Consumption Patterns in the Aftermath of the Financial Crisis: The Case of Baby Boomers ()

1. Introduction

Classical economic theory viewed consumption as a rational choice by consumers of products that provided long-term gratification by assisting them in continuously improving their personal condition [1] . The Marginalist Revolution [2] [3] quantified gratification in terms of utility of the product consumed. The consumer attempted to maximize the utility of products consumed by making choices that catered to individual taste. Marginalism injected realism into consumption decisions by measuring the extent of satisfaction in purchase decisions. This paper extends marginalist thought by measuring the impact of several variables on key household consumption decisions such as home purchases, automobile purchases, food purchases, vacation and appliance purchase decisions for a specific age cohort, i.e. those born 1946-1964.

The baby boomer generation is defined as those born 1946-1964 [4] . In the US, the 80 million baby boomers form 39% of the adult population and earn 57% of discretionary income [5] . In the postwar period until 2006, home values became a source of household wealth. The Case-Shiller Index reached a peak of 19.93 in the second quarter of 2006 with a base value of 100 in 2000 [6] . Throughout this period, housing acted as an investment in call options. Buyers paid a premium to purchase a home that was continuously rising in value. With loss aversion, the buyer would exercise the option by selling the home at the new higher price and collecting the additional cash flow from proceeds. The success of this strategy was predicated upon prices rising continuously. This expectation created a bubble from increased demand from the 25% of the public who wished to capitalize upon this investment, yet lacked the means to qualify for a traditional mortgage due to derogatory credit or limited income [7] . These subprime borrowers qualified for adjustable-rate mortgages with low introductory interest rates set to rise in the future [8] . As interest rates on subprime mortgages rose in 2007, many borrowers could not meet the higher payments resulting in a subprime foreclosure rate of 43% on 6.8% of loans [9] . Home equity declined with the housing investment becoming a put option. A buyer could sell, but would receive less than the value of the outstanding mortgage, resulting in foreclosure. Postponing the sale would serve no purpose, as housing prices continued to fall and the loss between the home value and the mortgage amount continued to increase. With shrinking home equity, wage income became the sole source of consumption income. Wage income became variable due to high unemployment levels, which in 2009 were higher than at any time since 2003 [10] . Expectations of unemployment may have driven baby boomers to reduce consumption given that job insecurity has been found by 1.6% [11] . Consumption of durables was postponed, with households seeking to increase precautionary savings.

Relative consumption may vary based on social group comparisons. Weber coined the term, budgetary unit, to refer to a unit of individuals belonging to the same social class. Members of a social class make similar consumption choices based on the need to conform to group values. Empirical support for this thesis may be provided by an Euler equation describing consumption based on income in which the addition of a peer group comparison variable yielded a significant coefficient thereby explaining consumption in terms of acquiring items simply to keep up with one’s peer group [12] . Other studies have shown that peer effects are important for estimating budget share equations [13] [14] .

Gender differences may add another qualifier to consumption. As women exhibit group affinities through dyadic relationships with group members while men identify with the group as an entity [15] , women may differ in their emphasis on certain determinants of consumption such as labor supply and family size. Labor supply in an automobile purchase decision may be viewed as the means to provide additional convenience to enhance the day-to-day lives of members of the household by having a second vehicle. Family size may be important for the purchase of small appliances as a larger family will need more food prepared using these labor-saving devices such as toasters and coffee makers. Men, on the other hand, will view labor supply as a means to boost income and consolidate one’s position within a group. Deviation from one’s own group may be counter to the goals of men in that it prevents self-identification with the group, while for women it erodes dyadic relationships with group members.

The objectives of this study are to investigate the joint impact of economic variables, societal variables and gender on consumption expenditure on housing, new car purchases, used car purchases, lunch brought from home, lunch eaten at restaurants, vacations, furniture and appliances and small appliances. We set forth a richer array of determinants of consumption, and simple income-consumption studies with decisions involving eight product groups and three separate categories of determinants, i.e. economic, societal and gender-based. We quantify social relationships first enunciated in the sociological tradition in terms of predictors of consumption to supplement their theoretical underpinnings. We add to the limited body of literature on consumer behavior that has found gender-role consumption preferences [16] . Our time period of study of 2009 is pertinent to the examination of variability of income as this was a time of unusually high unemployment with its fears of high variability of future income as found in the aftermath of the Great Depression [17] .

