Modern Economy

Vol.10 No.03(2019), Article ID:91498,14 pages

10.4236/me.2019.103070

Urban Housing Prices, Labor Mobility and the Development of Urban High-Tech Industries

―An Empirical Analysis Based on Panel Data in the Pearl River Delta Region

Zhengyi Niu

College of Economic, Jinan University, Guangzhou, China

Copyright © 2019 by author(s) and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY 4.0).

http://creativecommons.org/licenses/by/4.0/

Received: February 24, 2019; Accepted: March 25, 2019; Published: March 28, 2019

ABSTRACT

This paper proposes two hypotheses that urban housing prices inhibit urban labor mobility and urban high-tech industry development by introducing the extended CP model of housing prices. On this basis, using the data of the 9-city data of the Pearl River Delta from 2001 to 2015 to conduct empirical analysis and testing through the fixed-effects model, it is found that the increase of relative housing prices in cities will promote urban labor inflows and inhibit the development of urban high-tech industries. Factors such as education level, medical level, and government budget expenditure will, to a certain extent, strengthen the role of relative housing prices in promoting labor inflows and weaken the inhibition of urban housing prices on high-tech industries.

Keywords:

City Housing Price Level, Labor Mobility, High-Tech Industry Development Level

1. Introduction

Since the reform and opening up, Guangdong, as the forefront of China’s reform and opening up, has made tremendous contributions to China’s economic development in the past 40 years. However, with the disappearance of China’s demographic dividend, natural resources, land and other comparative advantages, the economic development of Guangdong has entered a critical bottleneck. At the same time, the large number of companies represented by Foxconn fleeing the Pearl River Delta has also brought unprecedented shortages to the labor force in the Pearl River Delta. The data show that after the Spring Festival in 2014, there is a short-term employment gap in the enterprise, with a peak of 0.8 - 1 million. Among them, the peak of the employment gap in the nine cities of the Pearl River Delta is 650,000, with an average gap of 450,000. At the same time, while the labor force in the Pearl River Delta region continues to become scarce, housing prices in the Pearl River Delta region have achieved a “leap” over the past 20 years. Data show that from 2001 to 2015, the sales price of commercial housing in the Pearl River Delta rose by an average of 3.55 times. Among them, the growth rate of Shenzhen and Zhuhai is even more alarming, and the average annual growth rate of house prices is more than 10%. In 2015, the increase rate was 583.37% and 407.117% respectively. In the context of “labor shortage” and high housing prices, people have expressed various concerns about the development prospects of the Pearl River Delta economy. Whether the Pearl River Delta can achieve rapid economic development as a leading region for China’s economic development is also full of uncertainty.

The economic growth model points out that technological progress is the most important driving force for an economy to achieve sustained long-term economic growth. High-tech, as the main driving force for the upgrading of traditional industries, its development level will directly affect the long-term economic development of the economy. Therefore, it has become an important focus of global regional competition in the 21st century. At present, the development of China’s high-tech industries is mainly concentrated in the eastern region, which is the largest development in Guangdong Province. In 2016, the output value of high-tech products in Guangdong Province was 5.9 trillion yuan, accounting for 24.6% of the country. Among them, the Pearl River Delta region was the leader in Guangdong development. Its output value of high-tech products in 2016 was 5.7 trillion yuan, accounting for 96.6% of Guangdong Province. The Pearl River Delta high-tech industrial belt led by Guangzhou and Shenzhen has taken initial shape. However, within the 9 cities of the Pearl River Delta, the development level of its high-tech industry still has a very large gap. In 2015, the output value of high-tech products in Shenzhen was 1729.69 billion yuan, 14 times the output value of high-tech products in Jiangmen. What is the reason for the large gap in the development of high-tech industries in the Pearl River Delta cities in Guangdong-Hong Kong-Marco Greater Bay Area. As well as the current severe labor force and rising urban housing prices, how to promote the high-tech industries in the nine cities of the Pearl River Delta and achieve common development is a question worthy of our deep thinking.

