The Equity-Efficiency Trade-Off in the Presence of Distorting Taxation ()

1. Introduction

One of the most important objectives of fiscal policy is to design a tax system to balance the various desirable, but often counteracting, attributes of taxation: to raise the required government revenue in a way that treats individuals fairly (equity) without inflicting damage to private agents’ incentives to growth (efficiency).

These attributes are usually analyzed in an optimal taxation area of research, which is a normative approach to tax analysis based on the standard tools of welfare economics. However, the first-best allocation of resources and a fair income distribution can rarely be achieved simultaneously. This leads to a divergence between optimal tax theory and practical tax design but, at the same time, it provides a scope for researchers to develop models which could help policy makers to reconcile opposing theoretical and practical considerations, so as to devise appropriate tax schemes. One of the main objectives of the present article is to reach a compromise between tax designers and policy makers, when an optimal tax policy fails to be achieved, due to the existence of distortions arising from the response of consumers and wage earners to changes in (direct-indirect) tax rates. Ignoring that taxes are collected at some cost to various economic goals implies that basic policy prescriptions are unlikely to result in improvements in welfare.

The major contributions of our study to existing literature are twofold:

1) To extend the analysis of the optimal trade-off between equity and efficiency by including indirect taxation in the relative discussion. So far, it was changes in direct tax rates that could affect income distribution, assuming that the response of workers to taxation is mainly captured by the elasticity of the wage rate with respect to changes in direct tax rates. The extra assumption in our study is that consumers’ behaviour is significantly affected, if fiscal authorities make adjustments to indirect tax rates, given that indirect taxes tend to cause distortions by “forcing wedges” between post-tax and pre-tax prices.

2) To extend the analysis of the effects of an optimal tax system on economic equilibrium beyond the conventional Pareto’s maximisation framework. In a competitive market, there is no monopoly power and hence no market distortions through price setting. Private agents are taken to act as independent units and to interact via the price system. This ensures that there are no externalities and no public goods. In such a framework, the trade-off between equity and efficiency is evaluated in terms of whether tax-rate changes succeed in equating the marginal rate of substitution (MRS) and the marginal rate of transformation (MRT) between consumption and leisure.

The present study will keep distance from Pareto’s comfortable postulate of equality between MRS and MRT, due to the non-existence of distortions in a competitive economy. Such a postulate might be theoretically valid in the case of a utility function, in which consumption and leisure would be treated as independent variables. In the real world, however, consumption (net of indirect taxes) is significantly affected by indirect-tax induced changes in market prices, whereas working time may be greatly affected by a progressive income-tax system, that generates disincentives to work effort.

In short, the present study makes an attempt to overcome the problem that arises from the first theorem of welfare economics, according to which a competitive equilibrium is Pareto optimal. Adopting such a position would imply that the optimisation process leads to the equality MRS = MRT, due to the lack of distortions. Instead, our analysis will be based on the alternative assumption that allows for indirect-tax induced changes in consumers’ behaviour and direct-tax induced changes in wages to disturb the optimisation procedure. Equilibrium will be reached after eliminating these distortions (MRS ≠ MRT), by introducing appropriate fiscal-policy measures, which would not be set off against the electorate’s volition because of their preferences for equity (efficiency) over efficiency (equity).

Instead of disputing over the validity of the equity and/or efficiency hypotheses, an attempt is made in the present study to extend the analysis by producing argumentation in support of an alternative approach that overcomes the problem of the equity-efficiency dichotomy. Following the standard optimisation process, a simple social welfare function is maximized with respect to consumption and labour, subject to the government budget constraint. If there are no distorting factors arising from the level or structure of taxation and affecting the behaviour of consumers and/or workers, the manipulation of the first-order conditions leads to Pareto optimality. In this case, the marginal rate of substitution (MRS) is equal to the marginal rate of transformation (MRT) and no government intervention is required. However, if such distortions occur and the MRS takes on a different value from the MRT, a scope is provided for policy makers to eliminate them via changes in the direct/indirect tax scheme.

In other words, the aim of the present study is not to give credit to any of the above approaches. The indicators (proxy variables) which are employed in empirical or theoretical analyses to evaluate variations in income distribution and/or growth performance are not considered to be reliable measures of equity and efficiency (see Thurow, 1981 ). For example, comparing the top and the bottom quartiles of the income scale, before and after taxes, or putting the Gini coefficient into practice, tends to ignore the importance of the skill level as a determinant of income inequalities. Similarly, the use of the rate of growth of GDP to measure variations in efficiency levels ignores the quality aspects of growth (environmental effects, incentives to the factors of production, potential growth, the use of human and physical resources, and so on), which enter the welfare function.

In summary, the research innovation in our study is that it introduces well-founded combinations of direct and indirect tax rates which can be used by fiscal authorities to define the optimal choice of equity-efficiency objectives compatible with the existing budget constraint or other potential budget constraints approved by the electorate.

In section 2, a literature review is presented with the most important contributions to the equity-efficiency doctrine. In section 3, we outline some of the important considerations that have been largely ignored by the conventional analysis, by using econometric techniques, simulations, numerical examples and mathematical tools to underline the practical implications of incorporating our theoretical work to the sphere of applied fiscal policy management. In section 4, a dynamic macroeconomic model is built-up to trace out the intertemporal choices of policy makers and to permit comparisons with the static model. Finally, section 5 concludes the discussion, laying out directions for further work.