2. Development of Exploratory Research Questions

2.1. The Rent or Buy Decision

AAs stated, in the real estate environment in the wake of the financial crisis, high unemployment expectations increased the variability of income, which in turn stimulated fears of foreclosure. However, given the high income of the boomer sample under consideration, it may be possible that actual foreclosure may not occur as buyers refinance their loans or use liquid assets to pay off the amount by which their property values are below the mortgage balance. Andersson et al. [18] observed that consumers were choosing to stay current on credit card debt to preserve liquidity. Jagtiani and Lang [19] supported this finding by identifying homeowners who were likely to stay current on home equity lines of credit. The other option would be loan modification which also increased liquidity with a lower monthly mortgage payment. In fact, it has been found that a lower monthly mortgage payment is associated with lower post modification default rates [20] . Labor supply, in the form of additional income may contribute to widening housing options in that prospective homeowners may qualify for more expensive homes. We may envision societal considerations including the desire to minimize deviation from the social referent group’s housing expense, maintaining status in relation to group members, and loss of mobility from home buying rather than renting. Males and females approach social interaction differently with men identifying themselves with groups per se and women with relationships with individual group members. Such group-like affinity has been found in male infants as early as six months in age, suggesting genetic roots [21] . Boys have been observed to prefer interacting in groups while girls interact in dyads unconnected with each other [22] [23] . In adulthood, men have been observed to perceive greater congruity between their values and those of groups, while women perceived congruity with specific individuals [15] . In a series of studies involving recall of whole-group identifiers and member characteristics, men showed enhanced recall of the former, while women had superior recall of the latter (see [24] for a review). Accordingly, we may theorize that in the context of housing, men may wish to minimize deviation from the group’s expectations of an ideal price range for homes owned by group members.

Housing stability is associated with purchasing a home, while mobility is associated with renting. The housing hierarchy defines the preference rankings of housing alternatives [25] . From the available supply of housing options, the public selects the highest-ranking alternative that it can afford. As money budgets increase over the life cycle due to increasing returns to human capital, individuals progress up the housing hierarchy as they progress up the occupational hierarchy. It follows that given the high income of this study’s sample, the respondents are at or near the peak of the occupational hierarchy so that their housing choice represents the most preferred choice in their lives.

Hypothesis 1: Economic considerations such as Variability of Income, Risk of Foreclosure and Labor Supply increase the propensity to own a home along with social group identification variables including Deviation from Referent Group’s housing Expenditure, Status and Loss of Mobility.

2.2. Determinants of New Car Expenditure

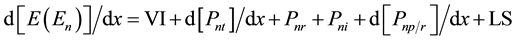

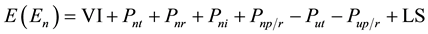

In a Coasian [26] framework, the new car seller is a monopolist who seeks to maintain market share by limiting supply. Eventually, the cars initially sold as new cars enter the used car market wherein sellers form an unstable oligopoly. Instead of colluding to limit supply, each supplier attempts to maximize profits by under pricing their product. Supply expands continuously driving down prices. It behooves the new car buyer to purchase when the new car seller, observing erosion of market share due to the surge in demand for used cars, discounts new cars to their minimum level at which the appeal of a new car just offsets the price advantage of a used car. In order to make a decision to purchase and make the higher investment in a new car (averaging $27,000 in our sample vs $11,000 for a used car), the prospective buyer must observe the price of a new car, the price of a used car, and add registration, payment and insurance for a new car. If female, labor supply may be included as well, in that the additional income permits the selection of new cars in a higher price range than if household income were lower. If we model a new car purchase from the perspective of the buyer,

(1)

(1)

where

Expected Price of a New Car

Expected Price of a New Car

Variability of Income

Variability of Income

Cost of a New Car from the lowest-priced seller at time t = lowest price offered by that seller that permits marginal profit,

Cost of a New Car from the lowest-priced seller at time t = lowest price offered by that seller that permits marginal profit,