This paper takes the nine cities of the Pearl River Delta as a sample to study the relationship between urban housing prices, labor mobility and urban high-tech industries. It is hoped that through the research in this paper, the relationship between urban housing prices and labor mobility in the Pearl River Delta region and the impact of rising urban housing prices on the development of urban high-tech industries will be found, which will provide certain policy recommendations for the development of high-tech industries in the later stages of the Pearl River Delta.

2. Literature Review

There are many literature studies on urban housing prices, labor mobility, and the development of urban high-tech industries. On the whole, they can be roughly divided into the following two categories: direct independent research and indirect related exploration. Among them, the direct independent research direction mainly includes the following three aspects: the first is to explore the impact of urban housing prices on urban labor mobility; the second is the relationship between labor mobility and urban related industry development; the third is to explore the factors affecting the layout and development of urban high-tech industries. The indirect relevance study is based on the results of previous studies, through the role of urban housing prices on urban labor mobility, and the impact of labor mobility on urban industrial development, Through its role model, the mechanism of urban housing price impact on urban industrial development is derived, and the relationship between urban housing prices and urban industrial development becomes more clear.

In the study of the relationship between urban housing prices and urban labor mobility, Helpman [1] first introduced the housing price factor based on Krugman’s new economic geography standard model [2] . The study pointed out that the relative utility of laborers in cities will be affected by urban housing prices, and the excessive housing prices in one region will affect the concentration of migrant labor in this region. Later, Hanson. et al. [3] proved the conclusion of Helpman [1] through empirical analysis. In the same way, many scholars and experts in China have also studied this issue. Ji Yujun and Zhang Peng [4] have found that high housing prices in cities will inhibit labor mobility to a certain extent, resulting in insufficient supply of labor in urban service industry agglomeration. Ding Xinxin [5] found that high housing prices will lead to the transfer of labor from first-tier cities to second- and third-tier cities, from the eastern region to the central and western regions. However, not all studies have argued that high housing prices in cities will inhibit the flow of urban labor. Nord (1998) [6] used 1985-1990 US census data as a sample analysis and found that there is no significant correlation between labor mobility and housing costs. Similarly, in the year of Saiz [7] , using the sample data of the American metropolitan area from 1983 to 1997, it was found that the impact of housing costs on the willingness of people to immigrate was not obvious. Compared with housing costs, people are more concerned about the convenience of living and social networks after moving into a metropolis. However, some scholars in China have also found that the relationship between housing prices and labor mobility presents an “inverted U-shaped” relationship [8] . Before the specific inflection point is reached, there is no reverse relationship with the labor force. In the study of the development of the relationship between labor mobility and urban-related industries, The new economic geography points out that due to the influence of cost and demand, when the labor flows into a certain area, it will promote the formation of industrial agglomeration in this area, and then change the industrial structure of the area [2] . Dumais et al. [9] used the US LRD manufacturing census data to find that at least at the metropolitan level, the accumulation of labor resources is an important factor in the industrial agglomeration of large cities. Skiba [10] used the general equilibrium model to analyze the relationship between immigration and industrial transfer, and found that employment immigration weakened the degree of urban industrial transfer. In domestic research, Xiao Zhi, Zhang Jie, Zheng Zhengzheng [11] found that the flow of urban labor has a significant impact on the development of urban tertiary industry. The agglomeration effect of the labor force in the east and the dispersion effect in the west are also one of the reasons for the development gap of the tertiary industry in the eastern and western cities. In addition, there are some scholars from the difference in urban wages [12] , household registration system differences [13] , regional urban integration and specialization [14] researching the perspective of the influencing factors of urban industrial development, and finging all of these factors have an important influence on urban labor mobility to a certain extent.