2. Literature Review

Literature on both the theory and the empirical evidence on the equity-efficiency dilemma has never gone out of print. For example:

• Tillmann (2005) argues that optimal income redistribution policies and Pareto optimal allocations can never co-exist, if there is variation in individual preferences. In our study, we claim that government intervention in the form of employing equity and/or efficiency enhancing tax-rate adjustments can lead to Pareto optimality and competitive equilibrium.

• Ng (1985) supports the view that a Pareto optimal outcome may result in an unacceptably unequal distribution of income, with ambiguous effects on incentives and growth.

• Thurow (1981) and Okun (1975) deal with the question of whether the co-existence of two discrete fiscal objectives in the same analytical model structure can bring out into the open the problem of whether equity and efficiency are rivals or complementary factors in the design and implementation of economic policy regulations.

• A number of researchers (see, for example, Okun, 1975 ) support the view that equity and efficiency cannot be achieved simultaneously: a greater equity comes at the cost of a loss of efficiency. Policy situations that promote greater equity will have adverse effects on efficiency and vice versa. In particular, income redistribution causes changes in work effort, in savings and investment behaviour and in attitudes (motivation to acquire human capital), thus leading to less efficient use of resources.

• Stevans (2012) contends that existing literature finds no empirical evidence for the argument that economic incentives are necessary for capital accumulation and growth or that inequality has any significant impact on investment. The resulting policy situation is one in which equity and efficiency complements each other.

• For further discussion of the equity-efficiency controversy, see for example Dalamagas et al. (2022) , Goulder et al. (2019) , Stantcheva (2020) , Piketty and Saez (2013) , Gürer (2021) , Colas and Hutchinson (2021) , Jacobs et al. (2010) , Gerritsen (2017) , McKenzie (2021) , Muinelo-Gallo and Lescano (2022) , Magnani and Piccoli (2020) .

3. Modeling Structure

3.1. The static Model

3.1.1. Some Introductory Notes

In building econometric models two forms of utility function are usually employed, always in the framework of a competitive economy.

1) The first formulation is related to the so-called private-sector oriented utility function, in which the utility of the household depends upon their consumption, c (or income) and the hours worked, l, i.e.

Subject to the household’s income (y) constraint

with the hourly wage rate, w, being determined in the labour market at the point of intersection of the labour demand and supply curves. At this point, the marginal rate of substitution (MRS) in consumption is equal to the marginal rate of transformation (MRT) in production, i.e. equal to the wage rate,

and the equilibrium condition in the economy is satisfied. The equilibrium point is determined after maximising the utility function with respect to consumption and hours worked subject to the income constraint and manipulating the first-order conditions.

2) The second formulation refers to a public-sector oriented utility function, that is known as Samuelson-type utility function: the household’s utility depends on:

a) The consumption of private goods, c, where consumption is assumed to be equal to income;

b) The supply by the government or, equivalently, the household’s demand of the tax-financed public goods and service, G, i.e.

subject to the government budget constraint,

where

stands for the indirect tax rate (indirect tax revenue as a percentage of income),

represents the direct tax rate (direct tax revenue as a percentage of income) and Y is the private-sector’s taxable income.

The maximisation of the new utility function with respect to

and

, subject to the government budget constraint, and the manipulation of the first-order conditions lead to an equilibrium point, where the marginal rate of substitution between private and public goods is equated to the marginal rate of transformation between direct and indirect tax rates,

The MRT in a Samuelson-type utility function measures the marginal cost in terms of equity-efficiency arising from moving from a direct (indirect)-tax financing of government spending to an indirect (direct) one.

By analogy with the above MRT definition, the MRT in a private-sector oriented utility function is considered to be the marginal cost of labour (wage rate) in the production of private goods.

What is of crucial importance in any econometric analysis is that both the market oriented and the Samuelson-type utility functions can be used alternatively in any maximisation exercise, on the basis of the rule of relative prices and the predictions of Walras’ law. In particular:

1) The basic interpretation of price given in the Arrow-Debreu economy: According to this interpretation, the price is considered to be the number of units of numeraire that have to be surrendered in exchange for one unit of a commodity, where the numeraire is a good denoted as having unit price. Suppose for simplicity that the consumer wants to purchase one unit of the commodity XA at price PA = 10 and one unit of the good XB at price PB = 25. In this case, the researcher has to solve two demand functions with two unknowns, the prices PA and PB (in our example, the prices are given to facilitate the analysis). Arrow-Debreu’s suggestion, adopted in our text, as well as in most empirical studies, is to hold that one unit of XB can purchase two and a half (2.5) units of XA. In this case, we save one degree of freedom, since we must solve one equation at

one unknown, the relative price

:

with the price of XA being used as numeraire, PA = 1. Thus, throughout our analysis, it is only relative prices that determine private and government choices.

