a martingale. Then, by taking the expectation on both sides of (2.11) yields that

![]() (3.7)

(3.7)

Note that f is a smooth solution to HJB equation (2.6), we have

![]()

That is to say for any![]() ,

, ![]()

![]() (3.8)

(3.8)

Taking ![]() in (2.13), it follows that

in (2.13), it follows that

![]() (3.9)

(3.9)

The proof of the second part of this theorem follows in a similar manner. If we plug ![]() back into (2.12), for all

back into (2.12), for all ![]() we obtain

we obtain

![]() (3.10)

(3.10)

By taking the supremum over all ![]() in (2.15), we obtain the inequality

in (2.15), we obtain the inequality

![]()

By considering (2.13) for all![]() , we deduce that

, we deduce that

![]()

Letting ![]() in the last equality, we have

in the last equality, we have

![]()

Moreover, by recalling (2.14), it is easy to find that

![]()

This completes the proof. ![]()

Remark 1 Classical method of applying HJB equation for solving optimal control problems is pre-assume (or find) that there exist a smooth solution to the HJB equation, and then finish the argument by verification theorem. However, the HJB equations do not always admit classical solution, and thus the verification theorem invalid. In this case, viscosity solution will be introduced to cover the connections between the optimal control problem and the HJB equation. However, in next section, we exploit a closed representation of the solution to the HJB Equation (3.1) when the utility function is an exponential type. By this results, we further find the closed from optimal investment policy and the expressions of value function. As to very general utility function, it is difficult to find closed form solutions to HJB equation and we leave it as future research.

4. Existence of a Optimal Pair of Solutions under the Exponential Utility Function

In this section, we devote to the existence and uniqueness of the solution of the HJB Equation (3.1) when the preferences of the insurer are exponential, i.e., the utility function is governed by

![]() (4.1)

(4.1)

In order to get a linear PDE, in the remainder of this paper we consider only the case where the correlation coefficient is equal to zero![]() . Besides Hypothesis 1, we make the following assumptions.

. Besides Hypothesis 1, we make the following assumptions.

Hypothesis 2 1) ![]() is constant;

is constant;

2) g is uniformly Lipschitz and bounded;

3) ![]() bounded with a bounded first derivative;

bounded with a bounded first derivative;

Considering the form of the utility function, We speculate the following function as a solution to the HJB Equation (3.1)

![]() (4.2)

(4.2)

where ![]() will be governed below by a solution to a Cauchy problem. From the definition of

will be governed below by a solution to a Cauchy problem. From the definition of![]() , we obtain

, we obtain

![]() (4.3)

(4.3)

![]() (4.4)

(4.4)

![]() (4.5)

(4.5)

![]() (4.6)

(4.6)

![]() (4.7)

(4.7)

Plugging these partial derivatives of f into the HJB Equation (3.1), we obtain

![]() (4.8)

(4.8)

For simplicity of presentation let us introduce the following notation

![]()

It is trivial to see that the supremum is achieved at

![]()

Indeed, by a measurable selection theorem, we may find a pair of bounded progressively measurable processes ![]() satisfied the supremum in (4.8). By substituting

satisfied the supremum in (4.8). By substituting ![]() into (4.8), we obtain the following Cauchy problem:

into (4.8), we obtain the following Cauchy problem:

![]() (4.9)

(4.9)

The following theorem asserts the existence and uniqueness of aforementioned Cauchy equation (4.9).

Theorem 3 Assume that

![]() (4.10)

(4.10)

Then the Cauchy problem given by (4.9) has a unique solution, which satisfies the following conditions:

![]() (4.11)

(4.11)

![]() (4.12)

(4.12)

where C1 and C2 are constants.

Proof. The theorem will be proved if we can show that the Cauchy problem given by (4.9) satisfies the conditions of the Theorem A.1. So we just need to check them.

・ Since ![]() is constant, naturally, it is Lipschitz continuous, Hölder continuous, and the operator

is constant, naturally, it is Lipschitz continuous, Hölder continuous, and the operator ![]() is uniformly elliptic.

is uniformly elliptic.

・ Considering Hypothesis 2, we know immediately that ![]() is bounded and uniformly Lipschitz continuous.

is bounded and uniformly Lipschitz continuous.

・ Now we show that

![]()

is bounded and uniformly Hölder continuous in compact subsets of![]() .

.

