1. Introduction

What risk factors are driving sovereign bond valuations? For instance, are the credit risk, liquidity or other market risks affecting sovereign bond markets? Do these relationships change during different phases of financial and business cycles? These and other related questions have been investigated by many researchers ( Kyle, 1985 ; Manganelli & Wolswijk, 2009 ; Favero et al., 2010 ; and others) who mostly analyzed the financial and macro data with various econometrical models. Still, the final answers to these complicated and multifaceted research questions are far from being conclusive and unanimously agreed on.

Another, yet rather non-standard in relevant literature way to approach this issue is by examining the speeches of policymakers, i.e., officials whose every word is attentively scrutinized by mass media and financial market participants. This is especially true for central banks as they are often regarded as independent and trustworthy institutions whose relative importance has increased substantially since the onset of the global financial crisis of 2007-2008. For instance, the famous words of Mario Draghi, President of the ECB, on 26th of July 2012 “to do whatever it takes to preserve the euro”, has highly affected overall market sentiments and thus impacted the dynamics of sovereign bond markets (Wanke, 2017; Jurkšas et al., 2024) . As a result, the speeches of central bank officials provide rich material that can help reveal how monetary policymakers assess the current state of the sovereign bond market development (for instance, whether it is overvalued or not) and what risk factors are driving bond valuations.

The direct concern of sovereign bond market functioning from the monetary policy implementation perspective arose due to the introduction of quantitative easing programs in advanced economies. After reaching the zero lower bound during the aftermath of the global financial crisis, the focus shifted towards influencing long term yields. Significant efforts were made by central banks in communicating their intentions to keep rates at zero for an extended period of time and conduct large scale asset purchases. In January 2015, the Eurosystem’s version of quantitative easing was announced which implied that the Eurosystem would become a dominant investor and would affect the functioning of euro area sovereign bond markets. It is well accepted that central bank purchases impact bond yields, but it is highly debatable through which channels these yields are affected. The speeches of “insiders” provide further useful explanation on this issue.

The aim of this paper is to assess the relevance of the sovereign bond valuation topic in ECB Executive Board (EB) member speeches. In particular, it is important to determine what risk factors, according to ECB communication, are related to euro area sovereign bond valuations. We do not try to build a causal model that links the ECB speeches and market reaction. Instead, we apply various methods to discover the dynamics, correspondence and sentiments of this relevant and important topic. This indirect and novel way helps to extract the risk factors that are potentially implicit in ECB underlying models and expert judgement. Besides, these speeches not only reflect the policymakers’ interpretation of the data and models, but also policy-oriented intentions, strategies and nuances to various stakeholders, including investors and analysts. As a result, the assessment of ECB EB speeches provides insights into the ECB’s communication strategy, which in turn might influence market expectations and behavior.

The application of different text mining techniques for the speeches of ECB officials helped us find out what risk factors were considered by monetary policymakers as the most related to sovereign bond valuations during different market regimes. The first set of visual analysis revealed that the sovereign bond pricing topic was used by ECB EB members several times more often during the European sovereign debt crisis of 2010-2012 (compared to pre-crisis times) when the yield spreads spiked substantially. Meanwhile, the risk factor terms were relatively more often used during the global financial crisis of 2007-2008 when yield increases were rather muted in the euro area, possibly due to the substantial decrease of ECB policy rates. The correspondence analysis showed that sovereign bond pricing and risk factor terms were used unequally by different ECB officials: ECB EB members responsible for market operations have been touching on these topics much more frequently. The collocation analysis revealed that the risk factor terms were often mentioned without explicit referral to sovereign bond pricing, meaning that the sovereign bond price changes are often not linked by ECB EB members to the selected risk factors. The sentiment analysis showed that the view on credit risk and market liquidity deteriorated since the onset of the global financial crisis, while the sentiments on sovereign bond pricing topic were the lowest during the European sovereign debt crisis.