In the research of urban high-tech industry development, domestic research mostly tends to discuss some aspects of China’s high-tech industry development approach and layout. For example, Xu Yan [15] proposed from the perspective of mergers and acquisitions that under the current economic form, enterprises should strengthen the rapid acquisition of leading technology reserves through mergers and acquisitions to promote the rapid development of China’s high-tech enterprises; Wu Yongmin, Ji Yushan and Lu Yonggang [16] established a logistic model of the symbiotic evolution of financial industry and high-tech industry through the time series data of 1995-2012, and finally put forward the countermeasures and suggestions for the realization of symmetric and mutually beneficial symbiotic evolution of China’s financial industry and high-tech industry; Zeng Xueqin, Chen Jianguo and Lu Feng [17] constructed an evaluation model of high-tech industry competitiveness through entropy weight method, evaluated the high-tech industries in China’s three major economic circles, and proposed certain policy recommendations for the development of high-tech industries. In summary, we can find that most of China’s current research on high-tech industries is to study how to lay out the development of urban high-tech industries. However, the influence of other factors in the city (such as housing prices and high-quality labor mobility in cities) on the development of high-tech industries is relatively small, and this is also a major reason for this research.

In terms of labor mobility, urban housing prices and indirect correlation research of urban industrial development, the current domestic scholars are more concerned with the internal relationship between urban housing prices, labor mobility and urban economic development. Zhang Chuanyong [18] takes the data of the prefecture-level cities in the Yangtze River Delta from 2000 to 2013 as a sample, and found that the rapid rise in housing prices has hindered the economic convergence in the Yangtze River Delta to a certain extent, which has affected the trend of narrowing the regional economic gap. High housing prices have curbed the willingness of migrants to purchase houses. Gao Bo, Chen Jian, and Zou Linhua [19] used data from 35 large and medium-sized cities in China from 2000 to 2009 and found that when a region’s relative housing prices rise, it will lead to a decrease in relative employment, and it will also promote the relative output reduction of low value-added industries in the region and the relative output increase of high value-added industries, thereby promoting industrial upgrading in the region. Liu Zhiwei [20] analyzed the data of 35 major cities in China from 2006 to 2010 and found that the increase of urban housing prices will promote the development of urban tertiary industry.

In summary, although many literatures have spent on the interaction between urban housing prices, labor mobility, and urban industrial development, most of their research is isolated. Moreover, the research on how urban housing prices move through the role of urban labor to the development of urban high-tech industries is relatively scarce. Whether the role mechanism of urban housing prices for the development of urban high-tech industries has affected the development of urban tertiary industry through labor mobility. The same mechanism still requires a lot of research to explore and prove. The purpose of this paper is to further explore the internal linkage mechanism of urban housing prices, urban labor mobility and urban high-tech industry development by means of the “central-periphery” paradigm thinking method established by the predecessors. With the help of the intermediate variable of urban labor mobility, the paper analyzes the impact of urban housing prices on the development of urban high-tech industries, and conducts empirical analysis and verification with the data of the last 15 years of the 9 cities in the Pearl River Delta.

3. Theoretical Model

Based on the core-edge model proposed by Krugman’s new economic geography theory, this paper uses Helpman’s analytical paradigm to explore the relationship between labor mobility, urban housing prices and the development of urban high-tech industries by using the extended CP model that introduces housing prices. It mainly explores the mechanism of the effect of urban housing prices on urban labor mobility and the mechanism of urban housing prices on the development of urban high-tech industries.

First assume that there are two cities in a certain area: City 1 and City 2, and the labor of these two cities can flow freely. Consumers spend their entire income on products 1 (freely tradeable products) and products 2 (non-freely tradeable houses) by rationally arranging their own income to maximize their utility. They have the same preferences for consumers in City 1 and City 2, and the consumer utility function is represented by the Cobb-Douglas function.

For consumers of City 1:

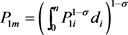

(1)

(1)

S.t.

