The Market Pricing of Information Risk: From the Perspective of the Generating and Utilizing of Information ()

1. Introduction

The discovery process of stock price is actually a process that stock price reflects information related to listed companies. In the process, whether the information obtained by investors is timely, full and accurate will affect whether their knowledge on corporate is clear, complete, undistorted, and comparable, thus having a crucial impact on the formation of the stock market prices. At the same time, there is no agreement about whether the relevant information risk can be dispersed effectively through portfolios or whether information risk is priced by market.

In this paper, we conduct our research based on the point that information risk is a dynamic and comprehensive concept. It is not limited to information generating link that under the concept of some static characteristics of financial reporting, but also need to associate the information disclosure of companies with information receiving and understanding of the external information users, which can be reflected on investors’ information interpreting ability, namely the extent of how investors understand the company's current financial situation and operating results through financial reports.

The rest of this paper is organized as follows. Section 2 reviews related literature and develops research hypotheses. Section 3 describes the data and methodology. Section 4 reports tests for an empirical relationship between information risk and expected cost of equity capital, the correlation between financial reporting quality and investors’ information interpreting ability, and examines whether information risk is a priced risk factor. Finally, Section 5 makes summary conclusions.

2. Literature Review and Research Hypotheses

2.1. Related Research

Easley and O’Hara (2004) found the amount of private information and the accuracy of both the private information and public information will affect the information risk premium, and they provided evidence that information risk was priced based on a multiple assets theory model including informed and uninformed traders. However, the research of Lambert et al. (2007) shows that the influence of information asymmetry on expected return may be dispersed in big economies and the author owed the result of Easley and O’Hara (2004) to the limited assets used in the model. Francis et al. (2005) proposed that information risk derived from the uncertainty or imprecision of the information used by investors to price securities. Using accrual quality to depict information risk, they tested the relevance of information risk and systemic risk beta as well as whether the information risk can be reflected in stock returns. The empirical results showed that the information risk had a significant positive correlation with cost of capital and the capital market priced information risk effectively. Chen et al. (2007) further eased the source of the information risk which can be generated by the accuracy of the financial report information and the change in equity valuations due to the change of investors’ expectations of dividends. Also, they proved that information risk represented by accrual quality was priced in an environment with dividends changed. The definition of information risk referred by Yu et al. (2007) was consistent with the one of Francis et al. (2005) , but their conclusions were just the opposite. Core et al. (2008) studied this issue using two- stage cross-sectional regression method and found no sufficient evidence to confirm information risk is priced. Kim et al. (2010) found that the U.S. stock market existed information risk premiums related to macroeconomic environment and the company’s economic activities after eliminating the low price stocks. Barth et al. (2013) found that there existed a negative relation between earnings transparency and cost of equity capital. Earnings transparency is the extent of financial reporting information reflecting the real economic value, the lower the earnings transparency, the poorer the reliability of the information usage, and the higher the information risk. Mouselli et al. (2013) studied the market pricing of information risk characterized by accrual quality in UK stocks market, but the results failed to get the support evidence.

In conclusion, the existing research about the measurement of information risk can be grouped into two classes. Categories one is the quality of financial reporting based on accrual quality, the second is information asymmetry based on the probability of insider trading. The former focuses on the information quality in generating step, while the latter emphasizes the difference among investors about the information acquisition and understanding in utilizing step. However, the whole process of companies passing information to external information users with financial reporting need to experience two links: the information production step of listed companies and the utilizing step of investors, thus the transfer effect of information is joint result of these two steps, namely, the generating and utilizing steps of information decide the final level of the information risk together. Therefore, the study of information risk should combine the information production process and output process with the understanding and reaction of users.

2.2. Research Hypotheses

In the step of generating information, information risk is mainly reflected in the quality of financial reporting which is the carrier of accounting information disclosed by company. Investors make investment decisions based on inaccurate accounting information may enlarge the deviation for the forecast of future earnings, leading to adverse selection problem and distorted capital configuration, thus inducing valuation risk related to information and impacting investors’ expected return for investment. The higher the financial reporting quality, the more objective and fairer of the company’s financial position and operating results can be to reflected by the disclosed information, the easier for investors to know the real condition of the company, thus the lowest required return of investors could be reduced.