The better understanding of (changing) relations between sovereign bond valuations and risk factors in official speeches is beneficial for various interested parties. Firstly, market analysts can gain insights about ECB officials’ view on the sovereign bond market conditions both in relation to previous communication and on driving risk factors. This is especially the case during the period from 2007 to 2012, when the euro area experienced two crises with different contributing factors. ECB EB members deliberated much more about market liquidity and, in particular, about credit risk, and less about overall pricing of sovereign bonds during the global financial crisis of 2007-2008, while the focus changed significantly throughout the European sovereign debt crisis of 2010-2012 when yield spreads spiked. Secondly, bond market investors can make more substantiated decisions by understanding policy makers’ shifting sentiments. For instance, although overall sentiments deteriorated significantly during both crises, the timing of shifting sentiments was not like the ones for different risk factor and bond pricing terms. Thirdly, the relations between bond valuations and risk factors are not yet fully known from the academic perspective, and thus this analysis complements event and econometrical studies. The risk factors were mentioned without explicit referral to the sovereign bond pricing term during some periods, meaning that changing prices are often not linked to the sampled risk factors. As a result, a dynamic rather than static analysis of sovereign bond pricing and risk factors is necessary. Fourthly, better comprehension of the effects of officials’ speeches is beneficial for the policy makers themselves because this helps them to improve public communication in order to achieve the desired goals more efficiently. For instance, ECB EB members stress particular asset valuation risks (e.g., due to emerging financial stability risks) or shift their focus / tone about a specific issue. This is predominantly important during times when central banks around the world are employing various forms of forward guidance to affect the markets and improve the transmission channels.

The remainder of this paper is organized as follows. Section 2 provides a review of literature on the related topic. Section 3 briefly describes the methodological aspects of the analysis. Section 4 provides a visual representation of the results as well as the discussion of main finding. Section 5 concludes.

2. Literature Review

To our knowledge, there is no similar study that focuses on the sovereign bond pricing factors extracted from central bank speeches. However, some strands of literature touch on this topic. Below in this section we review studies related to the text mining of central bank communication as well as sovereign bond pricing.

There are only several papers analyzing public ECB EB speeches, possibly due to technical difficulties in obtaining data. Minutes or press conferences held after monetary policy meetings are analyzed quite often (e.g., Ehrmann & Fratzscher, 2009 ). Still, Hartmann & Smets (2019) have used almost 2000 inter-meeting ECB EB member speeches to analyze the main themes and how they evolve during time. By using the Latent Dirichlet Allocation method, the authors identified 50 specific topics and then group them to nine general themes. For instance, they found that the theme of public debt and sovereign risk increased in importance since the start of the European sovereign debt crisis. Ferrara (2019) also analyzed the ECB EB member speeches with automated text classification tools to detect the evolution of different economic ideas. By concentrating on a relatively narrow topic of fiscal policy and sovereign debt issues, the author revealed that after an initial emphasis on fiscal discipline, EB members gradually shifted their focus to the systemic risks, in line with major ECB unconventional measures. Kuesters (2018) analyzed ECB EB member speeches between 2007 and 2015. He found that speeches containing references to historical lessons constituted only 5% of the overall corpus, while the German school of economic thought has regained prominence during the euro area crisis. Tortola & Pansardi (2018) analyzed only ECB presidential speeches and found that the charismatic content of ECB’s presidency corpus emerged after the financial crisis of 2007-2008. Jurkšas et al. (2024) reveal that ECB speeches had more nuanced impact on financial markets than the decisions and press conferences. Several researchers used natural language processing techniques and dictionaries to find the sentiments of central bankers’ speeches (e.g., Musard-Gies, 2006; Brand et al., 2010; Hansen & McMahon, 2016 ).

Turning to sovereign bond valuations, this topic has been analyzed from various perspectives. Many central bankers as well as academic scholars analyze sovereign yield curves and their developments with Nelson & Siegel (1987) or similar-type methods. Following the state-space specification, the shape of the yield curve can be decomposed to three main elements: the level, slope and curvature. However, such models are mostly used to represent and fit the shapes of yield curves by finding different parameters and thus less applicable in the case of this study, i.e., analysis of ECB speeches that are linked with sovereign bond pricing and related factors.