Cost of Registration of a new car at time t

Cost of Registration of a new car at time t

Cost of Insurance of a new car at time t

Cost of Insurance of a new car at time t

Discounted perpetual annual Payments on new car

Discounted perpetual annual Payments on new car

Labor Supply

Labor Supply

Over time, the price of the new car falls below the original minimum, but remains above the price of a used car,

where,

(2)

(2)

Cost of a Used Car at time t

Cost of a Used Car at time t

Discounted perpetual Payments on a used car

Discounted perpetual Payments on a used car

Equation (2) implies that

and

Equation (1) may thus be modified to include the price and discounted perpetual payments on a used car,

(3)

(3)

The purchase is actually made by male buyers when the condition specified in Equation (3) holds as such buyers are primarily concerned with cost of a new car. In other words, Variability of Income, Cost of a New Car and Cost of Maintenance are paramount considerations for such buyers. For female buyers, the new car (additional car) improves convenience and strengthens relationships within the family. The rate of change in value of the new car is a function of the increase in Labor Supply with its concomitant increase in household income.

(4)

(4)

When Labor Supply reaches its maximum, i.e.![]() , a new car purchase occurs that optimizes intra-household relationships.

, a new car purchase occurs that optimizes intra-household relationships.

Hypothesis 2a: Variability of Income, Cost of a New Car, and Cost of Maintenance increase New Car Expenditure while Cost of a Used Car decreases the variation in New Car Expenditure for all buyers and male buyers.

Hypothesis 2b: Variability of Income, Cost of a New Car, Cost of a Used Car and Labor Supply increase New Car Expenditure for female buyers.

2.3. Used Car Expenditure

The buyers in this study are affluent and wish to display the symbols of success. Housing theorists [27] -[30] have shown that homes carry symbols that reflect the owner’s social status. An upscale neighborhood sends the message that the buyer is upscale. New cars may act as such status symbols. Buyers of used cars may see a divergence between the images of success that their incomes convey and the used cars that they purchase. Such divergence results in a lack of congruity between the used car buyer’s self-image and the image portrayed by the used car. Research in housing has found that dissatisfaction results with lack of self-congruity [31] -[33] . To achieve self-congruity, used car buyers may select vehicles that are similar to used cars in price, color and design as new cars to conform to the image of new car buyers as the aspirant group. At the same time, the price of the used car is an important consideration. Female buyers may consider the additional income from the purchase of a second used car as increasing transportation choices for family members thereby improving intra-family relationships.

Hypothesis 3a: Deviation from new car buyers decreases Expenditure on Used Cars while Cost of a Used Car increases Expenditure on Used Cars for male buyers.

Hypothesis 3b: Labor Supply influences the Expenditure on Used Cars for female buyers.

2.4. Expenditure on Lunch Brought from Home

Consumer research has shown that a buyer’s attitude towards a product is dependent upon the congruity between the buyer’s self-image and the product-user image [34] . Self-image acts as a cognitive cue in evaluating symbolic product cues. In the context of food-sharing in the workplace, those who bring food from home usually consume it in the presence of peers in a break room. There are no career-building opportunities through such interactions. This lunch group is diametrically opposed in values to the group that consumes lunch at restaurants. The latter consists of upwardly-mobile employees who seek to socialize with their superiors by eating with them at restaurants. The Lunch at Home group views this group as an aspirant group. They observe the career focus of the Lunch Consumed at Restaurants group but are unwilling to socialize to advance their own career goals. This attribute is in keeping with the literature on achievement vanity which has resulted in the purchase of luxury items to elevate social status [35] [36] .

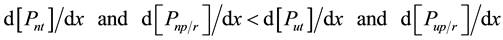

![]() (5)

(5)

where,

![]() Expected Value of Lunch Brought from Home

Expected Value of Lunch Brought from Home

![]() Family Size; as Family Size increases, food becomes more expensive and the expected value of Lunch Brought from Home decreases

Family Size; as Family Size increases, food becomes more expensive and the expected value of Lunch Brought from Home decreases

![]() Lunch Consumed at Restaurants; as the aspirant group increases consumption, the Lunch at Home Group mimics them within their context increasing its own consumption

Lunch Consumed at Restaurants; as the aspirant group increases consumption, the Lunch at Home Group mimics them within their context increasing its own consumption

