Strategic Firm Interaction, Returns to Scale, Environmental Regulation and Ambient Charges in a Cournot Duopoly ()

1. Introduction

The regulation of polluting firms by decentralized mechanisms is not only of theoretical interest but is also a policy issue that has assumed considerable significance over the last decade. Nonpoint source (NPS) pollution— that is, pollution from diffuse sources rather than one specific source—accounts for the majority of present day pollution, especially water pollution. Since NPS pollution originates from several sources, firm specific emissions are virtually impossible to measure and are moreover considerably complicated by issues of moral hazard1.

A central issue in environmental policy is the design of a regulatory system to address NPS pollution. Commandand-control policies for reducing nonpoint source (NPS) water pollution mandated under the Federal Water Pollution Control Act (FWPCA) have not been particularly successful. Ambient charges—charges based on the total amount of pollution irrespective of firm specific origins— constitute one possible mechanism of pollution control. The use of such charges has been widely discussed in the literature ([2-7]). Ambient charges have several advantages over other instruments of pollution control such as quantitative standards, effluent taxes and tradable permits. An effluent tax requires monitoring the amount of pollution generated from each source as well as an assessment of the abatement costs of the polluting firms ([8-12]). However such firm-specific information is difficult to gather and requires effective monitoring involving substantial enforcement costs.

Much of the earlier work on pollution control assumed polluting firms to be price takers. There is some literature on environmental policy under conditions of imperfect competition for point sources of pollution (see [13,14]). In contrast, environmental policy under NPS pollution and imperfect competition has hardly received much attention in the literature. More recently, [3] explores the effectiveness of ambient charges when NPS polluting firms cooperate with each other. Clearly, the issue of competetive interaction among nonpoint source polluters is central to the policy effectiveness of ambient based charges.

The fundamental objective of our paper is to study the effect of ambient charges on total NPS pollution in a Cournot-type duopolistic market. Such a setting clearly brings to the forefront the central issues of competitive interaction and its effect on the optimal design of ambient based pollution charges. Such duopolistic interaction is common in many industries. Prominent examples include Airbus and Boeing, Pepsi and Coca-Cola, Home Depot and Lowes, Canon and Nikon, Kleenex and Puffs, Fedex and UPS, Verizon and AT & T, PetroChina and Sinopec, etc. Many of these companies are located in industries like transportation, transportation equipment manufacturing, beverages, paper, petroleum, etc. that generate significant pollution and account for considerable pollution abatement operating and capital equipment expenditures.

We assume a two stage duopolistic game. In the first stage of the game, the regulator announces an ambient charge following which both firms choose their pollution abatement technologies. In the second stage after the pollution abatement technology has been chosen, the firms simultaneously choose their optimal output levels. The model assesses strategic firm interaction under alternative assumptions about production technologies (constant and decreasing returns to scale). Simulation is used to evaluate the effect of changes in the ambient charge on total NPS pollution under different technologies.

2. Ambient Charges, Pollution Abatement Costs and Expenditures

Periodically, the US Department of Commerce along with the Environmental Protection Agency (EPA) conducts a Pollution Abatement Costs and Expenditures (PACE) survey [15] that constitutes the most comprehensive source of information on capital expenditures and operating costs associated with pollution abatement for about 20,000 plants in the US manufacturing Industry. The most recent PACE data was published in April 2008.

The PACE survey divides pollution abatement costs into two broad categories—pollution abatement operating costs and pollution abatement capital expenditures. Table 1 reports overall data for the US manufacturing sector as well as 12 of the most significant subsectors. For the entire manufacturing sector, pollution abatement operating costs constitute roughly 78% of total abatement costs while pollution abatement capital expenditures constitute 22%. Of total pollution operating costs, pollution treatment constitutes 52%, disposal 22%, prevention 17% and recycling 8%. Air pollution abatement makes up the major bulk (42%) of operating costs while water (33%) and solid waste (26%) account for remaining costs. As far as capital expenditures are concerned, air pollution capital expenditures makes up nearly 66% while water (23%) and solid waste (11%) constitute the remaining expenditure. Among industries with the largest pollution abatement costs are transportation, paper, petroleum, beverages and transportation equipment manufacturing. As noted earlier, several of these industries are characterized by duopolistic competition.

Empirical assessments of ambient charges on pollution are fairly sparse. A recent study by the economy of Estonia2 tried to assess if ambient air pollution permits encouraged investment in pollution abatement technology. Pollution is a significant problem in Estonia; the economy’s ecological footprint is nearly 4 times larger than is considered economical and its energy intensity usage per capita is among the highest in Europe. A recent study by the National Audit Office of Estonia to assess the effectiveness of ambient air pollution permits revealed several problems. Current charges taxed hazardous pollutants— regardless of the level of danger they represented—at one and the same rate. Pollutants that were produced in large quantities were taxed at a lower rate than others while some pollutants were not taxed at all. In many cases pollution charges were set so low that is was far more economical to pay the charges than incur the cost of pollution abatement technology. The Estonian report highlights the many real world design and implementation problems that underlie ambient charges. Ambient pollution charges are only one part of a more comprehensive environmental regulatory system and are most effective when supported by other legal and administrative measures.

3. The Model under Constant Returns to Scale (CRTS)

The basic model relates to a Cournot type setting in which two firms  produce output

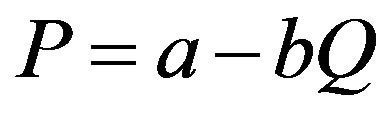

produce output . Market inverse demand is given by

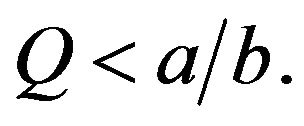

. Market inverse demand is given by  where

where  is total output. Market inverse demand, P, is positive for

is total output. Market inverse demand, P, is positive for  For simplicity set

For simplicity set .

.

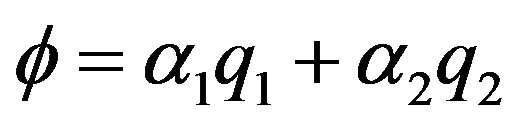

Now assume that this duopolistic market is subject to NPS pollution. Let  for

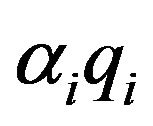

for  be the pollution abatement technology parameter of firm

be the pollution abatement technology parameter of firm . The pollution from firm

. The pollution from firm  is then equal to

is then equal to  and total pollution is given by

and total pollution is given by . Notice that

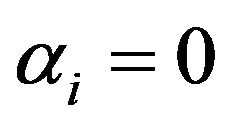

. Notice that  corresponds to maximum pollution abatement (zero output pollution) for an individual firm while

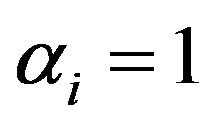

corresponds to maximum pollution abatement (zero output pollution) for an individual firm while  corresponds to no pollution abatement (100% output pollution). The form of the cost function, given the abatement technology of each firm, is given by:

corresponds to no pollution abatement (100% output pollution). The form of the cost function, given the abatement technology of each firm, is given by: