Post-Optimality Analysis of Energy Consumption Model and Utility Application ()

1. Introduction

Post-optimality Analysis (or Sensitivity Analysis) is concerned with the propagation of uncertainties in mathematical models. It belongs to a broader area of Perturbation Analysis [3] that defines the largest sensitivity region and its main goal is to assess the influence of parameter changes on the state of the system [4] . Post-opti- mality analysis is necessary in identifying critical or breaking-even values where the optimal strategy changes, and also for investigating sub-optimal solutions. For instance, given the optimal solution of a linear optimization model, a series of post-optimality analyses can provide valuable decision making information to deal with uncertainties.

Specifically, our earlier game model solutions focused on the optimal week-day strategies (or equivalently identified the optimal days of use of energy) and the game value (which was proposed as a uniform tariff estimate parameter). By nature of the game model, there was no information on the energy consumption for the non-optimal week days. The post-optimality analysis model in this paper fills the gap, providing information on the “sub-optimal” solutions which are earlier characterized as “non-optimal” in the game model [1] . Moreover, the dual LPP problem provides the optimal solutions for the time-block decision variables.

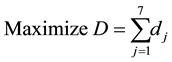

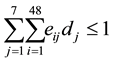

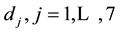

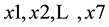

We earlier as in [1] solved the following version of the game model represented by Equations (1)-(3):

(1)

(1)

Subject to

(2)

(2)

(3)

(3)

where

= the week day strategies (days of the week, Monday to Sunday).

= the week day strategies (days of the week, Monday to Sunday).

= the energy consumption values (or the payoff matrix of the game model, represented by the kilowatt- hour values recorded for each time instant, separated by 30 minutes on each day).

= the energy consumption values (or the payoff matrix of the game model, represented by the kilowatt- hour values recorded for each time instant, separated by 30 minutes on each day).

A mixed strategy solution with respective probabilities and value of the game were obtained. However, in this paper, a direct linear programming problem (LPP) approach is employed for the above model to confirm our earlier game model optimal solution and to further derive the associated post-optimality results.

In the following LPP model to be solved, the decision variables  above have corresponding LPP decision variables as

above have corresponding LPP decision variables as  while the coefficients

while the coefficients  are as defined above. The relationship between the game model decision variables and the LPP decision variables are defined by Equation (8) below.

are as defined above. The relationship between the game model decision variables and the LPP decision variables are defined by Equation (8) below.

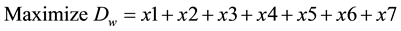

2. Solution of Winter LPP Model

2.1. The Model

Defining the variables x1, x2, x3, x4, x5, x6 and x7 as the energy decision variables for the days of the week, namely for Monday, Tuesday…, Sunday, our LPP model is as in Equations (4) and (5):

(4)

(4)

Subject to

(5)

(5)

The coefficients in the above model are the energy readings taken from the dual-occupancy high-rise building (stated in the Abstract).

