1. Introduction

Accounting, recognized as the “language of business”, counts the results of economic activities of an organization and conveys this information to stakeholders, investors, creditors, management, and regulators. The classic accounting was established in 1494 by Italian mathematician Luca Pacioli who was the first person to publish a work on the double-entry system of book-keeping [1] . In the dou- ble-entry accounting system, at least two accounting entries are required to re- cord each financial transaction where every entry to an account requires a corresponding and opposite entry to a different account [2] .

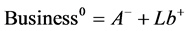

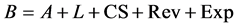

Double-entry bookkeeping is governed by the accounting equation:

Assets = Liabilities + Equity.

At any time point, the equation should be true. Therefore, a change in one account must be matched with a change in another account. The terms debit and credit are used to record these opposite changes [2] . However, the usage of these terms in accounting is not the same with their everyday usage, sometimes even counter-intuitive, which makes accounting difficult for ordinary people to understand. Even worse, there is no consistency for an increase or a decrease of accounts by a debit or a credit post, which makes accounting even tougher. To break down these difficulties, I brought chemistry concepts to accounting.

Accounting equation is similar to chemical equation after several steps of transformation, and the knowledge of chemistry can be applied to accounting, which helps understand the nature of accounting from science perspective.

An accounting transaction is very similar to the chemical reaction named redox. Redox (short for reduction-oxidation reaction) is a chemical reaction where any such reaction involves both a reduction process and an opposite oxidation process simultaneously [3] , which is similar to debit and credit posts of an accounting transaction. The electricity should be balanced to maintain a chemical equation in a similar way that the accounts should be balanced to maintain accounting equation.

In this article, I uncover the nature of accounting by comparing accounting equation with chemical equation and accounting transaction with chemical reaction. Using analogy, I introduce the concept of cashlet that is equivalent to electron in chemistry. I find out the nature of an accounting transaction is a process of transferring cashlets from one account to another, and the process can be visualized using graph theory. I discover that the nature of accounting is a process of moving cashlets and recombining accounts. Meanwhile, I introduce the concept of credit status, and simplify the terms “Debit” and “Credit”, which makes accounting more accessible for ordinary people.

2. Comparison of Accounting Equation and Chemical Equation

Accounting equation is normally known as

We can treat Liabilities + Equity as Liabilities in broader sense. Therefore the equation can be simplified as

If we move A from left side of equation to right side, then the equation becomes

Let’s move all values and positive/negative sign to superscript, and give the left side a name―business. The equation becomes

which means business equal to assets and liabilities in broader sense.

Let’s see a simple chemical equation of salt dissolution:

Here we can see the similarity of the new accounting equation and chemical equation. In chemical equation, we see Cl is negatively charged because it carries an electron. Na is positively charged because one of its electrons is depleted. The total electricity is 0.

In order to apply chemistry to accounting, I introduce a novel concept of cashlet which is equivalent to electron in chemistry. Cashlet is a basic accounting unit the value of which is always negative one (−1). The adjective form of cashlet is cashletic which is equivalent to electric. Cashlecity is equivalent to electricity. Chemical reaction is a process of moving electrons and recombination of atoms. The total electric charge of all atoms is always zero. Accounting transaction is the same thing: it’s a process of moving cashlets and recombination of accounts. The total cashletic charge of all accounts is always zero.

In the new accounting equation ( ), we have the following properties:

), we have the following properties:

1) Business is always neutral, which means its cashletic charge is always 0.

2) The “+” sign between two accounts only means “AND”, and between accounts there is only “AND” relationship (no minus relationship).

3) The calculation happens in the cashletic charge (or in the superscripts) of accounts.

4) The total cashletic charge of all accounts should be zero.

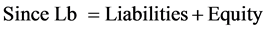

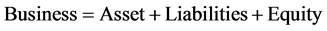

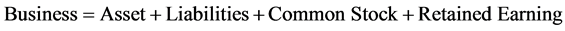

Based on the above prosperities, we can deduce lots of accounting equations. When a business is just set up, all accounts are neutral, which means all accounts have 0 cashletic charge. We can deduce the equation as following:

, therefore:

, therefore:

Since , we have

, we have

Since Retained Earning = Revenue + Expense + Dividend, and let’s assume no dividend will be paid at early years of a business, we can deduce the following extended accounting equation which is called operational equation:

Abbreviated as

Note that between accounts there is always a + sign which means “AND”. The actual calculations happen in the cashletic charge or in superscripts.

