Modeling Returns and Unconditional Variance in Risk Neutral World for Liquid and Illiquid Market ()

1. Introduction

It is well known that the stock price changes are neither independent nor identically distributed. There are linear and nonlinear dependencies between successive price changes. Distributional assumptions concerning risky asset log returns play a key role in option pricing. According to research finding of Mandelbrot [1] , evidence indicates that the empirical distributions of daily stock returns differ significantly from the traditional Gaussian model. In search of satisfactory descriptive models for financial data, large number of distributions have been tried (see for example, [2] - [6] ).

The deviations from normality become more severe when more frequent data are used to calculate stock returns. Various studies have shown that the normal distribution does not accurately describe observed stock return data. Over the past several decades, some stylized facts have emerged about the statistical behavior of speculative market returns such as aggregational Gaussianity, volatility clustering, etc see [7] [8] . On the same note, most of the literature for example [9] - [12] and references therein, assume that daily log returns, can be modeled by exponential Lévy processes and geometric Lévy process.

There are two important directions in the literature regarding these type of stochastic volatility models. Continuous-time stochastic volatility process represented in general by a bivariate diffusion process, and the discrete time autoregressive conditionally heteroscedastic (ARCH) model of [13] or its generalization (GARCH) as first defined by [14] . Option pricing in GARCH models has been typically done using the local risk neutral valuation relationship (LRNVR) pioneered by [15] . The crucial assumptions in his construction are the con- ditional, normal distribution of the asset returns under the underlying probability space and the invariance of the conditional volatility to the change of measure. The empirical performance of these normal option pricing models has been studied extensively, for example in [16] , [17] .

The main focus of this paper is to develop a ARCH type Lévy model which attempts to capture some of the stylized features observed in demeaned log returns from any market data. More so we derive unconditional variance of daily log returns in risk neutral world of different ARCH type models, and an in-depth empirical study in liquid and illiquid market. All parameters are estimated from historical data, i.e. for S&P500 index from January 3, 1990 to January 18, 2008 and NSE20 index from March 2, 1998 to July 11, 2007.

The article is organized as follows. Section 2 provides a brief overview of ARCH type models and Lévy increments resulting to parameter estimation of observed salient features. In Section 3 which is our major con- tribution, unconditional variance of different ARCH type models is presented. Filtered Leptokurtic residuals of Lévy increments are calibrated. Conclusions are drawn in Section 4. Appendix is in the last section.

2. ARCH Type Models

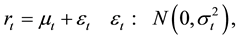

ARCH-type models are in general, discrete models used to estimate volatility of financial time series data such stock returns, interest rates and foreign exchange rates. Let

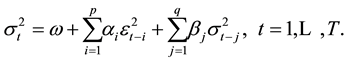

where  denotes the price of stock at time

denotes the price of stock at time . Define the following equation

. Define the following equation

(1)

(1)

where

(2)

(2)

where  is the GARCH(p, q) volatility process. If

is the GARCH(p, q) volatility process. If  then

then  is ARCH(p). [18] and [19] provide a general specifications of volatility dynamic that nest most ARCH type models. In this connection volatility dynamics can be written as

is ARCH(p). [18] and [19] provide a general specifications of volatility dynamic that nest most ARCH type models. In this connection volatility dynamics can be written as

where  is the innovation function. Different GARCH models are mainly characterized by the following specifications of the innovation function

is the innovation function. Different GARCH models are mainly characterized by the following specifications of the innovation function .

.

(3)

(3)

The innovation function is used to model asymmetry and news impact to say the least. These GARCH models can be generalized to allow non-linearity of volatility dynamics by using Box-Cox transformation as follows

(4)

(4)

which implies modeling news and power, will nest most of the proposed GARCH models in Literature. Note that the leverage parameter  shifts the innovation function, the news parameter

shifts the innovation function, the news parameter  tilts the innovation, and the power parameters

tilts the innovation, and the power parameters  and

and ![]() flatten or steepen the innovation function. Such a model (4) is the Asym- metric Power Autoregressive Conditional Heteroscedastic model i.e. APARCH model defined in (5).

flatten or steepen the innovation function. Such a model (4) is the Asym- metric Power Autoregressive Conditional Heteroscedastic model i.e. APARCH model defined in (5).

The APARCH(m, n) model of can be written as follows

![]()

![]() (5)

(5)

subject to ![]() for

for![]() ,

, ![]() , for

, for![]() . and

. and

![]() (6)

(6)

The model introduces a Box-Cox power transformation on the conditional standard deviation process and on

the asymmetric innovations, ![]() , adds flexibility of a varying exponent with an asymmetry co-

, adds flexibility of a varying exponent with an asymmetry co-

efficient to take the leverage effect into account. The properties of APARCH model have been studied, see [20] . The model nests seven other ARCH extensions as special cases.