2) Walras’ law provides results that make more widely applicable the aforementioned Arrow-Debreu’s definition of numeraire and carry significant implications for the analysis of the general equilibrium analysis. Suppose that we have a system of n (demand) equations with n goods and n prices to be solved simultaneously. The content of Walras’ law is that these n equations are not independent and that only n − 1 actually need to be solved. In other words, the equality form of Walras’ law implies that, if demand is equal to supply in n − 1 equations of the system, that is if n − 1 markets have zero excess demand, so must the nth. Hence, there are only n − 1 independent equations in the system since the value of any n − 1 implies the value of the nth. By using the price of any equation of the system as a numeraire, there are also n − 1 relative prices that determine trade patterns. Thus, the set of n − 1 independent equations can be solved for n − 1 relative prices.

Walras’ law does have another implication that has been exploited in public economics. The statement above can be modified to the following. If n markets are in equilibrium and all agents but one are satisfying their budget constraint, the remaining agent must also be satisfying his budget constraint. The consequence of this statement in an economy with a government is that if the n markets are in equilibrium and households are meeting their budget constraints, the government must also be meeting its budget constraint. When describing such an economy, it is therefore optional to include the government budget constraint as an equation and to consider equilibrium on n-1 markets. By the same token, if private and public sector markets are in equilibrium and the government meets its budget constraint, it is optional to include the household’s income constraint as an equation. Consequently, we can consider equilibrium solely in the government sector, ignoring the income constraint of the private agents.

For a detailed description of the Arrow-Debreu economy and Walras’ law, see Myles (2012) , Introduction.

3.1.2. Describing the Static Model

Since the aim of the present study is to trace out a reliable approach that would optimise the distribution of the tax burden in a way that would meet both targets of income redistribution and efficient resource allocation, it is natural to opt for a Samuelson-type budget constraint in carrying out our analysis. Central government planning, with the power to re-design radical state-budget policies remaining with the fiscal authorities, is required to develop an effective innovation process with superior economic, social and political changes.

As becomes evident, in the context of the present analysis, the elements of the utility function, i.e. consumption (or income) and labour (or leisure), is no longer tenable to be determined exogenously because the maximisation of such a utility function subject to a government budget constraint would not ensure reliable results. As a matter of fact:

1) indirect taxes are considered to erode the purchasing power of the households and reduce private consumption.

2) income taxes are usually seen as a direct means of effecting income redistribution in order to meet equity objectives, even though they are viewed as a major disincentive to work effort and entrepreneurship. Therefore, disregarding the influence of taxation on the two elements of the utility function would obscure the importance of the diffusion of fiscal-policy measures into the socio-economic activities of private agents. As a consequence, consumption in Equation (1) of our model is treated as a function of indirect taxes (and other determinants), whereas labour supply is treated as a function of direct taxes and a set of other explanatory variables.

Consider an economy with two commodities, a consumption good c ≥ 0 and a single labour service, l, where 0 ≤ l ≤ 1. To derive the efficiency rule, it will be assumed that the economy consists of H households, indexed

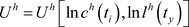

, with identical preferences. Each household has a utility function

(1)

(1)

Private consumption (net of indirect taxes) is taken to be a function of the indirect tax rate,

, and the exogenously determined disposable income, y = wl, whereas labour supply is a function of the direct tax rate,

, and the exogenously determined wage rate, w, that is,

(2)

(3)

Note that the utility function (1) is continuously differentiable, strictly increasing in consumption and strictly decreasing in leisure, i.e.

To characterise the set of first-best or Pareto efficient allocation, each household chooses consumption and working time (hours of work) to maximise their utility level, constrained by the condition that the government will raise sufficient revenue from direct and indirect taxes to finance public spending, G, i.e.

(4)

where

, and

.

The lagrangian for this maximisation problem is written

(5)

Note that the set of Equations (1) to (5) describe a simple static model of utility maximisation, in the context of a theory of optimal taxation that explores optimal (in)direct tax formulae with utility functions logarithmically linear in consumption and leisure (or working time). In a static framework, there are no transitional dynamics, the steady state is reached immediately and the elasticities of consumption and leisure with respect to the (in)direct tax rates are finite. Such a framework allows for a tractable optimal tax analysis with formulae expressed in terms of empirical elasticities and social preferences that can address important fiscal-policy questions. See, for example, Saez and Stantcheva (2018) , Chiappori and Mazzocco (2017) , Gayle and Shephard (2019) and Farhi and Gabaix (2020) .

A dynamic utility maximisation model will be considered in Section 3.

Coming now to the solution of the static maximisation problem, it is presumed throughout that:

• Responses of consumption spending to changes in indirect tax rates are equalised across households and to the population as a whole, i.e.,

, and

• Responses of labour supply to changes in direct tax rates are also equalised across households and to the population as a whole, i.e.,

.

The necessary conditions describing the choice of both the direct tax rate and the indirect tax rate are

(6)

(7)

Substituting the corresponding derivatives from (2) and (3) into (6) and (7), we get

(6a)

(7a)

Dividing (6a) by (7a) gives

(8)

Following the simple mathematical formula

Equation (8) takes the form

(9)

Given that the ratio of

stands for the marginal rate of substitution between consumption and labour and

,

with

representing the marginal rate of transformation between consumption and labour, Equation (9) takes the form

(10)

Equation (10) implies that market equilibrium exists (MRS = MRT) only if

,

that is, if

(11)

The interpretation of (11) is that:

1) Pareto efficiency results only if

• The direct-tax elasticity of labour supply (

) and the indirect-tax elasticity of consumption goods (

) exactly offset each other,

• The percentage changes in both direct and indirect tax rates are equal,

, and

• The direct-tax revenue share in total tax revenue is equated to the indirect-tax revenue share,

.