Let’s have some examples and see how these equations work. Stockholders invest $10,000 cash into a new company.

The company buys $2,000 inventory by credit.

The company makes a sale of $1000 by credit.

The company finds out that the inventory was reduced by $500.

We can see the equation is always balanced for each transaction. We can also consolidate accounts to get the information we need. For examples:

![]()

![]()

Using this approach we can extend the equation to all accounts at the lowest granule. We can consolidate proper accounts to get the information of interest. In this section, I introduce novel accounting concepts and novel accounting equation using analogy of chemical equation.

3. Comparison of Accounting Transactions and Chemical Reaction

Each accounting transaction involves at least two posts where one account is debited and the other is credited. These debit and credit should always happen together; they cannot occur independently. Accounting transaction is very similar to the chemical reaction of redox (short for reduction-oxidation reaction) where any such reaction involves both a reduction process and an opposite oxidation process simultaneously. These reduction and oxidation should always happen together; they cannot occur independently either. Here, I coin a term―crebit― to abbreviate credit-debit transaction, which is equivalent to the term redox in chemistry.

Redox reactions involve the transfer of electrons between chemical species and the changes of oxidation state of chemical species. The chemical species from which the electrons are stripped is said to be oxidized, while the chemical species to which the electrons are added is said to be reduced. It can be explained in simple terms:

Oxidation is the loss of electrons or an increase in oxidation state.

Reduction is the gain of electrons or a decrease in oxidation state.

The oxidation state, also known as the oxidation number, is an indicator of the degree of oxidation of a chemical species in a chemical compound. It can be positive, negative or zero. Similarly, I introduce the concept of credit state, which is an indicator of the degree of credit of an account in accounting. It can also be positive, negative or zero.

Using the analogy of redox reaction, we can describe accounting transaction as following: An accounting transaction involves the transfer of cashlets between accounts and the changes of credit state of accounts. The account from which cashlets are stripped is said to be credited, while the account to which the cashlets are added is said to be debited (or decredited). It can be explained in simple terms:

Credit is the loss of cashlets or an increase in credit state.

Debit is the gain of cashlets or a decrease in credit state.

To be more intuitive, it can be explained in this way:

When an account gives cashlets, it is credited.

When an account takes cashlets, it is debited.

When an account is credited, its credit state increases.

When an account is debited, its credit state decreases.

When an account’s credit state increases, it must have been credited.

When an account’s credit state decreases, it must have been debited.

The above statements are always true and there is no exceptions. Table 1 shows the comparison in details.

In chemistry, magnesium sulfide is formed by the reaction of sulfur (S) with magnesium (Mg) where magnesium (Mg) transfers two electrons to sulfur (S). Conceptually, the reaction happens like:

Initial state: Mg0 + S0

Mg is giving two electrons: Mg(2+)+(2−) + S0

S takes the two electrons: Mg2+ + S2−

New compound is formed: Mg2+S2− or MgS

Mg is oxidized. It gives two electrons out and increases its oxidation state

![]()

Table 1. Comparison of accounting transactions and chemical reactions.

from 0 to 2+. S is reduced. It takes two electrons in and decreases its oxidation state from 0 to 2−.

In accounting, when stockholders invest $10,000 in cash for a new business, the transaction can be explained in accounting like:

Initial state: ![]()

Common Stock is giving 10,000 cashlets: ![]()

Cash account takes the 10,000 cashlets: ![]()

Final state of the accounts: ![]()

Common stock is credited. It gives 10,000 cashlets out, and increases its credit state from 0 to 10,000+. Cash account is debited. It takes 10,000 cashlets in, and decreases its credit state from 0 to 10,000−.

Then the business purchases $2000 equipment in cash, which can be explained like:

Initial state: ![]()

Cash is giving cashlets: ![]()

Equipment takes the cashlets: ![]()

Final state: ![]()

Cash account is credited. It gives 2000 cashlets out, and increases its credit state from 10,000− to 8000−. Equipment is debited. It takes 2000 cashlets in, and decreases its credit status from 0 to 2000−.

It’s worth noting that the transfer of cashlets between accounts only changes the credit state of the involved accounts. It does not change the total cashletic charge of all accounts. Therefore, the total cashletic charge of all accounts involved should be the same before and after each transaction. For current example, the total charge of Equipment and Cash account is 10,000− before transaction. After transaction, the total charge of the two accounts is still 10,000−. Only the distribution of cashlets among accounts is changed.