Hypothesis 1: Financial reporting quality is negatively related with the company’s equity capital cost.

In the utilizing step of information, whether investors can fully absorb the information content and make the right judgment about the investment value of the company will also affect the investment risk. Investors’ information interpreting ability is a concept for the whole group of investors, not only for a certain part of them. Investors differ in the level of education, acquisition and analysis ability of information, leading to individual investors differ in the level of information interpreting, but for the market as a whole, what can be reflected in the price volatility and affect stock returns is the information interpreting ability of whole groups of investors. Low information interpreting ability means the ability of investors to understanding the company through financial reporting is limited, which will be a disadvantage in the decision and inducing higher requirements for the investment return, finally raising the equity capital cost.

Hypothesis 2: Investors’ information interpreting ability is negatively related with the company’s cost of equity capital.

High quality financial report can offer current and potential investors useful information that can make a reasonable investment decision without confusing or misleading investors. Therefore, high quality financial reporting is more helpful for stakeholders to understand the real condition of the company through the formal appearance of financial report and confirm or modify previous forecast and decision according to the financial report information of, so as to make the right economic decision.

Hypothesis 3: The negative relation between investors’ information interpreting ability and the cost of equity capital is more significant when the financial reporting quality is higher and other things being equal.

When investors estimate the valuation of the target company, they will use data in financial reporting of the target company as variables in valuation model, which make the financial reporting information affect the stock price. In incomplete and imperfect market, investors can only predict the future on the basis of historical information. Although financial report information are historical data, it can deliver the information of current and future cash flow to investors, which is the basis of foreseeing the company’s future development prospect as well as the information about intrinsic value of stocks. Accordingly, the risk related to the generating and utilizing of financial reporting information should be priced by market.

Hypothesis 4: Information risk is undiversifiable and can be priced by market.

3. Methodology and Data

This paper selected the Chinese A-share listed companies from 1998 to 2014 as sample, and the return, stock price, earnings and cash flow data of listed companies come from the CSMAR database and the Fama-French three factors come from the RESSET database. In view of the need of cash flow data to calculate the variables depicting financial reporting quality, the calculation time range of main variables is 1999-2013 and the time range of information risk factor is from May 2000 to April 2014. In research process, we filter data as following: ① Removing the companies in Growth Enterprise Market, since their information disclosure is different from the main board companies; ② Removing the financial listed companies, because their capital structure and financial data exist differences with others; ③ Removing the companies with some related data undisclosed.

3.1. Measurement of the Risk in Information Generating Step

The risk in information generating step depends on the quality of financial reporting. Financial reporting quality is mainly influenced by the manipulation of management and can be measured by the modified Jones model. The poorer quality of financial reporting, the more serious of information distortion, indicating the information can’t reflect the economic substance of the company effectively. Dechow et al. (1995) proposed modified Jones model to estimate the discretionary accruals of companies. Because the companies have motivation to increase profits or decrease profits, we use the absolute value of the discretionary accruals to reflect the magnitude of the information risk.

First of all, do cross-sectional regress in each industry according to Equation (1):

(1)

(1)

where i denotes company, t denotes year; TAi,t is the total accruals , which equals the operating profit in year t subtract the one in year t − 1; DREVi,t is the change of main business revenue; DRECi,t is the change of account receivable; PPEi,t is the net book value of fixed assets. In order to eliminate the scale effect, all variables are standardized with total assets in year t − 1.

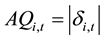

The absolute value of residual is discretionary accruals, namely the proxy of the risk in information generating step.

(2)

(2)

3.2. Measurement of the Risk in Information Utilizing Step

We use the earnings transparency proposed by Barth et al. (2013) to measure investors’ ability to interpret financial reporting information. There are three steps in the calculation of earnings transparency:

In the first step, do regression in accordance with Equation (3) in each industry to compute the interpretation extent of earnings and its change for the stock return, namely the adjusted R-squared in Equation (3), the result denotes TRANSI.