2) When the direct-tax elasticity of labour supply differs from the indirect-tax elasticity of consumption, then the only way to achieve Pareto efficiency is to change the structure of the tax system by placing greater emphasis on direct or indirect taxation.

In the usual case of asymmetric responsiveness of labour supply and consumption to changes in (in)direct tax rates, restructuring of the tax system is required to redress the balance. Policy makers have to reschedule the ratio of the two sorts of tax rates in a way that eliminates the tax-induced distortions in demand and labour market. To establish a reasonable relationship between indirect and direct tax rates, Equation (11) is solved for ti to generate the following reaction function:

, or

(12)

where k is a constant that captures the initial conditions in the economy. From Equation (12), we receive

(13)

In order to measure the response of the indirect tax rate to changes in the direct tax rate in a practicable and manageable way, that would help fiscal authorities to properly re-design the tax structure, we must turn to the empirical investigation of our theoretical proposition by using market data and assigning numerical values (from the real economy) to the variables of interest.

3.2. The Empirical Evidence and Simulations of the Static Model

The scope of our empirical analysis is to provide practical policy recommendations. This implies that the tax rules must be capable of being applied to the data and to the estimated values of the resulting optimal tax rates. All the data series used in evaluating the parameters of the relevant relationships have been taken from Ameco Database (Eurostat) and OECD Statistics (see Appendix 2). To put our proposals into practice and to reach an optimal (in)direct tax-rate regime, we must further manipulate Equation (13).

Equation (13) describes an infinite number of combinations of optimal direct and indirect tax rates. It measures the extent to which the indirect tax rate should change after a pre-determined one percentage-point increase (decrease) in the direct tax rate to maintain equilibrium.

A reverse relationship between the above two tax rates can also be found by dividing (7a) by (6a) and replicating the forgoing procedure that was employed for deriving Equation (13):

(14)

Equation (14) may be interpreted as providing a map of indifference curves that present the preferences of policy makers for direct (indirect) tax rates over indirect (direct) tax rates. The construction of this map is the necessary condition for eliminating distortions coming from the labour market and/or from the market for consumer demand. It can be shown that, in Equation (14), the direct

tax rate is a convex function of the indirect tax rate, if

. In contrast, the indifference curves are concave to the origin if

.

It is well understood that the design of a map per se that includes an infinite number of indifference curves, on the basis of (14), does not seem to solve the problem of determining an equilibrium point. It is clear that Equation (14) by itself cannot lend support to a mathematical method capable of proving the existence of equilibrium, unless a constraint on the direct/indirect tax-rate structure is introduced: the equality between government spending, G, and the sum of direct and indirect taxes (Ty + Ti) is considered to be a contextual and pragmatic constraint, i.e.,

or, dividing by national income,

(15)

The intersection of the budget constraint and one of the indifference curves gives the equilibrium values for the direct and indirect tax rates.

With the parameter values of γ and δ being given by estimating Equation (4), the last step is to assign an appropriate value to the constant, k, and then to run two regressions (Equations (2) and (3)) for each of the six countries considered (France, UK, Italy, Germany, USA, Japan) in order to estimate the coefficient

values of

and

. The choice of these six countries was

based on two criteria: 1) the adequacy, availability and reliability of the data on crucial (especially qualitative) variables, and 2) the existence of both experienced and well qualified personnel in the public sector and fiscal policy managers, capable of making major changes in re-designing economic policy. The logarithmic form of both the consumption and labour-supply functions is chosen because it provides currency-free elasticity estimates for both the indirect-tax induced changes in demand and the direct-tax induced changes in labour supply.

It should be stressed from the outset that it is beyond the scope of the present study to construct a fully-fledged system of equations (or an econometric model), that would capture the effects of all of the explanatory variables on consumers’ behaviour and labour-supply incentives. What we actually intend is to describe how our proposed model could successfully function in practical, real world terms, as a rough guide to policy makers. To this end, we opt for employing econometric estimates based on Equations (3) and (4) for each country rather than numerical values or numerical examples.

The results for the parameters of interest are presented in Table 1 (values of remaining coefficients, significance levels and other diagnostic tests are provided on request).

Table 1 is the estimates of the main coefficient values. Please have an introduction to the content in the Table 1.

Table 1 provides the parameters of the model that determines the optimal choice of the pair of direct and indirect tax rates within the framework defined by a given budget constraint. These parameters are shown to be the indirect tax elasticity of consumption, a1, the direct tax elasticity of labour supply, b1, a constant, k, and the ratio of indirect to direct taxes, γ/δ.