4. Expression of Accounting Transactions Using Graph Theory

To visualize how cashlets move between accounts during transactions, I introduce graph theory to accounting. In computer sciences, graph theory is the study of graphs, which are mathematical structures used to model pairwise relations between objects [4] . Objects are termed as nodes that are usually expressed by circles or ellipses in graphs, while relations are termed edges that are normally lines or arrows connecting two nodes. Accounting transactions can be easily expressed using graph theory. Accounts are nodes, while transactions are edges. An edge always goes from one node to another denoting that cashlets moves from one account to another.

Let’s look at an example. A new business gets investment of $10,000 in cash by issuing common stocks (Event I). First, we identify two accounts (Common Stock and Cash) that are involved. They have zero balance at the beginning (Figure 1(a)). In second step, Common Stock account breaks down zero to +$10,000 and −$10,000 the sum of which is zero (Figure 1(b)). In the third step, cashlets (with a charge of −$10,000) move out of Common Stock account (Figure 1(c)). Finally, Cash account receives the cashlets of −$10,000. Transaction is done (Figure 1(d)). For convenience of expression, we compress everything into one graph like Figure 1(e). The graph has the following properties:

1) At the beginning of time, each account (node) has zero balance.

2) For each transaction (edge), cashlets move from one account (node) to another account (node).

3) The account (node) that gives cashlets is credited, while the account (node) that receives cashlets is debited.

4) The credited amount is always denoted as positive, while the debited amount always negative.

5) If the negative and positive amounts are partitioned to two sets, the sum of one set is always the negative sum of the other.

Let’s continue the example. Then the business buy $2000 inventory using cash (II) and another $1000 inventory by credit (III). It makes a sale of $3000 by credit (IV) with the cost of goods sold at $1500 (V). By the end of the month, it receives the $3000 cash from its customer (VI), and pays the $1000 cash to its vendor (VII). The whole business transactions can be expressed in graph like Figure 1(f).

Using graph, the movements of cashlets between accounts are clearly visualized, and the transactions become straightforward. The concept of debit and

![]()

Figure 1. Expression of accounting transactions in graphs. (a) to (d) shows how cashlets are stripped and moved from one account to another. (e) compress the process of (a) to (d) into one graph. (f) shows how cashlets moves from accounts to accounts as business goes by.

credit is also simplified: debit is nothing but a minus, while credit a plus.

5. Accounts

In cashlet theory, debit always decreases the credit state of accounts while credit always increases the credit state of accounts, no matter what types of accounts they are. However, business users may not be interested in credit state. Instead they are more interested in the absolute value of accounts. Therefore, we need to translate language of cashlet theory back to normal business language.

In cashlet theory, accounts can be categorized to three types: positive accounts, negative accounts and zero-balanced accounts. Positive accounts are with a positive credit state, while negative accounts are with negative credit state. Asset accounts and expense accounts are normally negative accounts, because they are cashlet carriers and cashlets are negative. Liability, equity, and revenue accounts are normally positive accounts, because they are cashlet donors. They donate negatively charged cashlets out leaving themselves positive.

Although a debit post to any account decreases the credit state of the account, the effect of absolute value of the account is different between positive accounts and negative accounts. For positive accounts, the absolute value decreases. However, for negative accounts, the absolute value increases, which means they’re more negative in mathematics (Figure 2). Similarly, a credit post increases the credit

![]()

Figure 2. Effect of debit posts to different types of accounts. A debit post decreases credit state of accounts regardless of account types (all arrows go up). For positive accounts (in blue) the absolute value decreases. For negative accounts (in red), the absolute value increases, which means the accounts are more negative.

![]()

Figure 3. Effect of credit posts to different types of accounts. A credit post increases credit state of accounts regardless of account types (all arrows go down). For positive accounts (in blue) the absolute value increases. For negative accounts (in red), the absolute value decreases, which means the accounts are less negative.

state regardless of account types. For positive accounts the absolute value increases. For negative accounts, the absolute value decreases, which means the accounts are less negative (Figure 3).

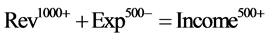

6. The Accounting Information System

An accounting information system (AIS) is a system that a business uses to collect, store, manage, process, retrieve and report its financial data so that it can be used by internal and external users. Nowadays computers are involved from data collecting to final reporting in modern business. However, the classic concepts of debit and credit complicate data processing for computers. In cashlet theory, debit always means minus while credit always means plus, and the relationship between any accounts is always “AND”, which makes it easy for computers to process data.