(3)

(3)

where j denotes industry; RET is annual return, it is computed from May in year t to April in year t + 1 to ensure that the annual return absorbed the earnings information fully, for Chinese listed companies are allowed to disclose their financial reports before April 30 in year t + 1 after the end of the fiscal year t. Et is the earnings per share, which reflects shareholder profitability of the company. Pt−1 is price at the beginning of the period, calculated using the closing price in April of year t. Standardizing the earnings with price aims to make it consistent with return variables. DE is the change of earnings.

In the second step, assign the sample companies into three portfolios from small to large according to the magnitude of the residuals in Equation (3). Then, do regression in each portfolio as shown in Equation (4). Similarly, adjusted R-squared in this step reflect the interpretation degree of earnings and its change for stock return in each company portfolio, the result denotes TRANSIN:

(4)

(4)

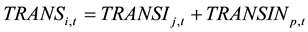

Finally, add adjusted R2 in Equation (3) to the one in Equation (4) and get the earnings transparency.

(5)

(5)

3.3. Measurement of Expected Cost of Equity Capital

Using data of each company to predict the capital cost of equity capital in year t + 1 as of year t.

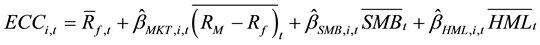

(6)

(6)

where ,

,  and

and  are the expected annual Fama-French factor returns for year t + 1. The annual factor return is the compounding result of 12 monthly average returns. The calculation of monthly average return adopted 36 months rolling window method. In particular, we use the arithmetic mean of the 36 months prior to month m to estimate the monthly average returns. To avoid the failure of the risk-free rate, the estimate of the monthly risk-free rates adopted 12 months rolling window. The coefficients are estimated from Equation (7).

are the expected annual Fama-French factor returns for year t + 1. The annual factor return is the compounding result of 12 monthly average returns. The calculation of monthly average return adopted 36 months rolling window method. In particular, we use the arithmetic mean of the 36 months prior to month m to estimate the monthly average returns. To avoid the failure of the risk-free rate, the estimate of the monthly risk-free rates adopted 12 months rolling window. The coefficients are estimated from Equation (7).

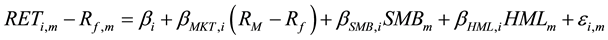

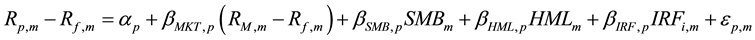

(7)

(7)

where RETi,m − Rf,m is the company’s monthly excess return, RM,m − Rf,m, HMLm and SMLm are the monthly Fama-French factor return, which are estimated using monthly returns of 36 months prior to the May of year t.

3.4. Information Risk and Expected Cost of Equity Capital

We estimate the following equation to examine the correlation between both steps of information risk and the expected cost of equity capital:

(8)

(8)

where IR is the information risk, the subscript τ equals 1 when IR is the risk in information generating link and equals 2 when IR is the risk in utilizing phase; Lev is the financial leverage; Size is the natural logarithm of market value in June; BM is the ratio of the book value to market value at the end of fiscal year; β is the loading of market risk factor in CAPM; Growth is the growth rate of the company’s main business revenue.

3.5. Financial Reporting Quality and Investors’ Information Interpreting Ability

To make further research about the correlation between financial reporting quality and investors’ information interpreting ability, we conduct two-dimensional grouping and multiple regression analysis.

3.5.1. Two-Dimensional Portfolio Analysis

We conduct two-dimensional grouping procedure to separate the two kinds of related risk factors. First of all, sorting and grouping stocks into 5 classes according to AQ scores in ascending order, then divide the stocks into 3 groups in descending order of TRANS. Finally, calculate the average AQ value and TRANS value in each of the 15 groups.

3.5.2. Multiple Regression Test of the Analysis

Bring in the virtual variable AQD representing the company's financial report quality and the interaction terms AQD * TRANS to test whether the effect of investors’ information interpreting ability in reducing the cost of equity capital is influenced by the quality of financial reporting. If the coefficient of the interaction terms is significantly negative, it indicates the effect of investors’ information interpreting ability on reducing cost of equity capital is significant because of high financial report quality; the opposite is negative.

(9)

(9)

where the AQD is a virtual variable, if the AQ value is less than or equal to the average of all companies in corresponding period, then AQD equals 1, indicating high quality of financial reporting, otherwise AQD equals 0.