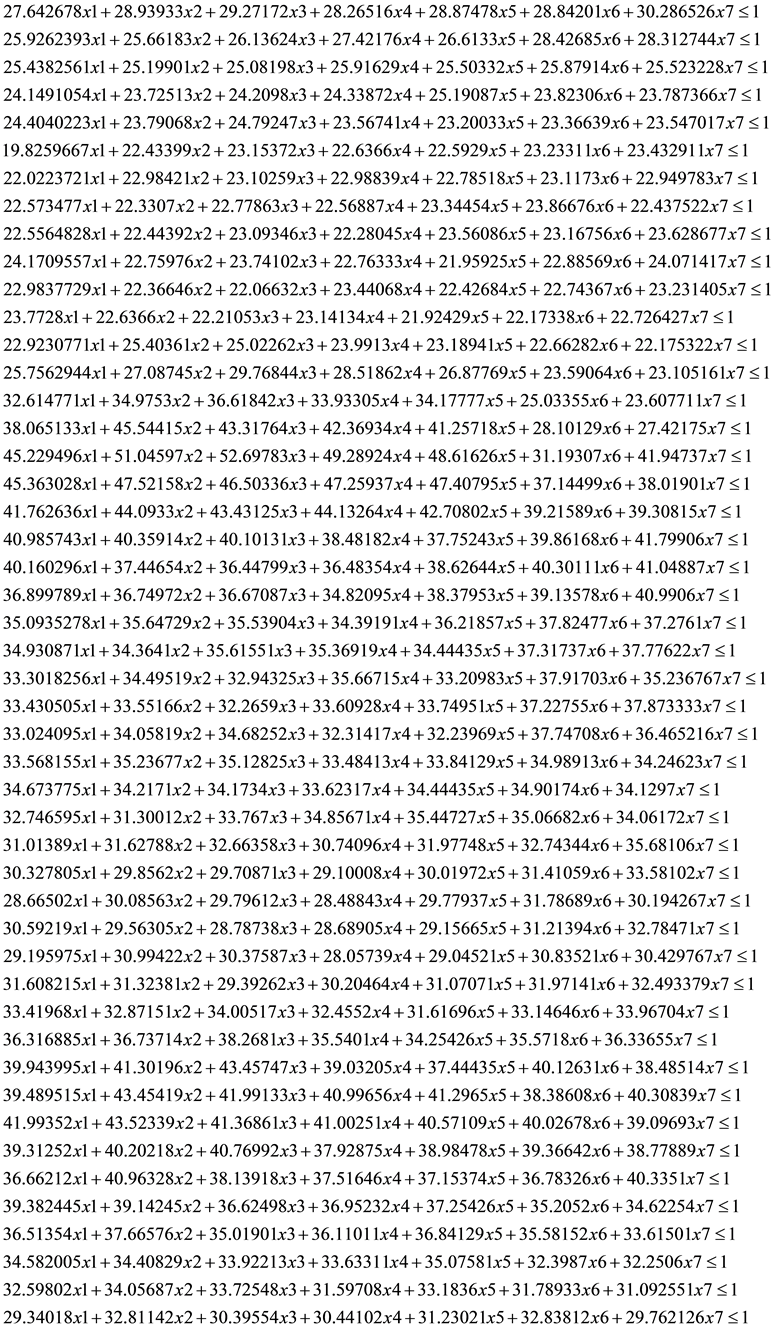

The optimal solution for the above model is as follows

![]()

And

![]()

Theoretically, given the expected value of the game defined by Equation (6) in our previous game model [1]

![]() (6)

(6)

where T is the time strategy vector, ![]() , the energy payoff matrix and

, the energy payoff matrix and ![]() the Day strategy vector, once we solve the associated linear programming problem, the value of the game is obtained by the formula in Equation (7) below.

the Day strategy vector, once we solve the associated linear programming problem, the value of the game is obtained by the formula in Equation (7) below.

![]() (7)

(7)

Thus, we have

![]()

Moreover, the column player’s (week day) optimal mixed strategy is obtained by the formula in Equation (8):

![]() (8)

(8)

where![]() ,

, ![]()

The comparative results are provided in Table 1.

It is observed that the above probabilities coincide with those earlier obtained from our game model [1] in Table 2.

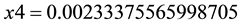

2.2. Winter Week-Day Sensitivity Analysis Results

Figure 1 summarises the procedure for the post-optimality analysis and Table 3 is the result of running a Post- Optimality test based on the Simplex method, using the LPSolve package.

The above gives on dividing by![]() , the optimal range of energy values as follows (and using zero (0) in place of −∞ for non-negative energy values):

, the optimal range of energy values as follows (and using zero (0) in place of −∞ for non-negative energy values):

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Table 1. Winter LPP and game model comparison.

![]()

The 5th degree polynomial regression plots for the optimal range of values (with the week day mean plot for the winter season) are as in Figure 2.

It is observed that the four-day optimal energy consumption days for the season (Thursday-Sunday) as obtained in our game model show fairly stable consumption profile from the post-optimality results (i.e. the values showing very close proximity).

Superposed plots with the mixed-strategy game model tariff estimate value are shown in Figure 3.

2.3. Winter Time Block Sensitivity Analysis Results

The following time-block optimal range of values in Table 4 which coincide with the same optimal time-blocks in the game model is obtained from the Dual problem (using the LPSolve Software).

Using Equation (6), we obtain the corresponding post-optimality energy ranges by computing the values using Equation (9).

![]() (9)

(9)

where ![]() is the Time-Block optimal mixed-strategy and

is the Time-Block optimal mixed-strategy and ![]()

Thus the ranges of energy values are as follows:

![]()

![]()

![]()

![]()

where![]() ,

, ![]() ,

, ![]() , and

, and ![]() are the time instants indicated in Table 4.

are the time instants indicated in Table 4.

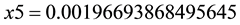

3. Solution of Summer LPP Model

3.1. The LPP Model

Following similar procedure as in the winter model, we have the summer linear programming model given by Equations (10) and (11):

![]() (10)

(10)

Subject to

![]() (11)

(11)

![]()

Table 2. Winter energy consumption concentration matrix.

![]()

Table 3. Results of winter week-day sensitivity analysis.

![]()

Figure 1. Post-Optimality algorithm for winter model.

The optimal solution is as follows:

![]()

![]()

Figure 2. Relationships between the seasonal mean and post-optimality energy values.

![]()

Figure 3. Relationships between the seasonal mean, post-optimality energy values and the tariff estimator.

![]()

Table 4. Results of winter dual problem sensitivity analysis.

and

![]()

For the summer season, the value of the game is obtained using Equation (12) below:

![]() (12)

(12)

Thus, we have

![]()

The comparative table of results for the summer season is as follows in Table 5:

It is also observed that the above probabilities coincide with those earlier obtained from our game model [1] for the season as seen in Table 6.