From a theoretical standpoint, various risk factors are often included in securities pricing models (Kyle, 1985; Vayanos & Wang, 2012) . For instance, the sovereign bond yields are often found to be positively linked with the debt/deficit dynamics, agents’ risk-aversion, and etc. There is also a wide range of empirical studies linking macroeconomic factors with bond valuations: Chen (1991) , Ludvigson & Ng (2009) , Gerlach et al. (2010) , Arghyrou & Kontonikas (2012) , Jurkšas & Kropienė (2014) , and many others. However, not many authors conclude that low frequency indicators, such as GDP, inflation and debt, constantly affect dynamics of bond valuations.

As sovereign bonds are regarded as an almost riskless asset, yields can be decomposed into risk-free rate (RFR) and additional yield spread that emerges due to the risk that investors assume by investing in sovereign bonds. In theory, the RFR is not a separate risk factor, but rather the minimum return that the investor would expect for any available investment as he would not accept additional risk if the probable rate of return is greater than the RFR. However, in practice the RFR does not exist as even the safest assets—sovereign bonds—carry additional risks. The relationship of the sovereign bond yield with RFR and various risk factors (RF) is often illustrated by the following equation:

The additional risk factors are often grouped to credit, liquidity and common market risk as well as bond- or market-specific components. Manganelli & Wolswijk (2009) and Afonso et al. (2015) state that the credit risk component is usually found to be the most important factor in explaining government yield spreads as even government bonds are not fully riskless assets—thus the credit risk component reflects the financial compensation that investors require to cover government default risk. Therefore, a rise in the country-specific riskiness indicator should naturally increase the yield spread over the risk-free rate. Favero et al. (2010) , Borgy et al. (2011) and Alessandrini et al. (2012) find that common market risk (often expressed as financial stress indicator) is highly linked to yield spreads. This risk factor entails the possibility that all investors would bear losses due to non-favorable dynamics in all financial markets, and thus this risk usually cannot be eliminated through diversification. The relative importance of the liquidity component embedded in yields is less trivial. For instance, Alquist (2010) found that liquidity is a prominent, economically strong and durable feature of the sovereign bond yields. When markets become more stressed, the market makers are less willing to take the additional risk, and thus usually widen the difference between submitted ask and bid prices and/or reduce the quoted quantities. However, Ejsing & Sihvonen (2009) and Afonso et al. (2015) highlight that the liquidity component is usually insignificant during normal market conditions. Bernoth & Erdogan (2010) add that liquidity premium never plays a significant role after the entrance of a given country to the European Monetary Union. Other factors are also often used to determine yield dynamics, e.g., Afonso et al. (2015) additionally add the euro effective exchange rate, Alonso et al. (2006) add lags of yield spreads as they often exhibit mean-reversion properties. Research of the euro area sovereign bond market is often complicated as there are 20 different markets and thus market fragmentation might appear in different periods for different countries.

Bridging these two separate strands of literature—text mining of central bank communication and sovereign bond pricing factors—helped us assess how often and in what circumstances sovereign bonds are mentioned in ECB EB member speeches.

3. Methodology

In this study we have used the publicly available ECB EB speeches. These speeches provide rich material that helped reveal, with regards to the objective of this study, what risk factors were considered by monetary policymakers as most related to sovereign bond valuations. Overall, we have downloaded over 2000 speeches that were delivered in the period between 1997 and April 2019. We have automatically downloaded all these speeches delivered by ECB EB with a statistical software R. The time frame of our research encompasses a comprehensive period that includes various economic and monetary cycles, policy shifts and significant financial events and shocks within the euro area, allowing for a robust analysis of ECB communication’s evolution on sovereign bond topic. Although we have downloaded all the ECB EB speeches, we had to remove non-English language speeches as well as speeches that were relatively short, i.e., less than 1000 symbols in length, as those usually does not contain any substantive messages. The remaining speeches (2075) were saved in one file. For these tasks, R packages called “XML” and “textcat” were used.

