1. Introduction

Asset pricing theory is one of the themes of the financial economy. Lèvy and Paras [1] proposed an uncertain volatility model, but the study could not give a dynamic option price. Peng [2] [3] defines G-expectation and G-Brown motion to provide a solution to this problem. Describing the theoretical basis of the option price. Yang and Zhao [4] simulate the G-normal distribution, and study the numerical simulation of G-Brown motion and the simulation of the second variation of G-Brown motion, then the finite difference method is given to solve the G-heat equation. Xu [5] [6] study the European call option price formula and Girsanov theorem under G-expectation. Wang [7] study the G-Jensen inequality under G-expectation. Wang [8] study the comparison theorem and Asian option pricing under G-expectation. Kang [9] study the Brownian motion martingale representation theorem under G-expectation.

The main purpose of this paper is to introduce the price change of the asset driven by G-geometric Brown. First we give the martingale property of discount value under G-framework. We simulate the stock price . We compare the stock price under normal

. We compare the stock price under normal  with the stock price under G-

with the stock price under G- . And we give the stock price under different G-

. And we give the stock price under different G- . Then we study the G-

. Then we study the G- influence on

influence on  under G-framework.

under G-framework.

2. The G-Martingale Property of Discount Value

Definition 1 [2] :  is G-brown motion,

is G-brown motion,  is a division on

is a division on , when

, when , we denote G-quadratic variation process by

, we denote G-quadratic variation process by :

:

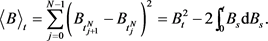

(1)

(1)

Definition 2 [2] : A nonlinear expectation  is a function

is a function  satisfying the following properties:

satisfying the following properties:

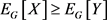

1) Monotonicity: If  and

and  then

then ;

;

2) Preserving of constants: ;

;

3) Sub-additivity![]() ,

,![]() ;

;

4) Positive homogeneity:![]() ,

, ![]() ,

,![]() ;

;

5) Constant translatability:![]() .

.

Definition 3 [2] : The canonical process B is called a G-Brownian motion under a nonlinear ![]() defined on

defined on ![]() if for each

if for each![]() ,

, ![]() and for each

and for each![]() ,

, ![]() , we have

, we have

![]()

Lemma 1 [2] [G-Itô formula]: for ![]() is G-brownian motion,

is G-brownian motion, ![]() is quadratic variation process of G-brownian miton,

is quadratic variation process of G-brownian miton, ![]() is a function about

is a function about![]() , and

, and![]() ,

, ![]() ,

, ![]() are continuous function, we have

are continuous function, we have

![]()

Lemma 2 [7] [G-Jensen inequality] h is a continuous function defined on R. Then the following two conditions are equivalent:

1) h is a convex function;

2) For![]() , if

, if![]() , we have

, we have

![]()

Lemma 3 [6] [Girsanov under G-framework]: for![]() , if existing

, if existing ![]() and satisfying:

and satisfying:

![]()

we have

![]()

![]() is a symmetrical martingale under

is a symmetrical martingale under ![]() for

for![]() ,

, ![]() .

.

In this section, we introduce the American call option, give a G-geometric Brownian motion asset. And we prove that the American call price is the same as the European call price.

Considering a stock whose price process ![]() is given by

is given by

![]() (2)

(2)

where the interest rate r and the volatility ![]() (

(![]() ) are positive and

) are positive and ![]() is a G-brownian motion.

is a G-brownian motion.

Now we compute (2) through G-Itô formula, in [5] the result is:

![]() (3)

(3)

where ![]() is the stock value at current moment.

is the stock value at current moment.

Theorem 1: ![]() is a nonnegative and convex function,

is a nonnegative and convex function, ![]() ,

,![]() . Then the discount value

. Then the discount value ![]() of American option

of American option ![]() is a G-submartingale.

is a G-submartingale.

Proof: ![]() is a convex, for

is a convex, for ![]() and

and![]() , we have

, we have

![]() (4)

(4)

![]() . Taking

. Taking![]() ,

, ![]() , and using the fact h(0)=0, we obtain

, and using the fact h(0)=0, we obtain

![]() (5)

(5)

for![]() , we have

, we have![]() , by (5) and G-expectation property

, by (5) and G-expectation property

![]() (6)

(6)

According to Lemma 2,

![]() (7)

(7)

by Lemma 3 we know that ![]() is a G-symmetrical martingale, which implies

is a G-symmetrical martingale, which implies

![]() (8)

(8)

So we conclude that

![]() (9)

(9)

and

![]()

the ![]() is a G-submartingale.

is a G-submartingale.

The Inequality (9) implies that the European derivative security price always dominates the intrinsic value of American derivative security. This shows that the option to exercise early is worthless, so the American call option agrees with the price of European option under G-framework.