In fact, by Hypothesis 2, it is clear that the first term of ![]() is bounded. The second term is bounded by

is bounded. The second term is bounded by![]() . Note that for

. Note that for ![]() we have

we have

![]()

Thus ![]() is bounded. Next we prove that

is bounded. Next we prove that ![]() is uniformly Hölder continuous in compact subsets of

is uniformly Hölder continuous in compact subsets of![]() . Denote

. Denote

![]()

Noting that ![]() is bounded with a bounded first derivative by

is bounded with a bounded first derivative by![]() ,

, ![]() and Hypothesis 2, then it follows from Lemma A.1 that

and Hypothesis 2, then it follows from Lemma A.1 that ![]() is uniformly Hölder continuous with exponent

is uniformly Hölder continuous with exponent![]() , i.e., for all

, i.e., for all ![]()

![]()

For the second term of![]() , combining the mean value theorem and the Hypothesis 2 and Definition 1, we have that for all

, combining the mean value theorem and the Hypothesis 2 and Definition 1, we have that for all![]() ,

, ![]() such that

such that

![]()

Then ![]() is uniformly Lipschitz in

is uniformly Lipschitz in![]() . Therefore

. Therefore ![]() is uniformly Hölder continuous in the compact set

is uniformly Hölder continuous in the compact set![]() . For the third term of

. For the third term of![]() , first, a routine computation gives rise to the following derivatives

, first, a routine computation gives rise to the following derivatives

![]()

Then by the mean value theorem of bivariate functions, we know that there is ![]() such that

such that

![]()

where ![]() and

and ![]() mean, for instance,

mean, for instance, ![]() ,

,![]() . In the last line, we used

. In the last line, we used![]() . So we obtain

. So we obtain

![]()

By (4.10), we obtain that ![]() is uniformly Lipschitz continuous in

is uniformly Lipschitz continuous in![]() , and then

, and then ![]() is uniformly Hölder continuous in compact subsets of

is uniformly Hölder continuous in compact subsets of![]() .

.

Since the Cauchy problem (4.9) is homogeneous with a constant terminal condition, then the right-hand side of (4.9) satisfies the property of linear growth and continuous. Finally, the conditions of Theorem A.1, it is easy to find that the Cauchy problem (4.9) has a unique solution ![]() which satisfies (4.11) and (4.12). The proof of the theorem is now complete.

which satisfies (4.11) and (4.12). The proof of the theorem is now complete. ![]()

The aim of the next theorem is to relate the value function V in the form (4.2) to the HJB Equation (3.1) in the form of the Cauchy problem (4.9).

Theorem 4 If (4.10) are satisfied, then the value function defined by (2.5) has the form:

![]()

where ![]() is the unique solution of the Cauchy problem (4.8), In addition, if

is the unique solution of the Cauchy problem (4.8), In addition, if

![]()

then the investment strategy ![]() is optimal, When

is optimal, When![]() , we get

, we get

![]()

and

![]()

Proof. We have already verified that

![]()

is a smooth solution of the HJB Equation (3.1). To prove that ![]() really copies the value function, we need to verify that Assumptions (3.2)-(3.4) of the Theorem 2 are satisfied by

really copies the value function, we need to verify that Assumptions (3.2)-(3.4) of the Theorem 2 are satisfied by![]() .

.

Firstly, we consider the case in which![]() . Let

. Let ![]() be a pair of admissible strategies, then by (4.11) and the fact that Y is independent of

be a pair of admissible strategies, then by (4.11) and the fact that Y is independent of ![]() and

and![]() , we have

, we have

![]()

In the last line, we used ![]() for

for ![]() and

and![]() . To get condition (3.2), it suffices to obtain an estimate of

. To get condition (3.2), it suffices to obtain an estimate of

![]()

We find that

![]()

In the last inequality, we used Hölder inequality (![]() , where

, where ![]() and

and![]() ). By considering Hypothesis 2.2 and Theorem A.2, we know that

). By considering Hypothesis 2.2 and Theorem A.2, we know that

![]()

where C is a positive constant. Moreover, by the Minkovski inequality

(![]() , where

, where![]() ), one will find that

), one will find that

![]() (4.13)

(4.13)

i.e., ![]() Then it is enough to estimate

Then it is enough to estimate ![]() Denote

Denote

![]()

One should note that

![]()

and

![]()

Recall that K is a pair of admissible strategy, by Hölder inequality, we have

![]()

Since ![]() is a martingale, it follows that

is a martingale, it follows that

![]()

This indicates that![]() , i.e., (3.2) holds for the case

, i.e., (3.2) holds for the case![]() . In order to prove conditions (3.3) and (3.4), by (4.11) and (4.12) we have

. In order to prove conditions (3.3) and (3.4), by (4.11) and (4.12) we have

![]()

and

![]()

Evidently, (3.3) and (3.4) are easily seen to hold with![]() . For the case in which the interest rate

. For the case in which the interest rate![]() , let

, let ![]() By Itô’s formula it is easy to see that

By Itô’s formula it is easy to see that ![]() satisfies the following SDE

satisfies the following SDE

![]() (4.14)

(4.14)

By ![]() for all

for all ![]() in the Hypothesis 1, we obtain that

in the Hypothesis 1, we obtain that

![]() (4.15)

(4.15)

This case is dealt with the same arguments by suitable modification to the first part of the proof. First, we get

![]()

![]()

and

![]()

To accomplish the proof, it is sufficient to prove that

![]() (4.16)

(4.16)

Note that

![]()

and the fact that ![]() from the first part of the proof, the proof is reduced to showing

from the first part of the proof, the proof is reduced to showing ![]() In fact, by applying (4.15) and with similar arguments to the first part of the proof we have

In fact, by applying (4.15) and with similar arguments to the first part of the proof we have

![]()

Similarly, since K is a pair of admissible strategy and ![]() is a martingale, we also have

is a martingale, we also have

![]()

This completes the proof. ![]()

5. Highlights and Summary

The main contributions of this paper include:

・ Both stochastic coefficients financial model and dual risk model are taken into account.

