Relating Carbon Dioxide Emissions with Macroeconomic Variables in the Philippine Setting ()

Received 21 December 2015; accepted 13 March 2016; published 16 March 2016

1. Introduction

The first objective of this study is to test the Environmental Kuznets Curve (EKC) hypothesis in the Philippine setting. The EKC proposes an inverted U-relationship between economic growth and environmental degradation. The EKC suggests that environmental degradation such as pollution and deforestation increases in the early stages of development, reaches a maximum at the middle income level, and then decreases with further income expansion [1] . As a country starts to develop, environmental degradation worsens due to the increase in the production of commodities. The decline in environmental damage as the country reaches the middle income level results from the shift in economic structure from the polluting manufacturing industries to the relatively clean services and information sectors, technological innovations in pollution and environmental damage control, and greater availability of public funds for environmental investments. Further, with greater wealth, there is a greater demand for environmental quality. An effect on scale of activity may also arise. As income rises, population growth rates drop and approach replacement levels [2] . The EKC hypothesis trivializes the issue of environmental degradation as it is seen to be temporary with development eventually leading to a better environment [3] . Hence, an empirical test of the existence or non-existence of the EKC will have important implications on development policy orientation. A strong empirical evidence for the EKC justifies a lenient environmental policy scenario while the absence of such evidence supports the pursuit of an economic growth trajectory that is stringently constrained by environmental considerations.

Interests in the EKC hypothesis have spread since its use in the World Bank Development Report in the 1990s [4] . There are studies that have found an inverted-U relationship between certain pollutants (e.g.: sulfur dioxide, dark matter, nitrogen oxide, carbon monoxide, suspended particulate matter, fecal coliform) and income [5] - [7] , studies that do not support the EKC hypothesis [8] - [11] , and studies with mixed results [12] . Scope of existing literature on the EKC ranges from single-country, single-pollutant to multiple-country, multiple-pollutant studies.

This paper focuses on one country, the Philippines, and one air pollutant, carbon dioxide. The Philippines is currently one of the fast growing economies in Asia, and the environmental consequences, if any, of this long- desired growth must be investigated and accordingly addressed. Carbon dioxide is said to account for about 64% of the greenhouse gasses that cause global warming. The need to be watchful of increased carbon dioxide emissions that may accompany income growth is dictated by both internal and external factors. Due to its geographical location, topography and current socio-economic structure, the Philippines is considered highly vulnerable to climate change impact [13] . Its more than 7000 small islands and long coastline expose much of its land and people to the dangers of stronger tropical storms and flooding. Increased occurrence of extreme weather disturbances will significantly lower productivity in agriculture and fisheries, sectors on which majority of the Filipinos depend for livelihood. The incidence of below-subsistence living may increase and gaps among socio-eco- nomic classes may widen as those in the lower strata are more susceptible to the damages that climate change can bring and are less able to cope with it than those in the upper strata. With added pressure to adhere to global environmental initiatives on carbon emission reductions (such as that of the Kyoto Protocol), Philippine policy makers are faced with difficult decisions regarding long-run economic growth and environment paths that the country must thread. In order to make sound policy choices, there is a need for empirical evidence on the relationship of key economic variables with carbon dioxide emissions.

While focusing on the Philippines, this paper shall include additional economic variables to the basic EKC relationship between carbon dioxide emissions and income. This model expansion aims to partially address the omitted variables bias and lag selection bias in past literature [14] . The augmentation also allows an analysis of how other economic variables, namely, trade openness, urbanization and foreign direct investment are related to carbon dioxide emissions. Hence, apart from the EKC hypothesis, this paper shall put into empirical test the propositions that 1) trade openness accelerates the transport of goods and services and hence carbon dioxide emissions, 2) urbanization increases carbon dioxide emissions as it entails movements of people and goods from rural to urban as well as large construction projects, and 3) foreign direct investors bring in dirty industries in developing countries (Pollution Haven Hypothesis). The inclusion of additional variables and additional hypotheses to be tested also sets this study apart from two past multi-country economic growth-carbon dioxide emissions/energy consumption studies that include the Philippines, namely, Asafu-Adjaye [15] and Saboori-Sulai- man [16] .