The constant term is taken to stand for the initial conditions prevailing in an economy, in which tax-induced distortions that arise from the labour market and/or from consumer demand should be minimised via introducing carefully designed changes in the mix of direct-indirect tax rates. A widely accepted indicator of a constant term is argued to be the ratio of average direct to average indirect

tax rates,

. Τhe value of k can be determined either directly from the Government Finance Statistics or indirectly by running the following regression:

(16)

The inverse logarithm of k in (16) may be interpreted as representing the initial conditions in each country, as shown in Table 1 (column 5).

To summarise, the three steps that should be taken to estimate the optimal (in)direct tax rates are the following:

1) To introduce the parameter values—as shown in columns 4 - 7 of Table 1—for each country into Equation (14), in order to obtain a numerically defined map of indifference curves, depicting the preferences of the policy makers over feasible combinations of direct and indirect tax rates.

2) To employ Equation (15)

, or

(17)

where the average tax rate,

, is taken from the official government statistics of each country. The budget constraint (17) describes affordable direct-indirect tax-rate combinations.

![]()

Table 1. Estimates of the main coefficient values.

Source: Ameco database (Eurostat), OECD Statistics.

3) To substitute (14) into (17)

(18)

assuming that Equation (14) holds for any combination of feasible direct and indirect tax rates (including their average values).

Equation (18) can be easily solved in terms of the (average) indirect tax rate. Substituting the latter into (17) gives the (average) direct tax rate.

The pair of (in)direct tax rates derived from (18) and (17) determine the point, at which the government budget constraint intersects the potentially higher indifference curve and corresponds to the optimal combination of direct and indirect tax rates. Accordingly, such a mixture of (in)direct tax rates is argued to eliminate any distortion, originating in the labour market and/or in the market for consumer goods and to achieve equilibrium via equating the marginal rate of substitution with the marginal rate of transformation.

Table 2 presents the details of calculating the optimal indirect tax rates, while Table 3 presents the actual (in)direct tax rates vis-a-vis the optimal ones.

A graphical representation of the budget constraint, the indifference curve, the equilibrium point and the optimal tax rates for each country is given in Appendix 1 (Figures A1-A6). In particular, the familiar conflict between equity and efficiency is illustrated in these figures, as well as in the results of Table 3. The indifference curve is derived from the solution of the relation

. The intersection of the indifference curve and the budget constraint

marks the point where the optimal combination of direct-indirect tax rates is achieved (point A).

The resulting optimal equilibrium pairs of direct and indirect tax rates for each of the six countries considered are then used to construct Table 3, columns 4 and 5. Finally, the above optimal values for (in)direct tax rates are compared to the corresponding actual (average) tax rates (columns 1 and 2) to provide valuable information as to the required restructuring of the tax system in the direction of removing distortions originating in the labour market and/or in consumer demand.

![]()

Table 2. Estimation of the indirect tax rates.

Source: The estimations are based on the parameter values of Table 1.

![]()

Table 3. Actual and optimal direct and indirect tax rates.

Source: Ameco database (Eurostat) and OECD Statistics (OECD.Stat) for columns 1 - 3.

Consider, for example, the case of the UK. In this country, the optimal indirect tax rate (0.54) is higher than the actual (average) indirect tax rate (0.294), whereas the optimal direct tax rate (0.134) is lower than the actual (average) direct tax rate (0.344). This finding may be interpreted as follows:

1) Actual direct-tax incentives are very effective in discouraging people both to work harder and to save and invest more of their income.

2) Actual indirect taxation tends to provide a strong incentive to consume more and save less of their income.

Accordingly, at a given level of total tax revenue, optimal taxation rules recommend that more resources be devoted to efficiency criteria, via causing the tax burden to move from direct to indirect taxation.

The general conclusion that arises from the inspection of Table 3 is that all the sample countries appear to assign a greater social welfare weight to equity considerations. Even though our findings seem to be in line with those of many other studies (see, for example, Sandmo, 1976 ; Forbes, 2000 ; Okun, 2015 ), it remains to be seen whether employing data from other countries or using alternative methodological procedures would differentiate the observed tendency of the tax systems in the sample countries to weigh the fair distribution of income heavily against efficient allocation of resources. Last but not least, it should not escape our attention that the conclusions of the present study are based on the assumption that high direct tax rates distort optimal households’ choices between work effort and leisure, whereas high indirect tax rates discourage consumption and cause serious damage to the welfare state of the poor.

4. The Dynamic Model

4.1. Introduction

In the dynamic, macroeconomic framework of this section, we adopt the Solow growth model to explore how the preferences of the representative household change over time and how these preferences influence the path of direct-indirect tax-rate combinations and the policy makers’ optimal choice between equity and efficiency through time. Such an extention of the theoretical discussion is necessary in order to incorporate the temporal and social aspects of an optimal tax policy.

The dynamic analysis in the present context is based on Solow (1956) growth model and its extension to the public sector by Barro (1990) and Mankiw (1992) . The Solow model or endogenous growth model is an economic model of long-run growth. It attempts to explain long-run growth by looking at capital accumulation, labour or population growth and increases in productivity largely driven by technological progress. A key component of growth is savings and investment which raise the capital stock and hence the full-employment income.

