1. Introduction

Roy’s identity is a useful tool in theoretical and empirical studies of static consumption problems. Most dynamic consumer problems, however, concentrate on obtaining the optimal consumption path derived from the Euler equation. In this note we assume that the consumer makes decision in a two-stage process. In the dynamic stage, two forms of Roy’s identity are derived. The first form relates the asset holding in each period to the marginal utility of interest rate and the marginal utility of income. The second form resembles the classic Roy’s identity in the static analysis.

2. Dynamic Roy’s Identity

The consumer is supposed to be making a two-stage decision. In the first stage, an inter-temporal decision on aggregate consumption and saving is made. Abstract from uncertainty about the future, a simple model of the decision problem can be set up as

(1)

(1)

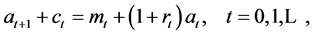

subject to the budget constraints

(2)

(2)

where ,

,  , and

, and  are exogenous asset, income, and interest rate respectively in period

are exogenous asset, income, and interest rate respectively in period , with

, with . The choice variables are

. The choice variables are  and

and . Utility is modelled by a stationary and separable discounted sum of utility function

. Utility is modelled by a stationary and separable discounted sum of utility function  in each period1. The Lagrangian is

in each period1. The Lagrangian is

(3)

(3)

The first-order conditions are

(4)

(4)

and the budget constraint (2).

The optimal solution is characterized by the Euler equation

(5)

(5)

and the consumption function (in the case of constant interest rate)

(6)

(6)

which implies that in the steady state consumption in each period is a fixed portion of total wealth. The indirect utility function  is obtained by substituting

is obtained by substituting  in (6) into the objective function in (1).

in (6) into the objective function in (1).

In the second stage, the consumer makes decisions on how much to buy in  number of goods and services in the market given the market prices

number of goods and services in the market given the market prices  and the aggregate consumption

and the aggregate consumption  in each period

in each period . The model becomes the standard consumer optimization problem in microeconomics, that is,

. The model becomes the standard consumer optimization problem in microeconomics, that is,

(7)

(7)

subject to

The indirect utility function in each period  is then

is then

Roy’s identity relates the optimal consumption of each good or service to the marginal disutility of price and the marginal utility of income, that is,

for every good  in every period

in every period . In other words, consumption of each good depends on the consumer’s preference structure and the relative price of the good to other goods and services.

. In other words, consumption of each good depends on the consumer’s preference structure and the relative price of the good to other goods and services.

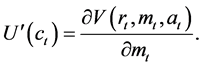

Can we have Roy’s identity for the inter-temporal consumption problem in the first stage? Apply the envelop theorem to (3), we have

Substituting the first-order condition (4) into the above gives

(8)

(8)

Similarly,

(9)

(9)

Combining (8) and (9) gives the Roy’s identity for the inter-temporal consumption problem as

It says that in any period if the consumer is in debt , the marginal utility of an interest rate increase is negative.

, the marginal utility of an interest rate increase is negative.

A Roy’s identity similar to the static form can be obtained by considering the “cake-eating” problem by assuming that income  in the budget constraint (2) in each period is zero. Then the inter-temporal budget constraint is reduced to

in the budget constraint (2) in each period is zero. Then the inter-temporal budget constraint is reduced to

If we define

then the intertemporal utility maximization problem becomes

Notice that  since

since . Starting in Period 1, price of consumption is decreasing over time due to discounting. The indirect utility function can be expressed as

. Starting in Period 1, price of consumption is decreasing over time due to discounting. The indirect utility function can be expressed as

Roy’s identity, in this case, is

3. Conclusion

We have used the envelop theorem to derive two forms of Roy’s identity under an infinite horizontal consumption setting. In the first form, asset holding is related to the marginal utility of interest rate and marginal utility of income. The result can be used as a structural restriction on empirical analysis of inter-temporal consumption. In the second form prices are interpreted as future discount factors. The resulting form resembles the static Roy’s identity.

NOTES

1See, for example, .