3.6. Asset Pricing Tests

3.6.1. Construction of Information Risk Factor

Grouping stocks into five groups in ascending order of the AQ values annually. According to the descending order of TRANS values, the companies are divided into high (30%), medium (40%) and low (30%) groups. As a result, we get 15 intersections (1H, 1M, 1L, 2H, 2M, 2L…5H, 5M, 5L). Then, calculate the arithmetic average monthly returns of each portfolio from May to April of the next year. IRF is the difference between the excess returns of the three highest risk groups (5M, 5L, 4L) and the three lowest risk groups (1H, 1M, 2H), which is expected to take consideration of the information risk premiums of two stages at the same time.

3.6.2. Asset pricing Test with Fama-MacBeth Procedure

Based on the perspective of the trade-off between benefits and risk, the greater the risk that investors faced, the higher the risk premium that investors require. If the risk is systemic and cannot be diversified through the portfolio, then the corresponding risk premium should be stable and reflected in the stock returns. By adding the information risk factor (IRF) to the three factor model proposed by Fama and French (1993) , we conduct Fama- MacBeth (1973) two stage cross-sectional regression to test whether information risk is priced. According to Berk (2000) , grouping based on variables related to return may increase the discrete degree of each portfolio’s realized excess return and make the results tend to reject an asset pricing model with economic significance. Therefore, in order to improve the reliability of the empirical results, this paper takes the pricing test on firm- specific and industry portfolios respectively.1

(10)

(10)

(11)

(11)

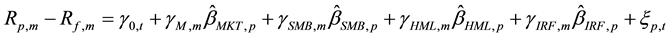

Then, regressing the corresponding return of firms or industrial portfolios on factor loadings from the first stage regression results:

(12)

(12)

(13)

(13)

In the firm-specific level, subscript p represents individual stocks, while in portfolio level, p denotes the portfolio, and the subscript p said industry combination. The explaining variables in Equation (12) are from Equation (10), and the explaining variables in Equation (13) are from Equation (11). The coefficients![]() ,

, ![]() ,

, ![]() ,

, ![]() are risk premiums of corresponding risk factors respectively. If the coefficient of information risk factor is positive, then information risk is priced.

are risk premiums of corresponding risk factors respectively. If the coefficient of information risk factor is positive, then information risk is priced.

4. Results

4.1. Summary Statistics

According to the results in Panel A of Table 1, the median of information risk factor (IRF) is less than the average, indicating the information risk of sample companies has right-skewed distribution, it means the amount of

![]()

Table 1. Descriptive statistics and Pearson correlation of main variables.

***denotes variables significant at the 1% level; **denotes variables significant at the 5% level; *denotes variables significant at the 10% level. AQ represent the risk in information generating link, calculated as Equation (2); TRANS represent the risk in information utilizing step, calculated as Equation (5); ECC is the expected cost of equity capital, calculated as Equation (6); MKT, SMB and HML represent the three factors described in Fama-French model; IRF is information risk factor; β, Lev, Size, BM, Growth represent market risk loading, the ratio of assets to liabilities, the natural logarithms of market value and the growth rate of main business revenue respectively.

companies with higher information risk is slightly larger than lower information risk companies. While market risk factors (MKT), size factors (SMB) present a left-skewed distribution, demonstrating there are differences between the risk premiums characterized by Fama-French three factors and the one depicted information risk factors.

Panel B shows that AQ is negatively correlated with TRANS significantly, suggesting that investors’ information interpreting ability and the financial reporting quality change in the same direction. At the same time, the correlative degree is low, indicating both the selected variables in this paper have certain representativeness and the overlap of both variables is small, for they reflect different properties. In addition, the information risk depicted by AQ presents a positive correlation with β, while TRANS present a negative correlation with β, suggesting the risk revealed by both of the information risk proxies is related to systemic risk. When financial reporting quality is worse, the systemic risk is higher, and when the investors’ information interpreting ability is greater, the systemic risk is lower. AQ is negatively related to the Size, BM and positively related to the Growth, indicating companies that are smaller, having a lower book to market ratio and greater growth tend to have high quality of financial reporting. TRANS and Lev present a significant positive correlation, suggesting companies with higher debt level tend to have higher earnings transparency and the constraints of external creditors to the company promoting earnings transparency. Panel C shows that there exist a significant positive correlation between IRF and SMB, demonstrating that information risk is related to the company size in reflecting some common risk. The relevance of the IRF and the Fama-French three factors is low (less than 0.4), suggesting that the overlap among these risk factors is small and each risk factor reveals different attributes.