![]() Variability of Income; as Variability of Income increases uncertainty about the affordability of food, the Lunch at Home group decreases consumption

Variability of Income; as Variability of Income increases uncertainty about the affordability of food, the Lunch at Home group decreases consumption

![]() As Labor Supply increases, so does income and in turn consumption of food

As Labor Supply increases, so does income and in turn consumption of food

![]() As more socialization opportunities for career advancement become available, the Lunch at Home group eschews them leading to reduced consumption

As more socialization opportunities for career advancement become available, the Lunch at Home group eschews them leading to reduced consumption

![]() Conformity to Own Group; as the Lunch at Home group conforms to its own referent group norms, consumption of Lunch Brought from Home increases

Conformity to Own Group; as the Lunch at Home group conforms to its own referent group norms, consumption of Lunch Brought from Home increases

![]() Conformity to Aspirant Group; conformity to an Aspirant Group’s norms will depress consumption of Food at Home.

Conformity to Aspirant Group; conformity to an Aspirant Group’s norms will depress consumption of Food at Home.

The most powerful determinants of Lunch Brought from Home may be LC, SO and COR, as this group wishes to meet its own group’s expectations while observing those of the Aspirant Group. Therefore, we differentiate Equation (5) with respect to these variables,

![]() (6)

(6)

At the maximum consumption of Lunch at Home, ![]() , or the Lunch at Home group internalizes the actions of the Lunch Consumed at Restaurants group, to the extent that they can mimic them at the minimum of socialization

, or the Lunch at Home group internalizes the actions of the Lunch Consumed at Restaurants group, to the extent that they can mimic them at the minimum of socialization

Opportunities, the Lunch at Home group abhor all attempts at socialization for career advancement. At the maximum of Conformity to One’s Own Group, the Lunch at Home group’s food choices and interactions fully support group beliefs.

Hypothesis 4: As Lunch Consumed at Restaurants, Labor Supply and Conformity to Own Group increase, Expenditure on Lunch Brought from Home increases; as Family Size, Variability of Income, Socialization Opportunities, Conformity to the Aspirant Group increase, Expenditure on Lunch Brought from Home decreases.

2.5. Expenditure on Lunch Consumed at Restaurants

Certain employees are upwardly mobile, eagerly seeking opportunities for professional advancement. They engage in social activities that increase their exposure to superiors who might assist them with recommendations, provide opportunities for training and development and share insights. Consuming lunch at restaurants with superiors is one such activity with professional promise.

We may state the following objective function and constraints:

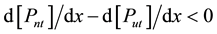

![]() (7)

(7)

subject to

![]() (8)

(8)

where

![]() Socialization Opportunities with Superiors

Socialization Opportunities with Superiors

![]() Conformity to Own Group

Conformity to Own Group

![]() Conformity to Lunch at Home Group

Conformity to Lunch at Home Group

We may restate (7) and (8) as a Lagrangian function,

![]()

At the optimum, the employee may advance to the position of choice so that![]() , or

, or

![]() , whereby socialization has been so effective that he or she is able to advance along the career path. This individual meets the expectations of others who share the same goals.

, whereby socialization has been so effective that he or she is able to advance along the career path. This individual meets the expectations of others who share the same goals.

Could a gender difference be recognized? This may be possible with Conformity to Own Group and Conformity to the Lunch at Home group. As noted, there are two social groups present, i.e. the clearly defined Lunch at Home group and the loose collection of upwardly mobile employees. The greater male identification with groups as distinct entities may lead them to distance themselves from the clearly defined Lunch at Home group as a collection of values with which they do not wish to be identified. The female propensity to form relationships with individuals may result in attachments to members of the Lunch at Restaurants group even though this is a loose network. We may state the following hypotheses.

Hypothesis 5a: Lunch Brought from Home, Socialization Opportunities and Conformity to Lunch at Home Group are explanatory variables for male employees’ Expenditure on Lunch Consumed at Restaurants.

Hypothesis 5b: Lunch Brought from Home, Socialization Opportunities and Conformity to Own Group for are explanatory variables for female employees’ Expenditure on Lunch Consumed at Restaurants.