Savings, investment, factor accumulation and technological growth are exogenous. The production function with physical capital K, labour L and technological knowledge A, is given by

Time affects output only through K, L and A. The term for a labour-augmenting technology is “effective labour”. Land and natural resources are ignored. With constant returns to scale in the context of a Cobb-Douglas production function, we get

with L from now on representing effective labour. Setting

and

, the production function takes the form

.

Assuming constant and exogenous savings rate, s (or investment rate) and constant depreciation rate of capital, δ, the net capital formation is given by the relationship

The dynamics of capital per unit of effective labour is defined as

where n stands for the growth rate of effective labour.

Thus, the first term in the last equation is the actual investment in physical capital per unit of effective labour and the second term is the effective depreciation of capital per unit of effective labour. The steady state equilibrium occurs at such a value of capital per effective labour,

, that

, i.e.

Note that, at

, investment equals effective depreciation and k remains constant over time, because there is only a single value of

, according to Inada conditions:

and

.

4.2. Description of the Dynamic Model

The steady-state properties of our econometric structure will be explored within the framework of the aforementioned Solow growth model. However, since some crucial features of our static model in Section 2, such as the utility function and the budget constraint, are not normally incorporated in Solow’s formulation, the latter will be slightly modified to bridge the gap. The manipulation of the first-order conditions from the maximisation process will allow us to evaluate a number of parameters which are indispensable for carrying our discussion and argumentation to a logical conclusion.

Consider an economy with H households, who have identical preferences and differ only in their skill level, the average level of which is given by the prevailing wage rate, w. Each household aims at maximising a utility function of the form

(19)

subject to the constraints

(20)

(21)

(22)

(23)

(24)

(25)

where A and B are constants, C represents consumption, L stands for labour supply (=number of annual working hours), Y (=GDP) is taken to be a function of both the capital stock, K, and labour supply, and the level of investment, I, is defined as a constant proportion, s, of GDP.

There are two additional constraints: Firstly, the government budget constraint, i.e. a balanced budget, with government spending, G, being equal to the total tax revenue, T. The latter is equal to the sum of indirect tax revenue (=average indirect tax rate, ti, multiplied by the private consumption spending) and direct tax revenue (=average direct tax rate, ty, multiplied by the wage income, wL). The second additional constraint is the national income identity, where GDP is equal to the sum of private consumption, investment and government expenditure.

Given the initial (base-year) values of capital and income, K0 and Y0 respectively, the equation system (19)-(25) may be re-written as follows:

(26)

where

(27)

(28)

, or

(29)

or  (30)

(30)

The Lagrangean of maximizing the utility function (26), subject to the constraint (29) is

(31)

The first-order conditions from maximising (31) with respect to consumption and labour are

(32)

(33)

Dividing (32) by (33) gives

(34)

Let us now substitute (34) into (29)

, or (35)

(36)

Rearranging the terms of (36), we get

(37)

Solving (34) with respect to C, we find

(38)

(38)

The next step is to substitute (38) into (29)

, or (39)

(40)

Equations (20), (21), (30), (37) and (40), which are repeated below

(41a)

(41b)

(41c)

(41d)

(41e)

can be said to represent a system of five equations with five unknowns:

C, L, ti, ty, w

which can be solved simultaneously to provide optimal values for the direct-indirect tax rates—and the remaining three variables—for the static model (one-step or current optimisation).

To turn the static model into a dynamic one, we should follow a number of steps:

1) We estimate econometrically, by using the 2SLS method, Equations (41a), (41b) and (41e) to determine the values of the parameters A, B, a1, a2, b1, b2, γ, δ. The value of the parameter s is calculated on the basis of Equation (23), as the ratio of investment to GDP. The capital allowance, r, is derived from the formula

,

where K stands for the capital stock.

The parameters of the utility function cannot be directly estimated by any econometric technique, because the dependent variable, U, is not a cardinally measurable variable. However, these parameters can be indirectly calculated by

manipulating the relation (29),

.

It is assumed that the utility function is homogeneous of degree one, that is,

. Thus, the relation (34) takes the form

, or (42)

, or

, or

, or

, and

(43)

The estimated values of the above thirteen parameters are presented in Table 4, for all the sample countries.

2) The second step is to define the horizon of the optimisation process. For the purpose of the present analysis, an horizon of twenty years is considered to be a sufficient period to capture the short and long-term paths of tax-rate changes.

3) We use the value of the capital stock in the first year of the sample period, K0. Note that the data set for the actual capital stock is provided by Eurostatistics for the EU countries (France, Germany, Italy). For the remaining sample countries (USA, UK, Japan), the capital stock is estimated by employing the widely used formula

where n is taken to be equal to 20, in order to justify a plausible average depreciation rate of 5% (or 20-year life expectancy) of the (public and private) capital stock.

The initial (base year) value of the capital stock, K0, is then recalculated, year after year, for each of the remaining years, till the end of the sample period, after successively updating the relation

(44)

The updated as above values of the capital stock are now introduced into the system of Equations (41a) to (41e) to determine the path of intertemporal movements of the variables of interest. To this end, Equations (41a) to (41e) are estimated for every period of time that is part of the longer 20-period of time that is considered with respect to the direct-indirect tax rates and the remaining variables (C, L, w).

