Chinese Studies

Vol.04 No.04(2015), Article ID:61593,14 pages

10.4236/chnstd.2015.44019

The Impact of Tax System on Capital Investment: Evidence from Taiwan and Mainland China

Huang Li-Hua, Wang Jui-Chih*, Hsiao Hsing-Chin

Department of Accounting Information, National Taipei University of Business, Taiwan

Copyright © 2015 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

Received 16 October 2015; accepted 27 November 2015; published 30 November 2015

ABSTRACT

Keywords:

Integrated Income Tax System (IITS), Dividend Imputation Tax Credits (DITC), Undistributed Retained Earnings (URE) Tax, Capital Investment

1. Introduction

At the end of 1970s, Mainland China implemented economy reform and Taiwanese businessmen started to invest in Mainland China as pioneers. Chinese open policy triggered the coast investment and attracted foreign direct investment. In 1980s, Taiwanese businessmen established the labor intensive industries in the four economy zones (Shenzhen, Zhuhai,

More investment from Taiwan to Mainland China improved the economy development in Mainland China and promoted the Taiwanese industry enhancement. Meanwhile, the trading structure of

After the IITS, the dividend imputation tax credit (DITC) eliminated the corporate double taxation, facilitated the investment intention, and lowered the corporate tax burden (Boyle, 1996; Huang Tien-Fu, 1998; Wang Jui-Chih, 2006) . However, some studies opposed to the IITS; there were limitations to the tax decrease and reluctance to promote the investment (Hsu Wen-Yu, 1996) . The IITS benefited to the high income persons and big corporation rather than the small-and-medium enterprises (SME) and individual investors (Cheng Yueh-Sui, 1996) . In order to offset the tax loss of the DITC, the authority taxed the 10% of the undistributed retained earnings (URE) which deteriorated the capital accumulation and shortened the available operating funds dividend credit. This policy intensified the capital to non-continuing operation, impaired the long-term development, and mitigated the investment intention (Chang Keh-Jen, 1997; Chen Chung-Chin, 1997; Wang Chien-Tung, 2003) . The IITS also cancels the 80% tax exemption to the transfer investment among the corporations and increases the corporate tax burden (Chen Chung-Chin, 1997) . Meanwhile, the IITS eliminated the tax exemption incentives policies to the high technology industry for both URE up to the double paid-in capitals and five years corporate tax exemptions.

The DITC of the IITS was the credit from the corporate tax applied to the individual income tax. The domestic shareholders tax burden would be lower than the foreign shareholders. Therefore, when there was higher DITC, there were more capital investments in Taiwan than in Mainland China. Obviously, after the IITS, the tax system reform improved the investment environment in

Compared to investment in Taiwan, the higher URE ratio presented less capital investment in Mainland China without statistics significant. The insignificant reason was due to the Taiwanese policy of 40% net worth ceiling limitation to Mainland China investment. The ceiling limitation affected the subsidiary company in Mainland China reluctant to wire the profit back to the parent company in Taiwan, reinvested the profit in the plant expansion and gained 100% fully tax reimbursement as well. This tax addition charge did neither affect nor lessen the investment in Mainland China. Our study supported that the DITC impaired the investment in Mainland China. However, the DITC might not the only investment determinant to Chinese investment. Most tax reforms are composed of numerous changes with potentially offsetting effects (Black et al., 2000) . Our empirical results would serve a reference for the authority to reconsider the policy of 40% net worth ceiling limitation.

Past research focused on the IITS to the investment decision effect: how the DITC ratio affected the fixed asset investment. However, the IITS in

In our study, we examined whether IITS enhanced the investment in Taiwan rather than investment in Mainland China. The remainder of this paper was organized as follows. In Section 2, we briefly reviewed studies related to tax effect to the capital investment. In Section 3, we presented the hypotheses development, the empirical model, and the variables measurement as well as the study design. In Section 4, we demonstrated and discussed our empirical results and analyses. Finally, conclusions and implications of our findings were discussed and limitation of this study was offered in Section 5.