・ ARCH model of [13] when![]() , and

, and ![]()

・ GARCH model of [14] when![]() , and

, and ![]()

・ GJR-GARCH Model of [21] when ![]()

・ TARCH Model of [22] when ![]()

Note that ![]() denote the conditional mean given the information set

denote the conditional mean given the information set ![]() available at time t − 1. The innovation process for the conditional mean is then given by

available at time t − 1. The innovation process for the conditional mean is then given by ![]() with corresponding unconditional variance

with corresponding unconditional variance ![]() and zero unconditional mean. The conditional variance is defined as

and zero unconditional mean. The conditional variance is defined as ![]()

2.1. Empirical Data

For simplicity, we focus on daily closing indices ![]() as reported in Nairobi Securities Exchange for NSE20 share index and S&P500 index in New-York Stock Exchange. Daily log-returns

as reported in Nairobi Securities Exchange for NSE20 share index and S&P500 index in New-York Stock Exchange. Daily log-returns ![]() of S&P500 index are computed from January 3, 1990 to January 18, 2008 for a total of 4550 daily observations. While for NSE20, share indexes are computed from March 2, 1998 to July 11, 2007 for a total of 2317 daily observations.

of S&P500 index are computed from January 3, 1990 to January 18, 2008 for a total of 4550 daily observations. While for NSE20, share indexes are computed from March 2, 1998 to July 11, 2007 for a total of 2317 daily observations.

All return series exhibit strong conditional heteroscedasticity. The Ljung and Box test rejects the hypothesis of homoscedasticity at all common levels both for returns in S&P500 index and AR(3) residuals of linear re- gression in NSE20 share index. We estimate GARCH type models assuming conditional normality. With re- spect to the absolute value of parameter estimates, we find that ![]() but different for both indices (NSE20

but different for both indices (NSE20![]() , S&P500

, S&P500![]() ), indicating the typical higher per- sistence of shocks in volatility in New York Stock exchange compared to Nairobi Securities Exchange. Model (5) is estimated using Pseudo Maximum Likelihood estimator based on the assumption of conditional normal in- novations. The parameter estimates of (8) are reported in Table 1 and AR-ARCH residual calibrations of GH distribution (9) are presented in Table 2. Empirical and kernel densities of fitted distributions for both indices are compared in Figure 1.

), indicating the typical higher per- sistence of shocks in volatility in New York Stock exchange compared to Nairobi Securities Exchange. Model (5) is estimated using Pseudo Maximum Likelihood estimator based on the assumption of conditional normal in- novations. The parameter estimates of (8) are reported in Table 1 and AR-ARCH residual calibrations of GH distribution (9) are presented in Table 2. Empirical and kernel densities of fitted distributions for both indices are compared in Figure 1.

![]() (7)

(7)

![]()

2.2. Lévy Increments

Suppose ![]() is the characteristic function of a distribution. If for every positive integer n,

is the characteristic function of a distribution. If for every positive integer n, ![]() is the

is the

![]()

Table 1. GARCH and GJR model estimates for the indices.

Notes: standard errors are in parenthesis. lgl is the log likelihood.

![]() power of a characteristic function, we say that the distribution is infinitely divisible. One can define for every such infinitely divisible distribution a stochastic process

power of a characteristic function, we say that the distribution is infinitely divisible. One can define for every such infinitely divisible distribution a stochastic process ![]() called a Lévy process, which starts at zero, has independent and stationary increments and such that the distribution of an increment over

called a Lévy process, which starts at zero, has independent and stationary increments and such that the distribution of an increment over ![]() has

has ![]() is the characteristic function. For more detailed treatment of Lévy process, see [23] .

is the characteristic function. For more detailed treatment of Lévy process, see [23] .

Definition 2.1 The probability density function of the one-dimensional Generalized Hyperbolic distribution is given by the following:

![]() (8)

(8)

where ![]() and

and ![]() is the modified Bessel function of third kind, with the index

is the modified Bessel function of third kind, with the index ![]()

![]() (9)

(9)

![]() is the location parameter and can take any real value,

is the location parameter and can take any real value, ![]() is a scale parameter;

is a scale parameter; ![]() and

and ![]() determine the distribution shape and

determine the distribution shape and ![]() defines the subclasses of GH and is related to the tail flatness.

defines the subclasses of GH and is related to the tail flatness.