2. Methodology

2.1. Empirical Model

This paper adopts the empirical model of Hossain’s study on the long-run and short-run dynamics of carbon dioxide emissions in relation to economic growth, energy consumption, trade openness and urbanization in Japan. Hossain incoporates additional variables to the core EKC relationship between carbon dioxide emissions and economic growth in order to address the statistical issues of omitted variables bias and lag selection bias raised against earlier studies on the EKC [17] . Our paper further expands Hossain’s model by including foreign direct investments.

Energy consumption is the factor most proximate to carbon dioxide emissions as the combustion of fuel in energy generation produces carbon dioxide. The amount of emissions depends on the type of fuel (different types of fuel have different carbon content) and on the kind of energy use. Energy consumption of transportation and industrial sectors, for instance, has higher carbon dioxide emission coefficients. Generally, energy sources in less developed countries are less efficient and more polluting than in developed countries. Likewise, both trade openness and urbanization may be positively correlated with carbon dioxide emissions. Trade entails movement of goods and services, and hence, greater energy consumption and more carbon dioxide emissions [18] . On the other hand, urbanization involves migration of labor from rural to urban, again leading to greater energy consumption and higher carbon dioxide emissions. Urbanization is also associated with other high- energy consuming activities such as large public and private construction projects. Martinez-Zarzoso [19] , however, notes that the responsiveness of carbon dioxide emissions to population and urbanization may vary depending on the income level of the country. Low and lower-middle income countries have an expected urbanization elasticity on carbon dioxide emissions of greater than unity, while higher income countries tend to exhibit less-than-unity elasticity.

The inclusion of FDI in the model is based on the Pollution Haven Hypothesis that suggests the tendency of high-income economies to relocate polluting industries to countries with less stringent environmental policies in order to save on production costs [20] . If the Pollution Haven Hypothesis applies, then FDI in developing countries such as the Philippines may be expected to increase carbon dioxide emissions. When industrialized nations transition towards becoming fully-developed nations, the country’s economic activity shifts away from manufacturing towards services. Developed countries also impose more stringent environmental policies that require a shift to more environmentally-friendly technologies which can raise the cost of production. Hence, heavily- polluting firms are compelled to move production bases towards low-cost and less environmental-policy-strin- gent countries.

This study estimates a linear logarithmic equation for two model specifications. The first model is a core EKC model with only Gross Domestic Product (GDP) and the square of GDP (GDPSQ) as explanatory variables:

(1)

(1)

The second is an expanded model with energy consumption (EN), trade openness (OPEN), urbanization (UR) and foreign direct investments (FDI) as additional explanatory variables:

(2)

(2)

Coefficients estimated from these models represent the elasticities of carbon dioxide emissions with respect to each of the explanatory variables. The signs of the coefficients representing the hypothesized relationships between carbon dioxide emissions and each explanatory variable discussed earlier are indicated below the corresponding variable.

2.2. Estimation Procedure

Empirical tests on the relationships among the variables are done in three steps: 1) Augmented Dickey-Fuller (ADF) unit root tests for non-stationarity, 2) Autoregressive Distributed Lag (ARDL) bounds test to determine the existence of co-integrating relationships among the variables, and 3) Error Correction Model (ECM) to inspect short-run and long-run dynamics among the variables.

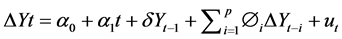

Augmented Dickey-Fuller (ADF) and Phillips-Perron (PP) unit root tests. Non-stationarity is an undesirable statistical issue for time series data as it results in a joint probability distribution that changes over time [21] . Without the property of stationarity, time series data will not be able to yield a constant value for its mean or variance [22] . This implies that the use of Ordinary Least Squares (OLS) regression, which assumes stationarity, may lead to spurious regression, that is, two or more unrelated time series processes can become erroneously significantly correlated due to the presence of a time trend. In this study, to determine whether or not each of the data series is non-stationary, the Augmented Dickey-Fuller (ADF) unit root test is conducted. This test utilizes the equation:

(3)