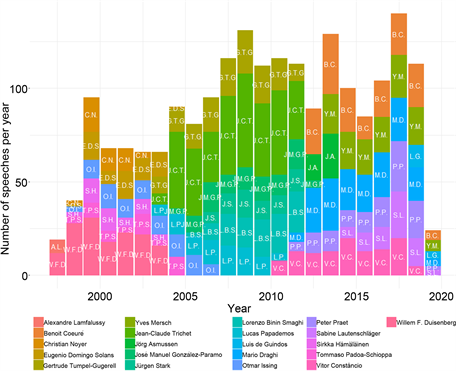

The number of speeches (remaining after the filtering procedure) varies highly in time and by different ECB EB member. As can be seen from Figure 1, the total number of speeches increased substantially after ECB formally replaced EMI and then remained relatively stable. The number of delivered speeches increased again during the global financial crisis in 2007-2008. The total number of speeches also seems to be dependent on the composition and changes of ECB EB. For instance, during the first full year of J. C. Trichet’s presidency (i.e., 2004), the number of speeches has increased, while during the first full year of M. Draghi’s presidency (i.e., 2012)—somewhat decreased. As the responsibilities of different ECB EB members differ, the number of speeches and content naturally relate to the composition of the ECB EB.

In order to find meaningful relations between different terms, the text of the speeches had to be substantially processed. First of all, the text had to be cleaned; secondly, different words had to be combined with meaningful terms and, thirdly, visualization of collocations, correspondence and sentiment analysis could be performed. For these purposes, we have applied various packages (e.g., “tm”, “quanteda”, “kwic”, “igraph”, and others) from statistical software R. A more detailed description is provided below.

Notes: Letters in stacked columns are initials of different ECB EB members. 2019 data encompass only speeches delivered during the first four months (January-April).

Source: Authors’ calculations.

Figure 1. The total number of speeches each year by different ECB EB member.

Text cleaning. The texts of downloaded speeches have a lot of meaningless elements that could negatively affect the text analysis results. For example, punctuation, numerical values and stop words create unnecessary noise for further analysis. Therefore, such meaningless elements were removed from the texts. Stop words are the most often used words, such as “a”, “was”, “if”, “which” and etc. Although there is no universal list of such words, we used a list of stop words in R package (“tm”); at the moment of writing this paper consist of 175 different words. Additionally, footnotes and references were also removed as they are more often of a technical nature.

Combination of words. In order to identify specific terms which might consist of several words, it was necessary to link words. First of all, we split text into consecutive sequences of words to find out what word combinations appear most frequently in the context related to our research. Although these sequences of words provide significant amount of information, it can sometimes be misleading as the word appearing together might be accidental. In order to avoid this, we additionally used the procedure of the so-called word collocations. Like in the case of consecutive sequences, word collocations allow us to identify word pairs, but it additionally measures statistical significance of such combinations, using chi-square test and p-value. Therefore, we used an R package called key word in context (“kwic”) to analyze context of specific phrases and to identify possible combinations of words. For the sake of this research, we have concentrated on four main terms: sovereign bond pricing, credit risk, market liquidity, and market risk. The specific combinations of words under these four terms are provided in Appendix. After extracting all word pairs that we were interested in, we again used word collocations, only this time for the combined terms.

Correspondence analysis. In our research we also used the so-called correspondence analysis that helps to identify possible relations between qualitative variables, i.e., speakers and key terms of interest. Correspondence analysis is often presented as a model-free technique, since the data “speaks for itself” (Benzecri, 1973) . Such analysis provides a solution for summarizing and visualizing a data set in a two-dimensional plot (Kassambara, 2017) . For example, it is self-evident that various ECB EB members use specific key terms (i.e., sovereign bond pricing, credit risk, market liquidity, market risk) at different frequencies. But it is also important to determine the x and y axis coordinates that could help to visualize graphically several different associations. R package “factoextra” and others were used for this task.

Sentiment analysis. Sentiment analysis allows to overview attitudes behind certain topics, in this study—the speeches of ECB EB members. There are multiple approaches for sentiment analysis, but we used R packages “quanteda” and “janeaustenr” as well as “NRC” lexicon, which contains positive and negative expressions. The detection of such expressions in ECB EB speeches allows us to compute the overall sentiment indicator (positive minus negative ones) for the full time period. It is important to mention that there are several limitations for sentiment analysis. For instance, it is not possible to distinguish sarcastic or similar expressions that usually mask negative sentiments. Also, it is possible that text data contain some irrelevant information, which can disturb the lexical approach of sentiment analysis, or sentiments would not be related to the key areas that we are interested in. In order to minimize such biases, additional text preprocessing was implemented. Speeches were tokenized into paragraphs, leaving only those with key terms under interest (i.e., sovereign bond pricing, credit risk, market liquidity, market risk). Also, we grouped speeches into different quarters of the year—by doing this, we could compute quarterly averages that are less prone to outliers and misleading dynamics.