4.2. Information Risk and the Cost of Equity Capital

As shown in Table 2, in both the multiple regressions including AQ and TRANS respectively, the symbols of coefficients before AQ and TRANS are in consistent with theoretical expectations and both are significant at the 1% level, indicating that IR variables cannot be contained or explained by controlling variables; cost of equity capital could be explained by IR variables the to some extent and investors’ expected return is affected by information risk. In addition, it also reflect that financial information is referenced by investors when making investment decisions, financial reporting quality and investors’ information interpreting ability are negatively correlated with cost of equity capital, hypotheses 1 and 2 are confirmed.

4.3. Investors’ Information Interpreting Ability and Financial Reporting Quality

As shown in Panel A of Table 3, along with the sort direction of AQ values, the average AQ values of groups are in accordance with the sort order of firm-specific AQ values, verifying the authenticity of AQ values. While

![]()

Table 2. Regression results of cost of equity capital on information risk variables.

The variables in this table are in consistent with these in Table 1.

![]()

Table 3. Correlations between investors’ information interpreting ability and financial reporting quality.

Groups 1 - 5 are divided in ascending order of the AQ values annually. H, M, and L represent high (30%), medium (40%) and low (30%) stocks according to the descending order of TRANS values.

along with the longitudinal direction, the AQ values also presents increasing trend. In the region of the high TRANS values, AQ values change slightly and in low TRANS values regional, AQ values increasing obviously, suggesting that in high TRANS values region, when investors’ information interpreting ability is higher, AQ values increase insignificantly and in low TRANS values region, AQ values increase significantly, suggesting that when investors’ information interpreting ability is higher, the financial reporting quality is generally higher, when financial reporting quality declines serious, investors’ information interpreting ability may also be largely affected. Panel B shows that along with the sort direction AQ values, the average TRANS values present a decline trend on the whole. In the region of high AQ values, the change of TRANS values are greater, demonstrating that as the financial reporting quality declines, investors’ information interpreting ability is weakened and in the case of poor financial reporting quality, investors’ information interpreting ability decrease rapidly.

The regression coefficient of the cross item is obvious―0.132 in model (9), suggesting that high quality of financial reporting will enhance investors’ information interpreting ability, means the higher the quality of financial reporting, the stronger the effect on investors’ information interpreting ability in reducing the cost of equity capital. Further, it also reveals the basis role of financial reporting quality and the direct effect of information interpreting ability in determining the cost of equity capital.

4.4. Asset Pricing Test of Information Risk Factor

Table 4 and Table 5 list the results of two-stage cross-sectional regression. As displayed in Table 4, the significance of the original three factors loadings reduced after adding the IRF to the three factors, demonstrating that IRF offset some related information contained in the other three factors. In the first stage regression based on individual stocks, the adjusted R-square improves after adding the IRF. Table 4 and Table 5 list the results of two-stage cross-sectional regression. As displayed in Table 4, the significance of the original three factors loadings reduces after adding the IRF to the three factors, demonstrating that IRF offset some related information contained in the other three factors. In the first stage regression based on individual stocks, the adjusted R-square improves after adding the IRF. In 20 industries, there are 16 portfolios increased in adjusted R-square, suggesting that the IRF has incremental explanatory power for model. In the case of goodness-of-fit lower, it can be owed to the relevance between Fama-French three factors and the IRF, besides, it also shows that three factors contains some information related to the IRF. The coefficients of IRF have statistical significance in 14 out of 20 industries, showing that the additional factor has explanatory power on the cross-sectional change of excess returns. The results in Table 5 showed that the asset pricing based on individual stocks are in consistent with industry portfolios, when including both Fama-French three factor and IRF, the model failed in statistical significance test, however, after removing the Size factor alone or removing both the Size and BM factors at the same time, there is significant risk premium of information risk factor, indicating that information risk is a pricing factor. The risk factors in four-factor model failed the test of significance could be due to the multicollinearity

![]()

![]()

Table 4. Regression results of the FF three-factor and modified four-factor model

βM, βSMB, βHML, βIRF are the OLS estimations of Equation (10) and Equation (11) for individual stocks and 20 industry portfolios respectively. The observation period is May 2000 to April 2014. The t-statistics are corrected for heteroscedasticity and serial correlation, using the Newey-West (1987) estimator with 1 lag.