(3)

where Y is the data series being investigated,  is the first difference and the lagged difference terms on the right-hand side are included to correct for serial correlations of the error term. The parameters are defined as follows: α0 is a constant, α1 is the coefficient on a time trend, and p is the lag order of the autoregressive process. By including lags of the order p the ADF formulation allows for higher-order autoregressive processes. The lag length p is determined using the Akaike Information Criterion. The unit root test is then carried out under the null hypothesis δ = 0 which means that there is a unit root and the time series of the variable Y is non-stationary. Conversely, rejection of the null hypothesis indicates that the time series process contains no unit root which implies a stationary process.

is the first difference and the lagged difference terms on the right-hand side are included to correct for serial correlations of the error term. The parameters are defined as follows: α0 is a constant, α1 is the coefficient on a time trend, and p is the lag order of the autoregressive process. By including lags of the order p the ADF formulation allows for higher-order autoregressive processes. The lag length p is determined using the Akaike Information Criterion. The unit root test is then carried out under the null hypothesis δ = 0 which means that there is a unit root and the time series of the variable Y is non-stationary. Conversely, rejection of the null hypothesis indicates that the time series process contains no unit root which implies a stationary process.

A time series process will have to be integrated to the order of x, denoted by I(x), where x is the number of times the series has to be differenced in order for the process to become stationary. If a series is found to contain a unit root, an OLS regression can still be applied if the time series data are first made stationary by differencing the series to the order in which it is integrated. This method, however, has some serious consequences. As the error term also ends up being differenced, a moving average error will occur and the procedure will not be capable of yielding long-run properties. To avoid this, the cointegration method, an alternative way of analyzing time series data that have a unit root, is employed.

Autoregressive Distributed Lag (ARDL) bounds test for cointegration. Cointegration happens when the cumulated error processes between variables produce a stationary process. Asteriou and Hall claims that cointegration is an over-riding requirement for any economic model in non-stationary time series data. The particular technique used for this study is the ARDL bounds testing approach introduced by Pesaran et al. [23] . This approach evades the usual endogeneity problem (when correlation exists between an independent variable and an error term), allows simultaneous estimation of long-run and short-run parameters as well as hypothesis testing on the estimated long-run coefficients [14] .

The bounds test approach to determine the existence of a cointegrating or long-run relationship among variables in a model is done by running an unrestricted regression equation. For the expanded model of this study, the unrestricted regression equation is:

(4)

(4)

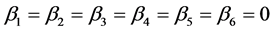

ADRL tests the null hypothesis:  which implies the absence of long-run cointegrating relationships among variables. Thus, the variables are cointegrated if the null hypothesis is rejected. The F-statistic is used for the decision rule. There are two critical values: the lower-bound (one that corresponds to the case when all the series are I(0)), and the upper bound (corresponding to the case when all series are I(1)). The null hypothesis is rejected when the value of the F-statistic is greater than the upper bound critical value. If the F-statistic is less than the lower bound critical value, the null hypothesis is accepted. The result is inconclusive when the F-statistic lies between the two critical values.

which implies the absence of long-run cointegrating relationships among variables. Thus, the variables are cointegrated if the null hypothesis is rejected. The F-statistic is used for the decision rule. There are two critical values: the lower-bound (one that corresponds to the case when all the series are I(0)), and the upper bound (corresponding to the case when all series are I(1)). The null hypothesis is rejected when the value of the F-statistic is greater than the upper bound critical value. If the F-statistic is less than the lower bound critical value, the null hypothesis is accepted. The result is inconclusive when the F-statistic lies between the two critical values.

Error Correction Model (ECM). Once a cointegrating relationship is established, an ECM is performed to arrive at estimates of long-run and short-run elasticities of carbon dioxide emissions with respect to each of the explanatory variables. Long-run elasticities are derived from the following cointegration model (for the expanded model):

(5)

(5)

The difference between the observed value of the dependent variable, lnCO2, and its long-run estimate is the error correction term, ECM:

(6)

(6)

Short-run elasticities are then derived by regressing the first difference of the dependent variable with the first difference of the independent variables plus ECM:

(7)

(7)

The coefficient of the ECM, λ, represents the speed of adjustment for short-run to reach long-run equilibrium. These regression procedures are done with the use of Gretl and Microfit statistical softwares.