4) To proceed with the sequential updating and computation of Equations (41a) to (41e), by solving this equation system. The first stage in the process is to solve Equation (41e) in terms of L, given the values of GDP and the updated values of the capital stock. The second stage is to solve Equations (41b) and (41d)—in logarithmic form—simultaneously in terms of ty and w. The third stage is to

![]()

Table 4. Parameter values for the equation system.

substitute these values of L, ty and w into (41a) and (41c) and solve them simultaneously in terms of ti and C, in every subperiod of the selected horizon.

4.3. Discussing the Results of the Dynamic Model

The quantitative findings from the estimation of the dynamic model, as well as those from the estimation of the static model, are presented in a modified form in Table 6. Specifically, they are depicted in a qualitative form to facilitate the comparison between the two models and to help interpreting the internal workings of each model and their possible interactions. Lines 2 and 3 of Table 6 simply reproduce the basic conclusions of the static model:

The actual direct tax rates are higher than the corresponding optimal direct tax rates in all of the sample countries, whereas the actual indirect tax rates are lower than the corresponding optimal ones.

As becomes evident, policy makers in these countries concentrate mainly on progressive income taxes, which are claimed to be a major disincentive to work effort but, at the same time, they contribute to a fair distribution of income. In other words, the tax policy in these countries aims at meeting the equity objective, overlooking the efficiency criterion. Similarly, low actual indirect tax rates imply that a low (actual) tax burden is concentrated among goods consumed by low income groups, thus favouring the fair distribution of income.

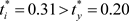

Given that policy makers in the sample countries seem to sacrifice the efficiency target of taxation in favour of equity considerations, one should expect that, at the optimal level, the optimal direct tax rates will be lower than the optimal indirect tax rates. This is really shown to be verified, in the first line of Table 6, for all of the sample countries, except for the United States. The same tendency seems to prevail for the optimal direct-indirect tax relationships in the dynamic model (last line in Table 6).

Table 5 briefly reviews some evidence on the time path of optimal direct-indirect tax rates over the first ten-year subperiod of our steady-state growth experiment and allows us to consider the implications of the alternative formulations of the tax-rate schedules. However, even though the optimal direct-indirect tax-rate combinations of the static model (see Table 3) seem to be in compliance with the direct-indirect tax-rate profile of the long-run evolutionary process, the tax-rate pairs are shown to exhibit considerable variations over time and serious discrepancies among the six sample countries. To be specific,

1) France: Starting with a static optimal tax-rate scheme that is clearly in support of efficiency (

), France appears to reverse the earlier policy in favour of a mild equity objective, with optimal long-term income tax rates slightly above the optimal long-run indirect tax rates over the first ten subperiods. However, the data for the remaining ten subperiods (not displayed in the table but available on request) are in inverse relation to our findings related to the first ten subperiods of the steady-state growth model.

2) Germany: The short-term findings of the static model show a pro-efficiency attitude of Germany’s tax system ( ). It was in the first five subperiods of the dynamic model that our estimates did change the direction of the tax-policy target to its opposite, with the emphasis being shifted to equity considerations. However, policy-makers gave priority again to efficiency during the next five subperiods of the dynamic model.

). It was in the first five subperiods of the dynamic model that our estimates did change the direction of the tax-policy target to its opposite, with the emphasis being shifted to equity considerations. However, policy-makers gave priority again to efficiency during the next five subperiods of the dynamic model.

3) United Kingdom: The tax system of the UK appears to be coded with an impressive pro-efficiency attitude in the short-run static model (

) and the same attitude is shown to be taken during the first five subperiods of the dynamic model, although at a slower pace. Nevertheless, the last five subperiods of the steady-state growth put the equity-efficiency priorities in the opposite order (i.e. of equity).

4) United States: The USA is the only country in our sample that appears to place as much emphasis on equity in the static model (

) as it does in the first five subperiods of the dynamic model. Priorities change in the opposite direction by focusing on efficiency considerations during the last five subperiods of the steady-state growth model.

![]()

Table 5. Optimal direct-indirect intertemporal tax rate changes of the dynamic model for the first ten of the twenty periods examined.

![]()

Table 6. Comparison of actual-optimal (in)direct tax rates (static-dynamic models).

Note: The asterisk represents optimal values of (in)direct tax rates.

5) Italy: The main characteristic of the Italian tax system is that it does not take good care of the process of weighing up the pros and cons of the controversy over the equity-efficiency dispute. Our estimates point to a clear-cut position of policy makers in support of the equity principle during the entire 20-period horizon of the dynamic model, in sharp contrast to the short-run support for the efficiency criterion.

6) Japan: The tax scheme of Japan is shown to follow the track of the Italian tax system. Estimation results demonstrate a consistent equity profile throughout the 20-period horizon of the dynamic model, even though the short-run outcome of the static model exhibits a mild anti-equity performance.

It should be stressed that, regardless of the results obtained when we get through to the first ten sub-periods, the validity of the estimates of the static model tends to be verified if we take into account the average estimates of the total 20-period horizon.