4. Results

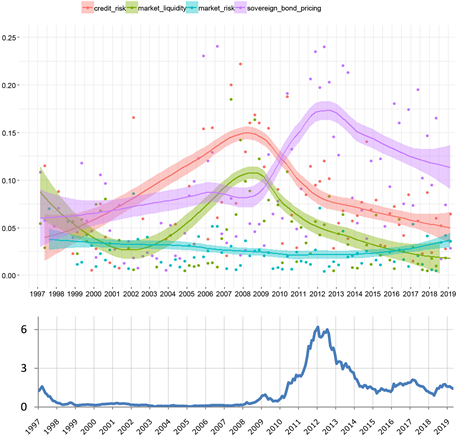

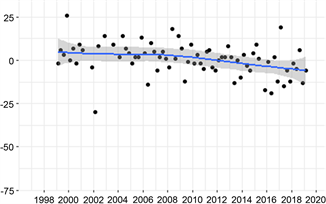

The first set of the visual inspection revealed that the terms related to sovereign bond pricing and risk factors were used rather rarely by ECB EB members, but its’ relative importance was changing under various market regimes (see Figure 2). In order to understand fundamental and long-term changes in ECB officials’ speeches, the highly volatile quarterly usage of such terms was processed with geometric smoothing procedure. By doing this, the main structural shifts of the topics used by ECB EB members become much clearer.

Notes: One dot in the upper chart depicts how many times a particular term is used in relation to all other words in the ECB EB speeches during 3-month period. The lines are drawn from the geometric smoothing (from loess method with 0.5 span) of how much a particular term is used during time. Bands around the central line indicate the level of confidence interval (95%). The lower chart depicts the dynamics of the average sovereign yield spread, calculated from major euro area markets:

.

Source: Authors’ calculations.

Figure 2. Number of times a particular term is used out of all words used in the ECB EB member speeches (upper chart, in %) and euro area yield spreads (lower chart, in %).

The break points of the sovereign bond valuation topic were highly linked to the turbulences in financial markets. The usage of the sovereign bond pricing topic increased in tandem with a commonly constructed indicator for financial risk: yield spreads of euro area sovereign bonds. This is particularly visible during the European sovereign debt crisis in 2010-2012 when yield spreads spiked together with the usage of the sovereign bond pricing term. When the risks in euro area sovereign bond market abated, this topic naturally became less relevant and thus EB members used it less often, although the decline was quite gradual. This finding is in line with Hartmann & Smets (2019) result that the theme of sovereign risk increased since the start of the European sovereign debt crisis. Still, the usage of this term remains higher than before the sovereign debt crisis, possibly because Eurosystem has been conducting large scale asset purchases since March 2015, thus directly interfering in the euro area sovereign bond markets.

It is important to note that the usage of this term did not increase during the global financial crisis in 2007-2008. In some sense, it is quite natural: there were very few signs of fragmentation in euro area sovereign bond market in 2007-2008 as the rise of yield spreads remained relatively muted. Therefore, ECB EB members did not speculate much about this issue through their official communication. Also, then the ECB had not employed significant sovereign bond purchases, but substantially decreased interest rates, i.e., by 3.25 p.p. in one year. However, the situation has changed dramatically during the European sovereign debt crisis of 2010-2012, when yield spreads spiked and the ECB decided to introduce several measures to reduce the fragmentation in the euro area sovereign bond markets, for instance, the Securities Markets Programme in 2010 and Outright Monetary Transactions in 2012. After approaching the zero lower bound in 2009, the focus of policymakers shifted towards influencing long term yields. As a result, the increasing usage of terms related t sovereign debt pricing is also noticeable in ECB EB speeches.