2.3. Time Series Data Description and Sources

This paper uses annual time-series data for the Philippines for the period 1971-2010. The data were obtained from the World Bank Development Indicators database. A summary description of the time series data used in the study is given in Table 1. Carbon dioxide emissions include carbon dioxide produced during the burning of fossil fuels; manufacture of cement; and consumption of solid, liquid, and gas fuels and gas flaring. The variable used in the model is per capita emissions (carbon dioxide emissions/population), denoted as CO2 and measured in metric tons. Gross domestic product (GDP) is the sum of gross value added by all resident producers in the economy, plus any product taxes and less any subsidies not included in the value of the products. GDP is calculated without making deductions for depreciation of fabricated assets or for depletion and degradation of natural resources. GDP data are in constant 2005 US dollars. Per capita GDP is GDP divided by midyear population. Energy use refers to use of primary energy before transformation to other end-use fuels. It is equal to indigenous production plus imports and stock changes, less exports and fuels supplied to ships and aircraft engaged in international transport. Trade openness is indicated by the share of total trade, the sum of exports and imports of goods and services, in GDP. Urban population refers to people living in urban areas as defined by national statistical offices. It is calculated using World Bank population estimates and urban ratios from the United Nations World Urbanization Prospects. Foreign direct investment (FDI) is the net inflow of investments to acquire a lasting management interest (10% or more of voting stock) in an enterprise operating in an economy other than that of the investor. FDI is the sum of equity capital, reinvestment of earnings, other long-term capital, and short-term capital as reflected in the balance of payments. The series used in the study is net inflows (new investment inflows less disinvestment) in the reporting economy from foreign investors, divided by GDP.

3. Results

The unit-root tests performed using the ADF method reveal that at the 5% significance level, all variables are found to be non-stationary with the exception of lnFDI (Table 2). At the 1% significance level, however, lnFDI is considered non-stationary.

The ARDL bounds test does not reveal a cointegrating relationship among the variables in the core EKC model. For the expanded EKC model, cointegration among variables becomes conclusive only at the 10% significance level. Because of these initial and subsequent findings of a non-existent EKC relationship, an expanded model without lnGDPSQ is run. The ARDL bounds test for this third model specification reveal a cointegrating relationship among the variables up to the 5% significance level (please refer to Table 3).

![]()

Table 2. Augmented Dickey-Fuller (ADF) unit root test results.

aAcceptance of the null hypothesis implies that there is a unit root and that the time series is stationary.

![]()

Table 3. Autoregressive Distributed Lag (ARDL) bounds test results for cointegration.

aIf the F-statistic lies between the bounds, the test is inconclusive. If it is above the upper bound, the null hypothesis of no cointegration is rejected. If it is below the lower bound, the null hypothesis of no cointegration cannot be rejected. The critical value bounds are computed by stochastic sumulations using 20,000 replications.

Table 4 and Table 5 present estimates of long-run and short-run elasticities of carbon dioxide emissions with respect to each explanatory variable based on the coefficients of the ECM. Table 4 gives the results of the basic model while Table 5 gives the results for the expanded model. In the core model, both lnGDP and lnGDPSQ yield coefficients that conform with the EKC hypothesis but they are statistically insignificant.

In the expanded model (Model 2), the signs of the coefficients of lnGDP and lnGDPSQ are reversed, but they remain to be insignificant. As both the core and expanded EKC models provide no evidence for an inverted-U relationship between CO2 emissions and GDP, the expanded model is modified by removing lnGDPSQ in the equation, which is referred to as Model 2a. The results of Model 2a are shown in the last two columns of Table 5. With the removal of lnGDPSQ in Model 2a, the sign of lnGDP becomes significantly positive both in the short-run and the long-run. This means that economic growth is associated with more CO2 emissions. The results for the other macroeconomic variables included in the study are robust. The significance and the signs of the coefficients are consistent in models 2 and 2a, and the magnitudes of the coefficients are very close.