For data collection in classic accounting, transactions are initially recorded in chronological order in journals before they are posted to ledgers. For each transaction, the journal shows debit and credit effects on specific accounts. Therefore debit and credit are recorded in two separate columns. In cashlet theory, transactions are initially recorded in chronological order in a table that is then directly used as a source for any further data processing. Debit and credit are combined to one column called amount. Debit is always labeled as minus and credit always plus.

For data processing in classic accounting, one needs to remember the relationship of different accounts. For examples:

![]()

![]()

In cashlet theory, the relationship between all accounts is AND or plus (+), because the calculation uses credit state, not the absolute value of accounts. The plus or minus information of each account is reflected in the credit state of the account. Therefore,

![]()

![]()

In this way, data processing becomes easy, especially for computers. To calculate the balance of an account, just sum up all the entries of the account. To calculate the assets, sum up all asset accounts including contra-asset accounts. The balance sheet and income statements are nothing but summing up the accounts to levels that need to be reported.

7. Case Study

On January 2nd, 2017, Stockholders invest $10,000 cash in a brand new company to be known as Laurens Corporation. On January 3rd, the company borrows cash of $5000 by signing a 3-month, 12%, $5000 note payable. On January 4th, the company uses $1000 cash to purchase equipment. On January 5th, the company purchase $2000 inventory using cash, and buys another $1000 inventory on credit. On January 15th, the company makes a sale of $3000 on credit. On January 25th, it makes another sales of $5000 on credit. On January 27th, the company pays $900 in cash for office rental. On January 30th, the company receives $3000 cash for the sale of January 15th. On the same day, it pays $4000 cash for employee salary, and it also finds out that the inventory is reduced by $2500. On the last of January, the company pays the $1000 to its vendor for the inventory purchased on January 4th, and it also accrues $50 interest expense for notes payable. All events are listed in Table 2.

Let’s do a graphic analysis, an equation analysis and a debit-credit analysis before journalizing each transaction. The purpose of transaction analyses is first to identify the accounts and the types of accounts involved, and then to determine which account is debited and which is credited. The analysis of each transaction is illustrated in Figure 4.

We can visualize all transaction in one graph like Figure 5.

The journalized entries are showed in Table 3.

Using Pivot Table, we can easily calculate account balance for each account (Table 4).

We can also calculate the balance for each account category using Pivot Table (Table 5).

From Table 5, we can easily calculate Net Income by summing the credit state of Revenue and Expense.

![]() .

.

We can also prepare the Income Statement based on the above two Pivot Tables (Table 6).

Retain Earning = Net Income + Dividend. Since no Dividend was paid in January, Retain Earning is Net Income. We can prepare the balance sheet based on the above information (Table 7).

8. Discussion

In this work, I introduce two novel concepts―cashlet and credit state―to accounting enlightened by chemistry, and discover that the nature of accounting is a process of moving cashlets and recombination of accounts. I visualize accounting transactions using graphs, and simplify the concepts of debit and credit.

I make accounting more accessible for ordinary people. It’s a common philosophy and is intuitive that if you give something you get credits. Similarly, we can deduce that if you take something you get debits. Accounting is actually in the same common sense: if an account gives cashlets, it gets credits. A simple mathematical approach to record the credits is to use a positive sign before the amount of cashlets the account gives. Similarly if an account takes cashlets, it gets debits. Mathematically, we put a negative sign before the amount it takes to record the debits. It’s also easy to understand that when an account is credited, its credit state increases, and when debited, decreases. Up to now, everything is very intuitive. However, it becomes counter-intuitive that the cash account gets a

![]()

Table 2. List of all events of this case study.

![]()

Figure 5. Illustration of all transaction in January 2017. Note that any accounts are connected directly or indirectly to cash account. The dash line denotes future transaction.

![]()

Table 3. Journalized entries in a table. (+) denotes credit balance while (−) denotes debit balance.

![]()

Table 4. Balance by accounts. This table was calculated from Table 3 using Pivot Table (See Supplement).

![]()

Table 5. Balance by account categories. This table was also calculated from Table 3 using Pivot Table.

negative number (e.g. −$10,000) when it actually receives cash. This is because people do not differentiate cash from cashlet. Cash is real money, while cashlet is an accounting unit. In daily life, people use positive numbers to denote amount of cash, for examples “I owe you $10” or “I get $10”. However, cashlet is only used in accounting, and it is always negatively charged, which agrees the concept that “money is root of all evil (negative)”. When stakeholders invest $10,000 cash into a business, in real world the stakeholders give the real cash to the business owner. However in accounting, a Stakeholders’ Equity account gives cashlets (not cash) to Cash account. Because cashlets are always negatively charged, the cash account gets a negative number whenever it receives cashlets. Remember any accounts can only give or receive cashlet(s) but not cash in accounting.