(2)

(2)

Among them, C1m and C1h represent the number of products and the number of houses consumed by consumers in city 1. C1i is the consumption quantity of city 1 i-type products. P1m, P1h are the price of products and housing prices consumed by consumers in city 1. P1h is the price index form introduced by Krugman. P1i is the price of the i-th product. W1 is the income of the city 1 consumer. σ represents the elasticity of substitution between products consumed by consumers (σ > 1). μ represents the consumer’s share of consumption on freely tradeable products (0 < μ < 1). Let n1 denote the number of consumable products of city 1, n2 denote the number of consumable products of city 2, and n denote the total types of consumable products. Then

The indirect utility function of City 1 is obtained after finishing the optimization:

(3)

(3)

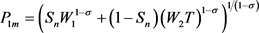

Combined with the optimization conditions of the manufacturer, the price index of the consumer product is derived from the variant form of (1):

(4)

(4)

Among them, W2 represents the consumer income of City 2. Sn represents the ratio of the number of freely traded products produced by City 1 to the total number of companies in City 1 and City 2. We use n1/n to represent Sn = n1/n. T is the use of iceberg transaction cost technology to measure the transportation cost of manufacturing products between different cities, T > 1.

Bring (4) into (3):

The same is available:

Use S12 to indicate the relative utility of City 1 and City 2,

Let , Φ denote the degree of trade freedom, and perform binary Taylor expansion on Sn/1 − Sn and W1/W2 respectively:

(5)

Take the logarithm on both sides:

When the long-term equilibrium is reached, the consumer’s utility in the two places is equal, that is, S12 = 1, thus obtaining:

(6)

From the above formula we can draw the following assumptions;

H1: Under the premise that the relative wages and trade freedom of the city remain unchanged, the increase in relative housing prices in cities will lead to a decrease in the relative labor inflows and employment of cities.

Since , , , so , . Since , , , so . Since , so , . According to the assumption of the classic new economic geography, there is a high positive correlation between Sn/1 − Sn and relative employment in the two regions. Therefore, we replace Sn/1 − Sn with the relative employment in the two regions, so that we can think that the relative wages and transportation costs are the same, that is, W1/W2 and Φ are unchanged.

H2: The rise in relative housing prices will not only reduce the employment of the city, but also have a crowding out effect on the development of new enterprises, and the longer the technology development cycle, the more obvious the crowding effect. In turn, it may inhibit the development of urban high-tech industries.

For a city, the rising housing prices in the city will not only increase the cost of living in the city, but also increase the cost for the company. High-tech industries have long-term product development cycles. Excessive housing prices will not only increase the rents of their R&D sites, but also increase the cost of living for their R&D personnel. Under the pressure of high cost of enterprises, some enterprises may move away from high-price cities, thus inhibiting the development of high-tech industries in high-price cities.

4. Empirical Results and Analysis

4.1. Model Setting

Considering that the development of high-tech industry and the employment rate may have a habit order, that is, the level of development of high-tech industries in the previous year and the level of employment rate may affect the development of high-tech industries and employment rate in the following year. Based on the research results of predecessors and the derivation results of Equation (8), this paper adopts a model that adds the lag term of the explained variable. The specific form of the estimated equation is:

Among them, the relative employment rate (REMP) of urban i and other cities in the t-year of and the relative output value of high-tech products (Rovhtp). is a constant term, and and are the coefficients of the respective variables. indicates the relative salary of city i and other cities in the t-th year. indicates the relative price of city i and other cities in the t-th year. is random perturbation. indicates the main control variables, that is, factors affecting labor mobility and the development of urban high-tech industries. It mainly includes traffic convenience, urban education level, urban medical level, urban public service investment, and urban foreign direct investment. Among them, the convenience of transportation is measured by the urban highway density data indicator, and the logarithm is followed by Lntrade. The level of urban education is expressed in the number of students in ordinary colleges and universities in the city, and the logarithm is followed by Lnedu. The city’s medical level is expressed in the number of health workers per 10,000 people in the city, and the logarithm is recorded as Lnhealth. The level of foreign investment is expressed in terms of foreign direct investment (FDI), and the logarithm is followed by LnFDI. The urban public service input is expressed in the city government’s budgetary expenditure, and the logarithm is recorded as LnInvest.

4.2. Data Sources

This paper selects the nine cities of the Pearl River Delta as the research object. Due to the availability of data, the sample data is selected from 2001 to 2015. The basic data is derived from the Guangdong Statistical Yearbook, the Guangdong Science and Technology Yearbook, and the city statistical yearbooks and statistical bulletins. The relative data is calculated from the ratio between two different cities. The statistical characteristics of each variable are shown in Table 1.