The mean and variance of GH distribution are given respectively by the followings

![]() (10)

(10)

and

![]() (11)

(11)

where![]() . Note that, if

. Note that, if![]() , then

, then

![]()

![]() (12)

(12)

![]() (13)

(13)

![]()

![]()

For more information about GH distribution, see [24] .

3. Modeling the Underlying

Let ![]() be a stochastic basis describing the uncertainty of the economy. We refer to

be a stochastic basis describing the uncertainty of the economy. We refer to ![]() as the

as the

physical probability measure and ![]() represent the information flow driven by Brownian motion

represent the information flow driven by Brownian motion ![]()

and Lévy proces![]() . Let

. Let ![]() be the price of a stock at time

be the price of a stock at time ![]() adapted to the natural filtration

adapted to the natural filtration![]() .

.

Define daily log return as ![]() It is well known from our empirical studies that

It is well known from our empirical studies that ![]() can he represented as

can he represented as ![]() where

where ![]() is a mean function and

is a mean function and ![]() are the two components of the error term. Moreover, define a

are the two components of the error term. Moreover, define a ![]() order autoregressive process

order autoregressive process ![]() with APARCH(m,n) error as

with APARCH(m,n) error as

![]() (14)

(14)

where ![]() and

and ![]() are identically and independently distributed random variables. A general time series model for log returns would be

are identically and independently distributed random variables. A general time series model for log returns would be

![]()

3.1. Risk Neutralization

In this section, we construct risk neutral probability measure in the context of [15] and [19] . Duan [15] intro- duced the GARCH option pricing model by generalizing the traditional risk neutral valuation methodology to the case of conditional heteroscedasticity, the so called Local Risk Neutral Valuation Relationship (LRNVR).

Definition 3.1 A pricing measure ![]() is said to satisfy the locally risk-neutral valuation relationship (LRNVR) if measure

is said to satisfy the locally risk-neutral valuation relationship (LRNVR) if measure ![]() is equivalent to

is equivalent to![]() , and

, and

![]()

Table 2. Calibration of AR-GARCH(1,1) residuals to a class of infinitely divisible distributions.

![]()

Figure 1. Empirical and kernel densities of standardized GARCH filtered Lévy increments of NSE20 index (left) S&P500 index (right) calibrated vs. density of fitted infinitely divisible distributions and normal distributions.

![]() (15)

(15)

![]() (16)

(16)

almost surely with respect to measure![]() .

.

For some commonly used assumptions concerning utility functions and distributions of change of con- sumption, [15] shows that a representative agent maximizes his expected utility using the LRNVR measure![]() . Risk neutralization should leave the variance unchanged and should transform the conditional expectation so that the discounted expected price of the underlying asset becomes a martingale. It is worth noting that in the case of homoscedasticity process,

. Risk neutralization should leave the variance unchanged and should transform the conditional expectation so that the discounted expected price of the underlying asset becomes a martingale. It is worth noting that in the case of homoscedasticity process, ![]() , the conditional variances become the same constant and the LRNVR reduces to conventional risk neutral valuation relationship.

, the conditional variances become the same constant and the LRNVR reduces to conventional risk neutral valuation relationship.

Consider the general model of daily log returns under the data generating probability measure ![]() as

as

![]() (17)

(17)

where the parameters ![]() and

and ![]() and

and ![]() and given

and given![]() . The sequence

. The sequence ![]() and

and ![]() are conditionally independent, while

are conditionally independent, while ![]() is the past information set.

is the past information set. ![]() represents the conditional expectation of returns.

represents the conditional expectation of returns.

The pricing measure ![]() shifts the error term

shifts the error term ![]() by some measurable function

by some measurable function![]() , so that the conditional expectation of

, so that the conditional expectation of ![]() becomes equal to

becomes equal to![]() . In the case of AR(1)APARCH(1,1)-Lévy filter, we follow the [25] argument. Therefore under the equivalent martingale measure

. In the case of AR(1)APARCH(1,1)-Lévy filter, we follow the [25] argument. Therefore under the equivalent martingale measure ![]() the model (16) translates to

the model (16) translates to

![]() (18)

(18)

![]() (19)

(19)

The LRNVR implies that under the risk neutral measure ![]() the return process evolves as

the return process evolves as

![]() (20)

(20)

![]() (21)

(21)

![]() (22)

(22)

![]() (23)

(23)

It follows quite easily that

![]() (24)

(24)

3.2. Unconditional Variance

The following propositions provide the unconditional variance for the process ![]() under

under ![]()

Proposition 3.1 Consider AR(3) APARCH(1,1) Lévy filter, with ![]() and

and ![]() which implies AR(3)- GARCH(1,1) Lévy model, the unconditional variance of

which implies AR(3)- GARCH(1,1) Lévy model, the unconditional variance of ![]() under the LRNVR equivalent measure

under the LRNVR equivalent measure ![]() is

is

![]()

