Comparison of ARIMA and ANN Models Used in Electricity Price Forecasting for Power Market ()

1. Introduction

The global reform of power industry transferred electricity producers and purchasers from not be able to select their suppliers to full free choice in the last decades. Price forecasting is becoming increasingly relevant to all participants in the new competitive electric power markets [1]. If electricity price can be accurately predicted, for power producers, power generation companies could develop suitable generation plan and maximize corporate profits by grasping market dynamics. Power consumers will choose the time they want to use power and the quantity they want to buy, so that it can reduce costs and increase the market competitiveness of enterprises. For regulators, it could improve monitoring ability for market operation and solve problems in the market based on the forecast results of grid. Regulators also can formulate relevant strategies and lead right development of power market through the trend of electricity price changes [2].

In the past decades, a large number of forecasting models and methods have been tried. These methods can be divided into two categories: classical approaches such as auto regressive integrated moving average (ARIMA) models and artificial intelligence (AI) based techniques [3]. In this paper, ARIMA models and artificial neural network (ANN) techniques have been used to predict electricity prices in UK electricity market.

UK electricity market is a competitive modern power market with relatively independent generation, transmission, distribution and retail companies. It has been completely open to competition since the sub-100 kW market was deregulated in September 1998, which means all customers in this market can choose their suppliers freely. The New Electricity Trading Arrangements (NETA) has put into use since 27 March 2010 [4].

2. Forecasting Models

2.1. Autoregressive Integrated Moving Average Model

Box and Jenkins developed the autoregressive integrated moving average ARIMA (p,d,q) class of processes in the early 1970, and since then they have been applied to a wide variety of time series prediction applications. The orders p and q represent the numbers of autoregressiveterms and moving average terms separately and

is the level of differencing which ensures the stationarity of the time series [5].

2.1.1. Model Identification

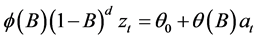

An ARIMA model can be expressed by the following formula:

(1)

(1)

where  is the operator of p and θ(B) is the operator of q. Their zeros need to be outside the unit circle. B is the lag operator, zt is the historical electricity data at time t and θ0 is a constant term. The error term at is generally assumed to be independent and it has an average of zero.

is the operator of p and θ(B) is the operator of q. Their zeros need to be outside the unit circle. B is the lag operator, zt is the historical electricity data at time t and θ0 is a constant term. The error term at is generally assumed to be independent and it has an average of zero.

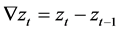

Electricity prices is a highly non-stationary time series with strong volatility and periodicity. Therefore, it is necessary to use differencing to alter the electricity price to a stationary time series. The first order difference can be expressed as:

(2)

(2)

If  is already stationary, d = 1. Otherwise, the order can be increased until the time series achieves a reasonable order of stationarity. Usually the value of d is up to 2 [6].

is already stationary, d = 1. Otherwise, the order can be increased until the time series achieves a reasonable order of stationarity. Usually the value of d is up to 2 [6].

2.1.2. Parameter Estimation and Diagnostic Checking

Autocorrelation function (ACF) and partial autocorrelation function (PACF) are used to select proper p and q. In the ARIMA model, the moving average order q is decided by ACF, while PACF can determine the autoregressive order p [7]. Usually, ACF decays rapidly from its initial value of unity at zero lag. For the stationary time series, ACF will die out over time. The orders p and q are selected from a reasonable range of non-negative values to create several ARIMA models and their parameters  and

and  are then determined.

are then determined.

After identifying the model’s parameters, diagnostic checking must be done. If the residuals inferred from the fitted model are normally distributed and uncorrelated, the model structure and all coefficients can then be used to estimate the predictions [8].

2.2. Artificial Neural Network Model

Artificial neural network (ANN) has been widely used in many different areas including transient detection, pattern recognition, approximation and time-se- ries prediction. The term ANN is used to describe various constructions of highly interconnected simple processing units that deliver an alternative to conventional computing techniques. The difference from the traditional methods is that ANN represents the related objects through learning from sample data rather than modelling calculation processes [9].

In general, a three-layer, feed-forward neural network shown in Figure 1 is the most widely used ANN structure [10]. This configuration can learn from retrospective information in a process called supervised learning in which the historical data derived from the system are used to train the network and determine the relationship between input and output.

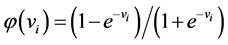

An artificial neural network is composed of many neurons which are interconnected with identical simple processing units. Every neuron in the network sums its weighted inputs to produce an internal activity level vi:

(3)

(3)

where wij is the weight of the connection from input j to neuron i, xij is the input signal number j to neuron i, and wi0 is the threshold associated with unit i. The

![]()

Figure 1. Artificial neural network architecture.

output of neuron yi is

(4)

(4)

(5)

(5)

where φ(vi) is the defined function that is one form of its expressions. In training, the network learns through adjusting both the weights connecting the input and hidden layer and the weights connecting the hidden layer and output, by the gradient multiplied by the learning rate parameter [11].