4.3. Stationarity Test

Before performing regression analysis, we perform data stability test on the selected sample data to minimize the possibility of pseudo-regression. In this paper, the unit unit root test method is used to investigate the stability of each variable data in the model. All the variable data are tested to meet the data stationarity test requirements. The specific test results are shown in Table 2.

4.4. Analysis of Regression Results

Since the model contains the first-order lag term of the interpreted variable, and there may be endogeneity problems between the variables, this paper needs to

Table 1. Statistical description

Table 2. LLC unit root test results

Note: *, **, *** indicate significant levels at 10%, 5%, and 1%.

use the dynamic panel data estimation method to perform the model estimation operation. According to the results of the Hausman test, the Hausman test p value for the regression corresponding to Table 3 is 0.0000. The chi-square value is 65.60. For the regression of Table 4, the Hausman test has a P value of 0.0847 and a chi-square value of 13.89. It is more effective to choose a fixed effect model, so this paper chooses to use the fixed effect model method for regression analysis.

This paper adopts a fixed effect model to test the correlation between urban housing prices, urban labor mobility and urban high-tech industry development. Combined with the theoretical model derivation results, we use the urban relative house price and the urban relative wage level squared term as the main endogenous explanatory variables of this paper, in order to ensure the unbiasedness and consistency of the model results as much as possible.

1) The impact of urban housing prices on urban labor mobility

The regression results of the impact of urban housing prices on urban labor mobility are shown in Table 3. The regression results show that: a) Before the introduction of control variables, the relative employment rate of the city is affected by the previous period, and there is also a significant positive correlation with the change in house prices. For each unit of house price increase, the relative employment rate of the city can be increased by 0.044.

Table 3. The return of urban relative housing prices to urban labor mobility.

Note: The t-statistic value is in parentheses, L. remp is the explanatory variable of remp lag phase 1; rw2 is the square term of rw.

After adding the control variables, the urban employment rate is significantly positively correlated with the relative wage squared and the urban medical level, in addition to the impact of the city’s relative housing prices. Comparing the regression results of the two groups, we can find that there is no significant correlation between the relative wage squared term and the relative employment rate before adding the control variables, but there is a significant relationship at the 1% level after adding the control variables. The reason may be that urban housing prices are affected by factors such as the city’s medical level in addition to the relative wages. This leads to a bias in the relative wage squared term before the control variable is added, and thus fails to pass the significance test. b) Before and after the addition of control variables, there is a significant positive correlation between urban relative housing prices and relative employment rates. However, after adding control variables, the coefficient of relative housing prices in cities decreased from 0.044 to 0.03. This indicates that the gravitational effect

Table 4. Regression results of relative housing prices and high-tech products in cities.

Note: t-statistic value in parentheses, rw2 represents squared term of rw.

of foreign labor caused by the improvement of urban medical level and other factors has led to a decline in the relative impact of urban relative housing prices on the relative employment rate of cities.

2) The impact of urban housing prices on the development of urban high-tech industries

From the regression results in Table 4 we can find: a) Before and after the introduction of control variables, the square of the relative wage level is significantly positively correlated with the output value of urban high-tech products, which indicates that the relative wage increase can promote the development of urban high-tech industries to a certain extent; After introducing the control variable, the coefficient of squared relative wages is reduced by 0.105 compared with the introduction of control variables. This shows that the increase in urban investment in education and government expenditure can weaken the impact of wages on the development of urban high-tech industries to a certain extent. b) Before and after the introduction of control variables, the relative price of the city and the output value of urban high-tech products are negatively correlated, which is consistent with our judgment of hypothesis 2. After the introduction of the control variables, the regression coefficient of the relative housing price of the city is reduced by about 0.05 compared with the introduction of the control variable. To a certain extent, this shows that the increase in urban investment in education and government budget spending can reduce the impact of higher urban housing prices on the development of urban high-tech industries. c) From the regression results, we can find that among the control variables introduced in this paper, the urban education level and the urban government budget expenditure have a significant positive correlation with the urban high-tech industry. To a certain extent, this proves that the development of high-tech industries is inseparable from the support of higher education talents and the government.