The ECB communication about terms of risk factors related to sovereign bond pricing has been also fluctuating highly over time. Naturally, the most widely used term was credit risk, i.e., the factor that investors mostly concentrate on when pricing bonds. Manganelli & Wolswijk (2009) and Afonso et al. (2015) also stated that it is the driving factor for sovereign bond valuations. Not surprisingly, the usage of this term in ECB EB speeches peaks during the global financial crisis of 2007-2008 when there was a lot of speculation about the solvency of the issuers. Similarly, albeit on a lower scale, market liquidity becomes an acute concern during turbulent periods, but was less used under more liquid market conditions. As a result, the credit risk and market liquidity terms have on average been much less-used recently. Overall, the increase of the usage of credit risk and market liquidity terms coincided with the ECB presidency of Jean-Claude Trichet. Meanwhile, the market risk term has been used much more consistently and rather rarely during the full sample period, although the usage of this term has increased recently. These findings somewhat relate to the results of Ferrara (2019) and Jurkšas et al. (2024) that ECB EB members shifted their focus to systemic risks when the ECB started employing various unconventional measures.

The dynamics of the usage of risk factor terms didn’t always coincide with the interest of sovereign bond pricing topic. For instance, the usage of risk factor terms did not increase during the turbulent period of 2010–2012, while the topic of sovereign bond pricing reached its peak during the same period. As it was explained before, the sovereign bond pricing topic was very acute during the European sovereign debt crisis as then euro area yield spreads increased dramatically and the ECB had to introduce new measures. At that time, ECB EB members mostly focused on the issue of fragmentation among member states and the broader term of sovereign bond pricing. Possibly, ECB EB members did not speculate much about particular risk factors driving market yields as not all euro area countries suffered increasing yields (e.g., Germany, the Netherlands, and Finland)—the main issue was more about the diverging paths of sovereign bond prices among different member states. Meanwhile, the situation was the opposite during the global financial crisis of 2007-2008, when euro area sovereign bond yields increased only marginally compared to the period of 2010-2012, partly due to the rapid decrease of ECB key policy rates. However, there were relatively more speculation about deteriorating market liquidity and increasing credit risk in overall euro area and global markets. Besides, there was no particular Eurosystem purchase program during the global financial crisis that could help alleviate market liquidity and credit risks. Another possible reason explaining the difference between various periods is the changing composition of the communications: all ECB EB members have changed in 2010-2012, so naturally the topics under interest have somewhat evolved.

The sovereign bond pricing and related risk factor terms were used unequally by different ECB EB members. As can be seen from Table 1, there is a stark difference between the usages of such terms. In particular, ECB EB members responsible for market operations (e.g., Benoît Cœuré, José Manuel González-Páramo) emphasized various terms related to sovereign bond valuations much more frequently. Meanwhile, several ECB EB members almost never used such terms in their public speeches. It is also important to note that the usage of different risk factor terms was unequal even for particular members: for instance, Lucas Papademos and Jean-Claude Trichet highlighted credit risk much more frequently than the market liquidity and, in particular, market risk, possibly because their terms in office coincided with the global financial crisis of 2007-2008.

![]()

Table 1. Number of times a particular term is used by each ECB EB member.

Notes: The more vivid the color, the more a particular term is used compared to usage of the same topic among all ECB EB members.

Source: Authors’ calculations.

The visual correspondence analysis showed that different EB members focus on different topics (see Figure 3). The first two dimensions explain a relatively high proportion of the total variance, while the chi-square test result (p-value <2e−16) confirmed that particular speakers and key terms are statistically significantly associated. Moreover, there seems to be clusters of terms used by different ECB EB members, although several officials used various terms rather equally, e.g., Willem F. Duisenberg, Sirkka Hämäläinen, Lorenzo Bini Smaghi. It is also visible that market risk term was used more in isolation from other terms.