・ Rigorous proof of verification theorem for optimal policy is provided and closed form expressions for optimal policies and value function are derived.

・ A solid example is presented to illustrate how to solve the HJB equation.

As a result, we find that the optimal investment policy is a function of the state of the external Modulate Markov process. When there is no modulated process, the model considered in this paper is reduced to the optimal investment problem under the risky market with stationary coefficient and our results cover those existing results (see Bai and Guo [7] or Li et al. [11] ). One should note that when the coefficients are not sensitivity to the changes of the external Markov process, i.e. when the external Markov process changes, the coefficients of the risky market do not oscillate greatly, then our optimal investment policies seem to be very conservative because the optimal investment amount is near to a constant.

Acknowledgements

The authors are very grateful to anonymous referees’ detailed comments and suggestions, which makes this paper much better. Lin Xu would like to acknowledge the support of the National Natural Science Foundation of China (Grant No. 11201006). Zhu Dongjin would like to acknowledge the support of Major Projects of Colleges and Universities in Anhui Province Natural Science Foundation (KJ2012ZD01).

Appendix. Parabolic Partial Differential Equations

To illuminate the expression of our research problem, now we introduce and summarize some important results on parabolic PDEs, which play a key role in the proof of Theorem 4.1 (existence and uniqueness theorem), and some terminology and definitions are introduced. We believe that this work will be useful in the development of this paper.

Definition 5 Let ![]()

1) We say that E is uniformly elliptic, if there is ![]() such that

such that

![]()

for all ![]() and all

and all ![]()

2) A function f on ![]() is called Hölder continuous in x with exponent

is called Hölder continuous in x with exponent![]() , uniformly with respect to t in compact subsets of

, uniformly with respect to t in compact subsets of![]() , if for each compact set

, if for each compact set ![]() there is a constant

there is a constant ![]() such that

such that

![]()

3) f is said to be uniformly Hölder continuous in ![]() in compact subsets of

in compact subsets of ![]() if for each compact set

if for each compact set ![]() there is a constant C such that

there is a constant C such that

![]()

Theorem A.1 (Friedman, 1975). We consider the following Cauchy problem:

![]() (A.1)

(A.1)

where L is given by

![]()

If the Cauchy problem (A.1) satisfies the following conditions:

1) The coefficients of L are uniformly elliptic;

2) The functions ![]() are bounded in

are bounded in ![]() and uniformly Lipschitz continuous in

and uniformly Lipschitz continuous in ![]() in compact subsets of

in compact subsets of![]() ;

;

3) The functions ![]() are Hölder continuous in x, uniformly with respect to

are Hölder continuous in x, uniformly with respect to ![]() in

in![]() ;

;

4) The function ![]() is bounded in

is bounded in ![]() and uniformly Hölder continuous in

and uniformly Hölder continuous in ![]() in compact subsets of

in compact subsets of![]() ;

;

5) The function ![]() is continuous in

is continuous in![]() , uniformly Hölder continuous in x with respect to

, uniformly Hölder continuous in x with respect to

![]() ) and;

) and;

6) The function ![]() is continuous in

is continuous in ![]() and

and ![]() with

with![]() ; then there is a unique solution u of the Cauchy problem (A.1) satisfying

; then there is a unique solution u of the Cauchy problem (A.1) satisfying

![]() and

and

Lemma A.1 Let f be a real positive bounded function with bounded derivative, then f is uniformly Hölder continuous with exponent![]() , i.e.,

, i.e.,

![]()

Proof. By the mean value theorem and using that ![]() is bounded,we have:

is bounded,we have:

![]()

where K is a constant. By f is positive,we have

![]()

i.e.

![]()

The proof of this Lemma is now complete. ![]()

Theorem A.2 (Pham, 1998). Let ![]() be a stochastic processes defined by the following SDE:

be a stochastic processes defined by the following SDE:

![]()

with a standard Brownian motion Bs. We assume that for some![]() , the coefficients satisfy:

, the coefficients satisfy:

![]()

![]() (A.2)

(A.2)

for all![]() . Let T > 0 and

. Let T > 0 and![]() . Then, there is

. Then, there is ![]() such that for all

such that for all ![]() we have:

we have:

![]()