So far, Hypothesis 1 and Hypothesis 2 proposed in this paper have been verified, and Hypothesis 1 is contrary to the conclusions obtained in this paper, because the impact of housing prices on urban labor mobility can be considered from two aspects: One aspect is that housing prices are one of the hallmarks of a city’s development level. Higher housing prices also mean that cities have more job opportunities and the possibility of higher incomes is greater; On the other hand, higher housing prices will increase the cost of living for workers in this city, so that workers may eventually receive less disposable income, which will inhibit the inflow of urban labor to a certain extent. Based on the data from the Pearl River Delta, this paper also shows that the housing prices in the Pearl River Delta region have not become a resistance to labor inflows in the region, but have promoted the inflow of labor to some extent. Hypothesis 2 has received the expenditure of the regression results of this paper, that is, the rise of urban housing prices has inhibited the further development of urban high-tech industries to a certain extent.

5. Conclusions and Policy Recommendations

This paper borrows Helpman’s analytical paradigm and uses the extended CP model that introduces the housing price factor to propose two assumptions that the rise in housing prices will inhibit the urban labor mobility and the development of urban high-tech industries. And using the panel data of the nine cities in the Pearl River Delta from 2001 to 2015, the measurement test is made and the conclusion is drawn: First, the increase in urban housing prices will promote the flow of labor to a certain extent and increase the employment rate of cities. At the same time, the gravitational effect brought by the improvement of public services such as urban medical level and traffic convenience will increase the influence of housing prices on labor mobility to a certain extent. Second, the rise in urban housing prices will inhibit the development of urban high-tech industries to a certain extent. However, the improvement of the level of education development and government expenditure in the city will, to a certain extent, weaken the adverse impact of rising housing prices on the development of urban high-tech industries.

In order to reasonably control the rise of housing prices, realize the orderly flow of labor in the Pearl River Delta region and the rapid development of high-tech industries, the following policy recommendations are proposed in combination with the research results of this paper: First, starting from the allocation of resources, from the perspective of overall development, the regulation of housing prices. Compared with the direct factors affecting housing prices, such as land resources and rigid housing demand, the unreasonable distribution of resources such as education, medical care, and transportation convenience is the main factor leading to the difference in housing prices between different cities in the Pearl River Delta region. The government should make full use of the fiscal and administrative methods to promote the rational allocation of resources in the Pearl River Delta region from a global perspective. Under the circumstance of giving full play to the advantages of the two first-tier cities of Guangzhou and Shenzhen, we will give full play to the comparative advantages of other cities in the Pearl River Delta, narrow the economic development differences between cities, and achieve coordinated development in the Pearl River Delta region. Second, implement the city’s differentiated development strategy, make full use of the comparative advantages of each city, and each city will focus on developing its own high-tech industries with comparative advantages, forming a development pattern in which each city coordinates and depends on each other. At the same time, Guangzhou, Shenzhen and other high-tech industries with relatively high-developed industries will be strengthened to assist the construction of high-tech industrial parks in relatively underdeveloped areas such as Zhaoqing and Huizhou. Third, while cities are vigorously developing the development of high-tech industries in this city, they will increase investment in education and medical care. For example, the introduction of “double-class” schools in the city to build branch campuses, strengthen cooperation with universities in scientific research, and strive to promote high-tech research results in this city, etc. The development of high-tech industries is inseparable from the scientific research results of scientific research institutions, which can make the development of high-tech industries in this city more dynamic.

Conflicts of Interest

The author declares no conflicts of interest regarding the publication of this paper.

Cite this paper

Niu, Z.Y. (2019) Urban Housing Prices, Labor Mobility and the Development of Urban High-Tech Industries. Modern Economy, 10, 1048-1061. https://doi.org/10.4236/me.2019.103070

References

- 1. Helpman, E. (1998) The Size of Regions. In: Pines. D., Sadka. E. and Zilcha. I., Eds., Topics in Public Economics, Cambridge University Press, London.