2. Literature Review

Mainland China utilized cheaper labor and lower tax investment environment to attract foreign direct investment. Young (1988) suggested that the tax incentives increased the foreign direct investment. The statutory tax rate was 30% in Mainland China. However, Mainland China offered the Taiwanese businesses for lower tax incentives such as five years tax exemptions and three years half-tax deductions. Taxes affect both the cost and the benefit of investment (Altshuler & Fulghieri, 1994) . The tax consideration was one of the Taiwanese businesses imperative concerns to invest either in domestic or in Mainland China investment. Past tax studies concentrated on fixed investment and lack of the capital investment themes. Carlson and Bathala (1994) discussed the Tax Reform Act (TRA) of 1986 for the issue between the investment tax credit and investment policy. During the TRA (1986-1987), the investment tax credit led positive influence to the investment. Before (1984-1985) and after the TRA (1988-1989), the investment tax credit would lower and decline the investment. When the investment tax credit affecting to the investment controlled, the investment ratio remained stable. The empirical study results of Carlson and Bathala (1994) were consistent to the works of Harrison (1990) , Shoven (1990) , Shoemaker (1991) , and Rosacker and Metcalf (1993) . They all supported that investment tax credit was an effective tool to promote the investment and decrease the capital cost.

Black, Legoria, and Sellers (2000) examined the effects of dividend imputation on corporate investment in New Zealand and Australia. Their empirical findings indicated that dividend imputation stimulated corporate investment in both countries. The more distributed dividends distributed brought higher impacts to the investment. Babcock (2000) developed a model to testify the DITC to multinational investment policy and result more domestic investment and less the foreign investment after the DITC implementation. Gupta and Hofmann (2003) examined how corporate tax changes affected the capital investment. They suggested the increasing tax burdens declined the capital expenditures. When the investment incentives increased to lower the tax, the capital expenditures surged.

The Integrated Income Tax System (IITS) had initiated in

The related IITS policy affected the investment. Chen Chung-Chin (1997) examined the IITS consequence and found the “tax-exempt” effect as well as to make the fund flow from investment to savings and other non-investment means. The IITS canceled the tax exemption of 80% transferred-investment gains within corporations. If all the transferred-investment gains taxed, the tax burden increased. However, under the imputation dividend system, the tax exemption of 80% transferred-investment gains would be replaced by the corporate tax credits. There were more benefits for more transferred investment layers. Therefore, there were less impact to the shareholders and corporations (Chen Chung-Chin, 1997) . Wu Chiuh-Wo (1997) found that after IITS the former tax incentives shrunk. The former industry promotion tax policies included the tax exemptions of the URE within the double paid-in capitals and 5 years corporate tax exemptions.

Chang Jui-Tang, Tseng Yu-Chi, and Huang Tien-Fu (1999) surveyed the IITS effects on investment. They found there were positive impacts of DITC on investment and negative impacts of 10% surtax of URE on investment. The modified tax incentive policies had no significant effects on investment. However, Wang Chien- Tung (2003) demonstrated that after the IITS implementation, the 10% surtax of URE had negative influence to the investment expenditure than the positive DITC. The 10% surtax addition impaired the capital accumulation and incurred negative capital investment effect. Wang Jui-Chih (2006) examined the periods before and after the IITS implementation to the capital investment influence. Wang Jui-Chih (2006) also found the companies with higher DITC ratios decreased the shareholders tax burden and lower the shareholder capital cost. There was an increase of the investment intention. Therefore, after IITS, higher DITC companies had higher capital investment ratio than before IITS without statistics significance. However, before IITS, the capital cost of the internal retained earnings was lower than the debt or stock financing. The companies would prefer maintaining the retained earnings rather than distributing to the shareholders. Under IITS, the URE were required to charge 10% surtax. If there were more retained earnings, there were more retained earnings taxes. When there were increasing costs of the retained earnings, there was less investment intention. When there were higher URE, there were higher capital cost of retained earnings and lesser investment intention (Wang Jui-Chih, 2006) . Therefore, under IITS, the companies with higher URE ratio had lesser capital investment ratios than before IITS.

3. Research Design

3.1. Hypotheses Development

Under IITS, the DITC mitigated the double taxation of the dividend income. The paid corporate tax was deductible in the individual shareholder claim. The IITS encouraged the business to distribute more dividends to the shareholders. The policy purpose was to decrease the retained earnings treated as the avoidance of the shareholder tax burden. Meanwhile, the capital costs derived from the shareholders were lowered.

Black et al. (2000)

found both in

H1-1: The business with higher dividend imputation tax credits (DITC) ratios has higher capital investment in Taiwan.