There is a marked improvement in the adjusted R2 value with the inclusion of additional explanatory variables. The predictive value of the expanded model is almost double that of the core model. Among the added variables, EN and FDI turn out to be significant both in the short- and long-run. A 1% increase in energy use is associated with a 0.73% - 0.87% increase in carbon dioxide emissions in the short-run and a 1.28% - 1.59% increase in the long-run. The impact of FDI, albeit much less, is significant and positive, a 1% increase in FDI is associated with a 0.007% increase in carbon dioxide emissions in the short-run and 0.013% increase in the long-run. This result conforms with the Pollution Haven hypothesis, indicating that foreign direct investors in the Philippines are bringing in less clean technologies and industries. Another significant short-run predictor of carbon dioxide emissions is urbanization. The study’s negative and highly elastic impact of urbanization on carbon dioxide emissions in the short-run is in contrast with results of previous studies. Interestingly, the highly elastic impact of urbanization on carbon dioxide emissions seems to disappear in the long-run. The error correction term is likewise significant and negative, implying that the short-run estimates adjust at a rate of 54.5% - 56.8% per year towards their long-run equilibrium values.

![]()

Table 4. Core EKC model, autoregressive distributed lag approach.

*Indicates 0.10 significance level, **indicates 0.05 indicates level, ***indicates 0.01 significance level.

![]()

Table 5. Expanded models 2 (with lnGDPSQ) and 2a (without lnGDPSQ).

*Indicates 0.10 significance level, **indicates 0.05 indicates level, ***indicates 0.01 significance level.

4. Discussion and Conclusion

Both the core and expanded models do not lend support for the EKC hypothesis in the case of the carbon dioxide pollutant in the Philippine setting. There is no evidence of a significant inverted-U relationship between economic growth and carbon dioxide emissions in the Philippines during the period covered in the study. Instead, they are found to have a significant positive linear relationship, suggesting that income growth policies must be subject to reasonably stringent environmental constraints related to CO2 emissions. The other macroeconomic variables that turn out to be significantly associated with CO2 emissions are energy use, urbanization and foreign direct investments.

The study shows that urbanization has a highly elastic negative impact on carbon dioxide emissions. This result is in contrast to Martinez-Zarzoso panel data study which reveals that lower-middle income countries (to which category the Philippines aptly belongs) typically exhibit a positive and less-than-unity urbanization elasticity of carbon dioxide emissions. A negative elasticity is typically observed in higher income countries where structural changes, advancements in clean technology and improvements in energy-intensity allow for carbon dioxide emissions reductions in the face of urbanization. Wan [24] further explains that in highly urbanized economies, the services sector, which pollutes less than the manufacturing sector, accounts for the largest portion of employment. The Philippines, despite being a lower middle income economy, has an employment composition that is more commonly found in high-income economies. In 2009, more than 50% of the working population in the Philippines was employed in the services sector, and only less than 9% was in the manufacturing sector. Comparable lower-middle income countries in Asia such as Thailand and Indonesia show a more robust manufacturing sector, accounting for 14% and 12% of the working population respectively, and smaller services sector (employment ratios of 39% and 41% respectively). The Philippines’ large services sector and its relatively small manufacturing sector may be the reason behind the high negative urbanization elasticity of carbon dioxide emissions in the Philippines.

The positive elasticity of carbon dioxide emissions with respect to FDI which conforms with the Pollution Haven hypothesis may be explained by the sectoral distribution of FDI in the Philippines. The manufacturing sector accounts for the greater part of FDI in the country. From 1996 to 2009, the share of the manufacturing sector in total approved foreign investments averaged 53%. Though an association between carbon dioxide emissions and FDI is statistically established, the magnitude of the impact is small (very low elasticity) which may imply that the manufacturing FDIs in the Philippines are not using very dirty technologies.

Carbon dioxide emissions are inelastic with respect to energy use in the short run, but its response becomes elastic in the long run. This finding underscores the need for policies that promote cleaner sources of energy and more efficient use of energy so as to dampen the effect of energy use, an indispensable production input for the currently fast growing Philippine economy, on the environment.