- 2. Paul, K. (1991) Increasing Returns and Economic Geography. Journal of Political Economy, 99, 483-499. https://doi.org/10.1086/261763

- 3. Hanson, G.H. and Spilimbergo, A. (1999) Illegal Immigration, Border Enforcement and Relative Wages: Evidence from Apprehensions at the US-Mexico Border. American Economic Review, 89, 1337-1357. https://doi.org/10.1257/aer.89.5.1337

- 4. Ji, Y. and Zhang, P. (2015) Urban Housing Price Level and Service Industry Agglomeration under Labor Flow—Based on the Threshold Regression Model Test of Panel Data of 284 Cities in China. Journal of Shijiazhuang University of Economics, No. 4, 12-18.

- 5. Ding, X. (2018) Housing Prices, Employee Turnover and Industrial Upgrading. Market Weekly, No. 7, 19-20.

- 6. Mark, N. (1998) Poor People on the Move: County-to-County Migration and the Spatial Concentration of Poverty. Journal of Regional Science, 38, 329-351. https://doi.org/10.1111/1467-9787.00095

- 7. Saiz, A. (2007) Immigration and Housing Rents in American Cities. Journal of Urban Economics, 61, 345-371. https://doi.org/10.1016/j.jue.2006.07.004

- 8. Zhang, L., He, J., Ma, H. (2017) Escape from Beishangguang?—How Does Housing Prices Affect Labor Mobility. International Monetary Commentary, 11, 1070-1091.

- 9. Dumais, G., Ellison, G. and Glaeser, E.L. (1997) Geographic Concentration as a Dynamic Process. NBER Working Paper No. 6270. https://doi.org/10.3386/w6270

- 10. Alexandre, S. (2006) Immigration, Firm Relocation and Welfare of Domestic Workers. 6th Annual Missouri Economics Conference Selected Papers, Columbia, 31 March-1 April 2006.

- 11. Xiao, Z., Zhang, J. and Zheng, Z. (2012) Labor Force Flow and Endogenous Research of the Tertiary Industry—An Empirical Analysis Based on New Economic Geography. Population Research, No. 2, 97-105.

- 12. Wang, Y. and Yuan, H. (2010) Wage Difference, Labor Flow and Industrial Agglomeration—Based on the Explanation and Empirical Test of New Economic Geography. Journal of Finance and Economics, No. 3, 53-60.

- 13. Zhou, W., Zhao, F., Yang, F. and Li, L. (2017) Land Circulation, Household Registration System Reform and Urbanization in China: Theory and Simulation. Economic Research, No. 6, 183-197.

- 14. Fan, J. (2004) Integration of the Yangtze River Delta, Regional Specialization and Manufacturing Space Transfer. Management World, No. 11, 77-84.

- 15. Xu, Y. (2018) Research on the Development of China’s High-tech Industry M&A in the Background of Economic Structure Transformation. Modern Management Science, No. 11, 69-71.

- 16. Wu, Y., Ji, Y. and Lu, Y. (2014) Research on the Symbiotic Evolution of Financial Industry and High-Tech Industry—Evidence from China. Economist, No. 7, 82-92.

- 17. Zeng, X., Chen, J. and Lu, F. (2014) Evaluation of High-Tech Industry Competitiveness in China’s Three Economic Circles—Analysis Based on Entropy Weight Extension Decision Model. Economic Research, No. 5, 37-44.

- 18. Zhang, C. (2016) Labor Flow, Housing Price Rise and Urban Economic Convergence—An Empirical Analysis of the Yangtze River Delta. Industrial Economics Research, No. 3, 82-90.

- 19. Gao, B., Chen, J. and Zou, L. (2012) Regional Housing Price Difference, Labor Mobility and Industrial Upgrading. Economic Research, No. 1, 66-79.

- 20. Liu, Z. (2013) Urban Housing Prices, Labor Mobility and the Development of Tertiary Industry—An Empirical Analysis Based on National Panel Data. Economic Issues, No. 8, 44-47.