The mathematics of double entry bookkeeping was well documented by Ellerman [7] [8] [9] [10] . According to his classification, the mathematical treatment I use in this study belongs to single sided system (SSS) with signed numbers. In Ellerman’s article, the asset accounts are with positive numbers while liability and equity accounts are with negative numbers [10] . In this study, Iuse the opposite treatment: asset accounts are with negative numbers while liability and equity accounts are with positive numbers. Both treatments are good from mathematics’ point of view. However, the method I use in this study make more sense in the context of cashlets and cashlet movements between accounts from the view of chemistry.

Chemists may notice that the credit state in this study is not exactly the same with the concept of oxidization state in chemistry. The purpose of introducing credit state is to facilitate the understanding of accounting transactions, but not to create an exactly the same concept of oxidization state in accounting. For accountants, they do not need to know how credit state was derived unless they really want to. In cashlet theory, credit state is the cashletic charge of an account, which is also different from chemistry.

In this study, I avoid the discussion of the cash flow statement, because the purpose of this article is to introduce novel concepts to accounting enlightened by chemistry. It will be very interesting to study cash flow using these novel concepts in the future. It will also be interesting to study the cashlet flow and to visualize how cashlets moves from accounts to accounts. From the preliminary study, I have noticed that any accounts should be connected to cash account directly or indirectly at some point of time in the graph. Cash account serves as a hub for all accounts. It will be very interesting to study how cashlets move from cash account to other accounts and how they come back from other accounts to cash account.

Cashlet theory will potentially make accounting easier in practice especially for the current digitalized world where everything is recorded as computerized data. Computers themselves do not understand human concepts like debit or credit. However computers are extremely good at dealing with signed numbers. In practice of accounting related enterprise applications, the application designers usually specify the negative sign to debit or credit balance/post for a default setting. For example, the default setting of SAP ERP (Enterprise Resources Planning) is that debit balance is with a negative sign [11] . The practice of using signed number to represent debit or credit has existed for decades in computer science. However, the accounting world still prefers the descriptive approach that were invented more than five centuries ago. This increases the work for computer scientists to translate computerized accounting languages to that of accounting world. The gap between accountants and computer scientists is due to the lack of a widely accepted theory for both sides to adopt signed number system of accounting. Due to this absence, the usage of positive or negative sign in accounting applications is not standardized, and it depends on the application designers. For example, SAP ERP allows users to set negative sign to debit balance or credit balance during the implementation [11] . This non-standardization of sign usage in accounting applications in turn causes confusing for accountants. By introducing cashlet, cashlet movement and graph theory, the cashlet theory provides full theoretical support for current practices of using signed numbers in accounting software. This theory is also easy for people including both accountants and computer scientists to understand. If it is widely accepted, the sign usage can be standardized, which will cause less confusing for all people. The graphs used in this theory may be helpful for accounting application development, because graph theory is a sound theory to be implemented in software development.

Cashlet theory can not only be applied to monetary accounting, but also to non-monetary accounting. With the emerging of new technologies and new forms of economic activities, this theory will be very useful. For example, the new economic form of Time Banking―the exchange of services using time- based currency―is not of a monetary system [12] . Using cashlet theory, the accounting for this new economic form become easier. The entity that provides services should be credited, while the one who receives services should be debited. Each of the transactions move cashlets from provider to receiver for cashletic accounting’s point of view. In a broader sense, cashlet theory can be applied to any type of economic transactions that are quantifiable, not limiting to monetary transactions, which may be very helpful in economic research as well.

9. Conclusion

This article proposes a scientific theory for accounting: It first introduces a novel concept of cashlet―a basic accounting unit with negative charge―that is equivalent to electron in chemistry. It then deduces that an accounting transaction is a process of moving cashlets from one account to another, and that the total cashletic charges of all involved accounts should remain unchanged before and after transactions. The account that gives cashlets is credited, while the account that takes cashlets is debited. In this theory, credit always means positive or plus (+), while debit always means negative or minus (−). The article concludes that the nature of accounting is a process of moving cashlets between accounts which is known as debit-credit transactions, and a process of recombining accounts which are known as reconciliation in accounting. This article also helps people better understand the world in that accounting transactions and chemical reactions are the same in nature, and in that when you give you get credits when you take you get debits.