3.2. Summer Week-Day Sensitivity Analysis Results

Running the LPSolve Sensitivity Analysis routine for the problem, we have the results as presented in Table 7.

On dividing by![]() , the above gives the optimal range of energy values as follows (using zero (0) in place of −∞ for non-negative energy values):

, the above gives the optimal range of energy values as follows (using zero (0) in place of −∞ for non-negative energy values):

![]()

Table 5. Summer LPP and game model comparison.

![]()

Table 6. Summer energy consumption concentration matrix.

![]()

Table 7. Results of summer week-day sensitivity analysis.

![]()

When the seasonal mean and post-optimality values in Figure 4 are superposed with the mixed-strategy game model tariff estimate value, we have Figure 5:

3.3. Summer Time-Block Sensitivity Analysis Results

The following time-block optimal range of values in Table 8 coinciding with the same optimal time-blocks in the game model are obtained from the Dual problem (using the LPSolve software).

Using Equation (6), we obtain the corresponding post-optimality energy ranges by using Equation (13).

![]() (13)

(13)

where ![]() is the Time-Block optimal mixed-strategy and

is the Time-Block optimal mixed-strategy and![]() .

.

Thus the ranges of energy values are as follows:

![]()

![]()

![]()

![]()

4. Duality Results and Discussions on Utility Application

4.1. Summer and Winter Dual Optimal Solutions

Solving a linear programming problem usually provides more information about an optimal solution than merely the values of the decision variables. Associated with an optimal solution are shadow prices (also referred to as dual variables or marginal values) for the constraints. The shadow price on a particular constraint represents the change in the value of the objective function per unit increase in the right hand-side value of that constraint. Thus duality in linear programming is essentially a unifying theory that develops the relationships between a

![]()

Figure 4. Relationships between the seasonal mean and post-optimality energy values.

![]()

Figure 5. Relationships between the seasonal mean, post-optimality energy values and the tariff estimator.

![]()

Table 8. Results of summer dual problem sensitivity analysis.

given (primal) linear programming problem and another related (dual) linear programming problem stated in terms of variables with this shadow-price interpretation

The related dual problems to the week-day models for the two seasons have the time-blocks as the dual variables. In Figure 6 and Figure 7 we have the dual problem model solution yielding the time-block optimal energy values plotted against the seasonal season means, the seasons’ Tariff Estimator game values and the four time-optimal energy consumption values for the winter and summer seasons, respectively.

4.2. Discussions on Utility Applications

From the foregoing model results, the following conclusions are drawn:

1) The direct LPP models and their associated post-optimality analyses for the two seasons validate our earlier optimal mixed strategy game values, both for the week-day and time-block optimal values.

2) The post-optimality analysis for each of the seasons provides additional information on the non-optimal week-day mixed strategies, specifically, the analysis shows the significant maximum energy values which are

![]()

Figure 6. Winter comparison plots and dual optimal simulation.

![]()

Figure 7. Summer comparison plots and dual optimal simulation.

not explicit in the game model results as summarised in Table 9:

3) In each of the seasons, the tariff energy estimator obtained from the mixed-strategy model lies within the post-optimality ranges. This is clearly seen in the plots in Figure 2 and Figure 5. Thus this confirms the uniqueness of the estimator as a very useful energy value for utility application, especially for determining a single uniform tariff estimate.

4) While the Time-Block post-optimality results may not be of significant application from utility point of view, however, they equally validate our mixed-strategy game model values, and also specifically show the range of energy values within the optimal time-blocks that were not explicit from the game model.

5) It is noteworthy to see that the time-optimal solution of the dual problem model reveals small deviations from each of the season’s means, globally.

We had earlier [1] categorized the consumers into morning (workplace) and (evening) residential consumers. Thus the comparison plots in Figure 8 show two fairly convergence points for the two seasons that appear useful for some estimates for the two periods of the day for the whole year.

5. Conclusion

Utilities, i.e. agencies in charge of distribution of electricity commonly face a serious challenge of determining a tariff policy as noted in [5] . This is even more challenging for consumers where provision of electricity meters (or metering) is not easily feasible, such as the informal settlements. Having determined a tariff estimate in our earlier game model as in [1] , useful for utilities in determining a uniform tariff policy, knowing the range of energy demand (or consumption) values within which uniform tariff remains unchanged, becomes essential for

![]()

Table 9. Summary of seasonal sensitivity analyses.

![]()

Figure 8. Seasonal means and the dual LPP time optimal values.

utility break-even analysis. This requires a post-optimality (or sensitivity) analysis as presented in this paper and reflected in the abstract.

Acknowledgements

The authors wish to acknowledge the partial support of this research work by the Polytechnic of Namibia’s Institutional Research and Publication Committee (IRPC).