Lastly, the optimal tax rate profile of the USA should not escape our notice (lines one and four in Table 6). In contrast to what happens to the rest of the sample countries, the optimal direct tax rate (

= 0.229) is slightly higher than the optimal indirect tax rate (

= 0.212). The optimal tax profile in not significantly different from the actual tax rate profile (ty = 0.276, ti = 0.16 in Table 3). Both tax profiles are of the same ordering of the tax rates, even though the actual direct-indirect tax rate margins are larger than the optimal ones. In essence, the optimisation process does not introduce major reforms in the tax system of the USA.

5. Concluding Remarks

So far, the focus of the tax literature on the equity-efficiency dichotomy has been on the role of personal income taxes in shaping the structure of the equity vs. efficiency basic idea. It is not a common practice to frame this object in terms of the ongoing discussion that is characterised by the distortions arising from the presence of indirect taxes. This paper presents a new feature of the Mirrless problem that takes the form of reaching an efficient co-existence of direct and indirect taxes and explores the practical insights that it provides.

In carrying out our analysis, the principle of equality between the marginal rate of substitution and the marginal rate of transformation is used to determine and eliminate the distortions originating in both the labour market and demand as a result of introducing suboptimal combinations of direct and indirect taxes. We demonstrate that this objective can be satisfied by making direct and indirect tax-rate adjustments, which are capable of minimizing these distortions. Our methodology is used to analyse existing tax schedules for six developed countries, providing meaningful answer to the question of whether the cost of overcoming the problem of inefficient tax systems is great enough to negate the value of improving social welfare.

A well-founded answer to the above question requires testing appropriate combinations of (in)direct tax rates and then using them to simulate alternative MRS-MRT equality conditions. The results of these experiments in our study strongly imply that the tax systems of the sample countries are mixed: actual tax systems give little weight to efficiency concerns relative to equity, even though the efficiency gains might be greater than the opportunity cost associated with sacrificing part of the equity objective. On the contrary, the tax systems of the static model give the opposite evidence on the subject.

To be more specific, the estimates of the static model show that in just one country, France, the prevailing actual direct/indirect tax-rate combinations tend to favour efficiency concerns, in line with the corresponding optimal combinations. In four other countries (UK, Italy, Germany, Japan), the actual direct/indirect tax-rate combinations seem to support equity factors, in sharp contrast to the optimal ones which lend support to the efficiency target. Lastly, the USA is the only country that is a real pro at planning an equitable static direct/indirect tax-rate mix, following the optimal-level results which also point to a fair income distribution.

It is worth noting that the results of the long-run dynamic experiments over a 20-period horizon construct a continuous interplay between equity and efficiency objectives within subperiods for each country and through time. However, on the average, the optimal inferences of the dynamic model tend to coincide with the corresponding inferences of the static model (though to a different degree).

Appendices

Appendix 1. Determination of the Optimal Direct-Indirect Tax Rate Combinations Leading to a Pareto Efficient Trade-Off between Equity and Efficiency

![]() Note: the data for the construction of the indifference curve and the budget constraint have been taken from Table 1.

Note: the data for the construction of the indifference curve and the budget constraint have been taken from Table 1.

Figure A1. France: competitive equilibrium with optimal combination of direct and indirect tax rates.

![]() Note: the data for the construction of the indifference curve and the budget constraint have been taken from Table 1.

Note: the data for the construction of the indifference curve and the budget constraint have been taken from Table 1.

Figure A2. UK: competitive equilibrium with optimal combination of direct and indirect tax rates.

![]() Note: the data for the construction of the indifference curve and the budget constraint have been taken from Table 1.

Note: the data for the construction of the indifference curve and the budget constraint have been taken from Table 1.

Figure A3. Italy: competitive equilibrium with optimal combination of direct and indirect tax rates.

![]() Note: the data for the construction of the indifference curve and the budget constraint have been taken from Table 1.

Note: the data for the construction of the indifference curve and the budget constraint have been taken from Table 1.

Figure A4. Germany: competitive equilibrium with optimal combination of direct and indirect tax rates.

![]() Note: the data for the construction of the indifference curve and the budget constraint have been taken from Table 1.

Note: the data for the construction of the indifference curve and the budget constraint have been taken from Table 1.

Figure A5. USA: competitive equilibrium with optimal combination of direct and indirect tax rates.

![]() Note: the data for the construction of the indifference curve and the budget constraint have been taken from Table 1

Note: the data for the construction of the indifference curve and the budget constraint have been taken from Table 1

Figure A6. Japan: competitive equilibrium with optimal combination of direct and indirect tax rates.

Appendix 2. Data Sources

The annual data cover the period 1991 to 2021.

Private final consumption expenditure, Final consumption expenditure of general government, Gross Domestic Product (GDP), Direct tax revenue, Indirect tax revenue, Direct tax rates, Indirect tax rates, Αnnual hours actually worked, Hourly wage rate:

Organisation for Economic Co-operation and Development (OECD) database. Data taken from 2022—OECD Statistics (OECD.Stat).

Gross fixed capital formation, Net fixed capital formation, Net capital stock, Gross capital stock, Consumption of fixed capital:

1) For the United States, the United Kingdom and Japan: Organisation for Economic Co-operation and Development (OECD) database. Data taken from 2022—OECD Statistics (OECD.Stat).

2) For Germany, France and Italy: Ameco Database (Eurostat). Data taken from 2022—Ameco Database.