![]()

Table 5. Cross-sectional regressions of excess returns on factor loadings

This table reports the average estimated coefficients from Fama-MacBeth cross-sectional regressions of excess returns on factor betas for the individual stocks (Panel A) and the 20 industry portfolios (Panel B). See Equations (12) and (13). The observation period is May 2000 to April 2014. ![]() is the average value of the intercept coefficients

is the average value of the intercept coefficients![]() .

. ![]() is the average value of

is the average value of![]() .

. ![]() is the average value of

is the average value of![]() .

. ![]() is the average value of

is the average value of![]() .

. ![]() is the average value of

is the average value of![]() . t-statistics are calculated using the Fama and MacBeth (1973) procedure.

. t-statistics are calculated using the Fama and MacBeth (1973) procedure.

between information risk factor and the original three factors, for example, in Pearson correlation test, the SMB and IRF has a significant positive correlation, which may lead to the multicollinearity of the model, thus causing the deviation of the result. The empirical results show that, in Chinese A-share stock market, investors can identify information risk related to earnings and information risk has a significant influence on stock prices, therefore, the empirical results provide evidence of the pricing of information risk.

4.5. Robustness Check

In order to minimize the influence of variable selection and calculation methods on the results, we change some aspects to verify the robustness of the results.

For the calculation of the total accrual used in modified Jones model, we use the balance sheet method to replace the cash flow statement method used in previous research. The results show that in multivariate regression, the correlation between AQ and ECC decreases to 0.186, but the influence on IRF is slightly.

In the Fama-MacBeth pricing test, we change the grouping method. First, grouping the stocks according to the Size and BM into four groups respectively, and then combining the intersections and getting 16 Size-BM portfolios. Finally, take the two-stage cross-sectional regression based on the 16 groups. The conclusion is consistent with the previous section.

5. Conclusion

From the perspective of the sources of information risk, we combine the generating and utilizing steps of information so as to measure the information risk more comprehensively and objectively. We verify that the financial reporting quality and investors’ information interpreting ability are negatively related to the cost of equity capital respectively. Then, using Fama-MacBeth two-stage cross-sectional regression method, we construct a two- dimension information risk factor and examine whether the information risk is priced by market based on individual stocks and industry portfolios respectively. Finally, we get the evidence that information risk is a pricing factor in China.

The empirical results also provide enlightenment for the market participants: Regulators should earnestly fulfill its protection function for investors who are at a disadvantage in information by curbing the earnings management behavior of management resolutely and giving harsh punishment to the companies violating the provisions. Policy makers should reduce the choice space of accounting policy for management, emphasizing the adequacy and completeness of the information disclosure and paying attention to the accounting policy choice and robustness of accounting estimates. As the producer of financial report, managers of companies should take a neutral attitude in the process of compiling and disclosure of financial reporting, avoid catering to certain party’s special interests to ensure its neutrality, thus expressing the real condition of company objectively and truthfully without subjective bias, and disclose the relevant information to investors in a timely manner, avoid withholding or delaying the release of bad news or earnings volatility deliberately. In addition, in order to realize the information transmission effectively, listed companies need to consider the recipient’s ability and behavior characteristics fully on the choice of the transmission channel. The financial reporting is a professional report for its generation is based on certain professional norms, therefore, to fully and properly interpret the information in the financial report, investors need to grasp the necessary theoretical basis and analysis ability.

Acknowledgements

This paper was supported by the Program for National Natural Science Fund (71371113), the Program for Humanities and Social Science Research of Education Ministry (13YJA790154) and the program for the Philosophy and Social Sciences Research of Higher Learning Institutions of Shanxi (2013303).

NOTES

1The industry classification of listed companies is based on the criterion published in Chinese securities regulatory commission website. To ensure the considering the number of stocks used in regressions and the reliability of the results, some similar categories of manufacturing are merged.