3. Numerical Simulation

We mainly simulate stock price ![]() under G-

under G-![]() and

and

G-![]() . The G-

. The G-![]() and G-

and G-![]() values are simulated in [4]. Yang and Zhao [4] mainly simulate the G-brownian motion by solving a specific HJB equation. Then they give four finite difference methods to solve the HJB equation. Finally they give the numerical algorithms to simulate G-normal distribution, G-brownian motion G-quadratic variation process. The following we give three algorithms.

values are simulated in [4]. Yang and Zhao [4] mainly simulate the G-brownian motion by solving a specific HJB equation. Then they give four finite difference methods to solve the HJB equation. Finally they give the numerical algorithms to simulate G-normal distribution, G-brownian motion G-quadratic variation process. The following we give three algorithms.

Algorithm 1 [4] (simulation ![]() and

and![]() ):

):

• For random![]() , calculating approximation

, calculating approximation![]() ;

;

• For![]() , calculating the difference

, calculating the difference![]() ;

;

• By ![]() calculating density function

calculating density function![]() ’s approximation

’s approximation![]() .

.

by the G-heat equation defining the G-normal distribution ![]() and the density function

and the density function![]() . By Algorithm 1 simulating the

. By Algorithm 1 simulating the ![]() and

and![]() , then we apply these in Algorithm 2 and Algorithm 3.

, then we apply these in Algorithm 2 and Algorithm 3.

Algorithm 2 [4] (G-brownian motion numerical simulation):

• For random![]() , using algorithm 1 compute

, using algorithm 1 compute![]() ;

;

• Produing N random numbers in [0,1] obey uniformly distribution ;

• For![]() , calculating

, calculating![]() ;

;

• By![]() , solving

, solving![]() ,

,![]() ;

;

• By![]() , approaching

, approaching![]() ,

,![]() .

.

We simulate the values of G-brown motion![]() . By simulating the

. By simulating the![]() , we use it in Algorithm 3 to get the

, we use it in Algorithm 3 to get the![]() .

.

Algorithm 3 [4] (numerical simulation![]() ):

):

• For random![]() , using algorithm 1 to compute

, using algorithm 1 to compute![]() ;

;

• Generating N random numbers ![]() in [0,1] for

in [0,1] for![]() , calculating

, calculating![]() ;

;

• By![]() , solving

, solving![]() ,

,![]() ;

;

• By![]() , approaching

, approaching![]() ,

,![]() .

.

The following we simulate the stock price ![]() under the G-

under the G-![]() and G-

and G-![]() values.

values.

Example 1: we consider stock price ![]() at time t immediately, where interest rate

at time t immediately, where interest rate![]() , the volatility

, the volatility![]() ,

,![]() .

.

Figure 1 denotes the comparison between ![]() under G-framework and

under G-framework and ![]() under classical framework. In Figure 1 we can know that the blue line is simulated by

under classical framework. In Figure 1 we can know that the blue line is simulated by![]() , the red line is simulated by

, the red line is simulated by![]() . Figure 2 simulates the price of

. Figure 2 simulates the price of ![]() based on three different G-

based on three different G-![]() in Figure 3. Figure 3

in Figure 3. Figure 3

is about G-![]() of simulation. In Figure 3, the three lines are respectively under (

of simulation. In Figure 3, the three lines are respectively under (![]() ,

,![]() ), (

), (![]() ,

,![]() ), (

), (![]() ,

,![]() ). Figure 4 is about

). Figure 4 is about

![]()

Figure 1. Comparing stock price of simulation between G-expectation framework and classical framework.

![]()

Figure 2. Comparing stock price under different G-![]() .

.

![]() of simulation under classical framework. We can know the G-

of simulation under classical framework. We can know the G-![]() is different from the

is different from the ![]() according to Figure 3 and Figure 4. And the stock price

according to Figure 3 and Figure 4. And the stock price ![]() is a about G-

is a about G-![]() , G-

, G-![]() , t function under G-framework. The stock price

, t function under G-framework. The stock price ![]() is a function about

is a function about ![]() and t. That is the main reason to cause the difference. We can know that the G-

and t. That is the main reason to cause the difference. We can know that the G-![]() influence on

influence on ![]() under G-framework from Figure 5.

under G-framework from Figure 5.

The blue line is function![]() . The red line is function

. The red line is function ![]() . From Figure 6, we can know the G-

. From Figure 6, we can know the G-![]() of simuation values. According to Figure 6 when we replace the

of simuation values. According to Figure 6 when we replace the ![]() with the

with the ![]() under G-framework, it has no impact on stock price fluctuations.

under G-framework, it has no impact on stock price fluctuations.

4. Conclusion

This article mainly proves that American call options that do not pay dividends under the G-framework are equal to European call options and simulate the G-![]() image. Comparing stock price images under different

image. Comparing stock price images under different![]() , G-

, G-![]() . There is a restriction on G-

. There is a restriction on G-![]() . When

. When ![]() is smaller, the G-

is smaller, the G-![]() of simulation shows a downward fluctuation. We need to find the appropriate range of

of simulation shows a downward fluctuation. We need to find the appropriate range of ![]() to simulate the stock price.

to simulate the stock price.