H1-2: The business with higher dividend imputation tax credits (DITC) ratios has lower capital investment in Mainland China.

Under IITS, the Ministry of Finance levied the 10% surtax of URE in order to offset the tax losses derived from the DITC. The surtax of URE reduced the capital accumulation and increased the retained capital burden. If the internal capital was short, the business needed to finance externally. The policy would lead to both investments in Taiwan and Mainland China down (Chen Tu-An, 1985; Chang Keh-Jen, 1997; Chen Chung-Chin, 1997) . Therefore we proposed the following hypotheses:

H2-1: The higher undistributed retained earnings (URE) ratios lead lower capital investment in Taiwan.

H2-2: The higher undistributed retained earnings (URE) ratios lead lower capital investment in Mainland China.

3.2. Research Models

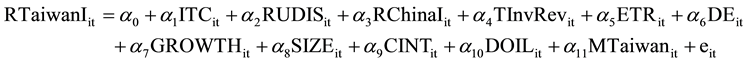

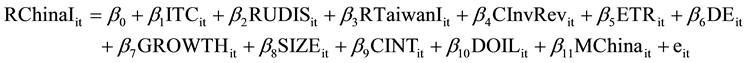

We explored the effects of Taiwanese and Chinese investment decisions based on IITS. Besides the DITC and URE, the firm-specific characteristics were measured in this study as well. Therefore, we applied the simultaneous regression models1 to estimate the regression coefficients as follows:

(1.1)

(1.1)

(1.2)

(1.2)

where: for firm i, at time t.

and

and

were the interceptions and coefficients of regression.

were the interceptions and coefficients of regression.

was the ratio of capital investment in Taiwan divided by the parent company total assets for firm i, at time t.

was the ratio of capital investment in Taiwan divided by the parent company total assets for firm i, at time t.

was the ratio of capital investment in Mainland China divided by the parent company total assets for firm i, at time t.

was the ratio of capital investment in Mainland China divided by the parent company total assets for firm i, at time t.

and

and

were the IITS variables: the DITC ratio and ratio of URE.

were the IITS variables: the DITC ratio and ratio of URE.

was the investment revenue from Taiwan divided by the parent company income before taxes.

was the investment revenue from Taiwan divided by the parent company income before taxes.

was the investment revenue from Mainland China divided by the parent company income before taxes.

was the investment revenue from Mainland China divided by the parent company income before taxes. ,

,

,

,

,

,

,

,

and

and

3.3. Variables Measurement

3.3.1. Dependent Variables

There were two dependent variables applied in this study. The first one was the ratio of capital investment in

3.3.2. Independent Variables

In this study, there are two sections of independent variables: IITS variables and the firm-specific characteristics variables.

3.3.3. IITS Variables

Ratio of dividend imputation tax credits (ITC): The DITC was to eliminate the double taxation of the dividend income derived from the corporate and individual income taxes. For Taiwanese shareholders, the DITC was a credit applied to the individual income tax from the paid corporate income tax on dividend distributions. The DITC reduced the Taiwanese shareholders tax and lowered the capital cost of the corporate to the domestic shareholders. However, the DITC was not applied to the investors whom invested out of

Ratio of undistributed retained earnings (RUDIS): The authority levied the 10% surtax of URE to offset the tax losses of DITC. The 10% surtax of URE was included in the corporate tax. Therefore, we measured the URE ratio applying the net income after income tax, lessened the salaries of board of directors, cash bonus to employees and common stocks (preferred stocks) dividends by the net income after income tax. When there was higher ratio of URE, there was higher charged retained earnings tax. The surtax of URE reduced the capital accumulation and lowered the investment intension. There were negative correlations among the URE to the capital investment both in

3.3.4. Firm-Specific Characteristics Variables

Ratio of investment revenue in

Ratio of investment revenue in Mainland China (CInvRev): We applied the investment revenues from Mainland China divided by the parent company income before taxes. There was a regulation to limit the Chinese investment up to 40% of net worth. The dividend wire back to

Ratio of effective tax (ETR): The corporate effective rate was to capture the impacts of the investment decisions. The ratio was measured as the income taxes expense divided by net income before income taxes expense. The effective (marginal) tax rate affected the capital investment. When there was no tax, there was no taxable income. When the corporate had more taxable income, there would generate more capital investment.