The major advantage of ANN is the offline training. However, this exercise is the most time-consuming.

3. Results and Discussion

The experimental data are half-hourly updated UK Reference Price Data (RPD) over 16 weeks from March 22nd to July 14th 2010, which are obtained from Power Spot Exchange (www.apxgroup.com). A sliding training window consisting of the historic price data in the most recent 8 weeks is used to determine the parameters of the ARIMA and ANN models from which the price predictions for one step (half hour), two steps (an hour) and three steps (1.5 hours) ahead are estimated respectively.

In order to compare the prediction accuracy of each forecasting model, the rootmeansquare error (RMSE) [12] of electricity price forecasts are calculated to assess the differences between predicted values

and actual values yt:

(6)

(6)

For ARIMA models, the historical data turns to stationary after the first difference. The parameter d of ARIMA model is therefore set to be 1. The orders p and q are dependence on the plots of ACF and PACF. In this study, a number of ARIMA models with p varying from 0 to 4 and q varying from 0 to 2 are applied to price predictions. It is found that the ARIMA (4,1,2) model has the best performance in terms of the RMSE of 1-step-ahead forecasts. For ANN models, the numbers of hidden neurons and delays are required to be adjusted and the training processes are carried out over several times until a satisfactory accuracy is achieved in the validation process. Here, when hidden neuronsreach 20 and the number of delays is 4 the autocorrelations of error indicates it is the best. The ANN models for one-step-ahead, two-step-ahead and three-step-ahead for- ecasts with the minimum RMSEs are chosen after training more than 50 times separately.

The electricity price forecasts for three steps ahead from 1:00 am 17th May to 00:30 am 14th July 2010 produced by the ARIMA (4,1,2) and the ANN (20 neurons, 4 delays) are compared with the actual electricity prices as shown in Figure 2 and Figure 3 respectively.

It can be seen from these two figures that the dashed curves representing the forecasts and the solid curves representing the actual values are all highly

![]()

Figure 2. Three-step-ahead forecasts by the ARIMA (4,1,2) compared with the actual prices.

![]()

Figure 3. Three-step-ahead forecasts by the ANN (20 neurons, 4 delays) compared with the actual prices.

coincident, which means the prediction are very accurate. In addition, the ARIMA (4,1,2) forecasts are shown to be closer to the actual electricity price values. In order to compare the accuracies of these two prediction methods, the RMSEs of price predictions for up to 3 steps ahead of the ARIMA (4,1,2) and ANN (20 neurons, 4 delays) models are tabulated in Table 1. And another prediction method is called Persistence Forecasting (PF), which is the simplest

![]()

Table 1. RMSEs of price predictions for up to 3 steps ahead of ARIMA (4,1,2) and ANN (20 neurons, 4 delays) models.

form of short-term forecasting which assumes the forecast value  at T time ahead equal to the current value

at T time ahead equal to the current value . In order to let the models to compare with this simple method, the RMSEs of PF are also shown in Table 1.

. In order to let the models to compare with this simple method, the RMSEs of PF are also shown in Table 1.

The unit of RMSE is £/MWh. It can be observed from Table 1 that the ARIMA model always has smaller RMSEs than the ANN in this study. In addition, as the forecast horizon increases, a higher improvement over the ANN in RMSE for the ARIMA (4,1,2) model is achieved. And comparing with the RMSEs of Persistence Forecasting, both models’ RMSEs are all smaller than the PF ones. In three steps forecasts, ARIMA improved accuracy by 3.34%, 5.21%, 6.15% over PF. And ANN improved the accuracy by 0.78%, 2.14%, 1.16% over PF in three steps respectively. So with the forecast steps increase, the improvement of ARIMA model is more obvious than ANN, especially in the third step.

4. Conclusions and Future Work

This paper has described and assessed the ARIMA and ANN models for electricity price prediction for up to three steps (1.5 hours) ahead based on the Reference Price Data (RPD) in UK electricity market. According to the forecast accuracy in terms of RMSE, the ARIMA (4,1,2) model is shown to outperform the ANN model in this study. Furthermore, the predictions from both ARIMA and ANN models become less accurate with the forecast horizon increasing. Both forecasting models rely on the historical data within the sliding training window. Therefore, the smaller forecast horizon is the stronger relationship between the historical values and prediction.

Comparing ARIMA and ANN models and selecting the optimal model for electricity price forecasting have been performed in this paper. In the future, the work tends to combine electricity price forecasts with new energy. Furthermore, the study can build on observing the relationship between electricity prices and other energy prices, and then based on the fluctuations of other energy prices to forecast electricity prices.