2.6. Expenditure on Vacations

The sample consisted of educated professionals with high incomes. Bourdieu [37] views such groups are eager to possess social capital through a network of connections based on institutionalized relationships of mutual acquaintance. The acquisition of social capital confers recognition and status upon the social agent within the group. Such social agents have been shown to engage in self-enrichment activities including travel, sports, job training and cultural activities [38] . The literature on tourism has found that income and education were predictors for participation in outdoor recreational activities [39] and that income was statistically significant and positively related to expenditure on recreation including vacations [40] . It follows that the social collectives with members from similar income classes and educational backgrounds. Conformity to the group becomes the most important determinant of vacation expenditure, though an additional variable of the ability of the vacation to provide enrichment opportunities may be included. Family size has been found to decrease vacation spending in terms of total expenditure, food and beverage expenditure, lodging, transportation and sightseeing entertainment [41] . Intuitively, the larger the family, the less affordable a vacation becomes. As leisure expenditure is discretionary, high variability of income should depress it. Labor supply increases income and may thereby increase vacation expenditure, particularly since vacation expenditure is has been found to be income elastic [42] . No gender-based preferences were observed in any of these studies. We may state the following expression,

![]()

![]() (9)

(9)

where

![]() Expected Expenditure on Vacations

Expected Expenditure on Vacations

![]() Conformity to Referent Group

Conformity to Referent Group

![]() Enrichment Opportunities

Enrichment Opportunities

![]() Variability of Income

Variability of Income

![]() Labor Supply

Labor Supply

![]() Family Size

Family Size

We assume that![]() , or that Conformity to the Referent Group does not meet the norm initially.

, or that Conformity to the Referent Group does not meet the norm initially.

As the social agent wishes to meet group norms, there is a need to continuously modify vacation spending to achieve CI, the socially-accepted level of spending. At the optimum level of vacation spending, ![]() ,

,

We may rewrite Equation (9) as,

![]() (10)

(10)

Hypothesis 6: As Conformity to the Referent Group, Enrichment Opportunities, and Labor Supply increase, the Expenditure on Vacations increases; as Variability of Income and Family Size increase, the Expenditure on Vacations decreases.

2.7. Expenditure on Furniture and Appliances

It has been found that home equity lines of credit are not used for appliance purchases by baby boomers in the high-income segment as incomes grow [43] . In addition, the presence of working wives has not resulted in the wives in a significant increase in expenditure on appliances, though it did have a positive impact on family income [44] . We may conjecture that an increase in labor supply may reduce expenditure on furniture and appliances, particularly for the male subsample. Among the societal variables, desire to conform to the referent group may provide social identity. Social identity can be defined as the individual’s knowledge that he or she belongs to certain social groups together with some emotional or value significance to him or her of this group membership [45] . In the context of furniture and appliances, a consumer may find that, particularly with the more visible furniture purchase that they have achieved true identification with the group as it makes similar purchases. The concept of salience is relevant in that it confers an identity that is activated across different situations. Social identity salience permits the consumer to see features of furniture and appliances that are similar to that of group members thereby underscoring his or her status within the group [46] .

![]()

![]() (11)

(11)

where

![]() Expected Value of Expenditure on Furniture and Appliances

Expected Value of Expenditure on Furniture and Appliances

![]() Labor Supply

Labor Supply

![]() Family Size

Family Size

![]() Conformity to Referent Group

Conformity to Referent Group

![]() Status

Status

At the optimum, the second derivative of ![]() as it will match the expectations of the group exactly.

as it will match the expectations of the group exactly.

![]()

Hypothesis 7: As Family Size, Conformity to Referent Group and Status increase, Expenditure on Furniture and Appliances increases; as Labor Supply increases, Expenditure on Furniture and Appliances decreases.

2.8. Expenditure on Small Appliances

Intuitively, consumers consider small appliance purchases such as toasters and coffee makers to be mundane. They are not status symbols, but necessities. Therefore, labor supply with its additional income and variability of income with future economic uncertainty are unlikely to influence expenditures on small appliances. As larger families require more coffee makers, toasters and more spacious microwave ovens, family size may positively influence expenditure on small appliances, especially for the female subsample which is the primary user of these devices. As members of a social referent group have a similar array of microwave ovens, electric knives, blenders, cake mixers, etc., their purchases may be undertaken with the desire to conform to the purchases of the social referent group.

![]()

![]() (12)

(12)

where

![]() Expected Value of Expenditure on Small Appliances

Expected Value of Expenditure on Small Appliances

![]() Family Size

Family Size

![]() Conformity to Reference Group

Conformity to Reference Group

At the optimum, the second derivative of ![]() as it will match the expectations of the group exactly.

as it will match the expectations of the group exactly.

![]()

Hypothesis 8: Family Size and Conformity to the Referent Group increase Expenditure on Small Appliances.

3. Data and Methodology

The Bureau of Labor Statistics’ Consumer Expenditure Survey’s Interview files formed the source for consumption data for 2009. Two types of Interview files were created. The first form were income files with annual wages, number of earners (labor supply), education, family size and age. Expenditure data was obtained from expenditure files which included housing expenditure, mortgage, home insurance, home taxes, home repair, rent, debt, new car price, used car price, car registration, car insurance, car maintenance, car repair, lunch at home, lunch away from home, vacation expense, new furniture expense, new appliance expense and small appliance expense. All variables were scaled by total household expenditure. Conformity to groups was measured as differences from the mean. Dichotomous variables for status (0 for renters, 1 for home buyers), mobility (1 for renters, 0 for home buyers) and risk of foreclosure (1 for deviations of housing expenditure above the mean, 0 for deviations of housing expenditure below the mean) were created. A baby boomer sample of 1054 consumers was extracted with ages of 45 - 64 years old and incomes from $75,000 - $140,000 per year. Subsamples of 586 men and 466 women were used. For details about the sample, please see Table 1. Eight OLS regressions measuring the relationships outlined in Sections 2.1 - 2.8 were conducted. To maintain brevity, regression equations are not repeated in this section, but are more thoroughly discussed in Results.

4. Results

Results of regressions of 8 predictors on consumption variables are reported in Table 2. Panel 1 describes the variables underlying the choice to rent or purchase the principal dwelling of residence. Hypothesis 1 was affirmed with the domination of economic considerations such as the risk of foreclosure and for the full sample and the two subsamples of men and women, and variability of income for the full sample was observed. Men alone appear to support an increase in labor supply as explaining homeownership. An increase in labor supply increases household income, thereby making more expensive homes available for purchase. The gender-based subsamples show some evidence of socialization variables with significant influences on the rent or buy decision of diminished status and loss of mobility. Intuitively, both men and women engage in comparisons with others in their social class, rejecting housing options that diminish status and favoring the loss of mobility, i.e. greater stability that emanates from home ownership. Panel 2 supports Hypothesis 2 by endorsing the influence of hypothesized variables on the expenditure for a new car. Given the small sample size, only partial results were obtained for the smaller female subsample.

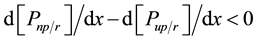

Economic considerations dominated for both the full sample and the male subsample with the higher cost of a new car and lower cost of a used car explaining new car purchase for the former and additional outlays such as the cost of maintenance and variability of income for the latter. An additional economic consideration, i.e. that of labor supply emerged in the female subsample. Perhaps, women considered the higher cost of new car to be justified in dual-earner families with higher income streams. In support of Hypothesis 3a and Hypothesis 3b, the

expenditure on a used car is influenced by both economic and social identification variables. Buyers of used cars wished to distinguish themselves from new car buyers both in the full sample and the male subsample in an attempt to view themselves as belonging to a different social stratum. Economic considerations such as the cost of a used car in the full sample and labor supply in the female subsample were found. The cost of the used car suggests frugality, while an increase in the number of wage earners in dual-income households (labor supply) may stem from the need to purchase additional vehicles, in support of Hypothesis 4. Social identification concerns dominated in the explanatory variables of the choice to bring lunch from home to be consumed at the workplace. Across all three samples, the strongest significances were observed for lunch consumed at restaurants. Given that those who choose to bring food from home may aspire to belong to the group that eats at restaurants, this finding may arise from the observation of an aspirant social group. If this result is combined with the strong significance of the need to limit deviation from those who bring lunch from home, we may surmise that the social group that brings food from home identifies itself with its peers, while simultaneously aspiring to belong to the group that spends more on lunch, i.e. the aspirant group that eats at restaurants. It is insightful that

![]()

![]()

Table 2. Results of OLS regressions of household consumption.

*p < 0.05, **p < 0.01, ***p < 0.001

socialization opportunities appear to be less important for those who bring food from home in that they are either not upwardly mobile or do not view the sharing of food as the means to advance their careers. In support of Hypothesis 5a and Hypothesis 5b, or for the group that eats at restaurants, other socialization variables become paramount with observations of those who bring food from home and the desire to distance themselves from this social class (as seen by a negative coefficient on deviation from the Lunch at Home group). Socialization opportunities to move upward along the chosen career path are important in all three samples. The female subsample is distinguished in its desire to conform to its own referent group, i.e. of upwardly mobile professionals, possibly due to achieve and maintain acceptance from other group members. In support of hypotheses 6 - 8, including vacation expenditures, outlays for furniture and appliances and small appliances group conformity is emphasized with the desire to conform to group norms explaining the largest amount of the variance in the criteria in each case. In addition, the female subsample considered family size to be a significant predictor of expenditure on small size, presumably because large families need more small appliances (i.e., toasters and coffee makers) and it is women who are frequent users of these devices.

5. Conclusions

Economic variables dominated for the rent or buy a home decision given the high cost of this investment. However, social identity was of importance in that respondents who wished to make housing choices that retained their status within the social referent group both in terms of maintenance of status and stability. The Coasian position linking new car and used car purchases was supported with new car production limits increasing the market for used cars which are competitively underpriced. Consumers respond by purchasing a new car only if it offers more in terms of features than a used car. At the margin, used cars are favored the more similar they are in capability to new cars. For Lunches Brought from Home and those consumed at restaurants, two distinct social groups emerge. The groups of employees who are satisfied with their current job status are the Lunch at Home group while those that eat at restaurants are more upwardly mobile. Both groups observe each other; the male subsample, wishes to distinguish itself from the Lunch at Home group in particular. For expenditure on vacations, furniture and appliances and small appliances, social group identification is the chief determinant of consumption with maintenance of group membership governing the level of expenditure.

Gender differences emerged primarily with respect to the labor supply and family size variables. Men viewed labor supply as a source of additional income for primary purchases such as a home. Women viewed labor supply as a source for secondary purchases such as an additional new or used vehicle. Family size remained insignificant in most regressions with the exception of small appliance expenditure with the utilitarian need for more devices for larger families. As women use small appliances more than men, they increase expenditure on small appliances for larger families.

This study has explored consumption patterns of baby boomers at a high income level. This group exhibits a high level of confidence in its consumption decisions, eschewing economic fears in most consumption decisions with the exception of housing (where the risk of foreclosure dominates). Social identification is paramount with boomers closely observing peer and aspirant groups. They seek to minimize the deviation from peer groups and observe aspirant groups who act as models for future consumption choices. The only case in which a higher- status group observed a lower-status group was when the Lunch Consumed at Restaurants group observed the Lunch at Home group. The reaction of the former was to increase separation between themselves and the lower-status group. In essence, status within a group is important.

Marketers may use the results of this study to segment markets both in terms of product preference and preferences by gender. For example, in housing, they may seek to allay buyer fears of variability of income by offering low interest rate mortgages with higher down payments and lower monthly payments. For dual-income families, used cars may be offered both as first and second vehicles with sufficient attributes to make them similar in quality to new cars. New car sellers, on the other hand, must attempt to increase the life of their monopoly status by offering new styles and designs continuously to differentiate their products from cheaper used cars. Vacations, furniture and appliances and small appliances must be tailored specifically to the needs of this segment. From past vacation choices, travel operators may find favorite destinations and prices paid and tailor vacation packages and amenities. Furniture and appliance stores may create rooms full of furniture in specific colors and styles based on surveys to elicit favored choices from prospective consumers. Once this information is available, a single promotional message may be targeted to the entire group.

A few limitations of the study may be noted. The consumption patterns measured belonged to the affluent whose consumption may be different from that of other income classes. Specifically, they may have felt the adverse effects of the 2008 financial crisis to a lesser extent. The study may be updated with more current data from 2013-2014 to measure the evolution of consumption patterns over time.