Ratio of debt to equity (DE): We applied each firm’s debt-to-equity ratio to evaluate the effects of financial leverage. The resource of the investment capital was either from debt or stock. Before IITS, the interest expense of the debt was expensed for tax saving effect. Therefore, the company would prefer debt rather than stock financing. The capital structure was affected by IITS. After IITS, the authority tried to lessen the tax impact to the capital structure and levy the 10% surtax on URE. This policy was to decrease the tax rate gap between the corporate and individual income taxes. The tax avoidance from the retained earnings was mitigated. Black et al. (2000) found that capital structure affected the investment. When the DE ratio was higher, there was higher debt burden. There was lesser internal capital accumulation and there was conservative investment intension as well.

Ratio of growth (GROWTH): Collins and Kothari (1989) and Black et al. (2000) asserted that the market-to-book ratio captured the difference between a firm’s return on both existing and future assets and its required rate of return on equity. A lower ratio indicated greater investment opportunities expected to yield returns in excess of the required rate of return. Carlson and Bathala (1994) utilized the market of equity to the book value of assets to measure the investment opportunities (Tobin’s q) and found there was positive relationship with capital investment. Therefore, we applied the ratio of the sum of the book value of long-term debt and the market value of equity to the book value of the total assets. We anticipated that the higher growth ratio led higher capital investment.

Company size (SIZE): We applied the natural log of total asset to measure the size of the firm. The size of the firm affected the ability to finance additional investment (Carlson & Bathala, 1994; Black et al., 2000) . We anticipated that the larger size of the firm led more capital investment.

Ratio of capital intensity (CINT): The decision to capital investment was not only affected by the tax system but also impacted by the firm’s industry and business operating type. The manufacturing and high technology industries required higher capital investment on the plants, properties, and equipments rather than the service industry.

Black et al. (2000)

found that capital investment with high capital intensity affected more by the tax system change rather than the ones with relatively lower capital intensity. We thus measured the capital intensity as the ratio of fixed assets to total assets. The costs of the capital and labor from Mainland China were relatively cheaper than

Net operating income loss (DOIL): When there was lower taxable income, there was possible to have increasing net sales loss. When the operating income loss decreased, the DITC would be lower. The IITS impact was lessened and the capital investment would be lesser than before IITS. We applied the dummy variable as proxy. When the sales were lesser than the operating expenses, the net operating income loss equaled to 1 and 0 otherwise. We would examine whether the operating situation would impact the investment decision either in Mainland China or

3.4. Data

We applied the pooled, cross-sectional, and firm-year data from 1998 to 2008. The financial data was derived from the listed and over-the-counter (OTC) company database of the Taiwan Economic Journal (TEJ) database. There were 102,834 original investment data including 22,534 non-Taiwan investment and 53,705 investment revenue applied cost method or lower-of-cost-or-market method. We got 26,595 investment adopted equity method. After merging the investment of the same year, there were 7285 firm-year observations in Taiwan. Meanwhile, there were 7368 capital investment and investment revenues data from Mainland China investment database. We applied the simultaneous regression models and retrieved 14,382 firm-specific variable data from the listed and OTC financial database. At final, we applied 3538 valid firm-year observations as study samples.

4. Results

The purposes of the integrated income tax system (IITS) were to mitigate the dividend double taxations from corporate and individual income taxes and charge 10% surtax of URE to motivate the retained earnings distribution. The authority initiated IITS to provide better tax environment and enhance the capital investment activities. Our study applied the listed and the over-the-counter (OTC) data to examine IITS effects to both capital investment in

4.1. Descriptive Statistics

Figure 1 revealed the capital investment both in

Figure 1. Ratios of capital investment in Taiwan and Mainland China.

Table 1. Descriptive statistics.

Note 1: Definition of variables; RTaiwanI: Ratio of Capital Investment in Taiwan. RMainland ChinaI: Ratio of Capital Investment in Mainland China. ITC: Ratio of imputation tax credits. RUDIS: Ratio of Undistributed Earnings. TInvRev: Ratio of Investment Revenue in Taiwan. CInvRev: Ratio of Investment Revenue in Mainland China. ETR: Ratio of Effective Tax. DE: Ratio of Debt to Equity. GROWTH: Ratio of Growth. SIZE: Log of the size. CINT: Ratio of Capital Intensity. DOIL: Dummy variable of Net Operating Income Loss. MTaiwan: Ratio of Taiwan Economic Growth. MMainland China: Ratio of Mainland China Economic Growth.