Proof: See Appendix. W

Proposition 3.2 A special case of AR(1)GARCH(1,1)Lévy filter the unconditional variance under the LRNVR equivalent measure ![]() is given by

is given by

![]()

Proof: See Appendix. W

Example 3.1 In case of Hyperbolic distribution we substitute mean and variance respectively into (25). Where the parameters used maximize the likelihood function of Hyperbolic distribution. i.e. Let

![]() then,

then,

![]() (25)

(25)

![]() (26)

(26)

![]() (27)

(27)

![]() (28)

(28)

Consider a discrete time economy, where interest rates and returns are paid after each time interval of equal spaced length. Suppose there is a price for risk, measured in terms of a risk premium that is added to the risk free interest rate r to build the expected next period return. As in Duan [15] , we adopt and extend the ARCH-M model of [26] with the risk premium being linear functional of the conditional standard deviation, hence the following model under![]() ,

,

![]() (29)

(29)

The parameters ![]() and

and ![]() are constant parameters satisfying stationarity and positivity conditions, while the constant parameter

are constant parameters satisfying stationarity and positivity conditions, while the constant parameter ![]() may be interpreted as the unit price for risk. If we change the function

may be interpreted as the unit price for risk. If we change the function ![]() in (29) to model news impact, we get threshold GARCH model of [21] where

in (29) to model news impact, we get threshold GARCH model of [21] where

![]() (30)

(30)

hence the resulting TGARCH Lévy filter model

![]() (31)

(31)

Proposition 3.3 The unconditional variance of the GARCH-M Lévy filter model under the LRNVR equivalent martingale measure ![]() is

is

![]() (32)

(32)

Proof: See Appendix. W

Proposition 3.4 The unconditional variance of the TGARCH-M Lévy filter model under equivalent martingale measure ![]() is

is

![]() (33)

(33)

where

![]() (34)

(34)

and ![]() denoting the cumulative standard normal distribution function.

denoting the cumulative standard normal distribution function.

Proof: See Appendix. W

4. Concluding Remarks

This article develops an log-ARCH-Lévy type risk neutral model. The proposed method delivers predictive dis- tribution of the payoff function for a given econometric model. As a result, the probability distribution could be useful to market participants who wish to compare the model predictions to the potential prices in liquid and illiquid markets.

Any effective option pricing model is expected to be consistent with distributional and time series properties of the underlying asset. The proposed model accommodates most of the observed stylistic fact about financial time series data i.e. skewness and leptokurtic nature of demeaned GARCH filtered log returns and perhaps aggregational Gaussianity. In summary,

・ developed markets and emerging markets may not have the same underlying dynamics. It would be incorrect to assume that a universal model for the underlying process for all markets.

・ The presence of linear autoregressive dynamics AR(3)-GARCH(1,1) effects in NSE20 index affects the un- conditional variance in risk neutral world. S&P500 index was found to follow GARCH(1,1) plus leptokurtic residual which was calibrated in one class of generalized hyperbolic distributions,say for example, Normal inverse Gaussian (NIG).

・ The presence of autoregressive dynamics, i.e. AR(3)-GARCH(1,1) model of NSE20 index as an example of illiquid market would have an impact in pricing options, if the index were to be used as an underlying process.

The log-ARCH-Lévy model is very tractable compared to other jump-diffusion or stochastic volatility models. It attempts to addresses the drawbacks of local volatilities. Further refinements and extensions are left for future research.

Acknowledgements

Comments from the Editor and the anonymous referee are acknowledged. Financial support from International Science Progam (Sweden)/EAUMP is greatly appreciated.

Appendix

Proof of proposition 3.1

Given ![]() We note that

We note that ![]() and

and

![]()

![]()

after rearranging and simple algebra

![]()

Thus under stationarity, the unconditional expectations are independent of ![]()

![]()

Therefore, the unconditional variance of AR(3)GARCH(1,1)Levy filter model under LRNVR equivalent mar- tingale measure is

![]()

Proof of proposition 3.2

This is a special case of (3.1) with ![]() and

and![]() .

.

Proof of proposition 3.3

It is a special case of proposition 3.4 when we take ![]() and

and ![]()

Proof of proposition 3.4

Under measure ![]()

![]()

where ![]() is the risk premium and

is the risk premium and

![]()

![]()

![]()

![]()

![]()

and ![]() denoting the cumulative standard normal distribution. Note that

denoting the cumulative standard normal distribution. Note that ![]() and

and

![]()

Therefore, for positive support

![]()