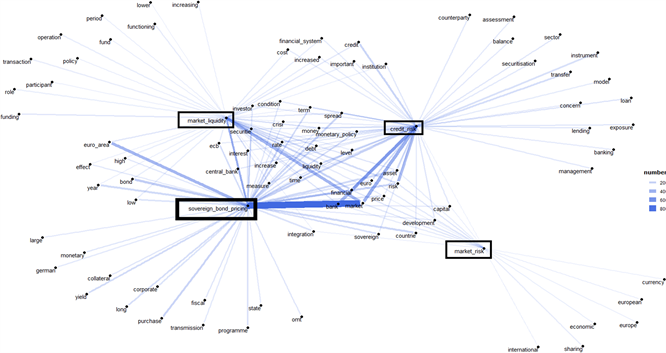

The visualization of collocations revealed the complex linkages of the terms of sovereign bond pricing and related risk factors in ECB EB member speeches (see Figure 4). The risk factors connect directly (i.e., through one straight line) to the term of sovereign bond valuations. ECB EB members (e.g., L. Papademos in 2010 or V. Constâncio in 2014) state that the financial crisis highlighted such drivers of euro area sovereign bond pricing as credit and liquidity risk premia, as well as market risk. However, other terms were also often used together with sovereign bond pricing and risk factor terms. For instance, credit risk is linked to sovereign bond pricing through “debt”, “bank”, “crisis”, i.e., terms implying solvency problems and thus relating to both sovereign debt and credit risk. Term of market liquidity connect to sovereign bonds through such terms as “low”, ”high”, “increase” or “spread”. This implies that changes of sovereign bond prices were often related to the level of market liquidity. The term of market risk relates to sovereign bonds through terms “capital”, ”asset”, “euro”, “financial”, i.e., refer more to market characteristics. Naturally, risk factors were often mentioned in ECB EB member speeches together without explicitly referring to sovereign bond pricing. However, standalone picture of relations between different terms gives only a subjective interpretation of the ECB officials’ sentiments—thus further automated text mining analysis is required.

![]() Notes: The two dimensions from X and Y axis explain 80.6% of variance, while the third dimension—19.4%.Source: Authors’ calculations.

Notes: The two dimensions from X and Y axis explain 80.6% of variance, while the third dimension—19.4%.Source: Authors’ calculations.

Figure 3. Correspondence of different ECB EB members and the risk factors.

Notes: Lines depict direct links between the term “sovereign bond pricing” with other terms associated with risk factors. The width of the line increases if the terms are used together more often. Ending letters (such as “s”) were removed for more accurate connections. Only the most often mentioned connections are shown in the figure.

Source: Authors’ calculations.

Figure 4. Relations between terms of sovereign bond valuations and main risk factors in speeches of ECB EB members.

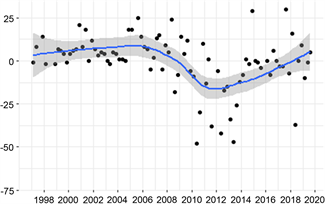

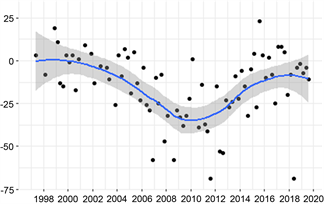

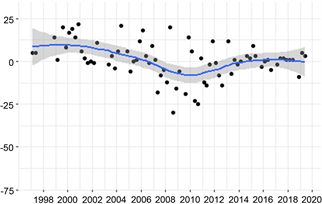

The additionally performed analysis on the opinion in the ECB officials’ speeches indicates that sentiments were rather different across risk factors and during time (see Figure 5). The sentiments on sovereign bond pricing deteriorated during the European sovereign debt crisis, while sentiments on related

Sovereign bond pricing Credit risk

Market liquidity Market risk

Notes: One dot depicts the sentiment index of a particular term during a 3-month period. The min/max value is −100/100. The lines are drawn from the geometric smoothing parameters (from loess method). Bands around the central line indicate the level of confidence interval (95%).

Source: Authors’ calculations.

Figure 5. Sentiment index of a particular term used in the ECB EB member speeches.

risk factors—somewhat earlier. The overall sentiments seem to have improved when the ECB started increasingly using non-standard monetary policy measures and directly interfering in bond markets. Jurkšas et al. (2024) also found that policy makers’ sentiments change in relation to the evolution of economic conditions. Sovereign bond pricing and, especially, credit risk terms seem to be the most volatile ones, while market risk and liquidity factors fluctuated in a narrow range. Although dynamics of sentiments of credit risk and market liquidity were rather similar, sentiments of the credit risk factor were usually on the negative side, meaning that this term was often attributed by ECB officials to undesirable occasions. Meanwhile, the sentiments of market risk seem to decrease gradually, although it usually remained on a positive side.