In 1998, Taiwan initiated IITS. There were two mechanisms of IITS: DITC and 10% surtax of URE. The mean of DITC (ITC) was 11.15% slightly lower than the corporate effective rate (11.60%). The DITC diminished the dividend double taxation and reduced the corporate average tax rate. The mean of the URE (RUDIS) was 44.87%. The ratio was pretty higher even there was a 10% surtax charge regulation. Taiwanese businesses still sustained more retained earnings in order to reduce the external financial situation and provide internal funding needs.

Regarding the firm-specific characteristics analyses, the mean (median) of ratio of investment revenue from Taiwan (TInvRev) was −10.52% (1.081%) higher than the mean (median) of ratio of investment revenue from Mainland China (CInvRev) −35.45% (0). The mean of the effective tax rate (ETR) was 11.60% lower than the statutory 25% tax rate. Most of businesses enjoyed excessive tax benefits. The businesses actually paid fewer corporate taxes. The mean of the debt-equity ratio (DE) was 81.06%. The mean of the investment growth ratio (GROWTH) was 97.24%. The mean of the company size (SIZE) was 15.81. The mean of the capital intensity (CINT) was 23.71%. Most of the sample businesses would invest the capital inclined to the labor intense industries. The mean of the company size was 15.81 and the median was 15.63, indicating there was no investment scale significant difference for the listed and OTC businesses to Mainland China. Pertaining to the economic growth, the mean of the Chinese economic growth rate (MMainland China) was 9.77% over the Taiwanese economic growth rate (MTaiwan) 3.66%.

4.2. Correlation Coefficients

Table 2 demonstrated the Pearson and Spearman correlation coefficients for the research variables. There was positive relationship but not statistics significance between the ITC and capital investment ratio in

Table 2.Pearson and spearman correlation coefficients.

There was positive statistics significance relationship but only in the Spearman correlation coefficient between the URE (RUDIS) and capital investment ratio in Mainland China (RMainland ChinaI) opposed to the hypothsis. There were negative statistics significance relationship between the ratio of debt to equity (DE) and capital investment ratio both in Mainland China (RMainland ChinaI) and in

When the capital investment revenue ratio in Mainland China (CInvRev) was higher, there was higher capital investment ratio in Mainland China (RMainland ChinaI). The larger size companies had higher investment ratio in

4.3. Multivariable Regression Analyses

The multinational businesses would consider different capital investment at different investment locations. In this study, we examined whether the Taiwanese businesses influenced by the DITC and URE when they both invested in

Table 3. Regression results by capital investment ratios.

Note 1: All variables are defined in Table 1 Note 1. Note 2: *5% significance level; **1% significance level.

In order to offset the loss of the DITC, there was 10% surtax of URE. This regulation increased the capital cost burden and reduced the capital accumulation. Based on Table 3, there was positive statistics significance between the URE ratio (RUDIS) and the capital investment ratio in

When the URE ratio (RUDIS) was higher, the capital investment ratio in Mainland China (RMainland ChinaI) was lower but not statistics significance. The reason might be the official investment regulation limit up to 40% of net worth. This limitation triggered the Chinese subsidiary reluctant to wire back the profit to Taiwanese parent company. The Taiwanese businesses would invest the profit for plant expansion in Mainland China. The empirical results did not support our second hypothesis. With limited investment capital resources, there were trade-off effects for different capital investment locations. Based on Table 3, the capital investment ratios between

Regarding the other firm-specific characteristics to the capital investment impacts, we assumed that the higher effective rate (ETR) might lead higher capital investment ratio. However, the empirical results exhibited a negative relationship. The possible reason was due to the tax environment influence. The corporate tax rate was 25% in

The larger size (SIZE) company had higher capital investment in Taiwan. However, the smaller size company had higher capital investment in Mainland China. The smaller company had advantages in Mainland China due to the cheaper capital and labor than

Figure 2. Distribution of URE Ratio (RUDIS) and Cash Dividend (CashDiv).

4.4. Additional Tests

In order to be robustness of the study, we conducted additional analyses to change the models (1.1) and (1.2) into (2.1) and (2.2). We measured the multidimensional levels of investment in terms of investment numbers instead of the investment amounts. We examined the IITS impact to the investment amounts both in Taiwan and Mainland China. Here were the research models:

Based on Table 4, higher DITC ratio (ITC) change companies had more investment numbers in Taiwan (NTaiwan) but fewer investment numbers in Mainland China (NMainland China). This result exhibited that the DITC of the IITS benefited to the Taiwanese shareholders and reduced the dividend double taxation. There were more Taiwanese investment numbers rather than in Mainland China ones. The higher URE ratio (RUDIS) change companies had higher retained earnings cost, increased the cost of the capital accumulation, and impaired the plant expansion. However, the empirical results indicated that the higher URE ratio (RUDIS) companies had more investment amounts in

Table 4. Regression results of the investment numbers in Taiwan and Mainland China.

Note 1: NTaiwan: the numbers of investment companies in Taiwan; NMainland China: the number of investment companies in Mainland China. All other variables are defined in Table 1 Note 1. Note 2: *5% significance level; **1% significance level.

5. Conclusions

In 1998, the Taiwanese Ministry of Finance enacted the Integrated Income Tax System (IITS). The tax system had two important features: the dividend imputation tax credits (DITC) to Taiwanese shareholders and the 10% surtax levied on undistributed retained earnings (URE) in the Taiwanese businesses. We examined the impacts of the DITC and URE on the capital investment of Taiwanese businessmen to investment both in

One limitation of this study was from the data resource. Our study data were derived from the TEJ database. This database collected Chinese investment data since 1998. Therefore, we might not analyze the periods before and after IITS in this study. Due to the tax reform, another limitation was inherent from the ceteris paribus assumption (Tung & Cho, 2000) .

Cite this paper

HuangLi-Hua,WangJui-Chih,HsiaoHsing-Chin, (2015) The Impact of Tax System on Capital Investment: Evidence from Taiwan and Mainland China. Chinese Studies,04,131-144. doi: 10.4236/chnstd.2015.44019

References

- 1. Altshuler, R., & Fulghieri, P. (1994). Incentive Effects of Foreign Tax Credits on Multinational Corporations. National Tax Journal, 47, 349-361.

- 2. Babcock, J. (2000). The Effects of Imputation Systems on Multinational Investment, Financing, and Income-Shifting Strategies. The Journal of the American Taxation Association, 22, 1-21.

http://dx.doi.org/10.2308/jata.2000.22.2.1 - 3. Black, E. L., Legoria, J., & Sellers, K. F. (2000). Capital Investment Effects of Dividend Imputation. The Journal of the American Taxation Association, 22, 40-59.

http://dx.doi.org/10.2308/jata.2000.22.2.40 - 4. Boyle, G. W. (1996). Corporate Investment and Dividend Tax Imputation. Financial Review, 31, 209-226.

http://dx.doi.org/10.1111/j.1540-6288.1996.tb00871.x - 5. Carlson, S. J., & Bathala, C. T. (1994). Impact of the Repeal of the Investment Tax Credit on Firm’s Investment Decisions. Journal of Applied Business Research, 10, 33-39.

- 6. Chang Jui-Tang, Tseng Yu-Chi, & Huang Tien-Fu 張瑞當, 曾玉琦, 黃天福 (1999). 我國兩稅合一新制對投資意願影響之實證研究. [An Empirical Investigation of the Integrated Income Tax System on the Effect of Investment]. Jingji Qingshi ji Pinglun, 4, 200-224.

- 7. Chang Keh-Jen 張克偵 (1997). 兩稅合一與企業經營效益. [The Integrated Income Tax System and Corporate Operation Performance]. Kuaiji Yanjiu Yuekan, 134, 64-66.

- 8. Chen Chung-Chin 陳忠勤 (1997). 新稅制~兩稅合一之剖析(上). [New Tax: Analysis of Integrated Income Tax System (I)]. Kuaijishi Huixun, 1-6.

- 9. Chen Chung-Chin 陳忠勤 (1997). 新稅制~兩稅合一之剖析(下). [New Tax: Analysis of Integrated Income Tax System (II)]. Kuaijishi Huixun, 1-18.

- 10. Chen Tu-An 陳聽安 (1985). 我國所得稅制改革的可行途徑. [The Methods of Income Taxes Reform in Taiwan]. Caishui Yanjiu, 17, 12-20.

- 11. Cheng Yueh-Sui 鄭月遂 (1996). 談兩稅合一的架構與實施的時機. [The Structure and Implementation of the Integrated Income Tax System]. Zhongguo Shuiwu Xunkan, 1616, 12-15.

- 12. Collins, D. W., & Kothari, S. P. (1989). An Analysis of the Intertemporal and Cross-Sectional Determinants of the Earnings Response Coefficients. Journal of Accounting and Economics, 9, 111-139.

http://dx.doi.org/10.1016/0165-4101(87)90002-4 - 13. Gupta, S., & Hofmann, M. A. (2003). The Effect of State Income Tax Apportionment and Tax Incentives on New Capital Expenditures. The Journal of the American Taxation Association, 25, 1-25.

http://dx.doi.org/10.2308/jata.2003.25.s-1.1 - 14. Harrison, L. H. (1990). A Policymakers View of the Cost of Capital. Proceedings of the American Council for Capital Formation Symposium on Business Taxes, Capital Costs, and Competitiveness, Washington DC, 1 May 1990.

- 15. Hsu Wen-Yu 徐文友 (1996). 兩稅合一制度之探討. [Investigation of the Integration Income Tax System]. Zhongguo Shuiwu Xunkan, 1613, 12-13.

- 16. Huang Tien-Fu 黃天福 (1998). 我國兩稅合一稅制對投資意願影響之探討. [The Study of the Integrated Income Tax System to the Investment Influence]. Unpublished Master’s Thesis, Kaohsiung: National Sun Yat-sen University.

- 17. Rosacker, R. E., & Metcalf, R. W. (1993). United States Federal Tax Policy Surrounding the Investment Tax Credit: An Empirical Investigation of Enactment, Rate Enhancement, and Repeals. Advance in Taxation, 5, 219-246.

- 18. Schulman, C. T., Thomas, D. W., Sellers, K. F., & Kennedy, D. B. (1996). Effects of Tax Integration and Capital Gains Tax on Corporate Leverage. National Tax Journal (1986-1998), 49, 31-54.

- 19. Shoemaker, P. A. (1991). Investment Tax Credit Effects on the United States and Canada, 1968-1985. Journal of Applied Business Research, 7, 56-66.

- 20. Shoven, J. B. (1990). Alternative Policies to Lower the Cost of Capital Cost, and Competitiveness. Washington DC.

- 21. Tung, S., & Cho, S. (2000). The Impact of Tax Incentives on Foreign Direct Investment in China. Journal of International Accounting, Auditing & Taxation, 9, 105-135.

http://dx.doi.org/10.1016/S1061-9518(00)00028-8 - 22. Wang Chien-Tung 王建棟 (2003). 兩稅合一對資本投資與股利政策影響之實證研究. [The Impact of Imputation Tax System on Capital Investment and Dividend Policy]. Unpublished Master’s Thesis, Taoyuan City: Chung Yuan Christian University.

- 23. Wang Jui-Chih 汪瑞芝 (2006). 兩稅合一制對公司資本投資影響之實證研究. [An Empirical Investigation of the Integration Income Tax System on Firms’ Capital Investment]. Zhonghua Guanli Pinglun Guoji Xuebao, 9, 1-18.

- 24. Wu Chiuh-Wo 吳去我 (1997). 兩稅合一稅收損失官商認知差距大. [The Tax Loss Recognized Difference between Government and Corporate of Integrated Income Tax System]. Zhongguo Shuiwu Xunkan, 1654, 11-12.

- 25. Young, K. H. (1988). The Effects of Taxes and Rates of Return on Foreign Direct Investment in the United States. National Tax Journal (1986-1998), 41, 109-121.

NOTES

*Corresponding author.

1We applied the seemingly unrelated regressions (SUR) to estimate each sample coefficient in order to control the residual correlation among different companies.

2When the rate was over the tax credit rate, the tax credit rate superseded the ceiling charge. There were three kinds of rate ceilings. 1) The accumulated undistributed retained earning without 10% surtax corporate tax would be imposed for 33.33%; 2) The accumulated undistributed retained earning with 10% surtax corporate tax would be imposed for 48.15%; and 3) if there were both accumulated undistributed retained earnings with and without 10% surtax charged situations, the proportion method was applied and calculated as the previous two regulations mentioned.