5. Conclusion

The speeches of ECB officials provide rich material about what risk factors were considered by monetary policymakers as the most related to sovereign bond valuations during different market regimes. The application of various text mining techniques let us find out the dynamics, sentiments and correspondence of the euro area sovereign bond topic in ECB EB member speeches.

The first set of visual analysis revealed that the usage of sovereign bond pricing and related risk terms fluctuated highly over time. The ECB communication shifted to sovereign bond valuations during the European sovereign debt crisis of 2010-2012 when yield spreads spiked, but this term remained relatively popular even later on, possibly due to the start of large-scale asset purchases since March 2015. The usage of related risk factors did not increase during the European sovereign debt crisis, possibly due to the fact that market fragmentation, including very high yields, was more acute topic during that period. The situation was very different during the global financial crisis of 2007-2008 when the usage of various risk factor terms peaked. Then the most widely used risk factor was credit risk as bond market investors began reassessing the solvency of the issuers. Similarly, market liquidity became an acute concern during the global financial crisis and was less used when markets were regarded as rather liquid. As the euro area yield spread remained relatively muted in 2007-2008, partly due to the substantial decrease of ECB policy rates, the communication of policymakers about pricing issues was also quite silent. These finding are broadly in line with the results of other relevant literature. Meanwhile, the market risk term has been used much more consistently, but rather rarely during the full sample period.

The correspondence analysis showed that sovereign bond pricing and risk factor terms were used unequally by different ECB officials and stressed different risk factors in their public communication. In particular, ECB EB members responsible for market operations have been touching the topic of sovereign bond valuations and related risk factors much more frequently. The changing composition of ECB EB in 2010-2012 has highly affected interest in the topic of sovereign bond pricing. However, concrete guidance of how to interpret different emphasis of ECB officials on particular terms and causal links are beyond the scope of this research.

The collocations of the terms of sovereign bond pricing and related risk factors in ECB EB member speeches were rather complex. The risk factors were linked directly to the term of sovereign bond valuations, but, on the other hand, risks were often mentioned without explicit referral to sovereign bond pricing. Moreover, other terms were also often used together with sovereign bond pricing and risk factor terms. The linkages between different terms can help market participants to better gauge how ECB officials relate sovereign bond valuations with risk factors. Policy makers can publicly stress particular risks and aspects to inform market participants in advance and thus achieve their desired goals. This is particularly useful during different market situations as was the case during the global financial crisis of 2007-2008 compared with the European sovereign debt crisis of 2010-2012.

The sentiment analysis revealed that the view on sovereign bond valuations deteriorated during the European sovereign debt crisis, while sentiments on related risk factors—somewhat earlier. The sentiment balance of the credit risk factor was usually on the negative side, while balance of other terms was much more neutral. The sentiments improved somewhat when the ECB started conducting non-standard monetary policy measures, i.e., by directly interfering in bond markets. Better understanding of current policy makers sentiments in relation to past perspective can help bond market participants make more substantiated decisions. However, the results should be assessed with caution as there are some well-known limitations for text sentiment analysis.

In future research, it would be worthwhile to investigate the topic of sovereign bond pricing for other central banks, e.g., FED, the Bank of Japan and then compare the results. Interesting findings could be obtained by linking sentiments of bond prices and risk factors with related high-frequency financial market data. This would give important findings on causal links. Also, the shifting relations between the sovereign bond pricing term and related risk factors are also worthwhile to investigate.

Appendix: Key Words Covering Multi-Word Terms

Sovereign bond pricing: government bond price, pricing of sovereign debt, sovereign yield, government bond yield, government bond spread, yield government bond, spread government bond, rate government bond, spread sovereign bond, yield sovereign bond, rate sovereign bond.

Credit risk: credit risk, risk credit, credit default, credit market, default risk, default.

Market liquidity: market liquidity, liquidity bond, liquidity market, liquidity financial market, liquidity traded instrument, liquidity asset, market illiquidity, liquidity risk premium, (il)liquidity premia (-ium), market depth, bid(-)ask, bid(-)offer.

Market risk: international risk, market risk, international market, common market.